Ev Tax Credit Income Limit 2022 Reddit Person B single individual earns 148k in 2022 and 220k in 2023 The lesser of is 148k and meets the threshold so eligible for the credit if they buy an eligible EV It doesn t The key phrase in that text is the lesser of which is commonly

Important Information About Tax Credits Congress recently passed new legislation the Inflation Reduction Act of 2022 which changes credit amounts and EV tax credit income limit In order to claim the EV tax credit your modified adjusted gross income MAGI must fall below certain limits These limits vary by your tax filing status as well as whether the car you are purchasing is

Ev Tax Credit Income Limit 2022 Reddit

Ev Tax Credit Income Limit 2022 Reddit

https://techcrunch.com/wp-content/uploads/2022/09/math-calculation-ev.jpg

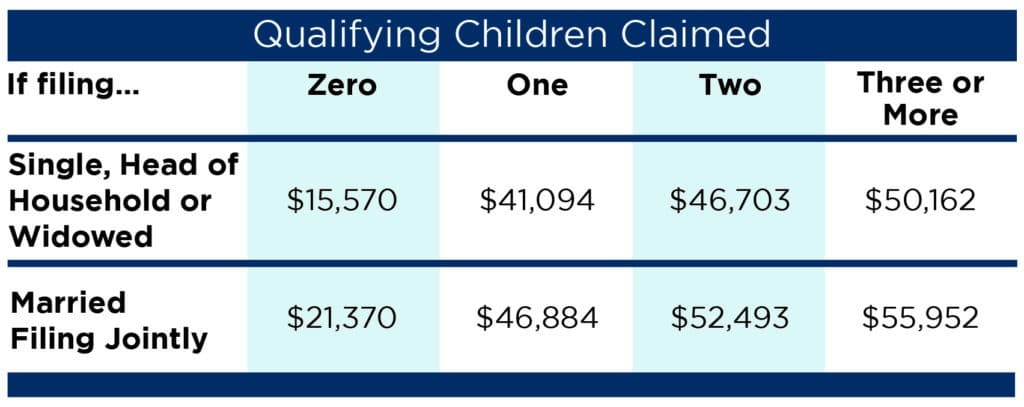

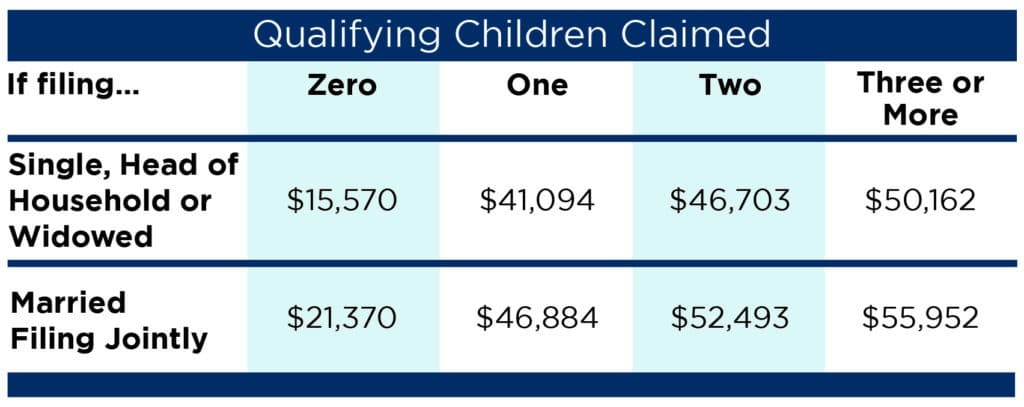

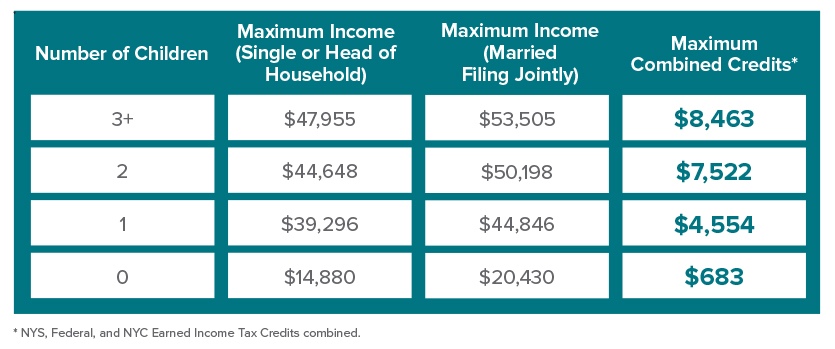

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

EV Tax Credit 2023 2024 How It Works What Qualifies NerdWallet

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/08/GettyImages-1252669337-ev-tax-credit-electric-vehicle-tax-credit-2400x1440.jpg

