Ev Federal Tax Rebate Form Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

Ev Federal Tax Rebate Form

Ev Federal Tax Rebate Form

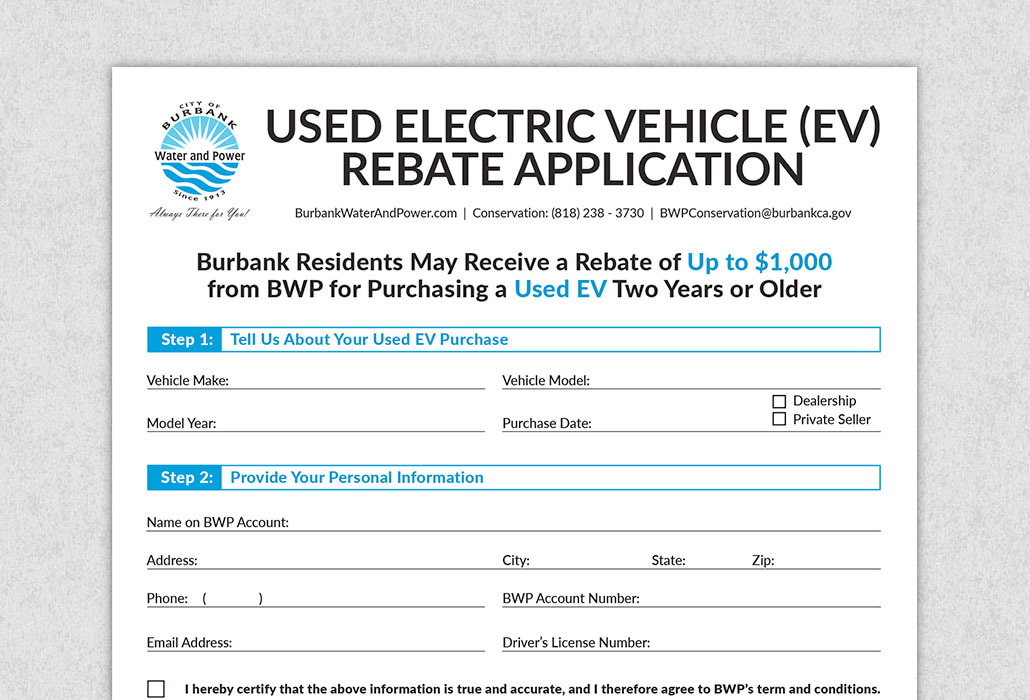

https://www.burbankwaterandpower.com/images/2020/02/11/used-ev_application_image.jpg

