Exemption Short Term Capital Gain Property Verkko 6 maalisk 2023 nbsp 0183 32 Capital Gains Exemption Updated on Mar 6th 2023 15 min read CONTENTS Show The sale of capital assets may lead to capital gains and these gains may attract tax under the Income Tax Act To save tax on these capital gains a few capital gains exemptions deductions are available

Verkko Section 54B provides the exemption from short term and long term capital gains arising from the transfer of agricultural land Only Individuals and HUFs are eligible to claim an exemption under this section Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 The term net short term capital loss means the excess of short term capital losses including any unused short term capital losses carried over from previous years over short term capital gains for the year Capital Gains Tax Rates

Exemption Short Term Capital Gain Property

Exemption Short Term Capital Gain Property

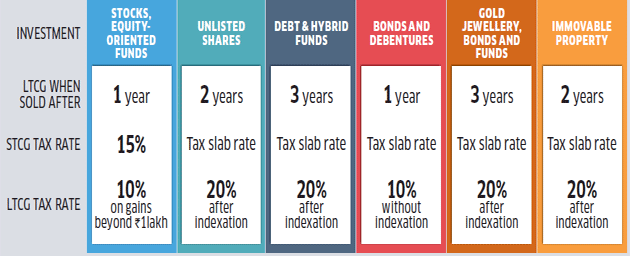

https://kmgcollp.com/wp-content/uploads/2022/02/Long-Term-Capital-Gains-tax-exemptions-sec-54-54ec-54f-on-sale-of-land-or-residential-property-LTCG-2-years.jpg

Capital Gain Exemption Section 54 Pioneer One Consulting LLP

https://pioneerone.in/wp-content/uploads/2022/01/Section-54-img-scaled-1-1024x727.jpg

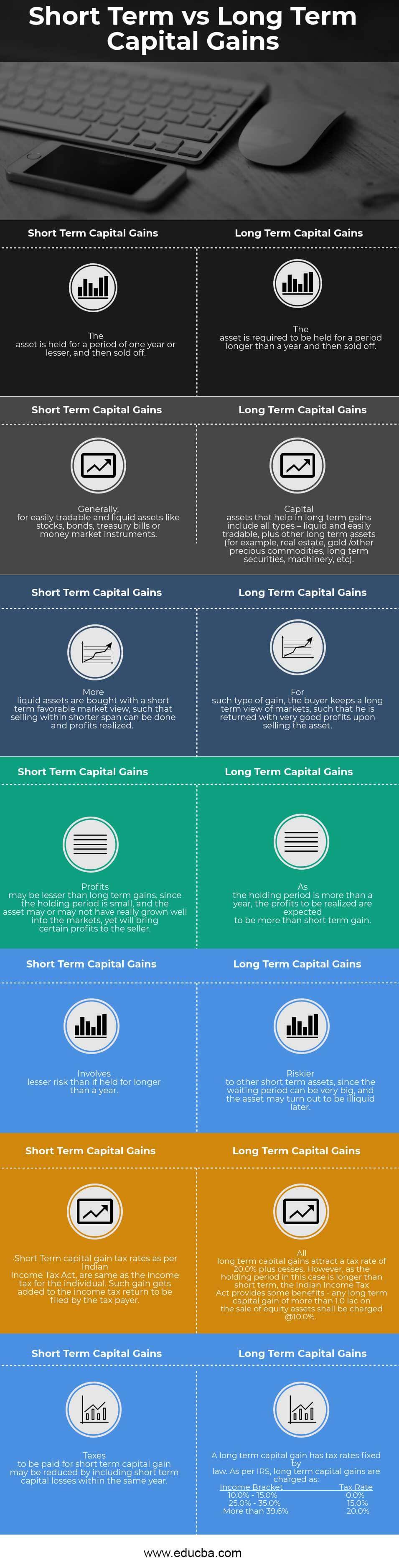

Short Term Vs Long Term Capital Gains Top 7 Awesome Differences

https://cdn.educba.com/academy/wp-content/uploads/2018/09/Short-Term-vs-Long-Term-Capital-Gains.jpg

