Tax Disabled Rebate Ri Web 3 oct 2022 nbsp 0183 32 The tax cut plan within the budget includes the Governor s proposal to offer child tax rebates of 250 per child up to three children for Rhode Island residents

Web T o qualify for the property tax relief credit you must meet all of the following conditions a You must be sixty five 65 years of age or older and or disabled b You must have Web 1 ao 251 t 2022 nbsp 0183 32 Q When will I receive the Child Tax Rebate A For those filing an original or amended filing by August 31 2022 your rebate will be issued starting in

Tax Disabled Rebate Ri

Tax Disabled Rebate Ri

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/national-grid-air-conditioner-rebate-national-grid-offers-ways-to-2-scaled.jpg

Boise Will Offer Property Tax Rebate To Low income Seniors Veterans

https://boisedev.com/wp-content/uploads/2022/03/prop-tax-1024x540-1-768x405.png

New Jersey Claim For Property Tax Exemption On Dwelling Of Disabled

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/new-jersey-claim-for-property-tax-exemption-on-dwelling-of-disabled.png

Web October 05 2022 Rhode Island families to start receiving Child Tax Rebate payments Checks will be issued throughout fall 2022 PROVIDENCE R I Over 100 000 Rhode Web You must first meet ALL the following qualifications in order to apply for this Property Tax Credit The qualifications are as follows You must be 65 years of age or older and or

Web Division of Taxation ADVISORY FOR TAXPAYERS AND TAX PROFESSIONALS August 5 2022 Rhode Island to distribute 250 Child Tax Rebates PROVIDENCE R I As Web The IRS determined that it will not be challenging the taxability of payments related to general welfare and disaster relief and the Child Tax Rebate payments issued by Rhode

Download Tax Disabled Rebate Ri

More picture related to Tax Disabled Rebate Ri

Trenton May Dance A Two Step Tax Shuffle Step 1 Cut Sales Tax Step 2

https://s1.nyt.com/timesmachine/pages/1/1992/03/28/445092_360W.png?quality=75&auto=webp&disable=upscale

