Energy Rebate 2024 Extended 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Energy Rebate 2024 Extended

Energy Rebate 2024 Extended

https://newsroom.shropshire.gov.uk/wp-content/uploads/energy-rebate-1024x576.jpg

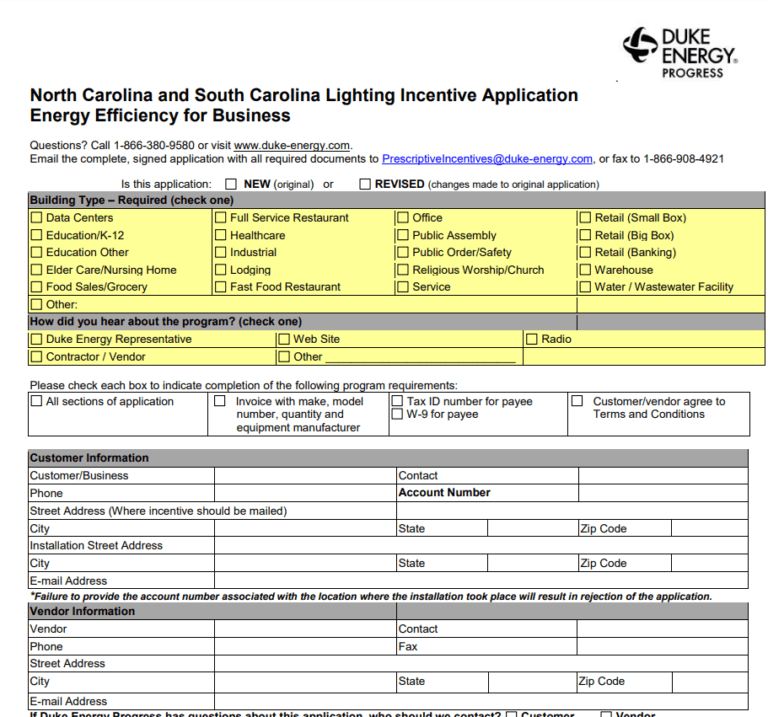

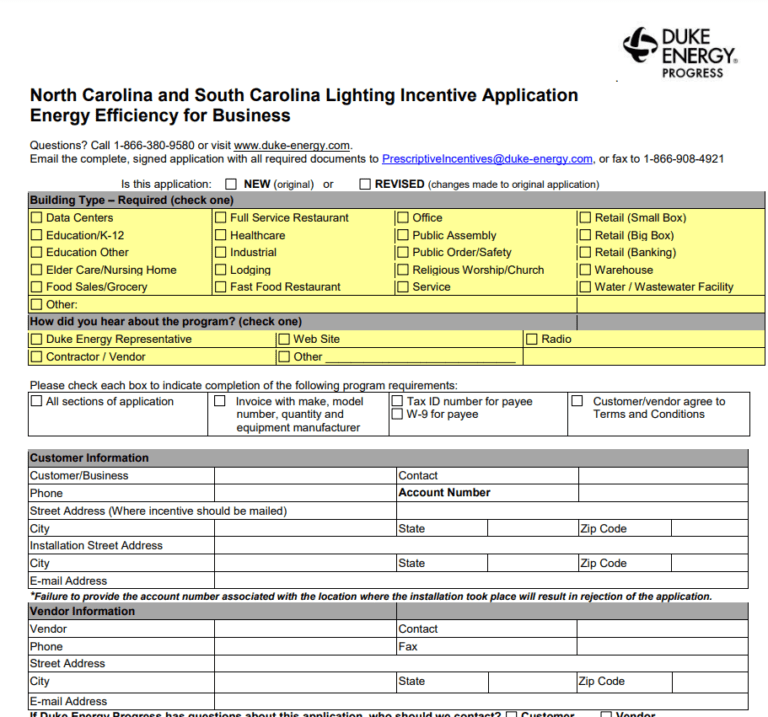

Duke Energy Rebate Form Air Conditioner Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Duke-Energy-Rebate-Form-768x717.png

