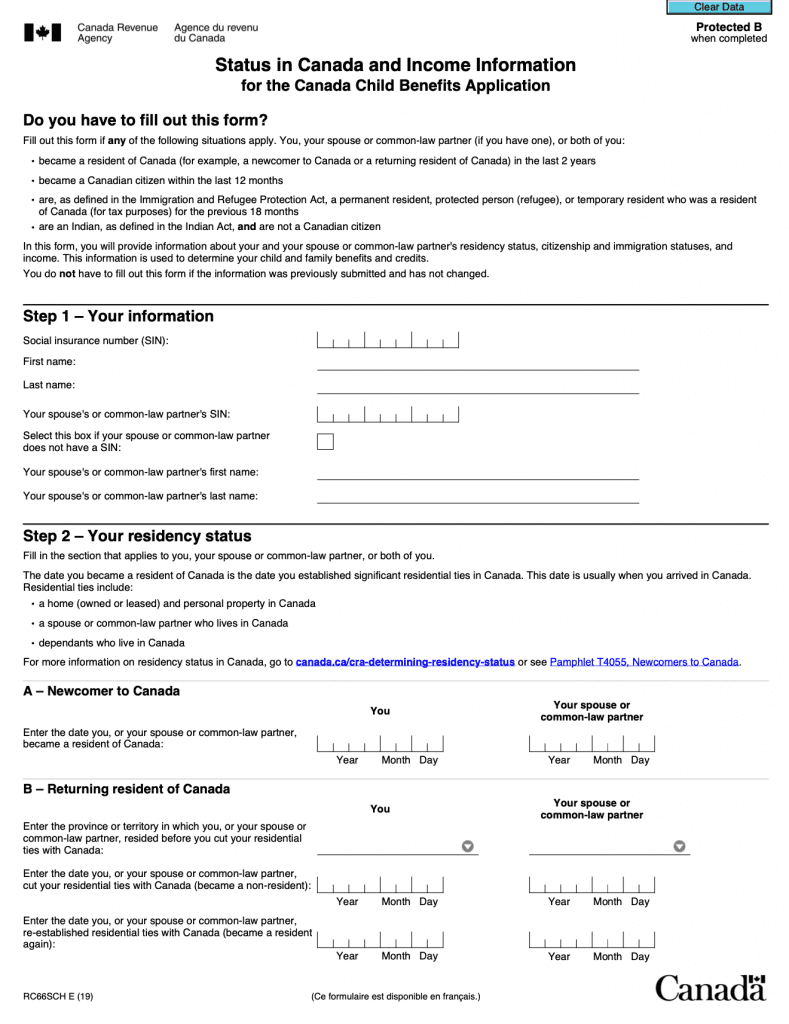

Fd Rebate In Income Tax Web 29 juin 2022 nbsp 0183 32 Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can