As of Jan 1 2024 eligible buyers can take the EV tax credit as a discount when purchasing a qualifying vehicle However one of the most important points is that there are income Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a

If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D Qualified Electric Vehicle Credit 2022 If you bought an Electric Vehicle in 2022 but didn t claim a related tax credit you may be able to amend your return The available credit you can take is the Qualified Plug in Electric Vehicle Credit

Download Ev Tax Credit Income Limit 2022 Reddit

More picture related to Ev Tax Credit Income Limit 2022 Reddit

Earned Income Tax Credit City Of Detroit

https://detroitmi.gov/sites/detroitmi.localhost/files/2019-01/ETIC-Chart.jpg

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

https://evadoption.com/wp-content/uploads/2021/08/Proposed-Changes-to-IRC-30D-Federal-EV-Tax-Credit-table-8.18.21-V4.png

Tameka Bullock

https://cdn.motor1.com/images/custom/bev-us-comparison-prices-20210225-gm-tesla-7000-tax-credit.png

Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a There are NO income caps on the CURRENT 7 5k EV tax credit a credit which is available on other EV s that have NOT yet reached the 200k sales cap The income limits

There are a lot of new requirements including maximum MSRP which differs for cars and trucks SUVs income limits for taxpayers and new battery requirements Plus cars IRS says 2022 or 2023 AGI is eligible for the income limits whichever is lower Does that mean if I make under 150k for 2022 and I purchase a Tesla in 2023 I can file the EV Tax credit in my

Child Tax Credit 2019 Chart What Is The Earned Income Tax Credit

https://gbq.com/wp-content/uploads/2019/05/Qualifying-Children-Claimed-Chart-1024x407.jpg

Earned Income Tax Credit Worksheet

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

https://www.reddit.com › electricvehicles › …

Person B single individual earns 148k in 2022 and 220k in 2023 The lesser of is 148k and meets the threshold so eligible for the credit if they buy an eligible EV It doesn t The key phrase in that text is the lesser of which is commonly

https://www.reddit.com › electricvehicles › comments › ...

Important Information About Tax Credits Congress recently passed new legislation the Inflation Reduction Act of 2022 which changes credit amounts and

