New York State Homeowner Tax Rebate 2024 2022 Homeowner Tax Rebate Credit Check Lookup 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions

The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state homeowners have until December 31 to apply for a You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

New York State Homeowner Tax Rebate 2024

New York State Homeowner Tax Rebate 2024

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

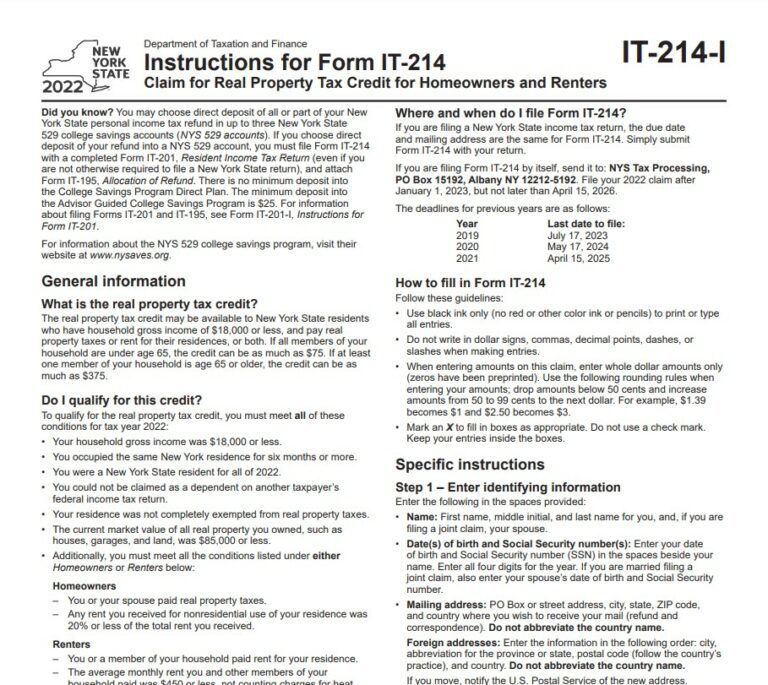

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

New York State To Send STAR Rebate Checks To More Than 2 Million Homeowners This Fall Syracuse

https://www.syracuse.com/resizer/iVEbcLLiSpBxD5qBWwsRxoo2lDA=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/S5PXB2KOABDLTBXLZC55TVQRCI.jpg

Albany NY Governor Hochul Announces FY 2023 Budget Investments to Deliver Tax Relief to New Yorkers Budget Provides Historic Levels of Support for Working Families Delivers Motor Fuel State Tax Relief Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers April 9 2022 GOVERNOR HOCHUL ANNOUNCES FY 2023 BUDGET INVESTMENTS TO DELIVER TAX RELIEF TO NEW YORKERS Budget Provides Historic Levels of Support for Working Families Delivers Motor Fuel State Tax Relief Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers

Currently New Yorkers can combine IRA tax credits with New York State incentives and programs helping homeowners cut energy use save more money contribute to a cleaner healthier planet Now is the time to start your clean energy future free from fossil fuels including natural gas oil and propane Published on January 23 2023 by Leslie Bailey NY Homeowner Tax Rebate Credit HTRC is a one year tax credit program for eligible homeowners The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption

Download New York State Homeowner Tax Rebate 2024

More picture related to New York State Homeowner Tax Rebate 2024

New York State Homeowner s Guide To Solar Leases Loans And Power Purchase Agreements JBI

https://jbisolar.com/wp-content/uploads/2019/06/NYS-PDF-Cover.jpg

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

New York Property Tax Rebate Governor s Budget Plan Targets Relief For Some Households Silive

https://www.silive.com/resizer/ml_NdSle8P7EtCGq3oPozFluHZI=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/25JLZFH33VGQDO36DLXH7LSNHI.png

The state requires that new homeowners be issued a check instead of an exemption Make 93 200 or less for the 2023 2024 school year About 2 26 million New Yorkers benefited from Basic STAR The credit will reduce the amount you can deduct on the property tax section Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or

Posted Jul 5 2022 02 19 PM EDT Updated Jul 5 2022 02 41 PM EDT ALBANY N Y WWTI Homeowners in New York should check their mail because the state is mailing out Homeowner The deadline to apply was November 15 2022 However homeowners can continue to apply for rebates until March 15 2023 if an extenuating circumstance prevented them from applying by November 15 Frequently Asked Questions FAQs

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/6bb6d79c-d629-4757-b1e2-c5fefa386c2f/6bb6d79c-d629-4757-b1e2-c5fefa386c2f_1140x641.jpg

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

https://www.the-sun.com/wp-content/uploads/sites/6/2022/05/NINTCHDBPICT000616816864-6.jpg?w=2640

