Exemption In Income Tax Exempt income refers to certain kinds of income that is non taxable for the taxpayers In India Section 10 of the Income Tax Act governs the provisions related to such exempt

4 min read The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about What Is Exempt Income Exempt income refers to certain types of income not subject to income tax Some types of income are exempt from federal or state income tax or both The IRS

Exemption In Income Tax

Exemption In Income Tax

https://www.relakhs.com/wp-content/uploads/2023/08/Difference-between-tax-exemption-tax-deduction-tax-rebate-tds-.jpg

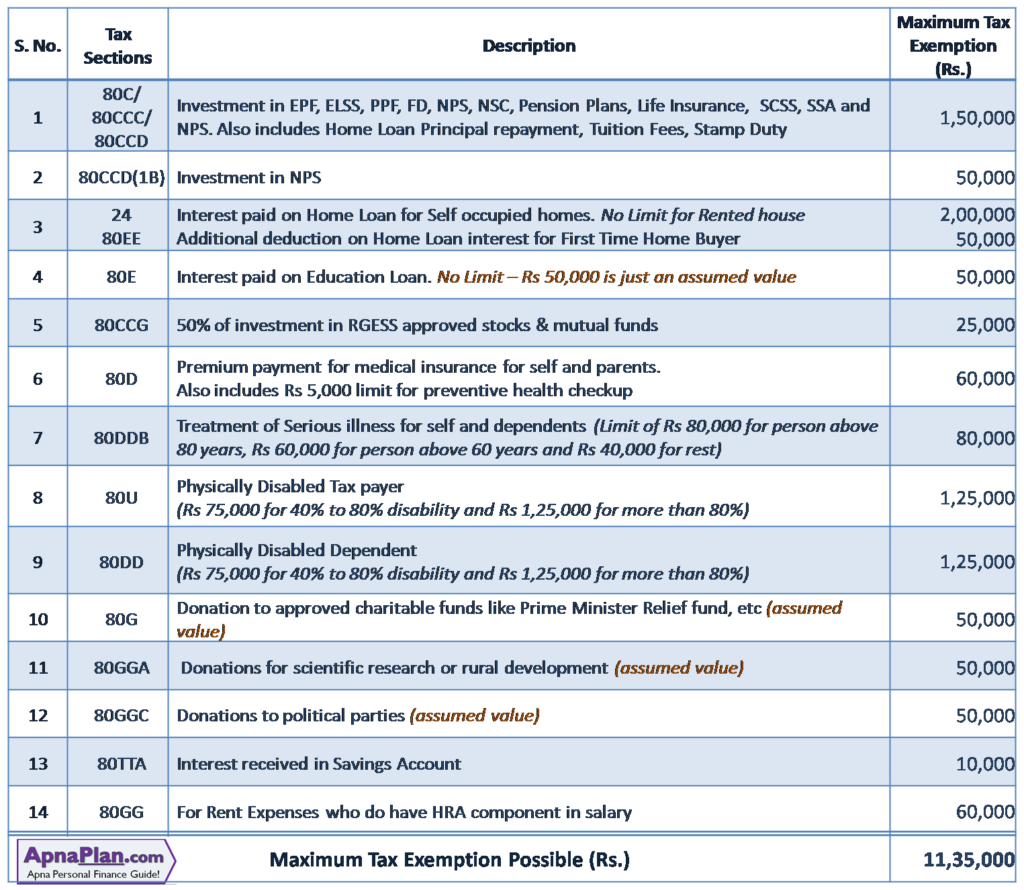

Maximum Income Tax You Can Save For FY 2016 17

https://www.apnaplan.com/wp-content/uploads/2017/01/Maximum-Income-Tax-Exemption-Limit-in-India-for-FY-2016-17-1024x890.png

Deduction Vs Tax Exemption Vs Tax Rebate 2021 What Is Tax Deduction

https://i.ytimg.com/vi/zg_bWbGeYms/maxresdefault.jpg

A tax exemption is the right to exclude certain income or activities from taxation Up until 2018 taxpayers were able to exclude up to 4 050 for each eligible Tax exempt refers to income or transactions that are free from tax at the federal state or local level The reporting of tax free items may be on a taxpayer s individual or

A tax exemption reduces or eliminates a portion of your income from taxation Federal state and local governments create tax exemptions to benefit people businesses and Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does Federal and state governments frequently exempt

Download Exemption In Income Tax

More picture related to Exemption In Income Tax

HRA Exemption Calculator For Income Tax Benefits Calculation And

https://educationalstuff.in/wp-content/uploads/2023/04/Tue_11_04_2023_15_27_40.png