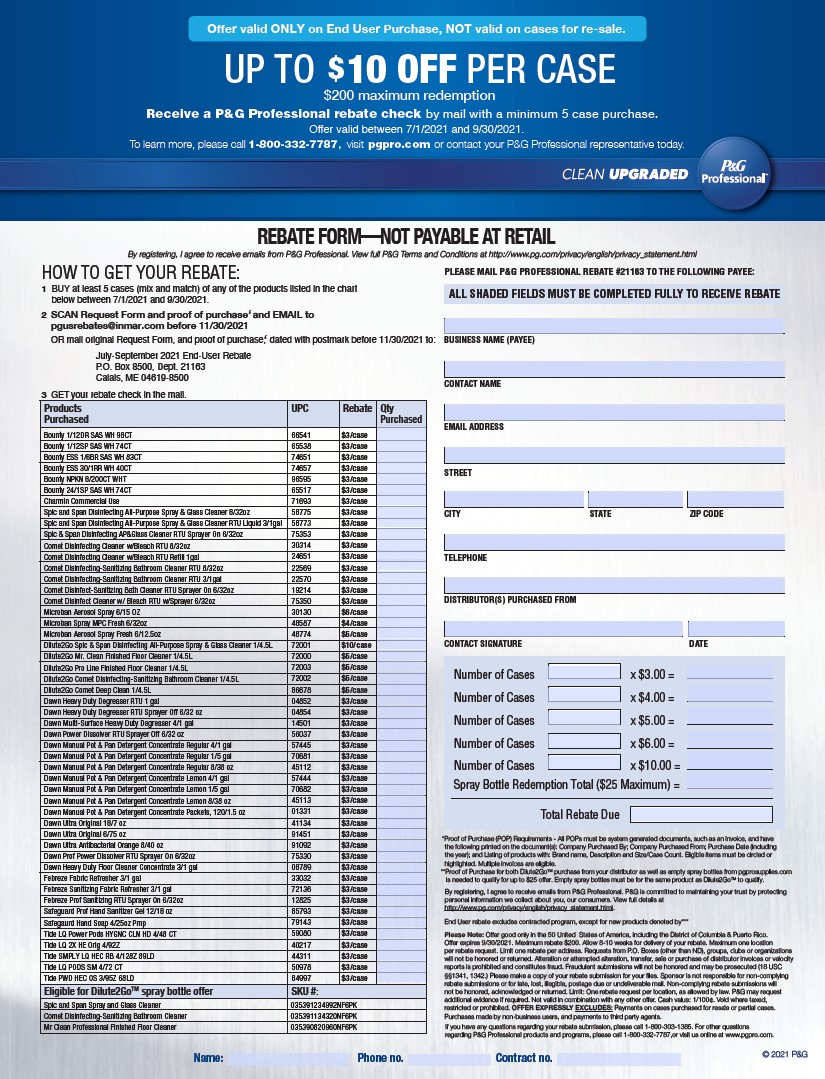

P G And E Ev Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PG-Rebate-Form-2021.jpg

Tesla Model 3 US Federal EV Tax Credit Update CleanTechnica

https://cleantechnica.com/files/2018/07/IRS-Federal-EV-tax-credit-form-8936.png

Web We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new Web 16 ao 251 t 2022 nbsp 0183 32 To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those

Web 18 avr 2023 nbsp 0183 32 For a list of incentives by vehicle see Federal Tax Credits on FuelEconomy gov Vehicles Placed in Service on or After April 18 2023 For vehicles Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Download Ev Federal Tax Rebate Form

More picture related to Ev Federal Tax Rebate Form

Ev Federal Tax Credit Form FederalProTalk

https://www.federalprotalk.com/wp-content/uploads/form-8936-qualified-plug-in-electric-drive-motor-vehicle-credit.png

