Exemption Of Income Tax For Salaried Employees Allowances are generally fixed irrespective of actual expenditure and are taxable Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is

97 rowsThe document provides valuable insights into The Income Tax Act 1961 mandates certain income tax allowances exemptions for the salaried class These exemptions thus can help

Exemption Of Income Tax For Salaried Employees

Exemption Of Income Tax For Salaried Employees

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2018/11/27/61587-taxes-pixabay.jpg?itok=hQvz8hno&c=24e3c3ca46a41e8219e76bb1527b7b4d

Income Tax For Salaried Person Curious Finance

https://taxguru.in/wp-content/uploads/2020/01/Income-Chargeable-under-The-Head-Salaries-1280x720.jpg

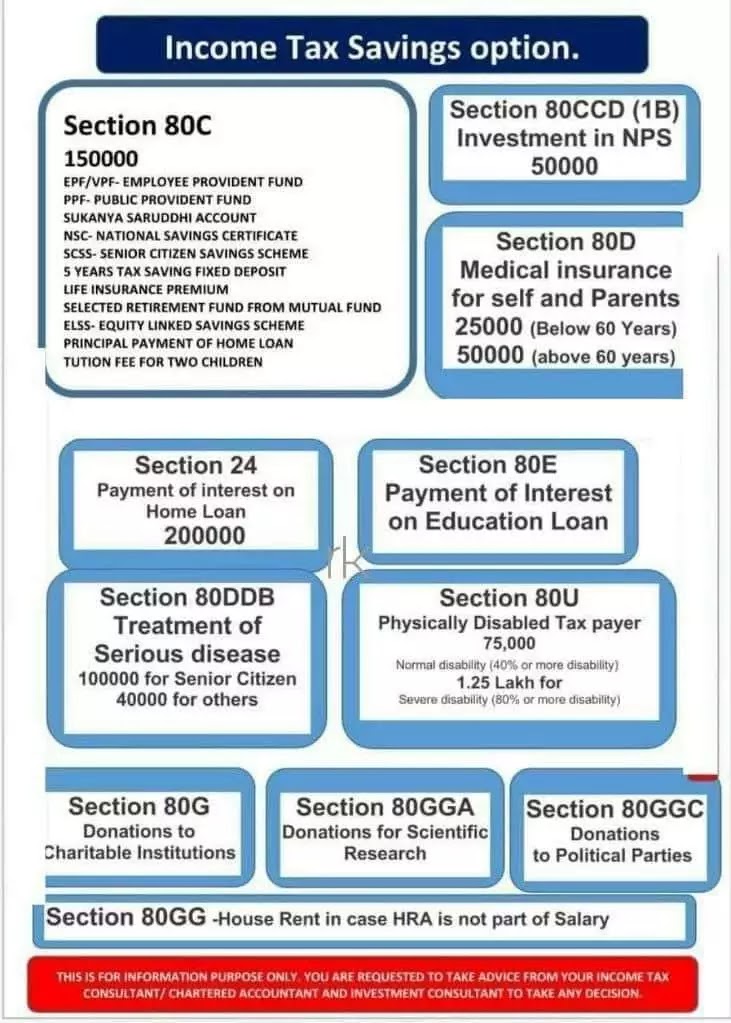

Income Tax Savings Options IT Savings Options For Salaried Employees

https://blogger.googleusercontent.com/img/a/AVvXsEgLDCnTZQuLnWBa8kiTwkdPhtVgzZiHH6BxGRp2eAYcysQ8S_DEuU7UQePjlrHlAZS4ajTVqfOZ3GbxKKR-63sbcNJATyghfwcQyN_7zwg2cdneuk46ffaLrRqHZe5vj5ZJJY-r8PDsrxyB6vOJoq-yCfY1agw1LwqrF1mAlhf71MR8MYMRP3uGWEVXRg=s16000

ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following Income Tax Slabs for Salaried Person and HUF for FY 2023 24 New Tax Regime Salaried individuals below the age of 60 will have to follow the given tax rates effective