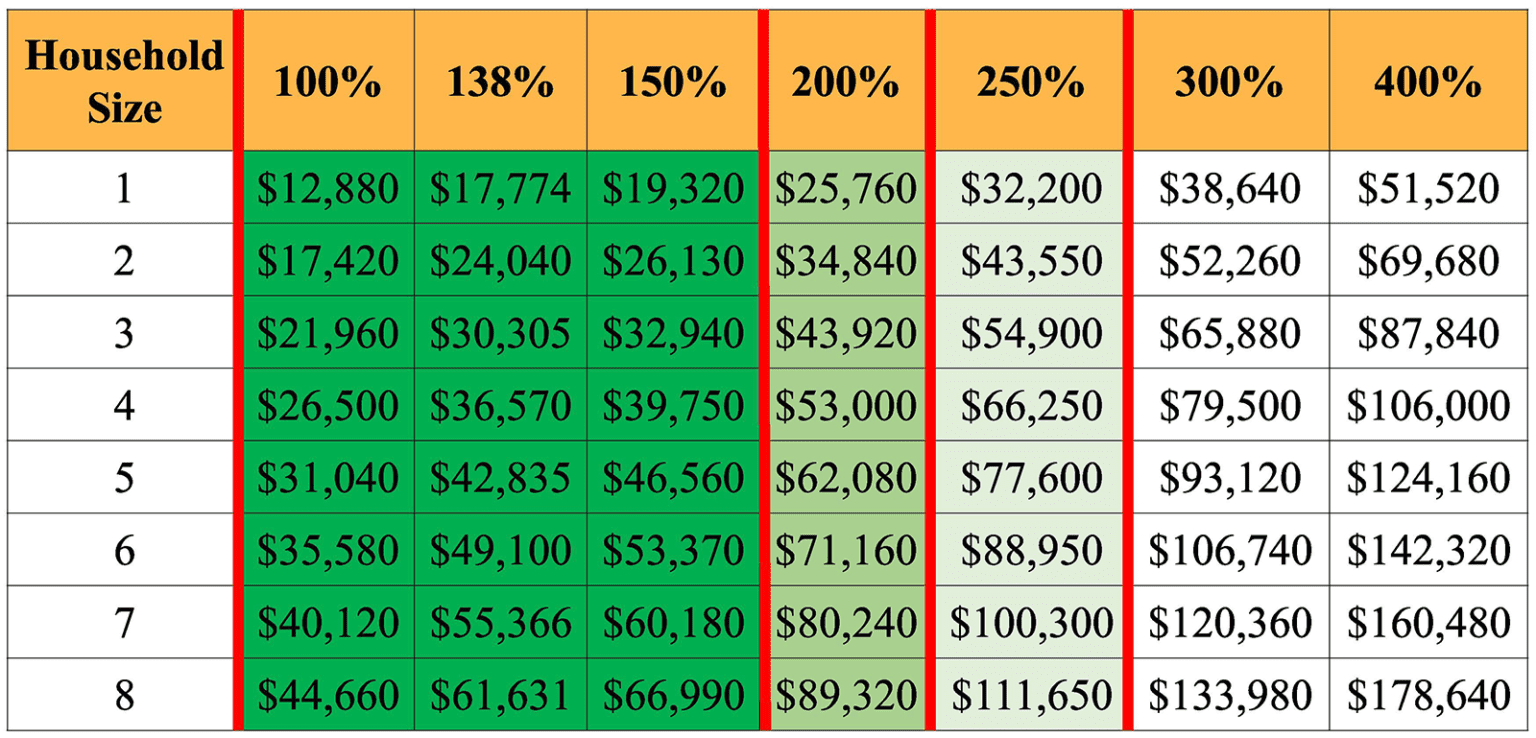

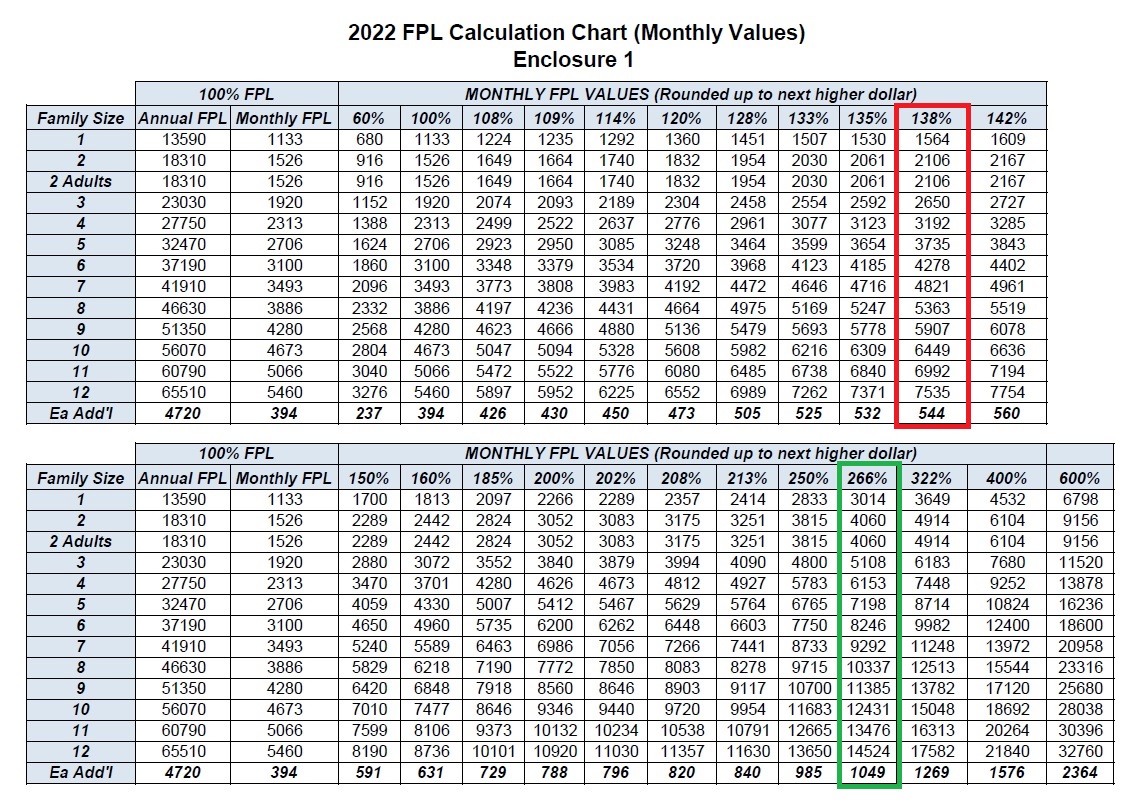

ACA Tax Credits To Help Pay Premiums White Insurance Agency

Child Tax Credit 2019 Chart What Is The Earned Income Tax Credit

Foreign Earned Income Tax Worksheet 2022

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

Child Tax Credit These Two Charts Show How The Gop S Proposed Tweaks

