Ev Tax Credit Ohio Additionally the 2022 Inflation Reduction Act provides Americans with a 7 500 tax credit for buying new EVs and 4 000 for used EVs plus credits for commercial clean vehicles EV

Use this tool to find Ohio generally available and qualifying tax credits incentives and rebates that may apply to your purchase or lease of an electric vehicle A federal tax credit is available for new and used electric vehicles that meet requirements specified in Internal Revenue Code Section 30D New Vehicle Clean Credit up to 7 500 You

Ev Tax Credit Ohio

Ev Tax Credit Ohio

https://images.prismic.io/palmettoblog/3cc74d72-b42d-4352-8d79-0ad24ff79b9d_electric-vehicle-tax-credit.jpg?auto=compress

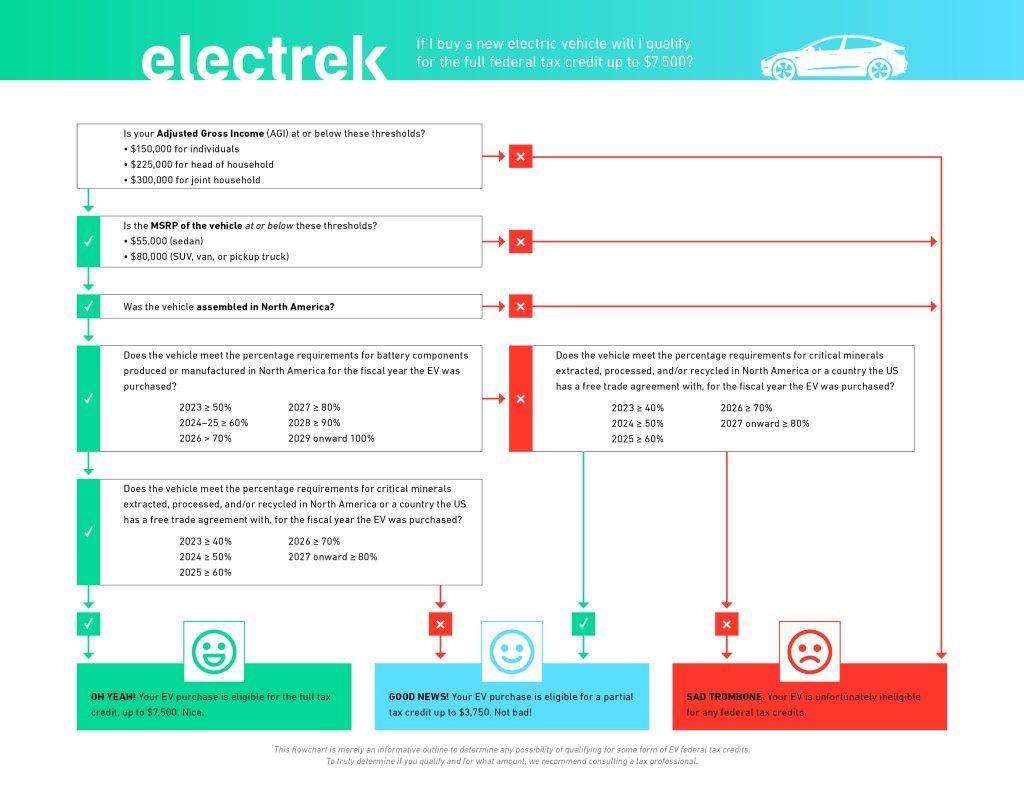

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

Government Electric Vehicle Tax Credit Electric Tax Credits Car

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

EV tax credits rebates incentives and exemptions by state Here it is the complete list of tax credits and rebates for new or used electric vehicle purchases or leases The Inflation Reduction Act of 2022 established a new tax credit for purchases of new or used Electric Vehicles EVs or Fuel Cell Vehicles FCVs Effective January 1 2024 this credit

The federal EV tax credit will be available to individuals reporting adjusted gross incomes of 150 000 or less 225 000 for heads of households or 300 000 for joint filers The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Download Ev Tax Credit Ohio

More picture related to Ev Tax Credit Ohio

Ev Tax Credit 2022 Cap Clement Wesley

https://electrek.co/wp-content/uploads/sites/3/2021/07/EV-Federal-Tax-Credit-Hero-2.jpg?quality=82&strip=all

New EV Tax Credits Taxed Right

https://taxedright.com/wp-content/uploads/2022/11/EV-Tax-Credit-1-760x505.jpg

EV Tax Credits And Rebates List 2022 Guide

https://avtowow.com/wp-content/uploads/2021/02/Copy-of-Header-Image-1-1-1.png

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug Effective Jan 1 2024 this new tax credit can be transferred to EV and FCV sellers reducing costs to consumers Qualified purchasers may be eligible for a credit of up to

Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles There s no denying that electric vehicles EVs are expensive but there are federal and state incentives like rebates and tax credits to make EVs more financially

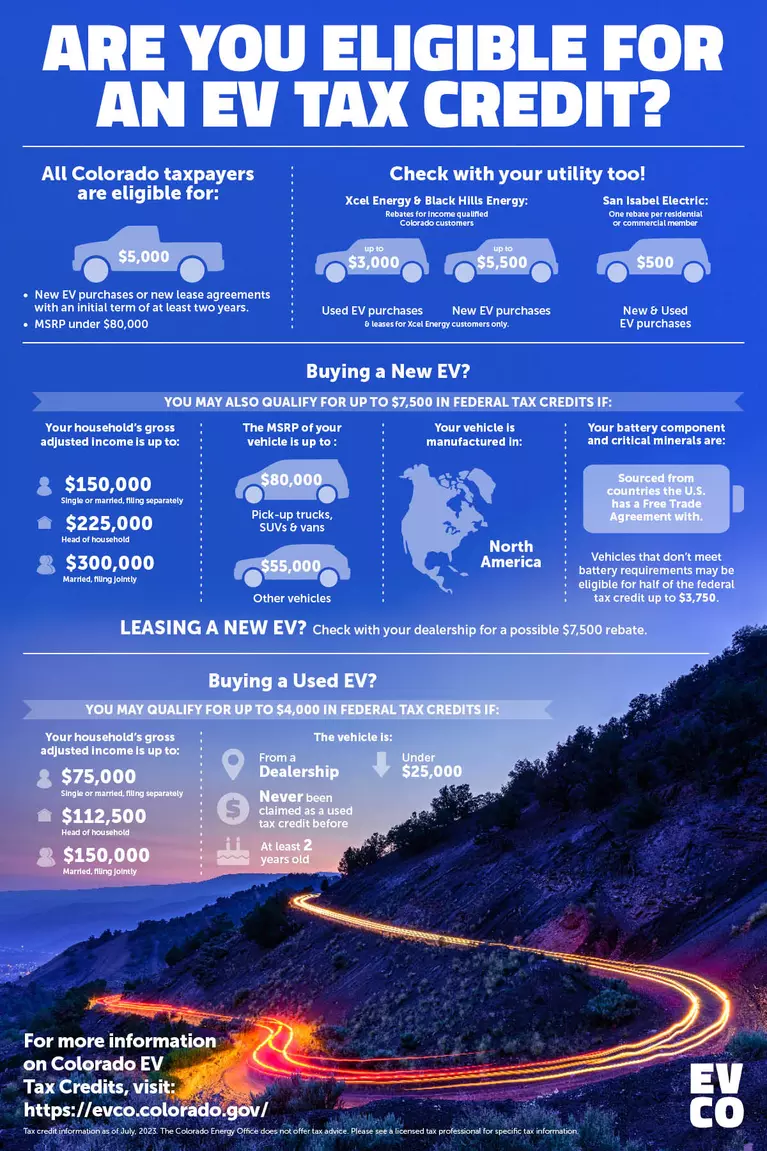

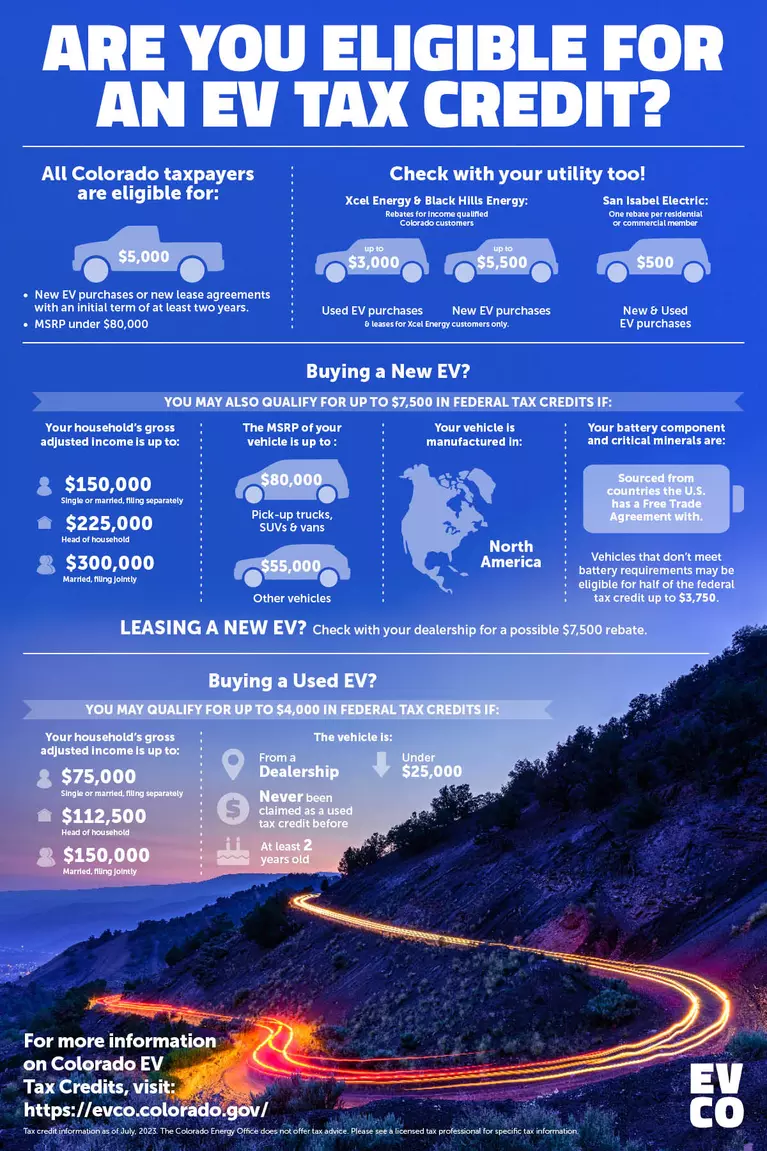

Are You Eligible For An EV Tax Credit EV CO

https://evco.colorado.gov/sites/evco/files/styles/mobile_x1_767px/public/2023-06/EVCO_Infographic_6.29.jpg.webp

The New EV Tax Credit In 2023 Everything You Need To Know Updated

https://caredge.com/wp-content/uploads/2021/11/ev-tax-credit-update-2022.png

https://www.msn.com/en-us/news/politics/the...

Additionally the 2022 Inflation Reduction Act provides Americans with a 7 500 tax credit for buying new EVs and 4 000 for used EVs plus credits for commercial clean vehicles EV

https://www.edmunds.com/electric-car/tax-credits...

Use this tool to find Ohio generally available and qualifying tax credits incentives and rebates that may apply to your purchase or lease of an electric vehicle