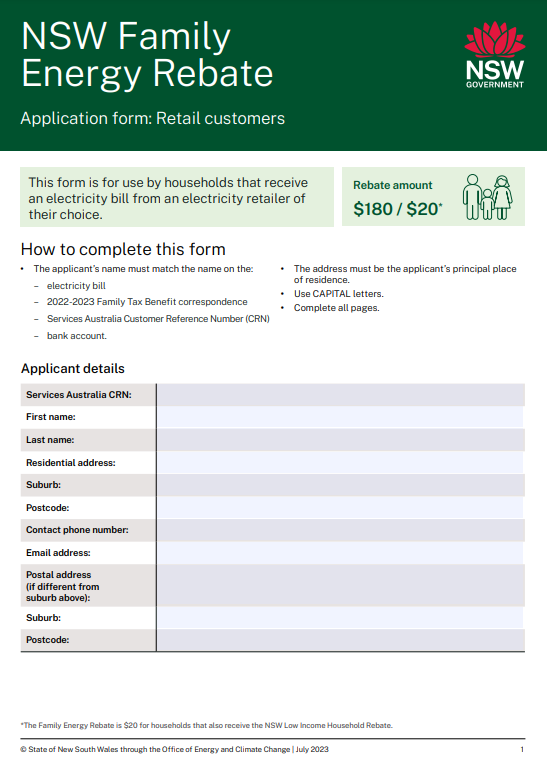

Energy Rebate Form 2023 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/09/Energy-Rebate-Form-2023.png

We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

The Residential Clean Energy RCE Credit is a renewable energy tax credit extended and expanded by the 2022 Inflation Reduction Act The credit is worth 30 of certain qualified expenses for residential clean energy property Must file between November 29 2023 and March 31 2024 to be eligible for the offer Includes state s and one 1 Tax credits for energy efficient home improvements are extended and expanded because of the Inflation Reduction Act Image credit Getty Images By Rocky Mengle last updated December 12 2023

Download Energy Rebate 2024 Extended

More picture related to Energy Rebate 2024 Extended

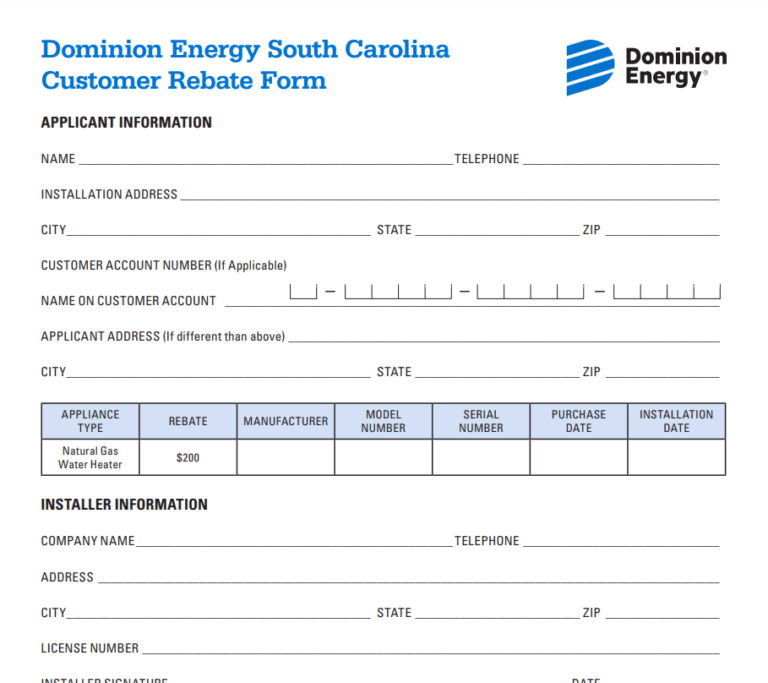

Mn Energy Rebate Forms Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Dominion-Energy-Rebate-Form-2023-768x683.png

