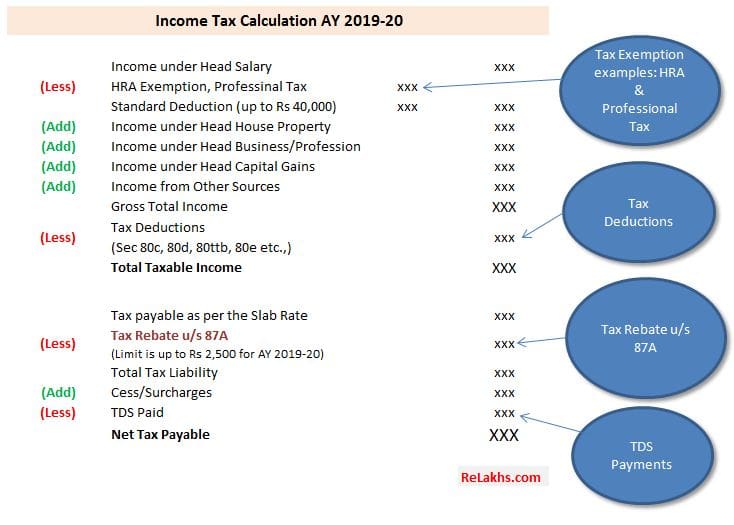

Income Tax Rebate On Interest Earned Web 13 mai 2017 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your Web 8 nov 2022 nbsp 0183 32 The tax rate is the same rate you would pay on any other income that you declare on your tax return Basically any interest bearing account will require you to pay tax on the earned income Any

Income Tax Rebate On Interest Earned

Income Tax Rebate On Interest Earned

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

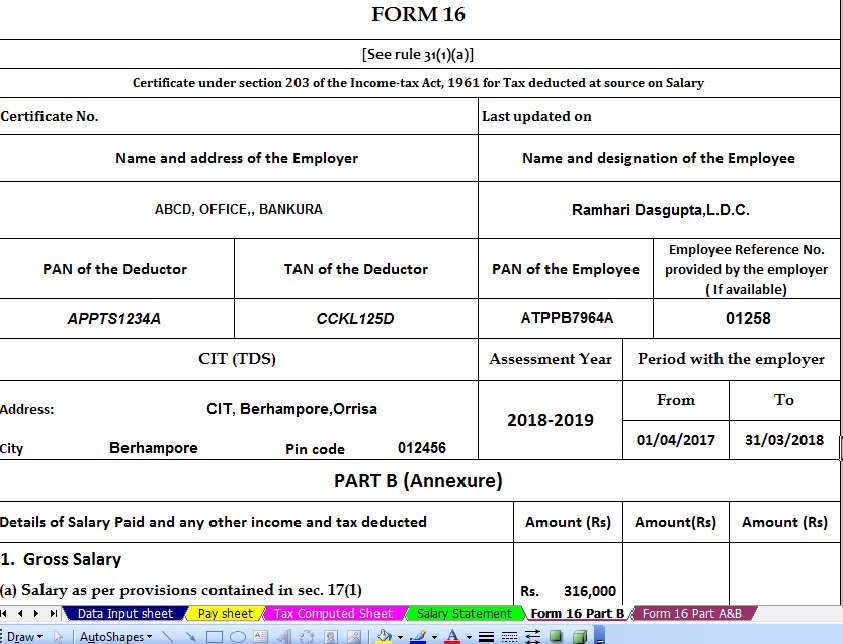

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web 22 f 233 vr 2023 nbsp 0183 32 Interest Exemptions Interest from a South African source earned by any natural person is exempt per annum up to an amount of 22 February 2023 No Web Deduction can be claimed only up to Rs 10 000 on the interest earned on the savings bank account However tax will have to be paid on any amount over and above Rs 10 000

Web 8 avr 2021 nbsp 0183 32 Interest earned from bank fixed deposits is fully taxable for individuals while senior citizens can claim a deduction of up to 50 000 against the interest earned on savings and fixed deposit Web 8 sept 2023 nbsp 0183 32 According to Section 80TTB of the Income Tax Act senior citizens can avail of a deduction of up to Rs 50 000 on the interest on deposits which includes fixed