Federal EV Tax Credit Explained YouTube

Are You Eligible For An EV Tax Credit EV CO

Changes To The EV Tax Credit Cray Kaiser

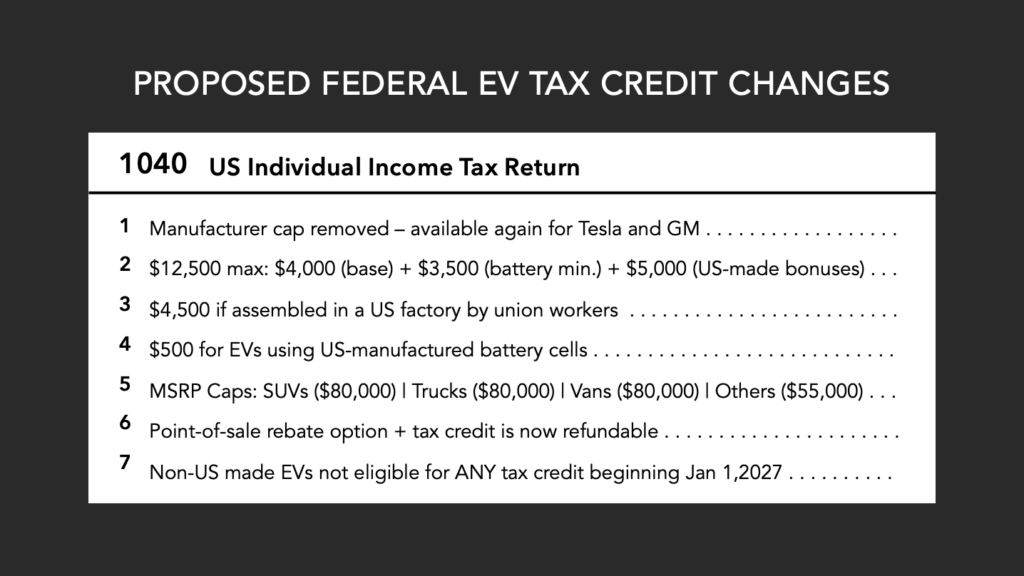

What Will Change With EV Tax Credits In 2023

What Cars Are Eligible For The 7500 EV Tax Credit It s Complicated

Rivian Offers Binding Contract To Maintain 7 500 EV Tax Credit

Rivian Offers Binding Contract To Maintain 7 500 EV Tax Credit

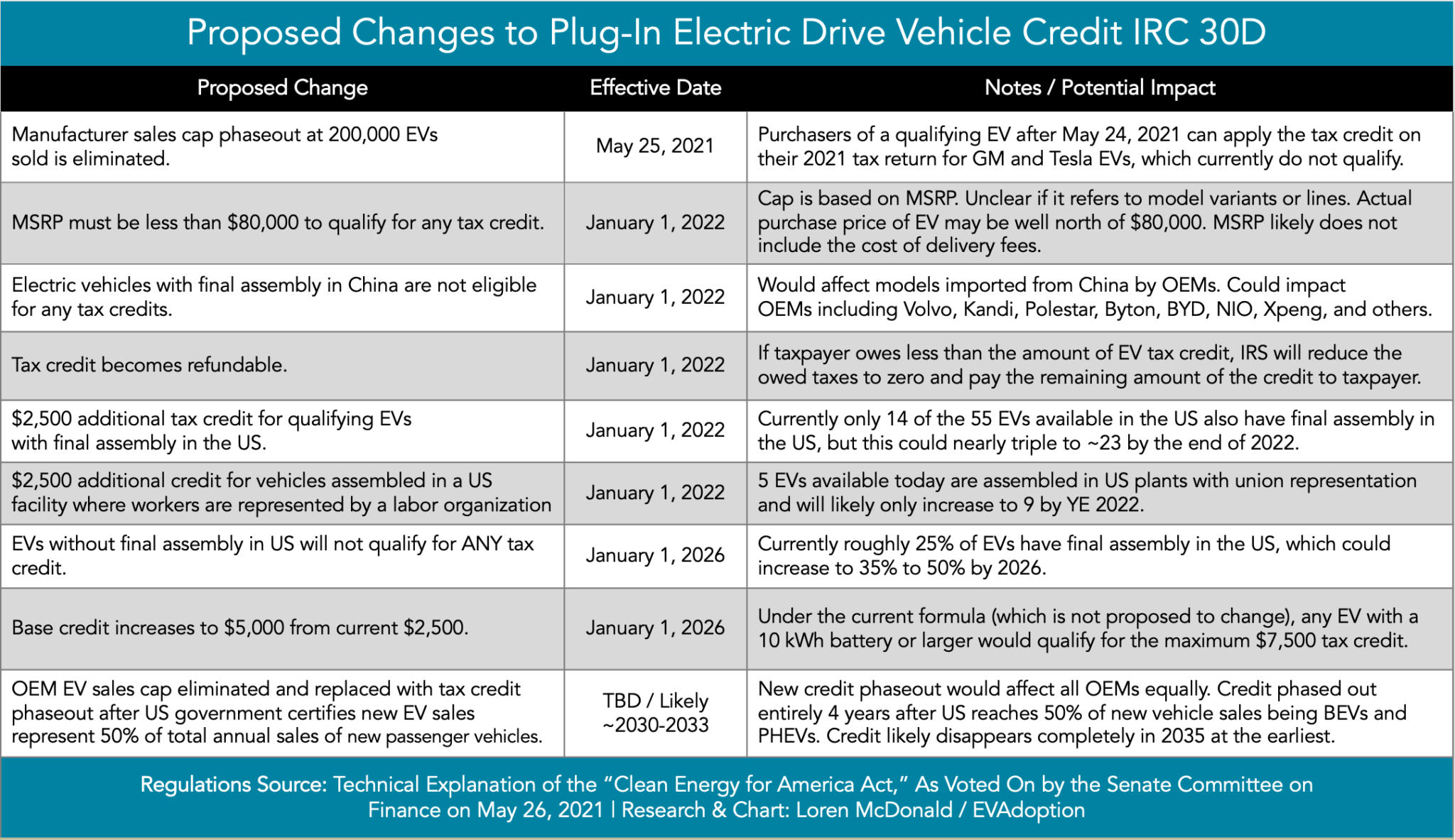

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

Proposed Federal EV Tax Credit Changes IRC 30D featured Image v3

Everything To Know About The New EV Tax Credits Virginia Automobile

Ev Tax Credit Ohio - Fortunately if you go electric you can save thousands of dollars through a tax rebate Thanks to new federal legislation most new EVs now come with a 7 500 rebate and most used EVs