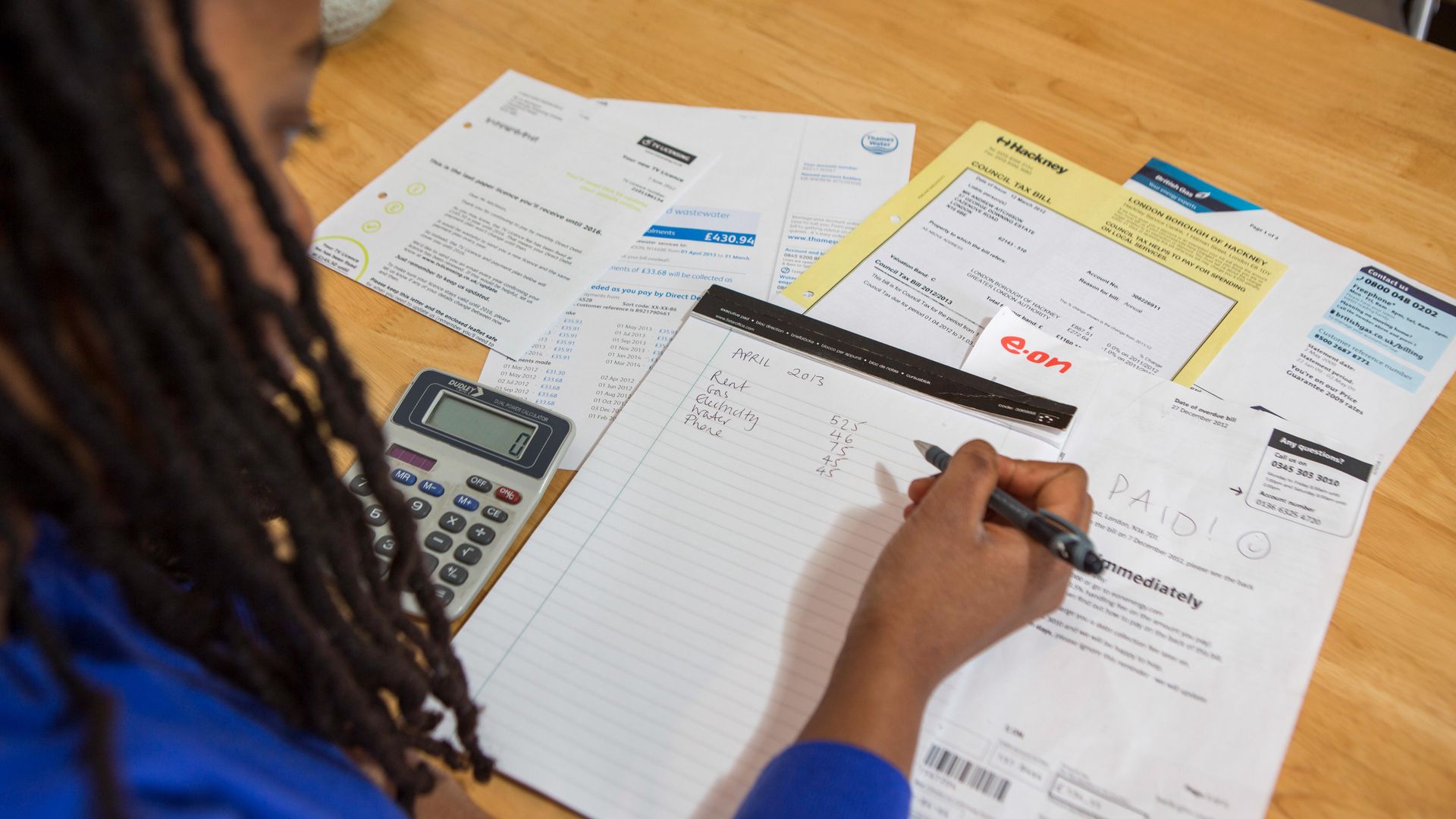

Discretionary Energy Rebate Scheme Extended To Support More Residents

https://www.lichfielddc.gov.uk/images/DER.png

Student News Energy Bill Rebate University Of Nottingham

https://www.nottingham.ac.uk/CurrentStudents/Images/News/2019/energy-rebate-1200x600.x353c334f.jpg

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

The credit was previously at 26 for systems installed in 2022 and scheduled to step down to 22 in 2023 before going away entirely in 2024 Better yet Americans that installed solar in 2022 expecting a 26 credit will now be eligible for 30 That s an extra 1 000 in tax credit for purchasing a 25 000 solar or battery system Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible for the tax credits Independently certified to save energy ENERGY STAR

Applications For Energy Rebate Scheme To Open Sandgate Parish Council

https://sandgatepc.org.uk/wp-content/uploads/sites/44/2022/06/related.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Will I Get The 400 Energy Rebate On A Prepayment Meter Who Can Claim The Payment And When It s

