Ev Tax Rebate Income Cap Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit

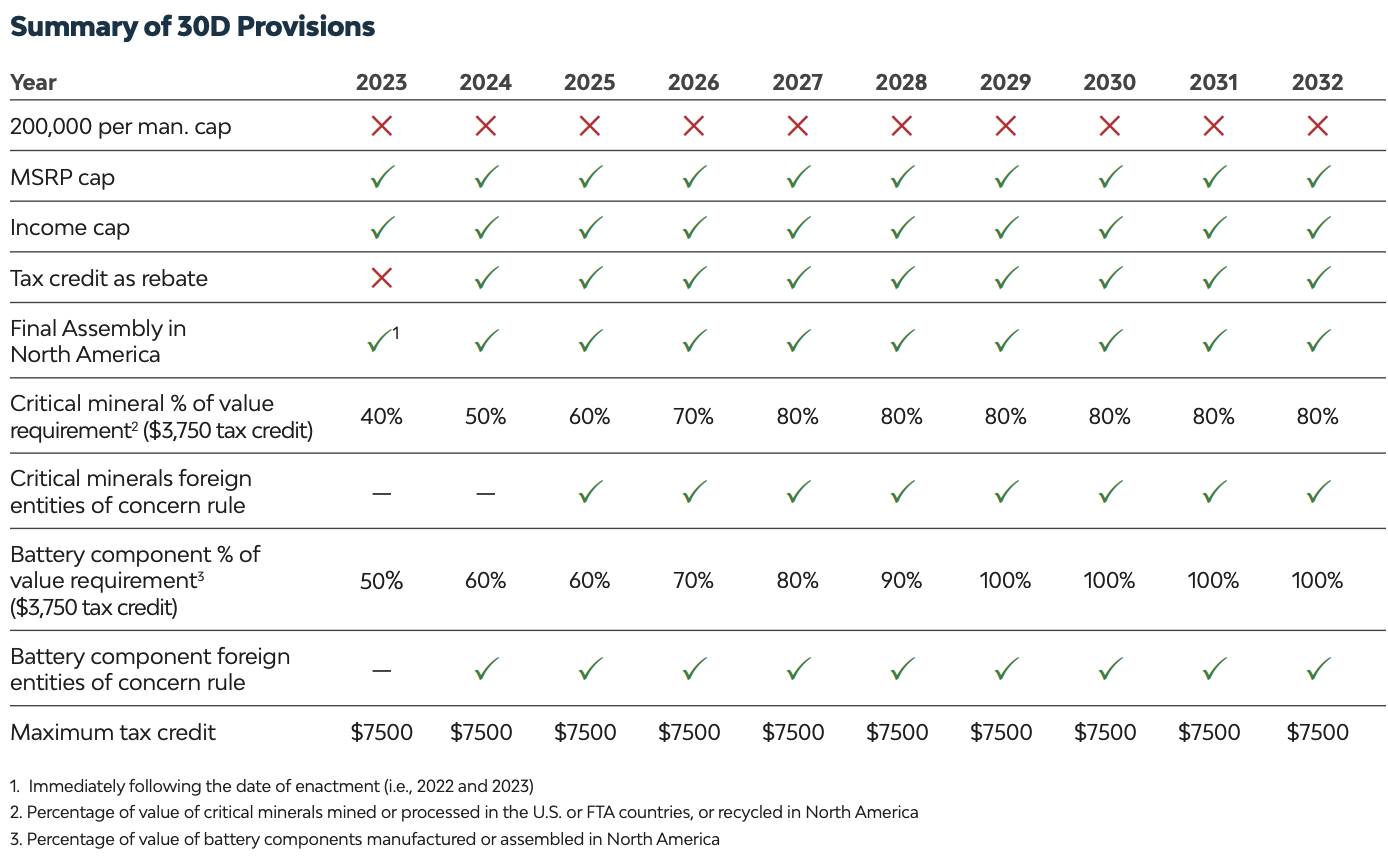

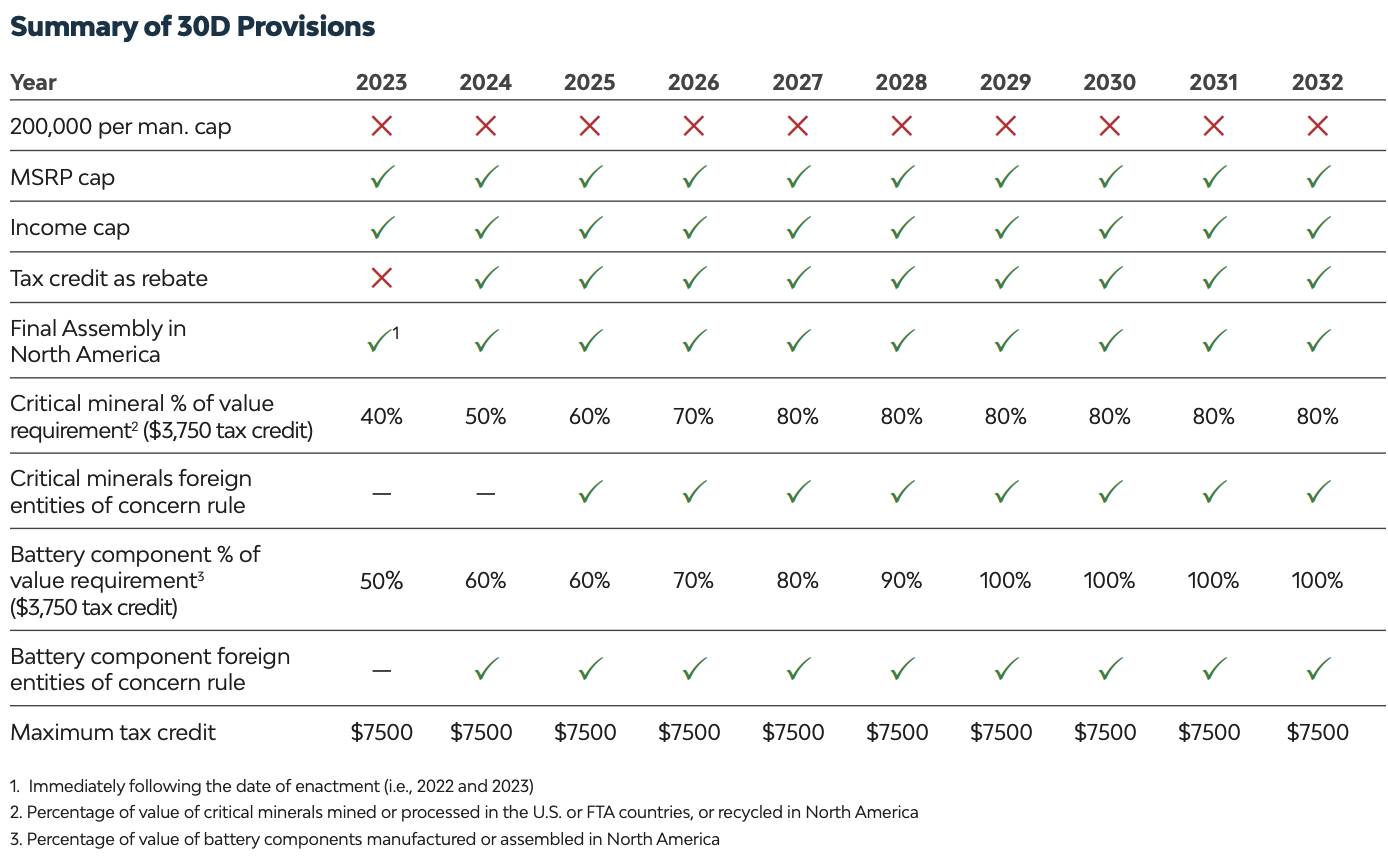

Web 2 sept 2023 nbsp 0183 32 Very few EVs currently qualify for the full 7 500 tax credit Some electric vehicles that don t qualify include about nine models mostly from foreign manufacturers including Hyundai Web 31 mars 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 167 30D tax credit The IRA

Ev Tax Rebate Income Cap

Ev Tax Rebate Income Cap

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Ev Car Tax Rebate Calculator 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

Much Needed Electric Vehicle Tax Credit Reforms Finally Announced

https://www.plugincars.com/sites/default/files/EV-Tax-Credits1.jpg

Web 20 juil 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 overhauled the EV tax credit adding income limits price caps and a requirement that battery Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of 2023 The EV tax