Individual Deductions Last reviewed 23 January 2024 Employment income exemptions Significant exemptions available under salary income are as follows Medical Deductions The lower your taxable income the lower your tax liability There are multiple provisions by which you can lower your taxable income For example under section 80C you can save Rs 1 5

Download Exemption Of Income Tax For Salaried Employees

More picture related to Exemption Of Income Tax For Salaried Employees

Income Tax Exemption List For Salaried Employees In AY 2021 22 Blog

https://www.tickertape.in/blog/wp-content/uploads/2022/02/12.png

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

5 Tax Saving Tips For Salaried Employees How To Save Maximum Tax For

https://i.ytimg.com/vi/RLgLve37oC0/maxresdefault.jpg

What is the tax exemption for salaried employees What is exempt from income from salary How much salary is exempted from ITR Income Tax Exemptions for Salaried Employees Note The maximum If you are a salaried person you have a right to claim the benefits of an exemptions available on your few parts of the salary components given either in the

However some exemptions are allowed by the Income tax Act Types of Allowances In accordance with the term of employment or condition of the workplace or For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some

Save Income Tax For Salaried Employees

https://i2.wp.com/www.phoenixtax.in/wp-content/uploads/2021/11/tax-free-income-for-salaried-employees.jpg?fit=1368%2C768&ssl=1

Tax Saving Guide 10 Smart Ways To Save Income Tax For Salaried Employees

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/07/20/986128-813334-saving-istock-041619.jpg

https:// incometaxindia.gov.in /Tutorials/80...

Allowances are generally fixed irrespective of actual expenditure and are taxable Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is