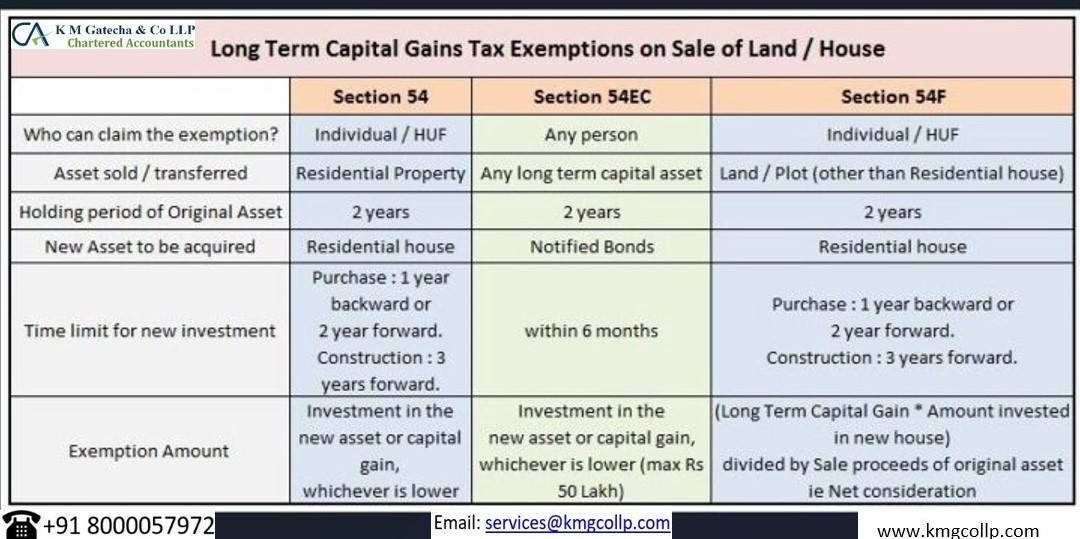

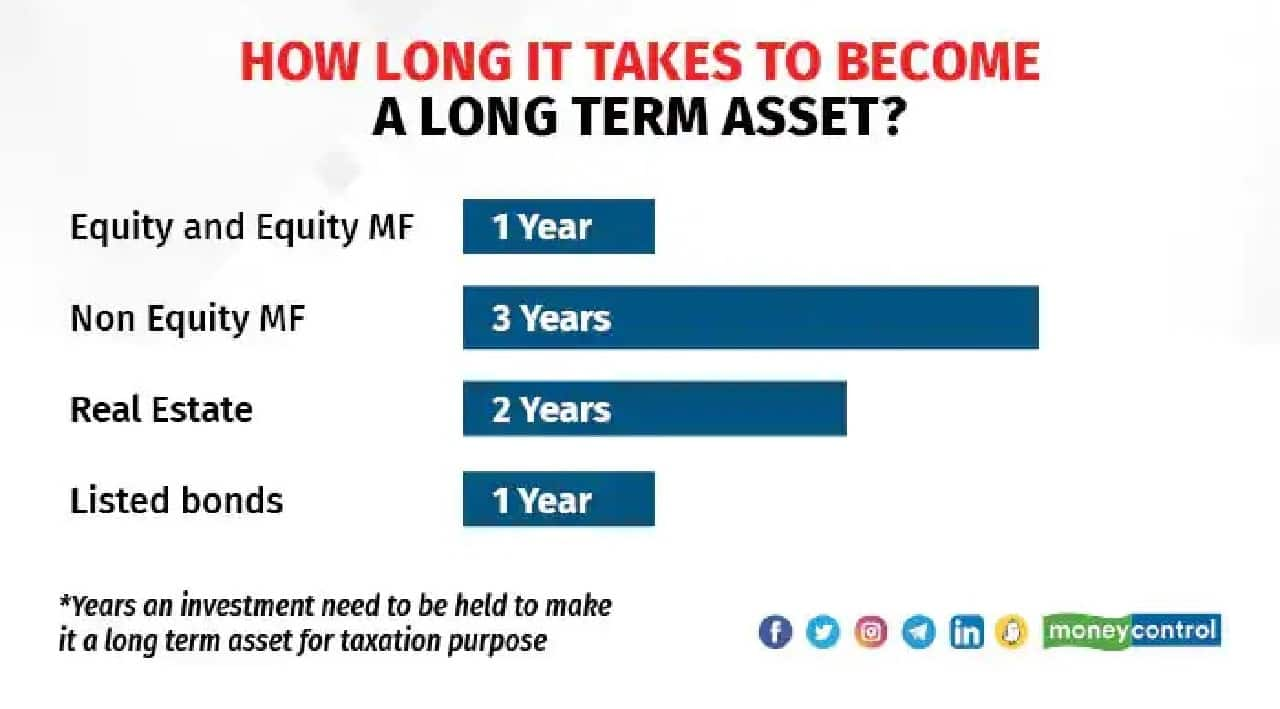

Verkko 25 hein 228 k 2023 nbsp 0183 32 A short term gain is a profit realized from the sale of personal or investment property that has been held for one year or less The amount of the short term gain is the difference between Verkko Indian residents below 60 years of age will be exempted from paying Income Tax on short term capital gain on sale of property if the profit stays within Rs 2 50 000 Indian residents between the age of 60 to 80 years will enjoy a higher exemption limit of Rs 3 00 000 on the sale of a property