Download Income Tax Rebate On Interest Earned

More picture related to Income Tax Rebate On Interest Earned

Interest Earned On Savings What Is It And How To Calculate It

https://www.wallstreetmojo.com/wp-content/uploads/2018/09/Interest-Income-1.png

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web Interest earned by a non resident is exempt unless the non resident was physically present in South Africa for more than 183 days during the 12 month period preceding the date on Web 11 nov 2019 nbsp 0183 32 Section 80TTA of Income Tax Act offers deduction on interest income earned from savings bank deposit of up to Rs 10 000 for FY 2023 24 AY 2024 25

Web 3 sept 2023 nbsp 0183 32 If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a deduction of Rs 10 000 on interest Web 4 mai 2023 nbsp 0183 32 For help with interest Call the phone number listed on the top right hand side of the notice Call 800 829 1040 Use telephone assistance Contact your local Taxpayer

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://cleartax.in/s/claiming-deduction-on-interest-under-section-80tta

Web 13 mai 2017 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative

https://www.idfcfirstbank.com/finfirst-blogs/finance/is-tax-refund...

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

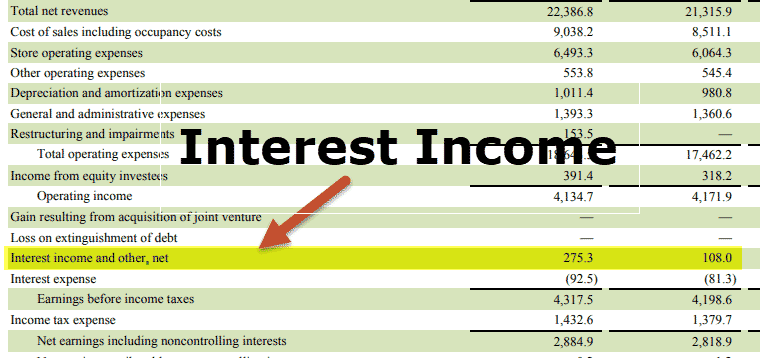

Solved From The Income Statement Other Income expense In Chegg

2007 Tax Rebate Tax Deduction Rebates

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

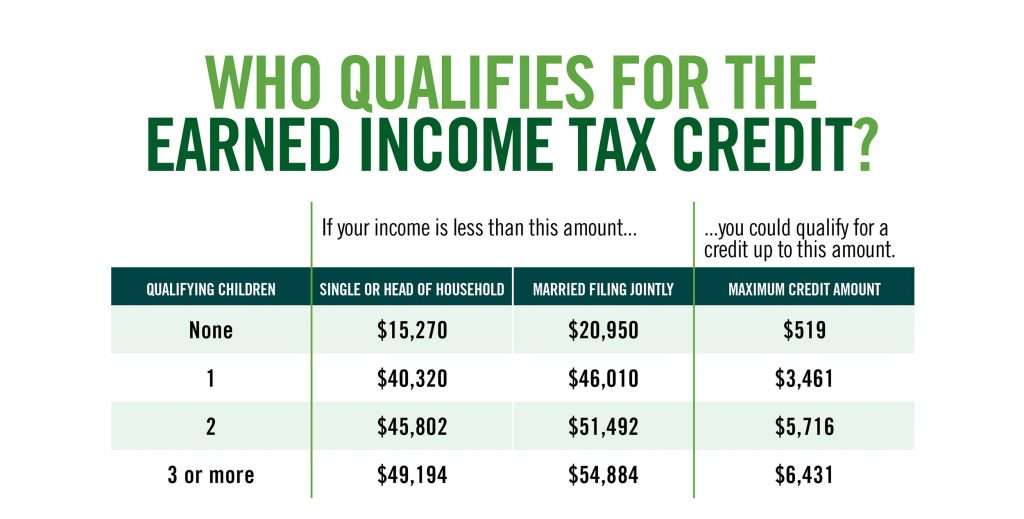

How Much Earned Income To File Taxes TaxesTalk

How Is Interest Income From Your Investments Taxed Personal Finance Plan

Retirement Income Tax Rebate Calculator Greater Good SA

Retirement Income Tax Rebate Calculator Greater Good SA

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

Times Interest Earned Calculator Double Entry Bookkeeping

Tax Rebate For Individual Deductions For Individuals reliefs

Income Tax Rebate On Interest Earned - Web 22 f 233 vr 2023 nbsp 0183 32 Interest Exemptions Interest from a South African source earned by any natural person is exempt per annum up to an amount of 22 February 2023 No