https:// taxguru.in /income-tax/list-incom…

97 rowsThe document provides valuable insights into

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

Save Income Tax For Salaried Employees

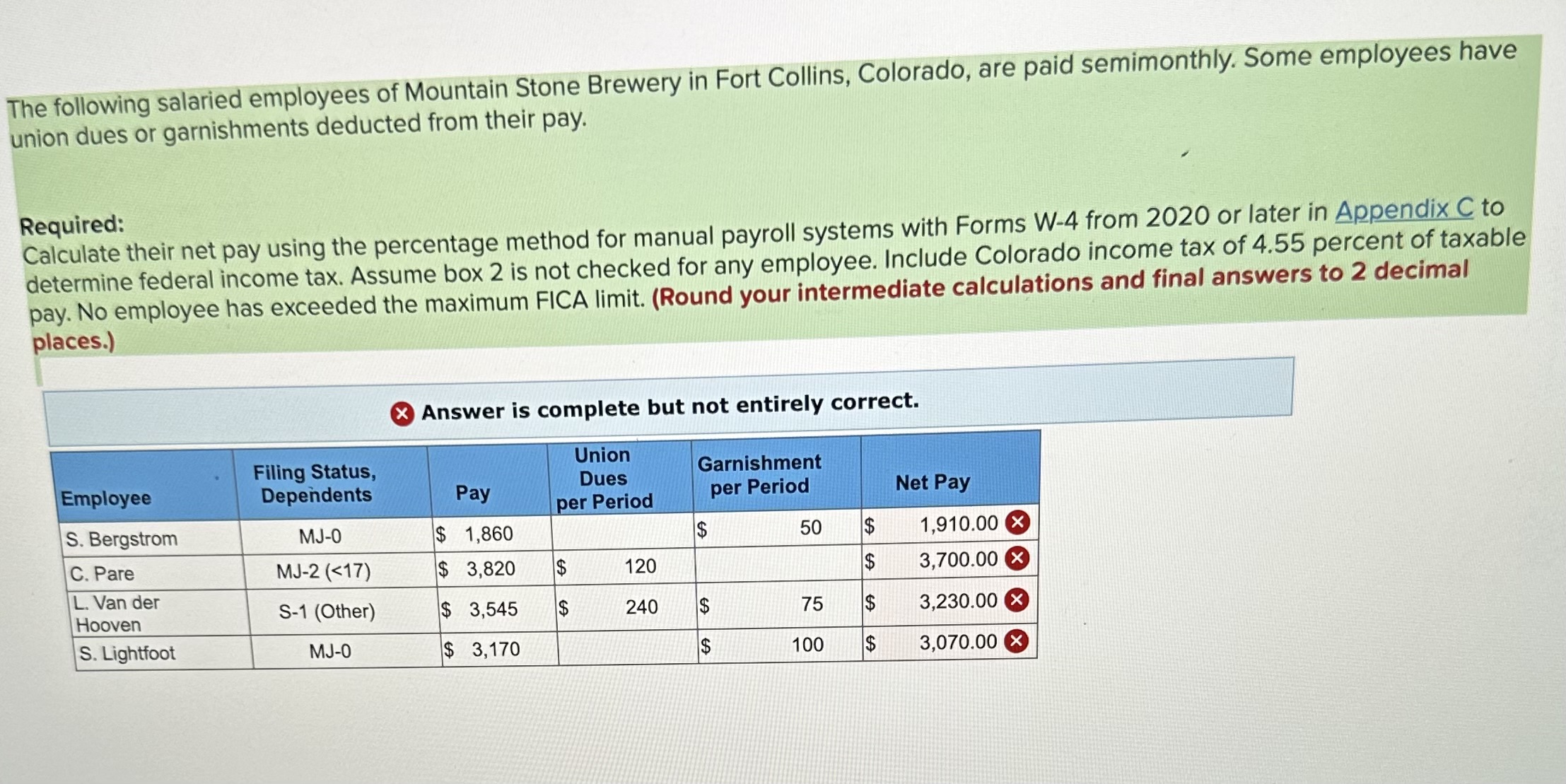

Solved The Following Salaried Employees Of Mountain Stone Chegg

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

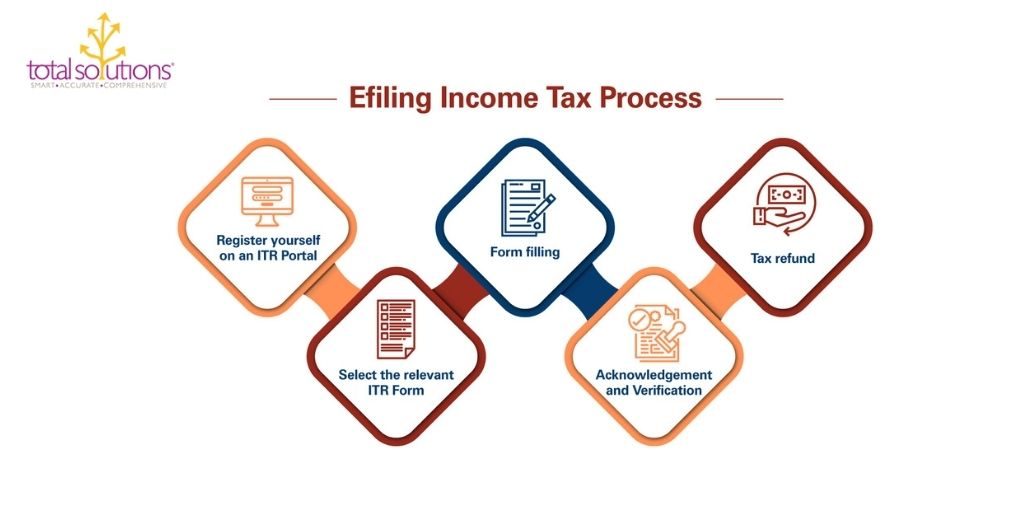

Easy Steps To File Income Tax Returns For Salaried Employees

How To Save Income Tax For Salaried Employees Jordensky

All The Salaried Employees Out There Save More With These Simple Tax

Exemption Of Income Tax For Salaried Employees - You can claim income tax deductions for salaried employees either or not by providing rent receipts to your employer This deduction is calculated for whichever is least of the