Verkko 6 helmik 2023 nbsp 0183 32 Capital Gain Exemption Documents for Capital Gains FAQs What is Capital Gain Capital Gain is simply the profit or loss that arises when you transfer a Capital Asset If you sell a Long Term Capital Asset you will have Long Term Capital Gain and if you sell a Short Term Capital Asset you will have a Short Term Capital Verkko 22 jouluk 2023 nbsp 0183 32 Long term capital gains are taxed at 0 15 or 20 according to graduated income thresholds The tax rate for most taxpayers who report long term capital gains is 15 or lower Short term

Download Exemption Short Term Capital Gain Property

More picture related to Exemption Short Term Capital Gain Property

Cost Inflation Index Up To FY 2016 17

http://bemoneyaware.com/wp-content/uploads/2017/09/capital-gains-overview.png

How To Calculate Capital Gain Tax On Shares In India Eqvista

https://eqvista.com/app/uploads/2022/01/image1-7.png

How To Save Tax On Long term Capital Gains

https://life.futuregenerali.in/media/gsbjdrz0/save-tax-on-long-term-capital-gains.jpg

Verkko 12 maalisk 2023 nbsp 0183 32 To be exempt from capital gains tax on the sale of your home the home must be considered your principal residence based on Internal Revenue Service IRS rules These rules state that you must Verkko 14 jouluk 2023 nbsp 0183 32 The long term capital gains tax rates are 15 percent 20 percent and 28 percent for certain special asset types like small business stock collectibles depending on your income Real estate

Verkko 22 marrask 2023 nbsp 0183 32 How to avoid capital gains tax on real estate 1 Live in the house for at least two years The two years don t need to be consecutive but house flippers should beware If you sell a house that Verkko 21 helmik 2023 nbsp 0183 32 When one sells a commercial residential property or a plot or even shares bonds whatever gain is made the same is taxed under the head Capital Gains under Income tax Act 1961 and the asset is classified as Capital Asset The only exemption in this case is for agricultural property hence when a rural agricultural

Long Term Capital Gain Tax On Shares Tax Rates Exemption

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/11/long-term-capital-gain-on-shares-image.jpg

Taxation On Short Term Capital Gains STCG Tax Rate Examples

https://fincalc-blog.in/wp-content/uploads/2022/04/taxation-on-short-term-capital-gains-STCG-tax-rate-examples.webp

https://cleartax.in/s/capital-gain-exemption

Verkko 6 maalisk 2023 nbsp 0183 32 Capital Gains Exemption Updated on Mar 6th 2023 15 min read CONTENTS Show The sale of capital assets may lead to capital gains and these gains may attract tax under the Income Tax Act To save tax on these capital gains a few capital gains exemptions deductions are available

https://incometaxindia.gov.in/.../65.Exemptions-from-Capit…

Verkko Section 54B provides the exemption from short term and long term capital gains arising from the transfer of agricultural land Only Individuals and HUFs are eligible to claim an exemption under this section

Long Term Capital Gains Tax Exemption List Of Exemptions As Per IT Act

Long Term Capital Gain Tax On Shares Tax Rates Exemption

Capital Gain Tax Long Term Capital Gains Short Term Capital Gains

How To Save Capital Gain Tax On Sale Of Commercial Property

Capital Gain Tax Worksheet 2021

Short Term Capital Gains Tax EXPLAINED All You Need To Know Budget

Short Term Capital Gains Tax EXPLAINED All You Need To Know Budget

.png)

How To Calculate Short Term Capital Gains Tax On Sale Of Shares Jordensky

How To Calculate Your 2023 Taxes PELAJARAN

Budget 2023 Will There Be A Rise In Exemption Limit For Long term

Exemption Short Term Capital Gain Property - Verkko 25 hein 228 k 2023 nbsp 0183 32 A short term gain is a profit realized from the sale of personal or investment property that has been held for one year or less The amount of the short term gain is the difference between