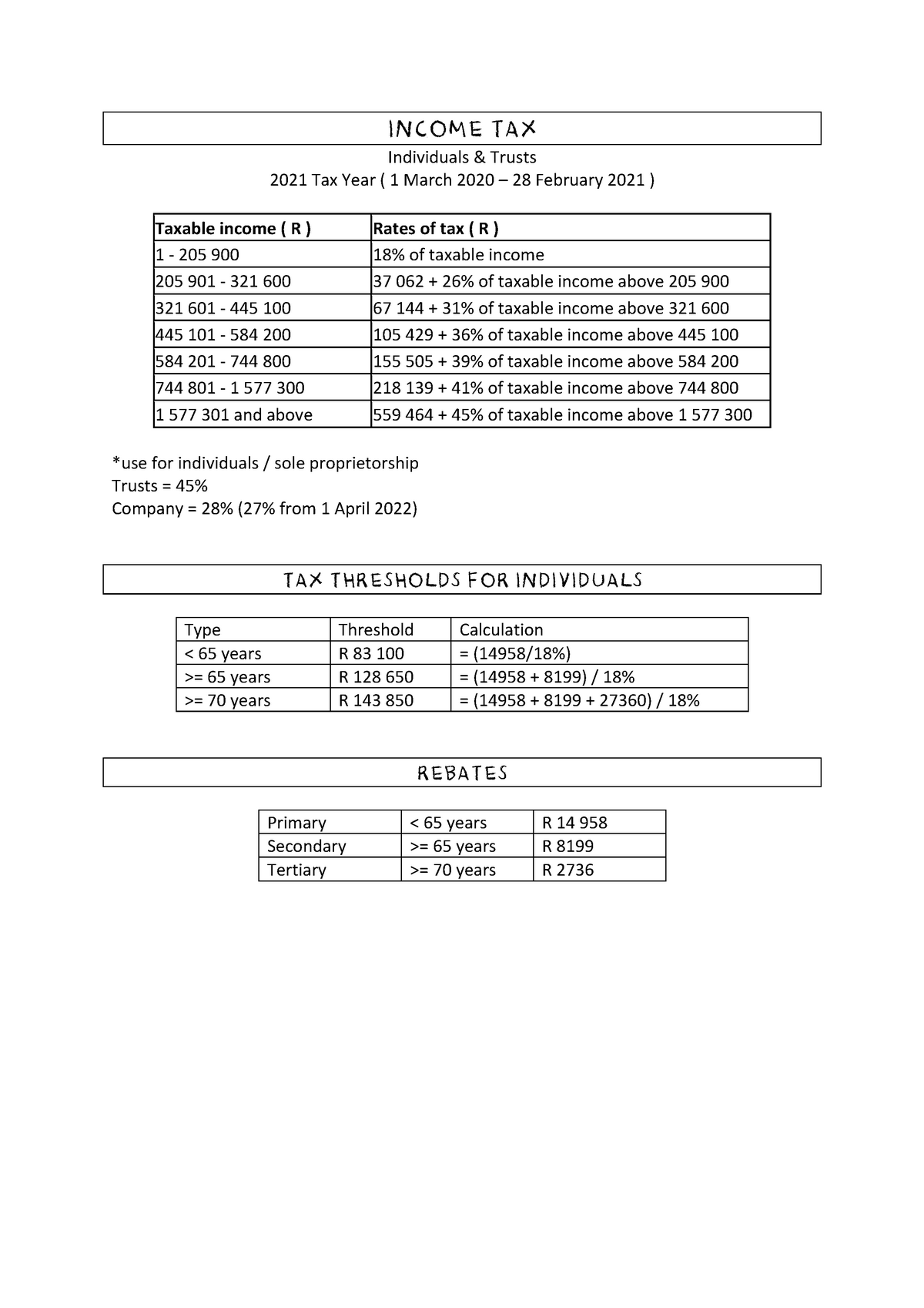

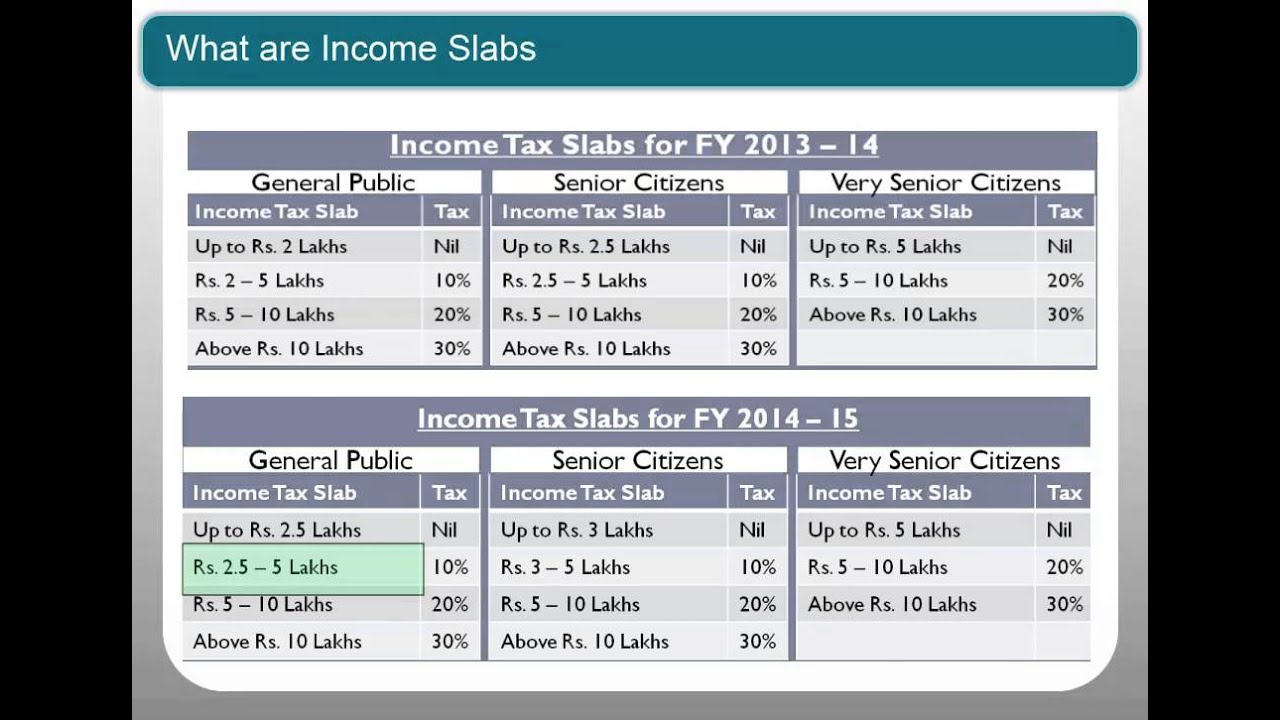

Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on interest Web 17 avr 2022 nbsp 0183 32 Interest earned on fixed deposits is taxable as per the Income Tax Act 1961 If you have FD in one or more bank accounts you should aggregate FD interest from all

Fd Rebate In Income Tax

Fd Rebate In Income Tax

https://lh6.googleusercontent.com/V-Vll753sLaCzJIQJfpfrdUH6geIv1Ad7kCiVAgX0UOg34X4YS_4goDP4ijfHdI3xWXK49DAYSOc4OZgf7gXkRt7tqEUbn9tEKr371cu2FncnHq1ZFPoEEBzbfxsFPqFs065SsqWCKzqJ9yg_965

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

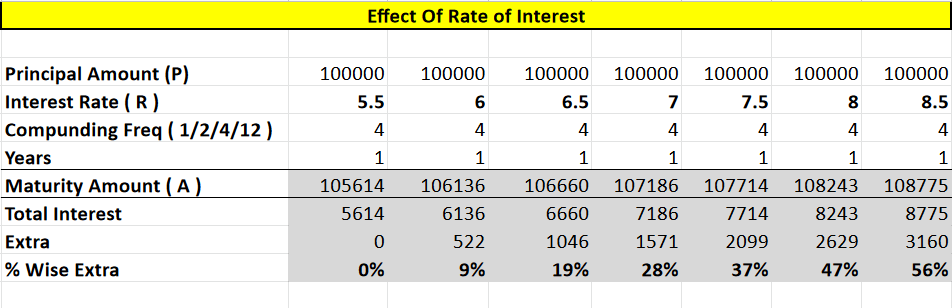

Axis Fd Calculator Wholesale Outlet Save 44 Jlcatj gob mx

https://labourlawadvisor.in/blog/wp-content/uploads/2020/08/Screenshot_2020-08-30-Fixed-Deposit-Excel-xlsx.png

Web 8 juin 2023 nbsp 0183 32 La d 233 duction forfaitaire de 10 est automatiquement calcul 233 e sur votre salaire pour tenir compte des d 233 penses professionnelles courantes li 233 es 224 votre emploi Les Web 16 mars 2023 nbsp 0183 32 Interest income from Fixed Deposits is fully taxable Read to know more about how to calculate tax on interest income when to pay tax Understanding TDS in

Web The interest income you earn from an FD is fully taxable The interest earnings form a part of your total tax liability You must also know that when you earn interest on an FD in a Web 21 juin 2023 nbsp 0183 32 TDS Tax Deducted at Source on Fixed Deposits FD is a mechanism by which the bank deducts a certain amount of tax from the interest income earned on

Download Fd Rebate In Income Tax

More picture related to Fd Rebate In Income Tax

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/dfa3db5ca69b9aab296dae9f4c821aa6/thumb_1200_1698.png

