Ev Rebate 2024 Income Limit You can t apply any excess credit to future tax years Credit amount The amount of the credit depends on when you placed the vehicle in service took delivery regardless of purchase date For vehicles placed in service January 1 to April 17 2023 2 500 base amount Plus 417 for a vehicle with at least 7 kilowatt hours of battery capacity

As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The nonrefundable A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models

Ev Rebate 2024 Income Limit

Ev Rebate 2024 Income Limit

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

BC Government Revamps EV Rebate Program To Target Lower income Buyers Canadian Auto Dealer

https://canadianautodealer.ca/wp-content/uploads/2022/08/1-BC-government-revamps-EV-rebate-program-to-target-lower-income-buyers_1200.jpg

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

As of Jan 1 2024 you can take the EV tax credit as a discount when purchasing the vehicle Be an individual who bought the vehicle for use and not for resale Not be the original owner Not be Rules for claiming the federal tax credit for electric vehicles have changed for 2024 Here s what you need to know if you want to buy an EV Image credit Getty Images By Kelley R Taylor

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit Modified adjusted gross income must not exceed 75k for individuals 112 500 for heads of households and 150k for joint returns Additionally in order for used EV to qualify for federal tax

Download Ev Rebate 2024 Income Limit

More picture related to Ev Rebate 2024 Income Limit

EV Rebate Program Topped Up With 73 Million In Fall Economic Update

https://media-exp1.licdn.com/dms/image/C4E12AQEQH-aqCSEBqA/article-cover_image-shrink_600_2000/0/1640618299248?e=2147483647&v=beta&t=fDIp5z4U_5Ro1qUpCdHATyuwbSSZ_n87WsISKGdANcE

2023 2024 Income Eligibility Guidelines CDPHE WIC

https://www.coloradowic.gov/sites/default/files/media/image/IEG 22-23 English_02.png

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y Comerciales Blink Charging

https://blinkcharging.com/wp-content/uploads/2023/04/BlogGraphic_AprilWk2-scaled.jpg

For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

These are the annual income limits for the 7 500 new vehicle credit 300 000 for married couples filing a joint tax return 225 000 for heads of household and 150 000 for single tax filers The new changes include the following The elimination of manufacturer sales caps The inclusion of both EVs and fuel cell electric vehicles FCEVs The requirement of a minimum battery capacity The federal tax credit offers significant savings opportunities on your next EV purchase

Personal Tax Relief Y A 2023 L Co Accountants

https://landco.my/wp-content/uploads/2023/07/Personal-Tax-Relief-2023-731x1024.png

Enhanced Child Tax Credit Income Limit For 2023 2024 Support For Middle Income Families YouTube

https://i.ytimg.com/vi/bAE0Oobls8c/maxresdefault.jpg

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

You can t apply any excess credit to future tax years Credit amount The amount of the credit depends on when you placed the vehicle in service took delivery regardless of purchase date For vehicles placed in service January 1 to April 17 2023 2 500 base amount Plus 417 for a vehicle with at least 7 kilowatt hours of battery capacity