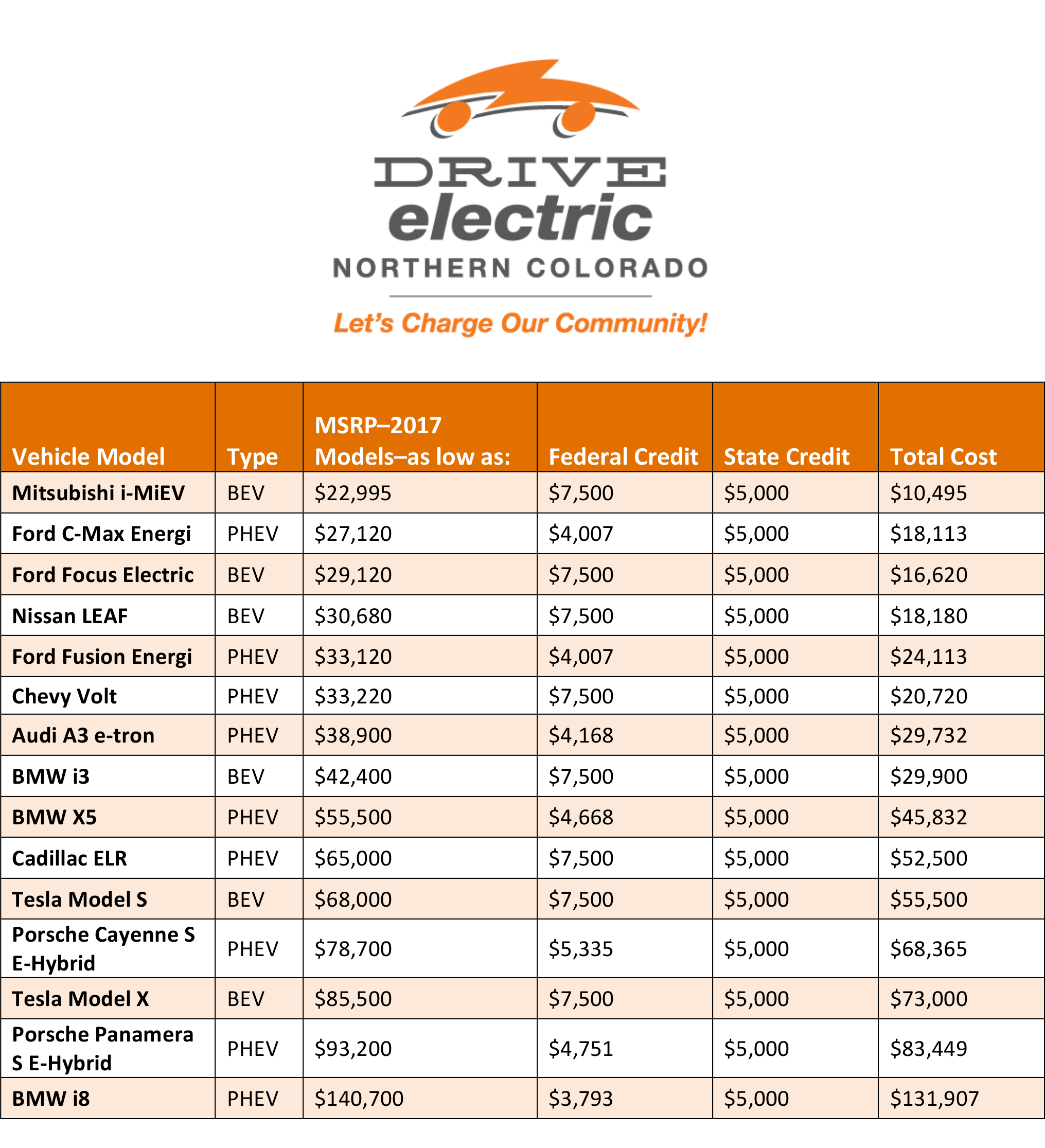

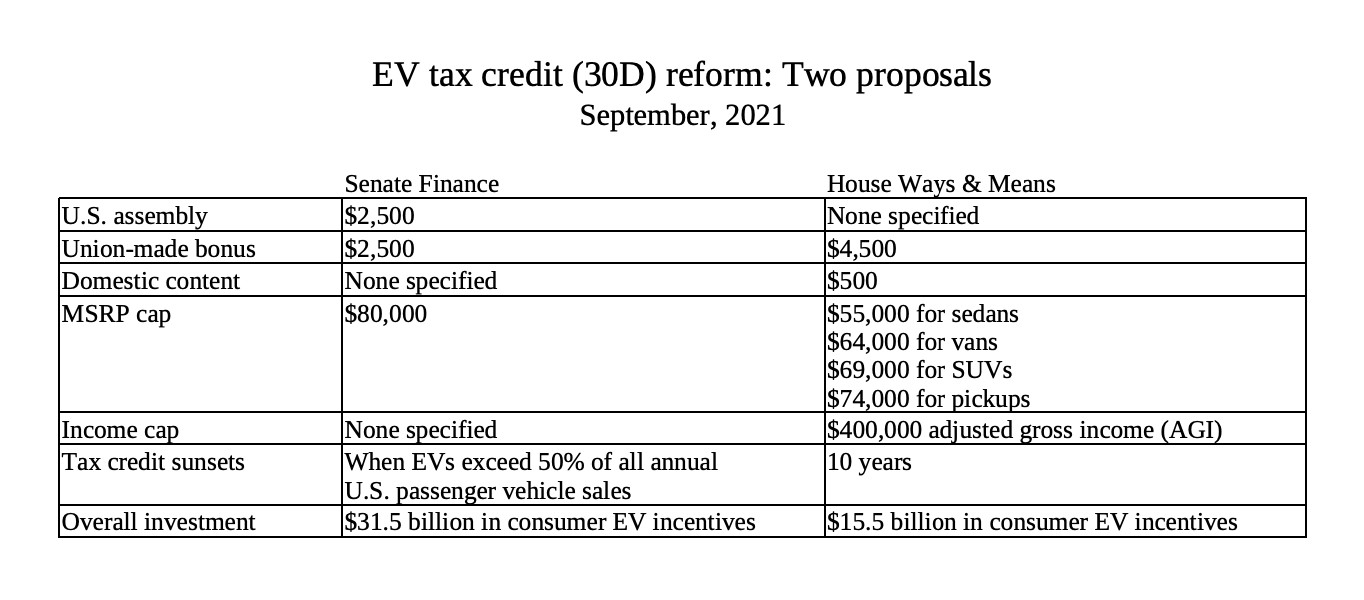

Web 21 avr 2023 nbsp 0183 32 What is the Federal EV Tax Credit The Inflation Reduction Act of 2022 renewed and expanded funding for the federal EV tax credit through 2032 for qualified drivers looking to purchase an electric vehicle Web 29 sept 2022 nbsp 0183 32 SUVs vans and pickup trucks under 80 000 and all other vehicles e g sedans under 55 000 will qualify for the EV tax credit For new vehicles purchaser income will be subject to an AGI cap 150 000 for individuals and 300 000 for a joint

Download Ev Tax Rebate Income Cap

More picture related to Ev Tax Rebate Income Cap

California s EV Rebate Changes A Good Model For The Federal EV Tax

https://cleantechnica.com/files/2019/11/CVRP-rebates-samples.png

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Save On 2020 Taxes Fi Life

https://fi.life/assets/upload/malaysia-tax-relief-2020-mypf.png

Web 25 juil 2023 nbsp 0183 32 They include a federal income tax credit of up to 7 500 for some new EVs And don t forget added rebates and other perks from state and local utilities Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Web 7 ao 251 t 2022 nbsp 0183 32 It will even be available on used EVs with a credit of up to 4 000 on cars priced 25K or less and subject to a number of other requirements including a lower income cap of 75k 150k Web 25 ao 251 t 2022 nbsp 0183 32 Those who meet the income requirements and buy a qualifying vehicle are eligible to receive up to 7 500 from the government The credit now applies to any clean vehicle and can be used on

EV Tax Credit

https://smithpatrickcpa.com/wp-content/uploads/2022/11/EV-Tax-Credit-Summary.png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit

https://www.kiplinger.com/taxes/605081/ev-ta…

Web 2 sept 2023 nbsp 0183 32 Very few EVs currently qualify for the full 7 500 tax credit Some electric vehicles that don t qualify include about nine models mostly from foreign manufacturers including Hyundai

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

EV Tax Credit

EV Tax Credit Boost At Up To 12 500 Here s How The Two Versions Compare

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

Proposed Federal EV Tax Credit Reform Will It Move The Sales Needle

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Ev Tax Rebate Income Cap - Web 21 avr 2023 nbsp 0183 32 What is the Federal EV Tax Credit The Inflation Reduction Act of 2022 renewed and expanded funding for the federal EV tax credit through 2032 for qualified drivers looking to purchase an electric vehicle