Family Tax Rebates Web 5 4 1 Definitions The standard tax breaks in France take the form of either tax relief r 233 duction d imp 244 t or a tax credit cr 233 dit d imp 244 t A r 233 duction d imp 244 t is an allowance

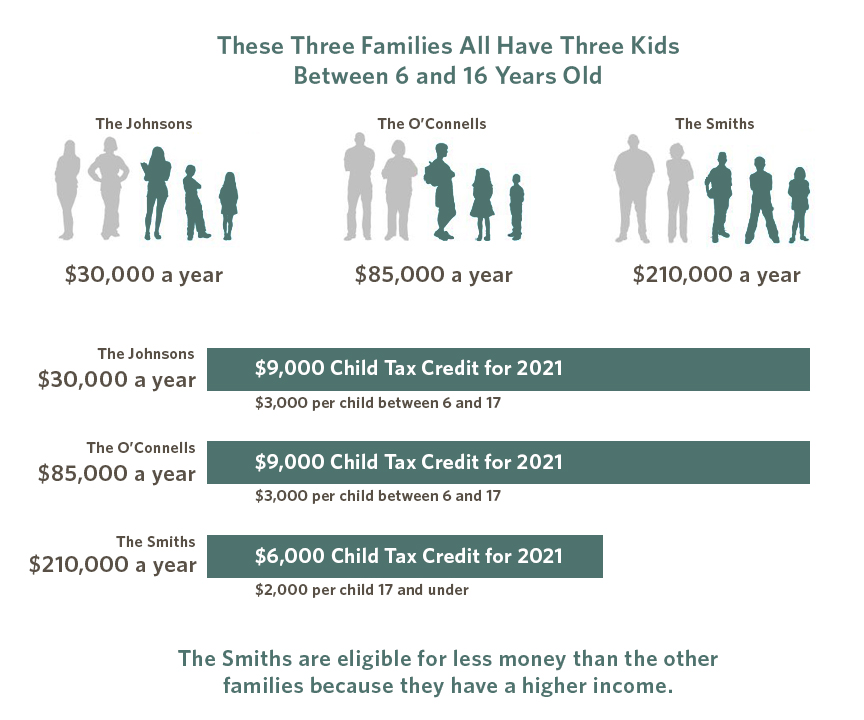

Web 20 d 233 c 2022 nbsp 0183 32 Families who added a dependent such as a parent a nephew or niece or a grandchild on their 2021 income tax return who was not listed as a dependent on their Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Family Tax Rebates

Family Tax Rebates

https://www.researchgate.net/profile/Lynda-Gagne/publication/255659376/figure/download/fig1/AS:669500693282831@1536632812550/Average-Family-Tax-Rates-as-a-Proportion-of-Predicted-Family-Earnings-Two-Parent.png