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

2022 Homeowner Tax Rebate Credit Check Lookup 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions

https://www.newsweek.com/stimulus-check-update-homeowners-this-state-can-apply-rebate-1852264

The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state homeowners have until December 31 to apply for a

NYS 2023 Homeowner Tax Rebate Tax Rebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

New York Issued 2 1 Million Property Tax Rebate Checks In Late Summer And Early Fall Saying It

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

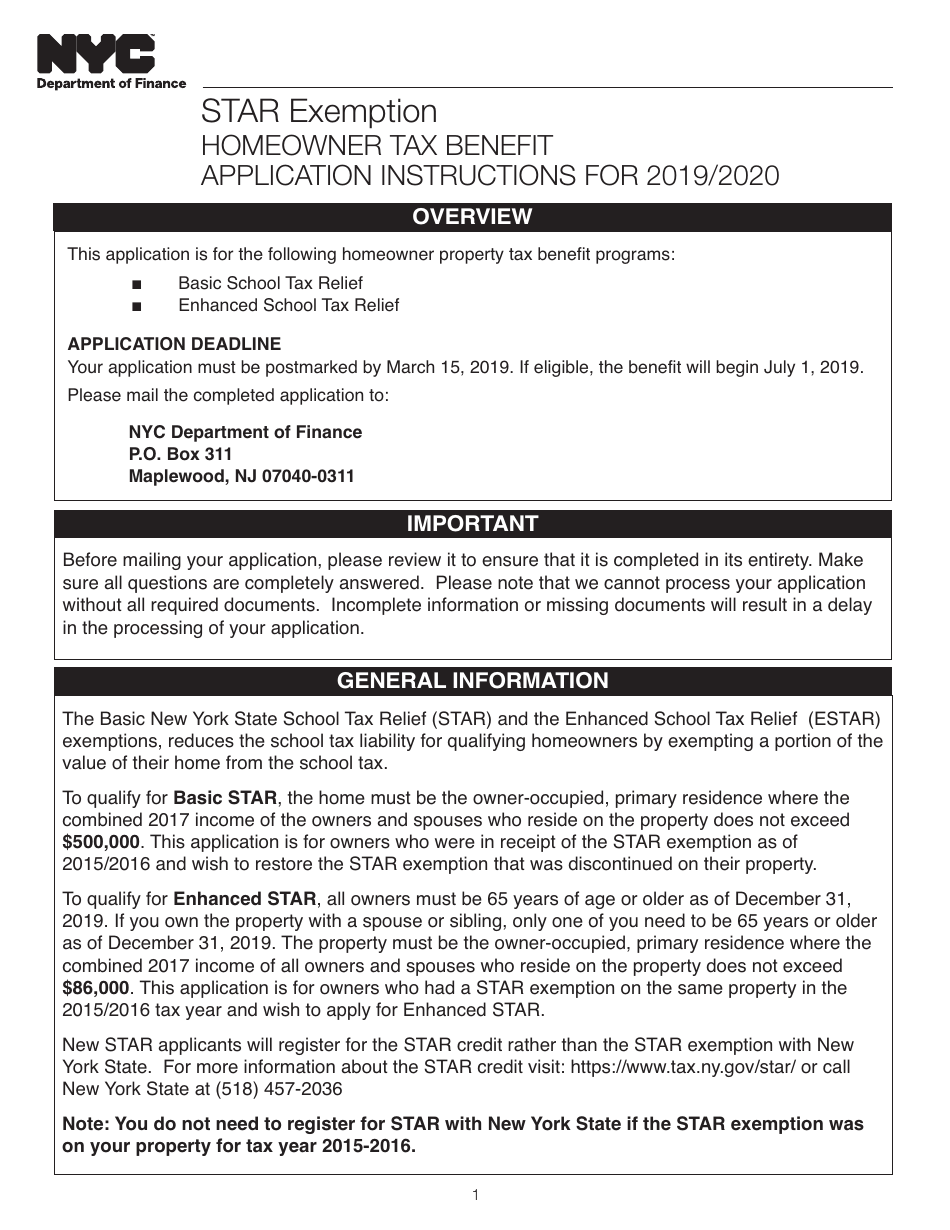

New York City Star Exemption Homeowner Tax Benefit Application For 2019 2020 Fill Out Sign

New York Homeowner Tax Credits Rebates And Savings

New York Homeowner Tax Credits Rebates And Savings

Tax Rebate Checks Come Early This Year Yonkers Times

NYC Homeowners Leave 75M In Tax Rebates Unclaimed

Two Million Americans Could Get Automatic Checks Worth 970 Under State Proposal Are You

New York State Homeowner Tax Rebate 2024 - The FY 2024 Budget adds 50 million for a Homeowner Stabilization Fund to finance home repairs in 10 communities across the state that have been identified as having high levels of low income homeowners of color and homeowner distress