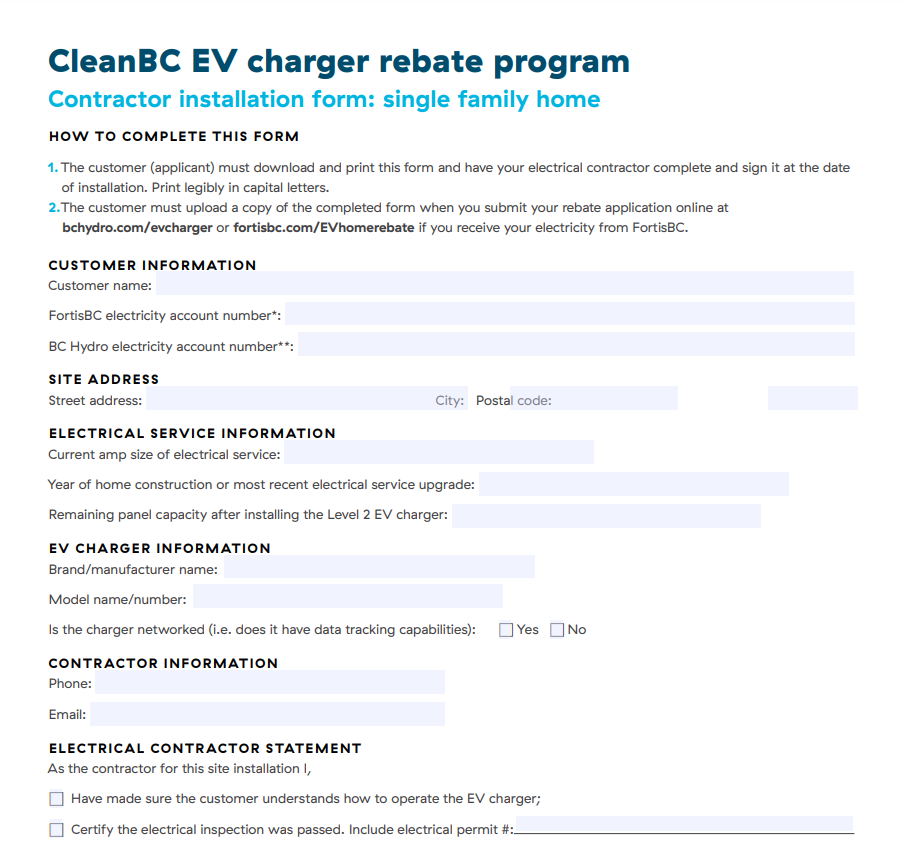

Ontario Ev Charger Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-Ev-Charger-Rebate-Form.png

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

https://www.f150gen14.com/forum/attachments/1621629715533-png.17461/

Web 7 janv 2023 nbsp 0183 32 For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Justin Web 5 sept 2023 nbsp 0183 32 To claim the EV tax credit you file IRS Form 8936 with your federal income tax return You ll need the VIN vehicle identification number for your electric vehicle to

Web 17 ao 251 t 2022 nbsp 0183 32 Plug in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 Save up to 7 500 Web 1 ao 251 t 2023 nbsp 0183 32 To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

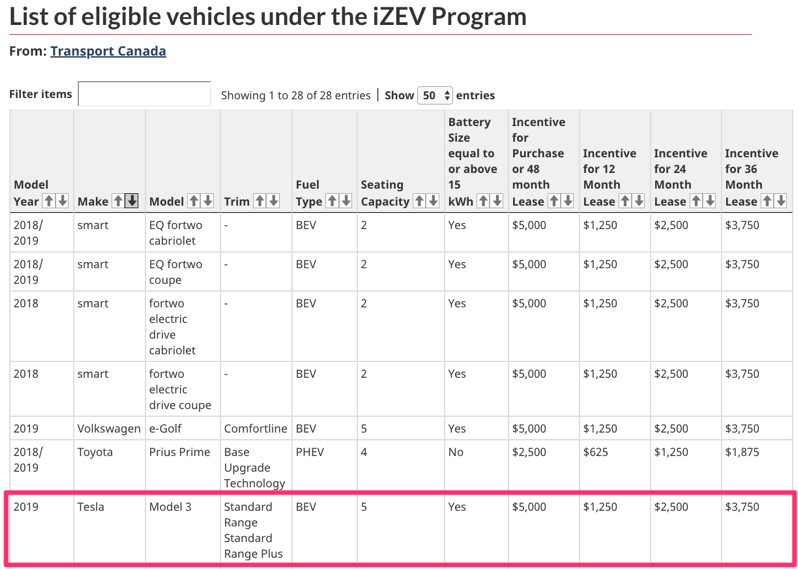

Surprise Tesla Model 3 Now Qualifies For 5 000 Federal Rebate In

https://cdn.iphoneincanada.ca/wp-content/uploads/2019/05/Screenshot_2019-05-01_07_33_14.png

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Ok Natural Gas Rebate Energy Fill Online Printable Fillable Blank

Electric Car Tax Rebate California ElectricCarTalk

T1159 Fill Out Sign Online DocHub

Ev Car Tax Rebate Calculator 2022 Carrebate

Rebate Form Download Printable PDF Templateroller

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Ev Federal Tax Credit Form FederalProTalk

2019 2023 Form Canada T778 E Fill Online Printable Fillable Blank

Ev Federal Tax Rebate Form - Web 16 ao 251 t 2022 nbsp 0183 32 To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those