Applications For Energy Rebate Scheme To Open Sandgate Parish Council

Energy Savings Rebate Program Cozy Comfort Plus

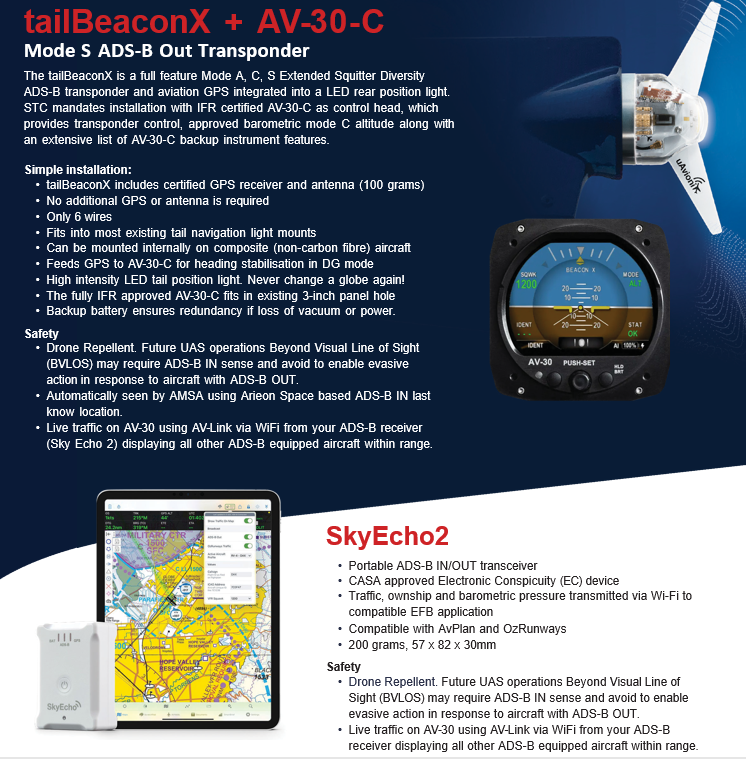

Government ADS B Rebate Extended To 31 May 2024 UAvionix Australia

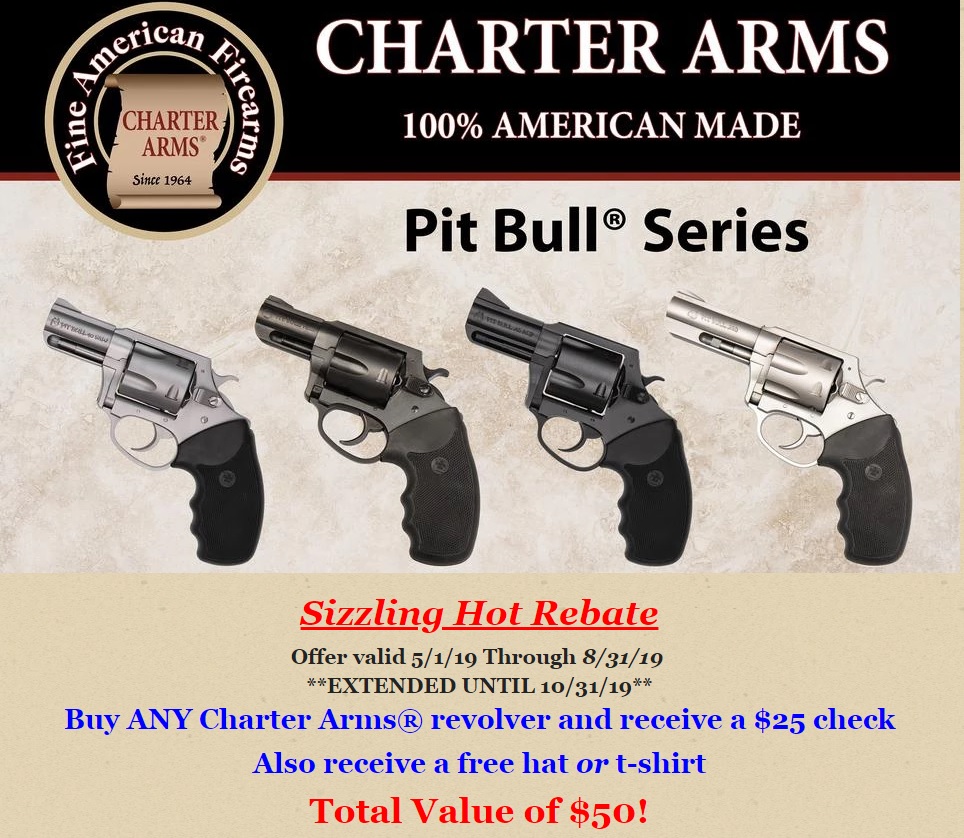

Charter Rebate Extended Gun Rebates

Cost Of Living Payments 400 Energy Rebate And Other Support Explained Which News

Cost Of Living Payments 400 Energy Rebate And Other Support Explained Which News

Mobil One Offical Rebate Printable Form Printable Forms Free Online

The 200 Energy Bills Rebate Everything You Need To Know TechRadar

Federal Solar Tax Credits For Businesses Department Of Energy

Energy Rebate 2024 Extended - The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034