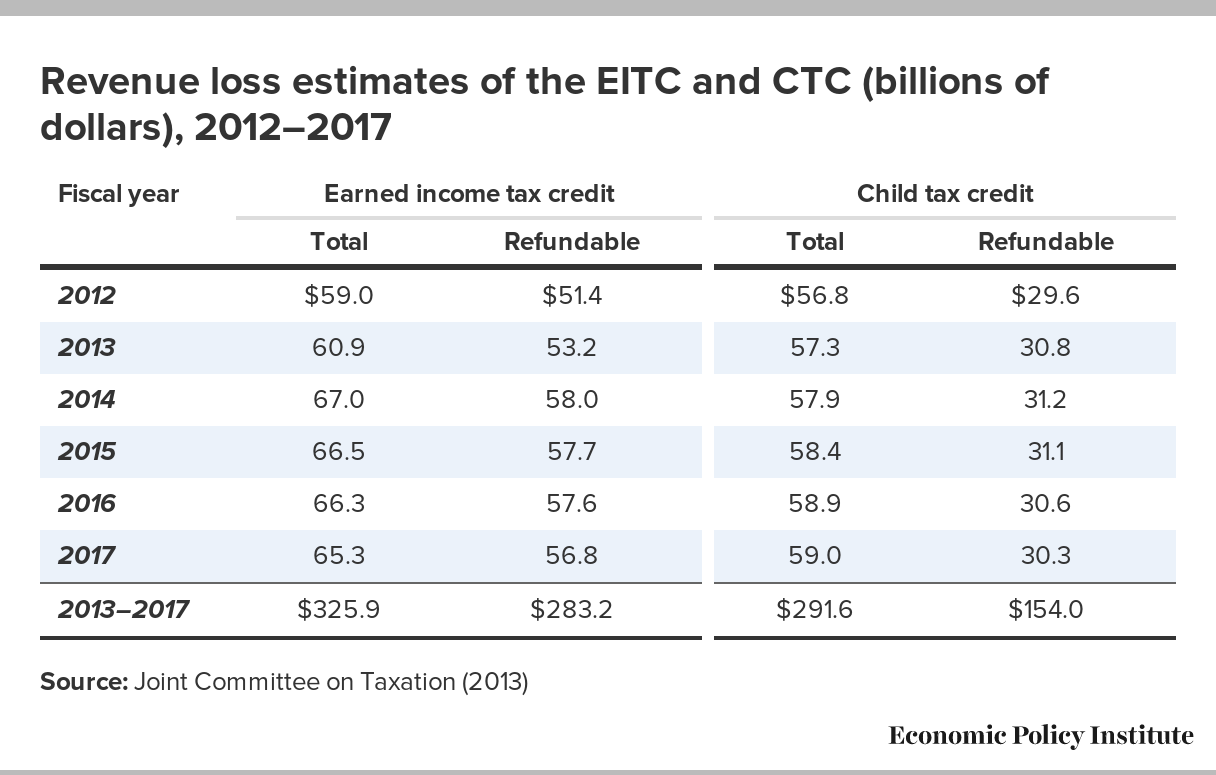

Earned Income Tax Credit Chart INCOBEMAN

Earned Income Tax Credit Chart INCOBEMAN

Earned Income Credit Table 2018 Chart Cabinets Matttroy

Child Tax Credit 2021 Chart Earned Income Tax Credit Eic Basics

Irs Tuition Reimbursement Limit 2022

Ev Tax Credit Income Limit 2022 Reddit - Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a