https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric-vehicle-tax-credit

As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The nonrefundable

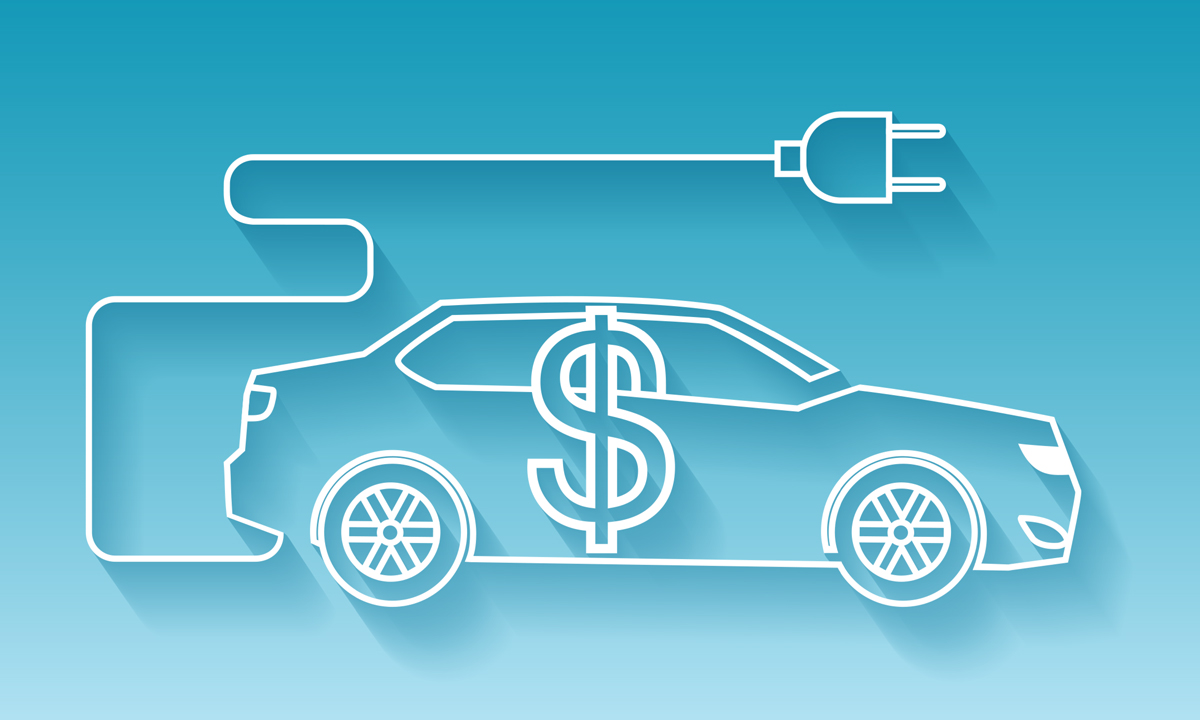

Electric Vehicle Rebate Redwood Coast Energy Authority

Personal Tax Relief Y A 2023 L Co Accountants

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

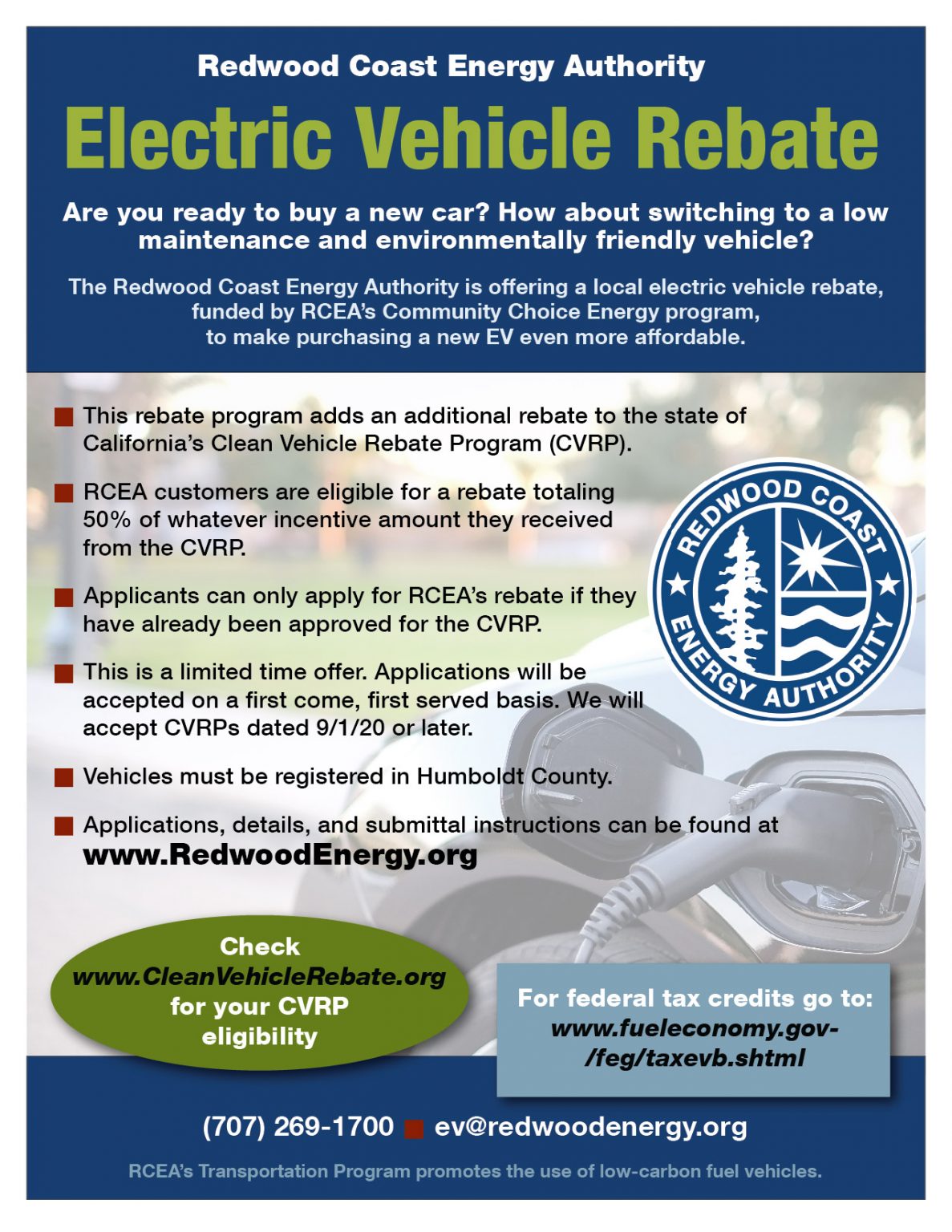

Health Insurance Income Limits For 2022 To Receive ACA Premium S

South Carolina Rebate Checks 2023 Printable Rebate Form

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check New Tax Rates BetaVersa

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check New Tax Rates BetaVersa

Union Budget 2023 24 Highlights Vision Priorities Tax Slabs

MAGI Medi Cal Income Eligibility For 2023 Increases Over 6

Canadian Federal Government Electric Car Rebate 2022 2022 Carrebate

Ev Rebate 2024 Income Limit - The buyer must meet certain income limits Those rules will remain in force on January 1 2024 Electric Car Tax Credit Changes Coming If you are buying a new electric car in 2024 good luck