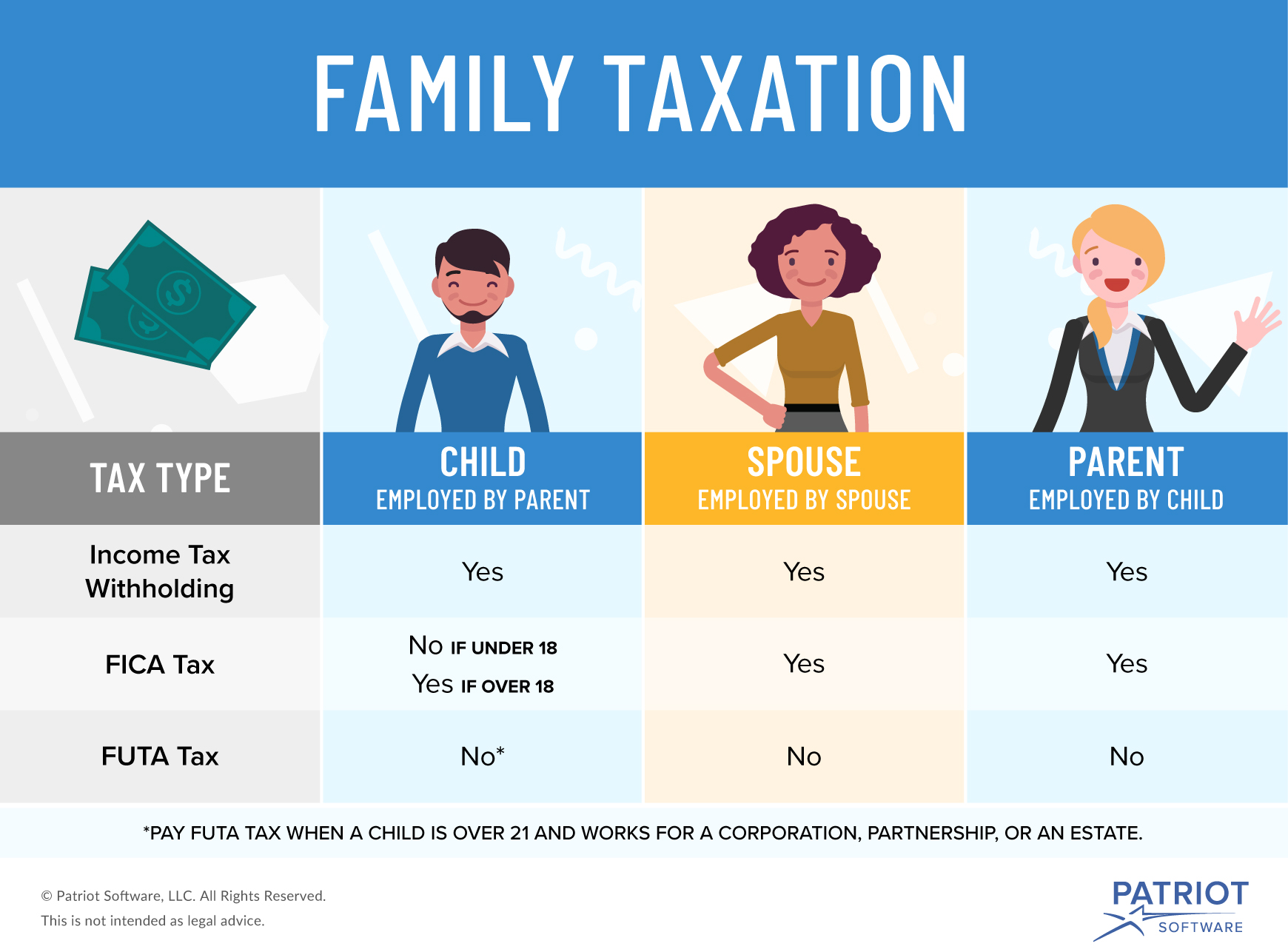

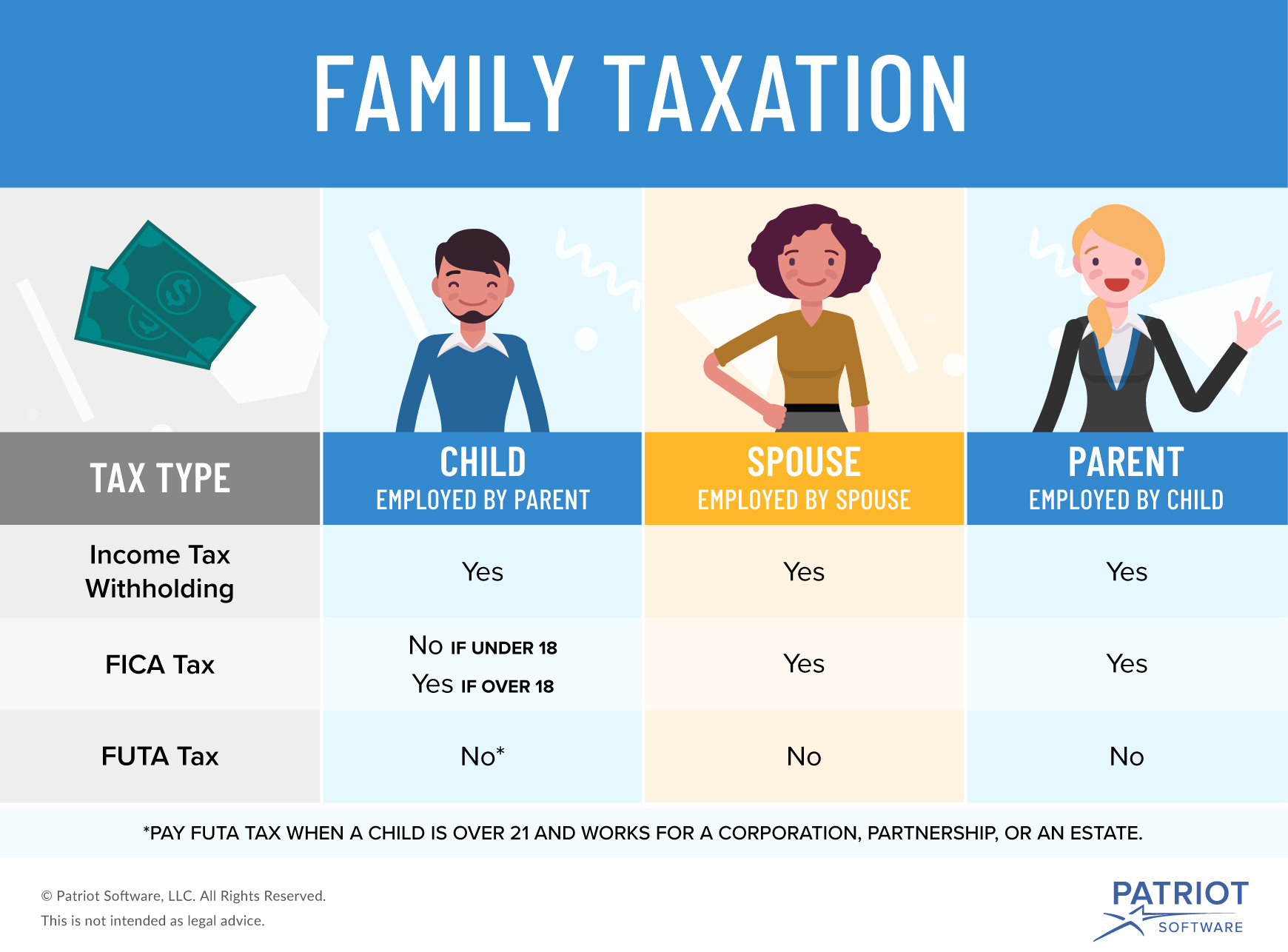

Family Taxation How To Legally Tax Your Loved Ones

https://www.patriotsoftware.com/wp-content/uploads/2019/12/legally_taxing_loved_ones-01.jpg

FAQs About The 2021 Child Tax Credit Larson Gross

https://insights.larsongross.com/wp-content/uploads/2021/04/family-comparison.jpg

Web 10 janv 2023 nbsp 0183 32 This simulator allows you to determine the amount of your income tax You can use one of the following 2 models Simplified model if you report wages pensions Web 8 sept 2023 nbsp 0183 32 The calculator says the Smiths will qualify for rebates in 2024 and they qualify for 15 600 in available tax credits right away which means the Smiths can claim

Web 27 ao 251 t 2021 nbsp 0183 32 For the 2021 tax year the credit was expanded to 8 000 per dependent from 3 000 and is capped at 16 000 instead of 6 000 In addition some families Web 8 juin 2023 nbsp 0183 32 The gross tax of the family is 134 53 x 2 5 or 336 32 The marginal tax rate BIT for this family is 11 because its family quotient puts it in that range But not all

Download Family Tax Rebates

More picture related to Family Tax Rebates

Didn t Get Your NYS Family Tax Rebate Here s What You Can Do WBFO

http://mediad.publicbroadcasting.net/p/wbfo/files/styles/x_large/public/201410/tax_rebate.PNG

1999 Average Family Tax Rates As A Proportion Of Predicted Family

https://www.researchgate.net/profile/Lynda-Gagne/publication/255659376/figure/fig2/AS:669500693303307@1536632812563/Average-Family-Tax-Rates-as-a-Proportion-of-Predicted-Family-Earnings-Two-Parent_Q640.jpg

