Ev Tax Rebates Kentucky Web Kentucky electric vehicle rebates tax credits and other incentives Use this tool to find Kentucky tax credits incentives and rebates that may apply to your purchase or lease

Web For vehicles acquired after December 31 2009 the federal tax credit is equal to 2 500 plus for a vehicle which draws propulsion energy from a Web 7 500 tax credit for EVs The federal government offers a tax credit up to 7 500 Consult the IRS website for details View a full list of qualified electric vehicles at fueleconomy gov

Ev Tax Rebates Kentucky

Ev Tax Rebates Kentucky

https://www.tax-rebate.net/wp-content/uploads/2023/05/Kentucky-Tax-Rebate-2023.jpg

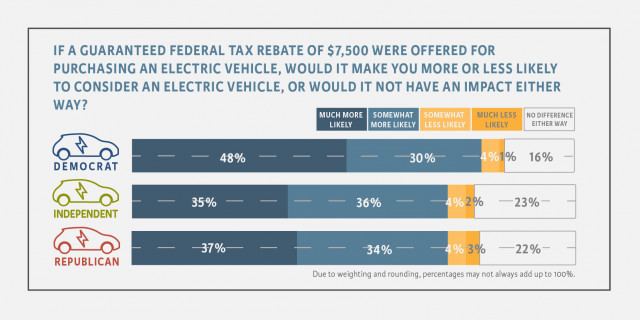

Politics Be Damned Electric Cars Aren t Really So Polarizing

https://images.hgmsites.net/med/ev-tax-credit-support--climate-nexus-may-2019_100702679_m.jpg

Estimate Kentucky Tax Refund Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Kentucky-Tax-Rebate-2023-768x683.png

Web On September 14 2022 FHWA approved KY s Plan securing the first two years of Kentucly s share of the federal NEVI formula program funds roughly 25M of the Web 11 ao 251 t 2023 nbsp 0183 32 Federal Tax Incentive The Federal Goverment has a tax credit for installing residential EV chargers The Federal EV Charger Tax Credit program offers a rebate of

Web Currently Kentucky does not offer many tax incentives for individual owners of fuel efficient cars But it does provide a list of state incentives for businesses involved in the Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Download Ev Tax Rebates Kentucky

More picture related to Ev Tax Rebates Kentucky

Electric Vehicle EV Incentives Rebates

https://wbmlp.org/docs/rebates/EVs/WBMLP-Chevy-Bolt-EV-Offers.png

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

EV Charger Program

https://chargeproev.com/wp-content/uploads/2022/10/Rebates-and-tax-credits-for-EV-chargers.jpg

Web Currently there are no EV tax credits or incentives in Kentucky Please check back to see if this changes You may qualify for a Federal electric vehicle tax credit of 7500 Find your Web Beginning on January 1 2024 EV charging station owners and lessees must pay a combined excise tax and surtax fee of 0 03 per kilowatt hour of electricity used to

Web 31 janv 2022 nbsp 0183 32 Kentucky is also one of only 10 states to not offer any incentives for EV or hybrid ownership according to the National Conference of State Legislatures Some Web Reference Kentucky Revised Statutes 186 750 Electric Vehicle EV Charging Station Tax Beginning on January 1 2024 EV charging station owners and lessees must pay a

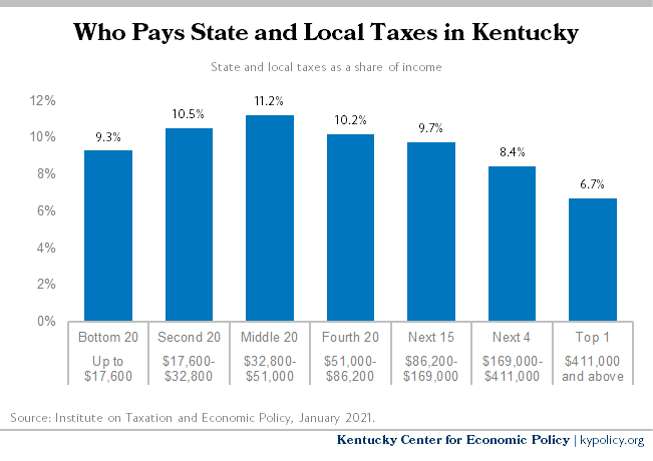

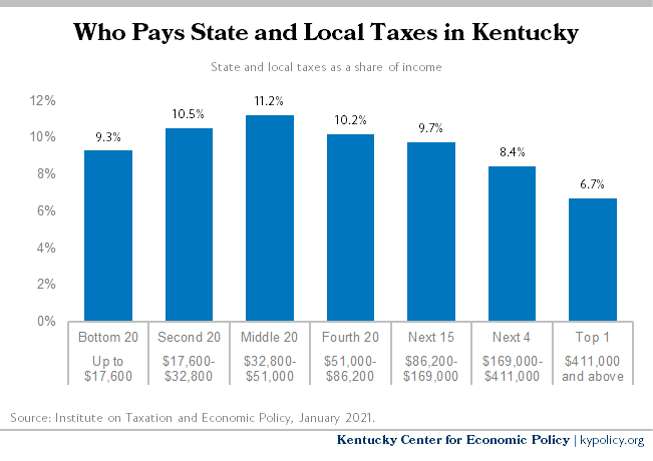

Senate Income Tax Rebate Unfairly Leaves Out Low Income Kentuckians

https://kypolicy.org/wp-content/uploads/2022/02/Who-Pays-State-Local-Taxes-in-Kentucky.png

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

https://www.edmunds.com/.../tax-credits-rebates-incentives/kentucky

Web Kentucky electric vehicle rebates tax credits and other incentives Use this tool to find Kentucky tax credits incentives and rebates that may apply to your purchase or lease

https://kentuckycleanfuels.org/electricity/law…

Web For vehicles acquired after December 31 2009 the federal tax credit is equal to 2 500 plus for a vehicle which draws propulsion energy from a

Electric Vehicle EV Incentives Rebates

Senate Income Tax Rebate Unfairly Leaves Out Low Income Kentuckians

PEI Takes Unique Steps With Its Aggressive New EV Rebates

EV Tax Credit Are You Claiming The Correct Rebates Benefits

Types Of Rebate Programs By Charger Type Graphs

EV Tax Credit Are You Claiming The Correct Rebates Benefits

EV Tax Credit Are You Claiming The Correct Rebates Benefits

All U S PHEV And EV Customers Get Rebates But Some Must Also Pay

Trump Bill Signing Meme Imgflip

Volta EV Charger At A Hotel

Ev Tax Rebates Kentucky - Web Currently Kentucky does not offer many tax incentives for individual owners of fuel efficient cars But it does provide a list of state incentives for businesses involved in the