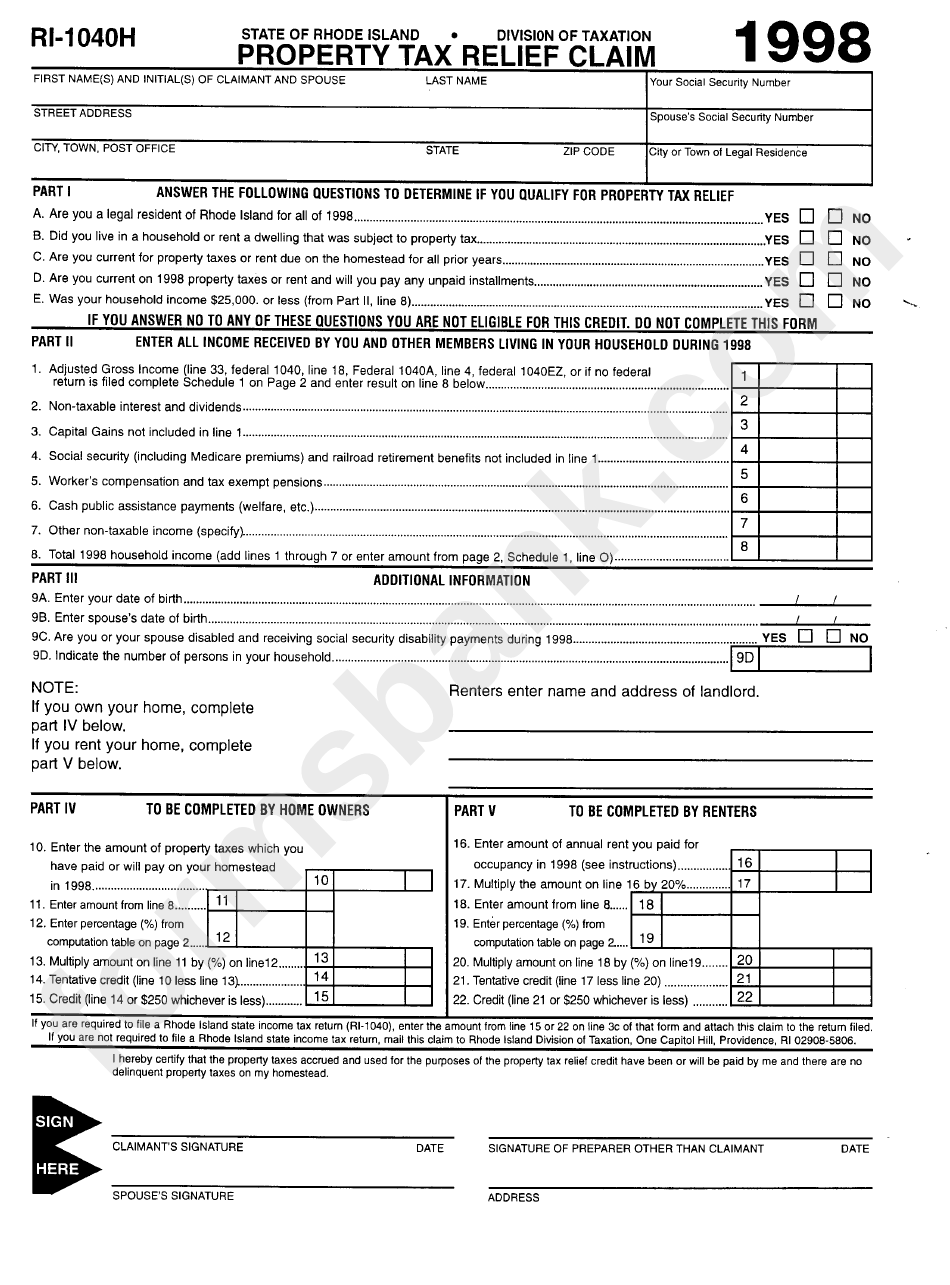

Fillable Form Ri 1040h Property Tax Relief Claim 1998 Printable Pdf

https://data.formsbank.com/pdf_docs_html/271/2719/271968/page_1_bg.png

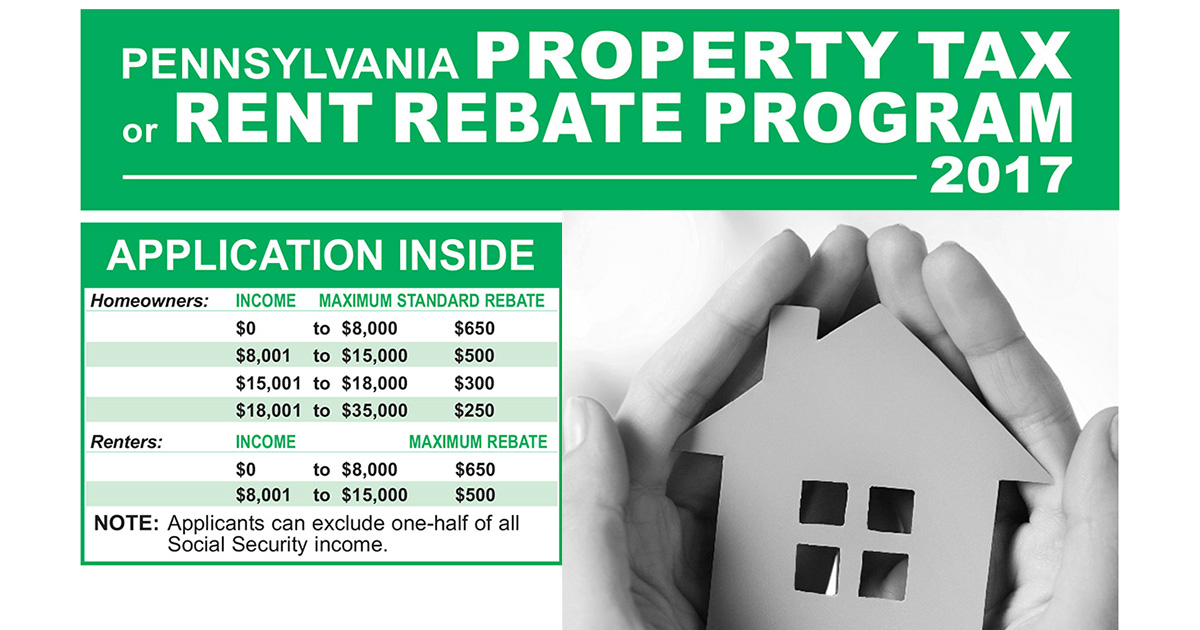

Brewster Property Tax Rent Rebate Deadline Extended For Senior And

http://www.senatorbrewster.com/wp-content/uploads/2018/06/PTRR_Twitter.jpg

Web The refund will be based on the amount of wages in excess of the taxable wage base to the Rhode Island Temporary Disability Insurance Fund Those wage bases are as Web 3 oct 2022 nbsp 0183 32 What is the Child Tax Rebate The Child Tax Rebate is a rebate payment of 250 per qualifying child up to a maximum of three children maximum 750 that