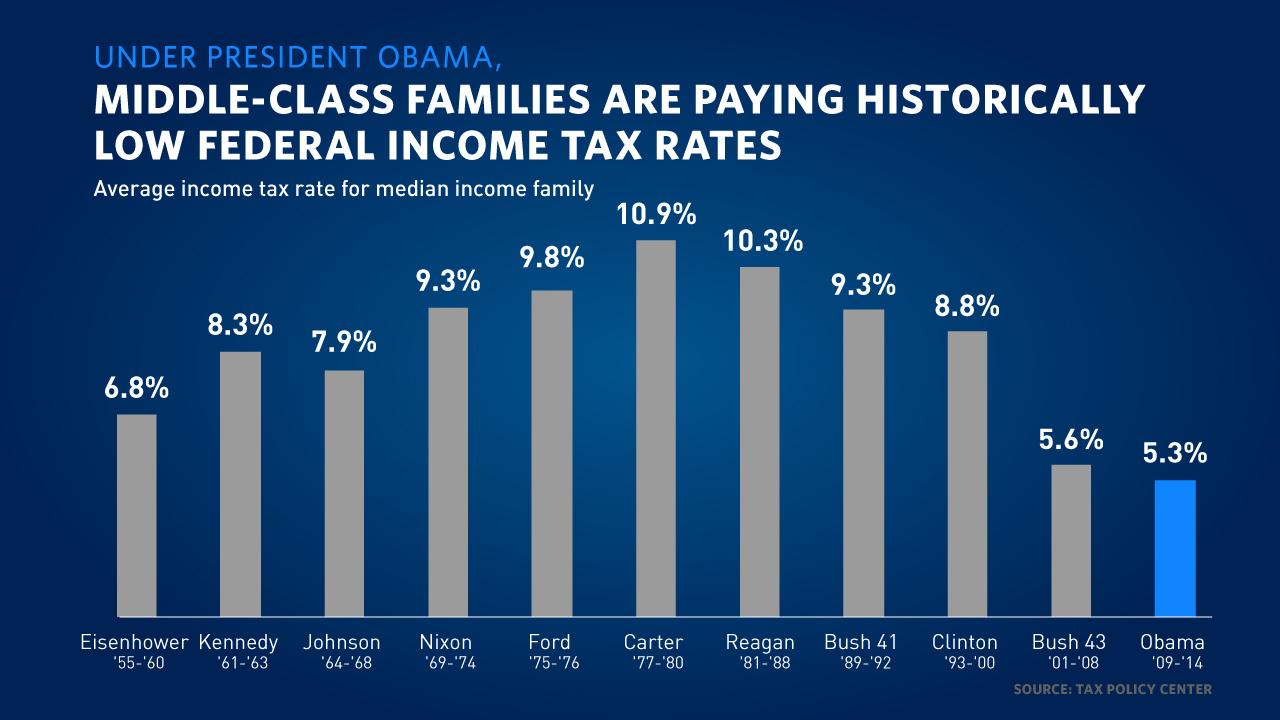

Here s What President Obama Has Done To Make The Tax Code Fairer

https://obamawhitehouse.archives.gov/sites/whitehouse.gov/files/images/taxCharts_Middle-Class-Families.jpg

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web 23 f 233 vr 2022 nbsp 0183 32 COVID Tax Tip 2022 29 February 23 2022 Some parents who have a legal agreement with their child s other parent about who claims the child on their taxes

Web 8 sept 2023 nbsp 0183 32 California Solar Panel Costs Various factors such as system components size fees permits and labor charges determine overall solar panel pricing Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Meghan Markle Snub Prince Harry To Stay Away From Duchess New Role

https://www.royalfashionnews.com/wp-content/uploads/2020/08/Royal-Family-tax-graph-2634534.jpg

The American Families Plan Too Many Tax Credits For Children

https://i2.wp.com/www.brookings.edu/wp-content/uploads/2021/05/CDCTC-chart-2.png

https://www.french-property.com/.../calculation-tax-liability/tax-credits

Web 5 4 1 Definitions The standard tax breaks in France take the form of either tax relief r 233 duction d imp 244 t or a tax credit cr 233 dit d imp 244 t A r 233 duction d imp 244 t is an allowance

https://www.irs.gov/newsroom/irs-expanded-credits-for-families...

Web 20 d 233 c 2022 nbsp 0183 32 Families who added a dependent such as a parent a nephew or niece or a grandchild on their 2021 income tax return who was not listed as a dependent on their

We Need To Demand Income Equality Now 2 Male Income Households Are

Meghan Markle Snub Prince Harry To Stay Away From Duchess New Role

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Family tax

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Analyzing Biden s New American Families Plan Tax Proposal

Analyzing Biden s New American Families Plan Tax Proposal

Historical Federal Income Tax Rates For A Family Of Four Tax Policy

Canada Quebec Tax Brackets Canadaaz

Historical Federal Income Tax Rates For A Family Of Four Tax Policy

Family Tax Rebates - Web 27 ao 251 t 2021 nbsp 0183 32 For the 2021 tax year the credit was expanded to 8 000 per dependent from 3 000 and is capped at 16 000 instead of 6 000 In addition some families