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Web 13 mai 2021 nbsp 0183 32 Premature encashment of FD s and impact on Income Tax CA Samyak Jain Income Tax Articles Download PDF 13 May 2021 27 108 Views 4 comments Web 22 mars 2023 nbsp 0183 32 Since the interest earned on an FD comes under the Income from Other Sources category it is therefore fully taxable if the annual interest exceeds 40 000

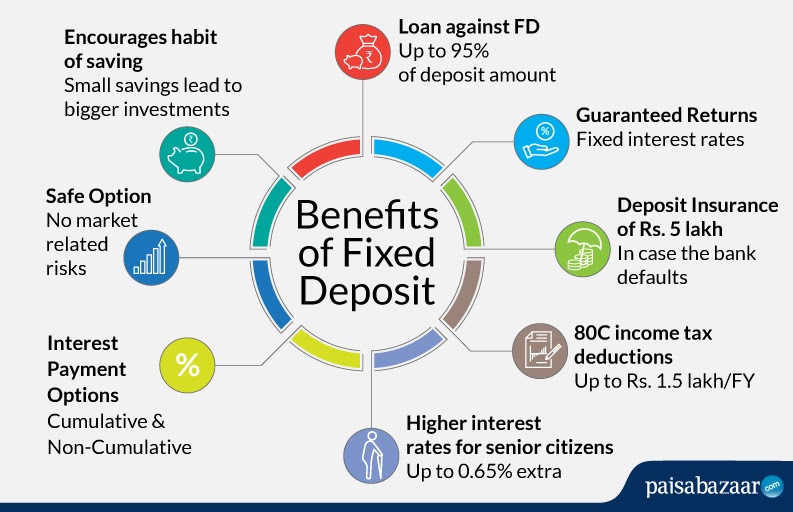

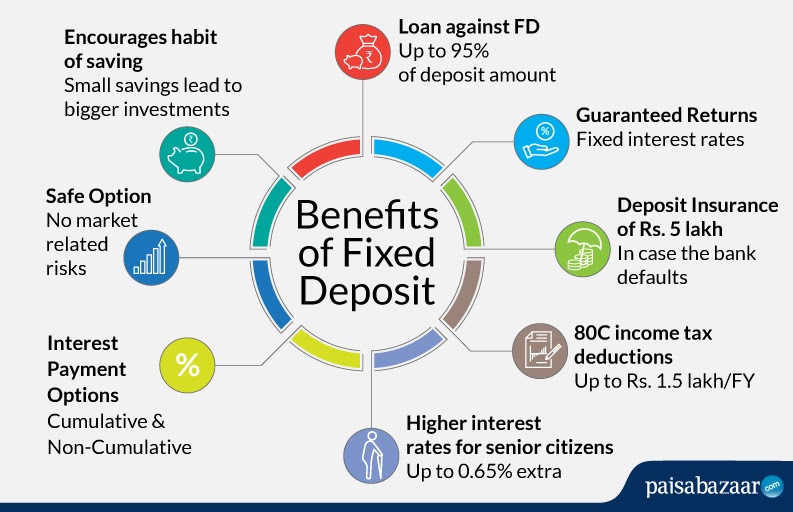

Web 8 d 233 c 2022 nbsp 0183 32 By Anjana Dhand Updated on 8 Dec 2022 Earning interest on a fixed deposit is very common for an individual taxpayer This is mostly because the fixed Web A tax saving FD gives you access to tax rebates of up to 1 5 Lakhs annually under Section 80C of the Income Tax Act 1961 However to enjoy such fixed deposit tax

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

https://cleartax.in/s/fixed-deposit

Web 29 juin 2022 nbsp 0183 32 Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on interest

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

2007 Tax Rebate Tax Deduction Rebates

Carbon Tax Rebate 2022 Alberta Printable Rebate Form

Tax Rebate For Individual Deductions For Individuals reliefs

Fixed Deposit TDS On FD And How To Show Interest Income From FD In ITR

Corporate FD Fixed Deposit By Company Complete Guide

Corporate FD Fixed Deposit By Company Complete Guide

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Fd Rebate In Income Tax - Web 6 avr 2022 nbsp 0183 32 To be eligible for a deduction from taxable income a fixed deposit must have a lock in period of five years In other words only specific five year tax saving fixed