Income Tax Deductions Financial Year 2022 2023 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

Income Tax Exemptions And Deductions For Salaried Individuals

https://media.geeksforgeeks.org/wp-content/cdn-uploads/20230227151715/Income-Tax-Exemptions-and-Deductions-660x330.png

Thailand Tax News Flash Issue 148 On 17 July 2024 a new Ministerial Regulation No 394 M R No 394 on income exemption for severance pay was published in the Royal Gazette M R No 394 replaces the Exemption limits If you are not married or in a civil partnership you are exempt from Income Tax where your total income is less than the exemption limit and you are 65

The personal exemption allows you to claim a tax deduction that reduces your taxable income Learn more about eligibility and when you can claim it A tax exemption is an allowance that reduces or eliminates the taxes owed by an individual or organization Exemptions can apply to many different types of taxes including income

Deductions Allowed Under The New Income Tax Regime Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2020/02/tax.jpg

Overview Of Exemptions Deductions Allowances And Credits In The

https://www.researchgate.net/profile/Gerlinde_Verbist/publication/5017520/figure/download/tbl1/AS:669356358922282@1536598400482/Overview-of-exemptions-deductions-allowances-and-credits-in-the-personal-income-tax.png

https://cleartax.in/glossary/exempt-income

Exempt income refers to certain kinds of income that is non taxable for the taxpayers In India Section 10 of the Income Tax Act governs the provisions related to such exempt

https://cleartax.in/s/section-10-of-income-tax-act

4 min read The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about

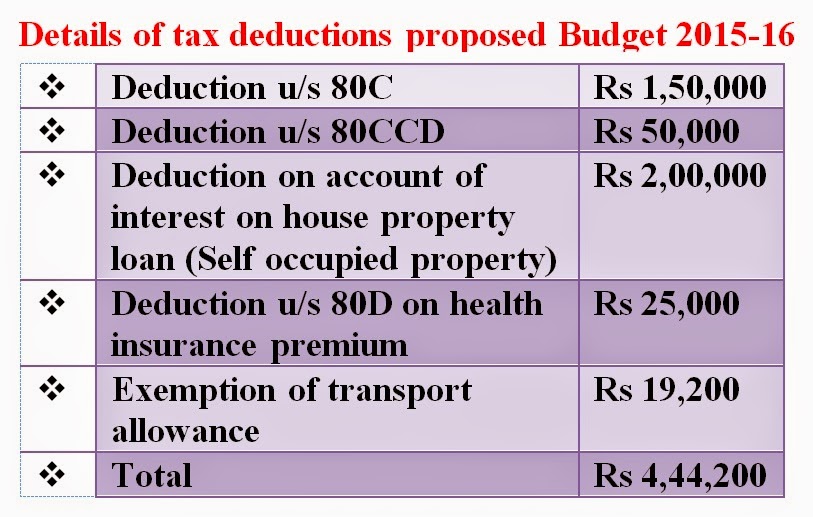

Income Tax Exemption Limit In The Budget 2015 16 Central Govt

Deductions Allowed Under The New Income Tax Regime Paisabazaar

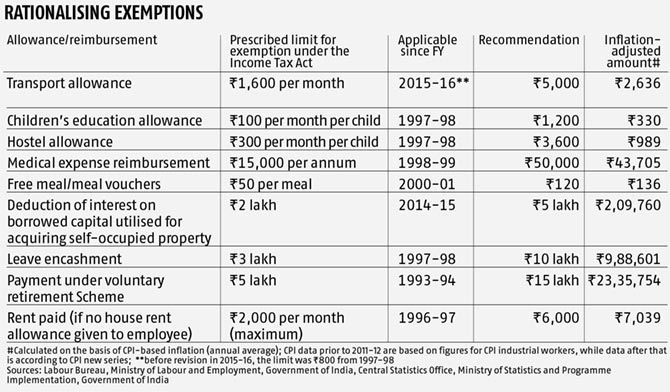

Time To Change Meaningless Income Tax Exemptions Rediff Business

How To Claim Tax Exemptions Here s Your 101 Guide

How To Claim HRA Allowance House Rent Allowance Exemption

Home Loan Interest Exemption In Income Tax Home Sweet Home

Home Loan Interest Exemption In Income Tax Home Sweet Home

What Is Taxable Income 2023

How To Use Exemptions When Filing For Chapter 13 Bankruptcy

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Exemption In Income Tax - 0 00 2 01 1X Japan is considering revising the consumption tax exemption system for visitors from abroad to prevent goods bought tax free from being resold within the