Ev Tax Credit Refundable Or Nonrefundable The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after Who qualifies You may qualify for a credit up to 7 500 for buying a qualified new car or light truck The credit is nonrefundable meaning it won t generate a tax refund if you don t owe any taxes For years prior to 2023 the new clean vehicle tax credit amount is similar

Ev Tax Credit Refundable Or Nonrefundable

Ev Tax Credit Refundable Or Nonrefundable

https://edgefinancial.com/wp-content/uploads/2020/02/refundable-tax-credits-vs-nonrefundable-tax-credits.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code EV tax credits are nonrefundable This means they can only be applied to tax owed in the year in which you took delivery Businesses however can transfer new EV tax credits to future years

In 2022 the available credit you can take is the Qualified Plug in Electric Vehicle Credit This non refundable tax credit is for four wheeled plug in electric vehicles that meet particular battery specifications The credit is That s because the credit is applied against your tax bill for vehicles purchased in 2023 you ll get the credit when you file in 2024 and you don t get a refund if your tax credit is

Download Ev Tax Credit Refundable Or Nonrefundable

More picture related to Ev Tax Credit Refundable Or Nonrefundable

Nonrefundable Tax Credit Requirements Examples How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgTMqGwItilexEoZQJNU2GLzvaTnbp258m3Nzi1jN5_u_xZrw9g4yvAOf-x19hxqiU9DeOiOw1hi2gBes0jtQ0dcT_GInA7ahKGKakdw3MTzOcVxOwEOQGghxnLpUEkrfRSkg2e_WCMS9N8qZQ0gbar9AiZYRe4B7qUOtVIttiBL_Nbs8SN0XKhBm7fd4k/s944/non.jpg

Refundable Vs Nonrefundable Tax Credits Experian

https://s28126.pcdn.co/blogs/ask-experian/wp-content/uploads/A-Person-Holds-A-Coffee-Cup-While-Writing-On-Tax-Forms-On-Their-Desk.jpg

The New EV Tax Credit In 2023 Everything You Need To Know Updated

https://caredge.com/wp-content/uploads/2021/11/ev-tax-credit-update-2022.png

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible and claim a

The complication comes in the fact that the credit is not refundable A nonrefundable credit can reduce your total taxes owed but not below zero In other words if you owed no taxes but purchased a qualified EV you would not receive a refund from the credit The credit can only offset taxes owed The first and possibly most notable aspect of Build Back Better is that the tax credits are refundable meaning that if your credit is worth more than the amount you owe in taxes then you would

What Is The Difference Between Non refundable And Refundable Tax

https://cdn.taxory.com/wp-content/uploads/2020/12/refundable-and-non-refundable-tax-credits-1080x590.jpg

The Federal Tax Credit For Electric Vehicles OsVehicle

https://cdn.osvehicle.com/is_the_pev_credit_refundable.jpg

https:// turbotax.intuit.com /tax-tips/going-green/...

The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

https://www. irs.gov /credits-deductions/credits-for...

It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after Who qualifies You may qualify for a credit up to 7 500 for buying a qualified new car or light truck

A Refundable EV Tax Credit Huddleston Tax CPAs Blog

What Is The Difference Between Non refundable And Refundable Tax

Tax Credits ElectricVehicleSolar

Refundable Federal EV Tax Credit featured Image EVAdoption

Refundable Vs Non Refundable Tax Credits

Refundable Non Refundable Tax Credits YouTube

Refundable Non Refundable Tax Credits YouTube

What Are Refundable Tax Credits YouTube

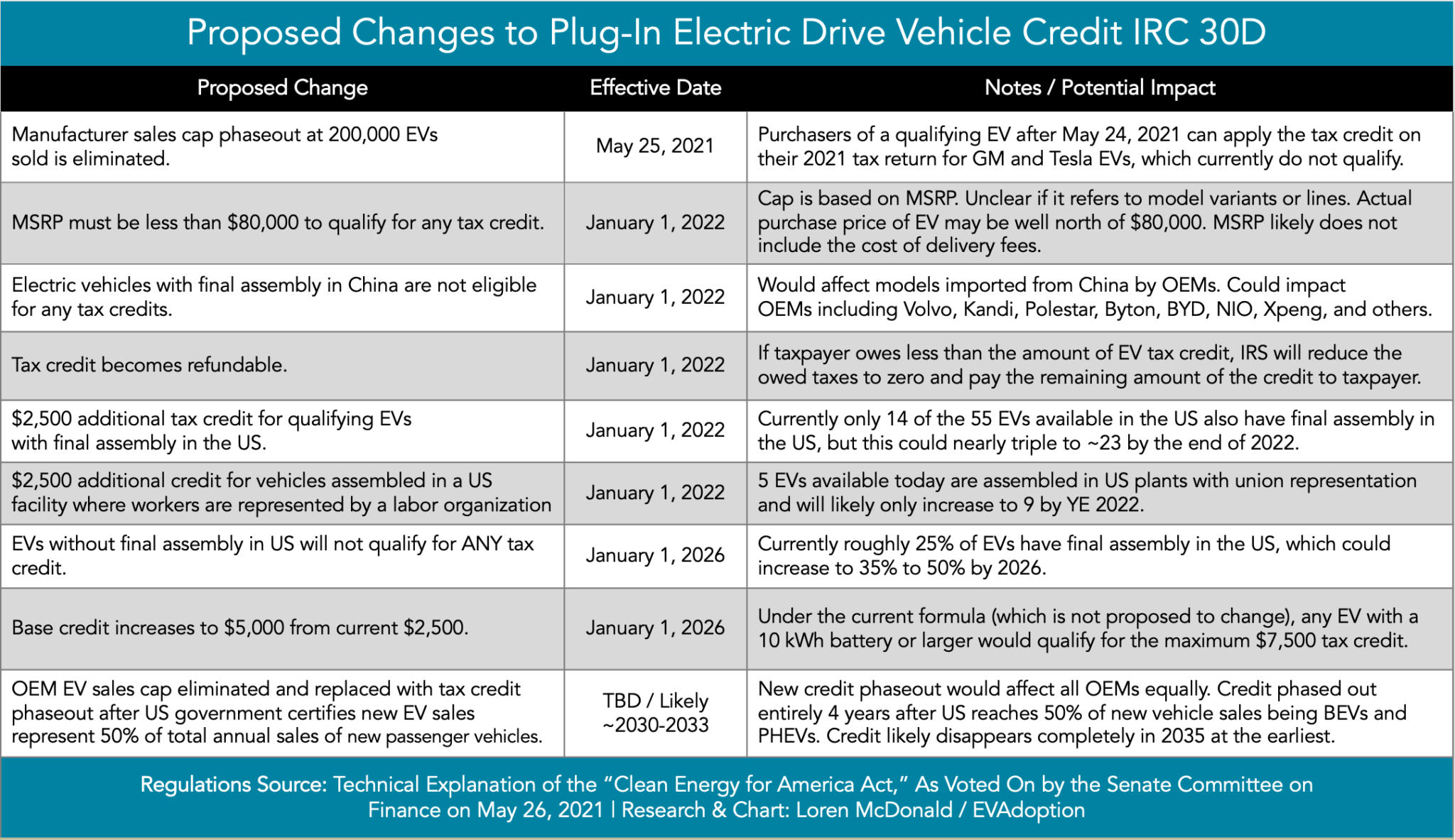

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

Residential Energy Tax Credits Changes In 2023 EveryCRSReport

Ev Tax Credit Refundable Or Nonrefundable - The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code