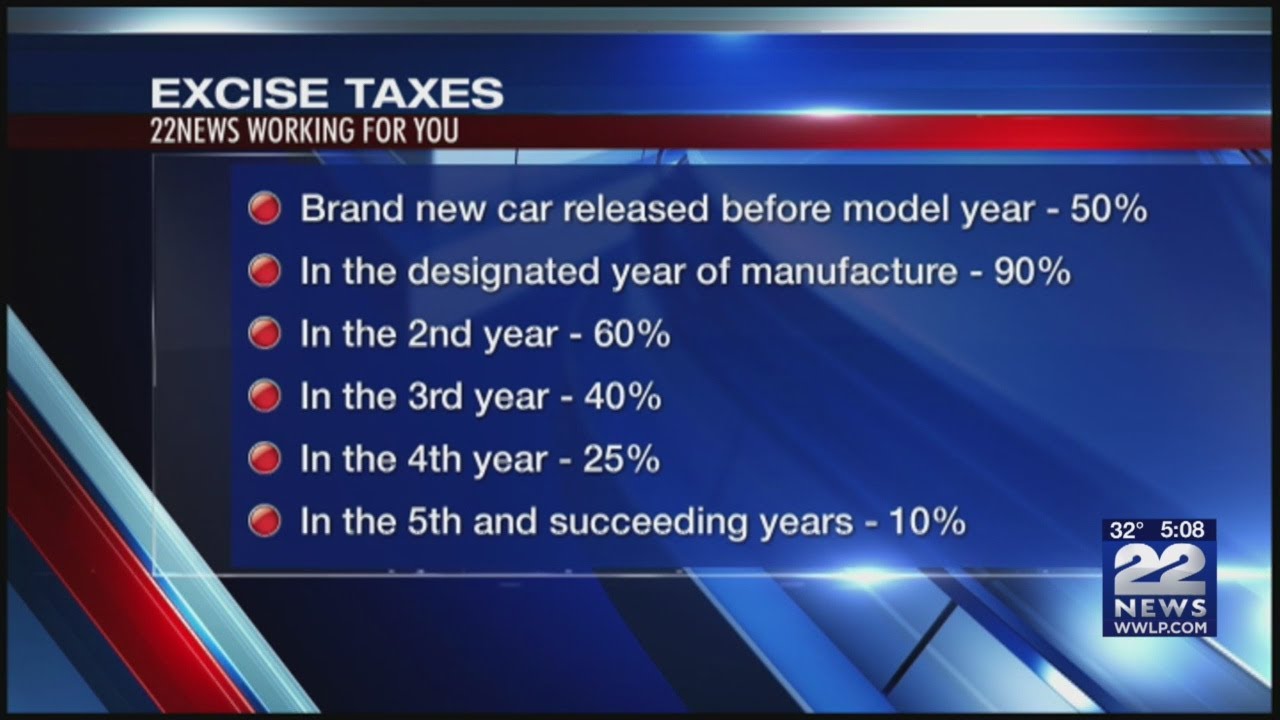

Excise Tax Definition Excise tax refers to a tax on the sale of an individual unit of a good or service The vast majority of tax revenue in the United States is generated from excise taxes The incidence of an excise tax depends on the price elasticity of demand and the price elasticity of supply

Excise taxes are taxes imposed on a specific good or activity They are commonly levied on cigarettes alcoholic beverages soda gasoline insurance premiums amusement activities and betting and make up a relatively small and volatile portion of According to the Internal Revenue Service IRS excise taxes are taxes paid when purchases are made on a specific good such as gasoline The price of something subject to an

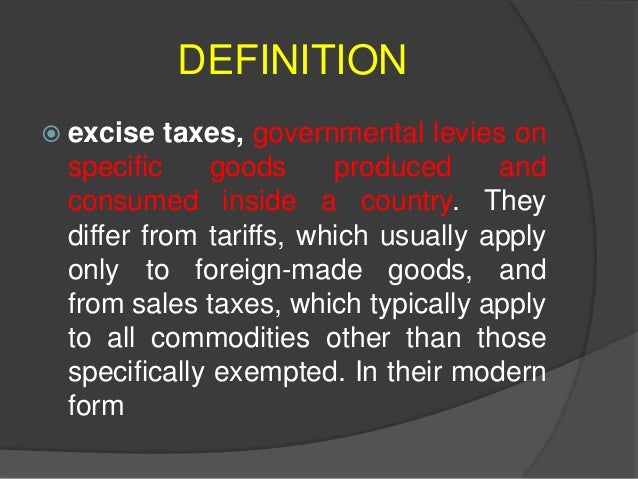

Excise Tax Definition

Excise Tax Definition

https://cdn.shopify.com/s/files/1/0070/7032/files/what_is_excise_tax.jpg?v=1666976261&width=1024