Web DRIVE EV Funded and administered by the Rhode Island Office of Energy Resources OER DRIVEEV provides rebates of up to 2 000 00 for the purchase or lease of new Web 2 ao 251 t 2022 nbsp 0183 32 NEWPORT RI Continuing his RIMomentum Tour Governor Dan McKee today announced the details of the new Rhode Island Child Tax Rebate a state tax

A As Fig 11 a But With Dec 20 m The Additional Curve Cutting

https://www.researchgate.net/publication/337100819/figure/fig4/AS:960356067319810@1605978137033/a-As-Fig-11a-but-with-dec20mm-The-additional-curve-cutting-across-the-rest-is-for.png

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-1024x683.jpg

https://governor.ri.gov/press-releases/governor-mckee-announces-child...

Web 3 oct 2022 nbsp 0183 32 The tax cut plan within the budget includes the Governor s proposal to offer child tax rebates of 250 per child up to three children for Rhode Island residents

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-01/2021-r…

Web T o qualify for the property tax relief credit you must meet all of the following conditions a You must be sixty five 65 years of age or older and or disabled b You must have

RI Child Tax Rebate Available McKee Kicks Off Program In Newport

A As Fig 11 a But With Dec 20 m The Additional Curve Cutting

Appliance Rebates For Disabled Alaskan Residents Akgal s Weblog

Apple Offering Newton Rebates The New York Times

Rent Rebate For Social Security Disability DisabilityTalk

Connecticut Housing CONDOMINIUMS WIN TAX REBATES The New York Times

Connecticut Housing CONDOMINIUMS WIN TAX REBATES The New York Times

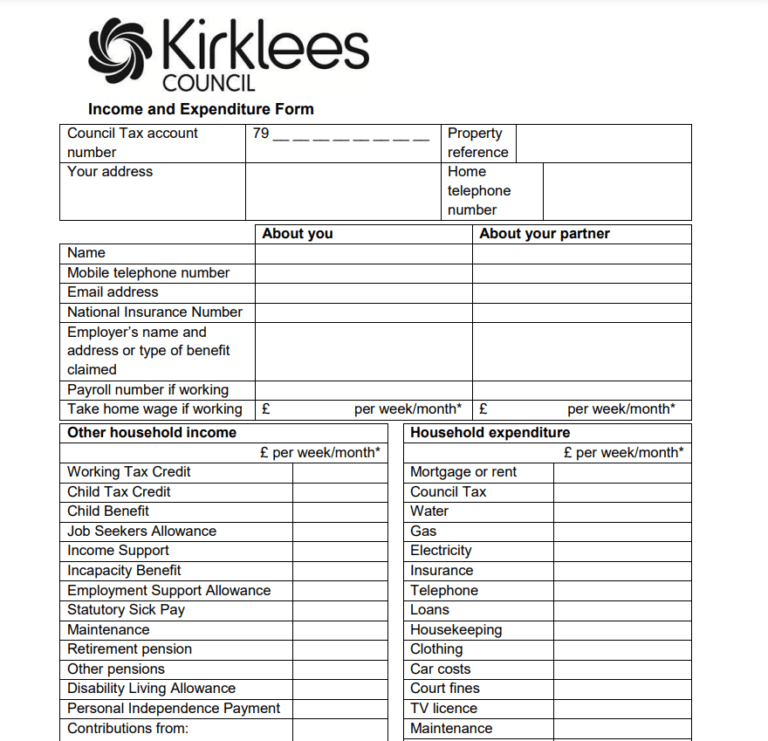

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

Ahorros Diarios Usando Cupones Rebate Tylenol

Details Come For New RI Child Tax Rebate

Tax Disabled Rebate Ri - Web The IRS determined that it will not be challenging the taxability of payments related to general welfare and disaster relief and the Child Tax Rebate payments issued by Rhode