Excise Tax Definition Types And Examples TheStreet

http://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/9c4ab4cb-56e2-11e9-a65a-d37e40182361.png

Thu Ti u Th c Bi t So V i Thu B n H ng Hai Lo i Thu Ho t ng

https://bestprint.vn/wp-content/uploads/2023/02/excise-tax-vs-sales-tax.jpg

Excise duty 1 1 Definition of Excise Duty This is a tax on particular goods or products or on a limited range of goods or products whether imported or produced domestically which may be imposed at any stage of production or distribution by An excise tax is an indirect toll placed on goods services or activities as a way to either offset the cost of public usage or discourage use of certain items In most situations you may

A An applicant for Local Excise license should state the following The nature of goods to be manufactured The process of manufacture The premises and equipment to be used in manufacturing of excisable goods The An excise tax is similar to a sales tax but it s levied only on certain products or services The most common excise taxes are imposed on tobacco alcohol and gasoline The Affordable Care Act also provides for an excise tax on some health related services and products

Download Excise Tax Definition

More picture related to Excise Tax Definition

:max_bytes(150000):strip_icc()/Term-f-federal-telephone-excise-tax_Final-085db22b9656415eb36a933d25b9a3f7.png)

Federal Telephone Excise Tax What It Is How It Works

https://www.investopedia.com/thmb/yH7Powp-tkUrHyI8GKYW9y8T7V8=/750x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-f-federal-telephone-excise-tax_Final-085db22b9656415eb36a933d25b9a3f7.png

Excise Tax Meaning YouTube

https://i.ytimg.com/vi/-l4vGZCKiOA/maxresdefault.jpg

What Is Excise Definition And Examples Market Business News

https://marketbusinessnews.com/wp-content/uploads/2018/08/Excise-duty.jpg

What Is Excise Tax Excise tax refers to an indirect type of taxation imposed on the manufacture sale or use of certain types of goods and products An excise tax is a tax on the purchase of a specific good or service such as alcohol cigarettes or gambling Some excise taxes are imposed by the federal government

[desc-10] [desc-11]

Is Excise Duty Direct Expense Accountancy Financial Statements Of A

https://s3mn.mnimgs.com/img/shared/content_ck_images/ck_5e0962e313e6d.png

Excise Tax Types Of Excise Tax How Does Excise Tax Work

https://cdn.educba.com/academy/wp-content/uploads/2021/02/Excise-Tax.jpg

https://corporatefinanceinstitute.com/resources/economics/excise-tax

Excise tax refers to a tax on the sale of an individual unit of a good or service The vast majority of tax revenue in the United States is generated from excise taxes The incidence of an excise tax depends on the price elasticity of demand and the price elasticity of supply

https://taxfoundation.org/taxedu/glossary/excise-tax

Excise taxes are taxes imposed on a specific good or activity They are commonly levied on cigarettes alcoholic beverages soda gasoline insurance premiums amusement activities and betting and make up a relatively small and volatile portion of

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Is Excise Duty Direct Expense Accountancy Financial Statements Of A

What Is Excise Tax And How Does It Differ From Sales Tax

Excise

Excise Taxes Slow Economic Growth Infographic Beer Institute

Excise Tax Examples Examples Of Excise Tax With An Explanation

Excise Tax Examples Examples Of Excise Tax With An Explanation

Excise Tax What It Is How It s Calculated YouTube

PPT Government Intervention In The Market PowerPoint Presentation

PPT Excise Tax Analysis Of A 1 unit Excise Tax PowerPoint

Excise Tax Definition - An excise tax is similar to a sales tax but it s levied only on certain products or services The most common excise taxes are imposed on tobacco alcohol and gasoline The Affordable Care Act also provides for an excise tax on some health related services and products