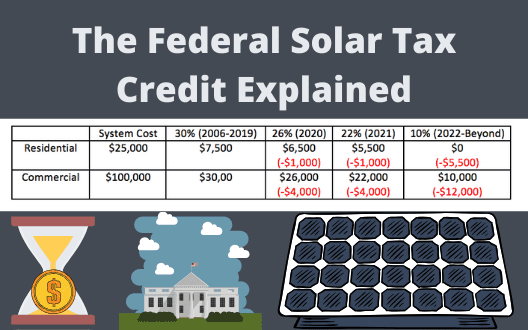

Fed Tax Solar Rebate Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Web 8 sept 2022 nbsp 0183 32 This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system Let s take a look at the biggest changes and what they mean for Americans who install Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Fed Tax Solar Rebate

Fed Tax Solar Rebate

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

How To File The Federal Solar Tax Credit A Step By Step Guide Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/solar-form-5695.png

Solar Rebate How It Works Ballarat Renewable Energy And Zero Emissions

https://breaze.org.au/images/19/Solar Rebate June 2019 Poster FB.png

Web 28 juil 2022 nbsp 0183 32 The tax credit applies to individuals adopters of solar technology The 30 credit also applies to energy storage whether it is co located or installed as standalone Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation

Web 8 sept 2022 nbsp 0183 32 Federal Solar Tax Credit Resources The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Web No Caution If you checked the No box you cannot claim the energy efficient home improvement credit Do not complete Part II

Download Fed Tax Solar Rebate

More picture related to Fed Tax Solar Rebate

Solar Panels Federal Tax Credit 2021 SolarProGuide

https://www.solarproguide.com/wp-content/uploads/solar-rebates-and-tax-incentives-realsolarsbc.png

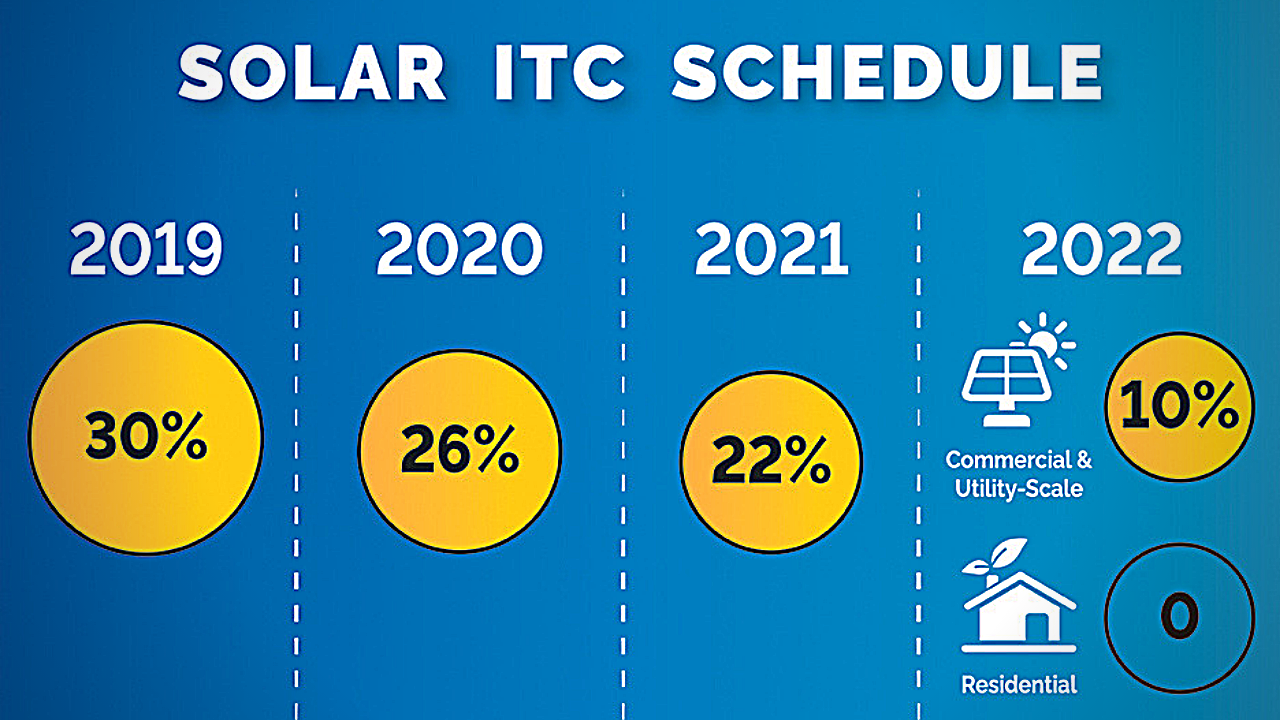

Federal Solar Tax Credit Save Money On Solar KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2018/08/updated-2020-federal-tax-incentive-for-solar-panels.png

California Solar Rebates The 5 Different Rebates

https://solartechadvisers.com/wp-content/uploads/2021/08/itc-SCHEDULE.png

Web 30 d 233 c 2022 nbsp 0183 32 See tax credits for 2022 and previous years The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in Web 30 d 233 c 2022 nbsp 0183 32 In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent income tax credit for clean energy

Web 26 avr 2023 nbsp 0183 32 Watch on How to Calculate Your Solar Tax Credit Calculating the amount of your federal solar tax credit is very simple Take the total cost your system and multiply Web 21 avr 2023 nbsp 0183 32 The federal solar tax credit at a glance Solar systems installed before 2033 are eligible for a tax credit equal to 30 of the costs of installing solar panels A 20 000

Solar Panel Cost In 2020 And Where The Money Goes

https://www.solarpowerrocks.com/wp-content/uploads/2020/01/2020-United-States-solar-rebates-ranked.png

What Is The Tax Credit For Solar Panels Fullorganictech

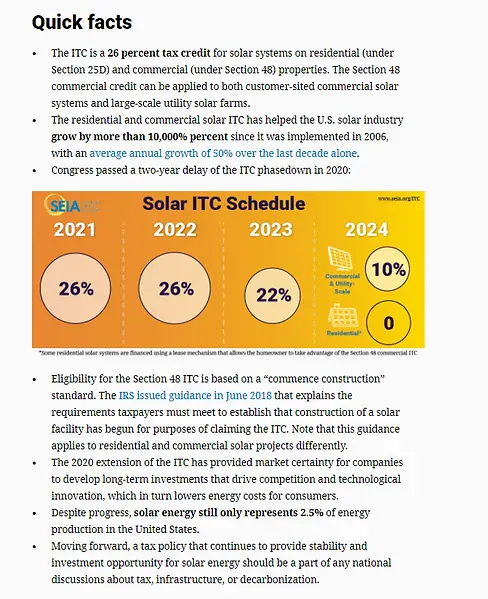

https://i2.wp.com/www.seia.org/sites/default/files/inline-images/Solar-ITC-Rampdown-Graphic.png

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

https://www.energy.gov/eere/solar/articles/sol…

Web 8 sept 2022 nbsp 0183 32 This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system Let s take a look at the biggest changes and what they mean for Americans who install

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

Solar Panel Cost In 2020 And Where The Money Goes

Alternate Energy Hawaii

2019 Texas Solar Panel Rebates Tax Credits And Cost

How To Claim Your Solar Tax Credit Design mlm

Solar Panel Deals Rebates And Incentives In Australia Solar Market

Solar Panel Deals Rebates And Incentives In Australia Solar Market

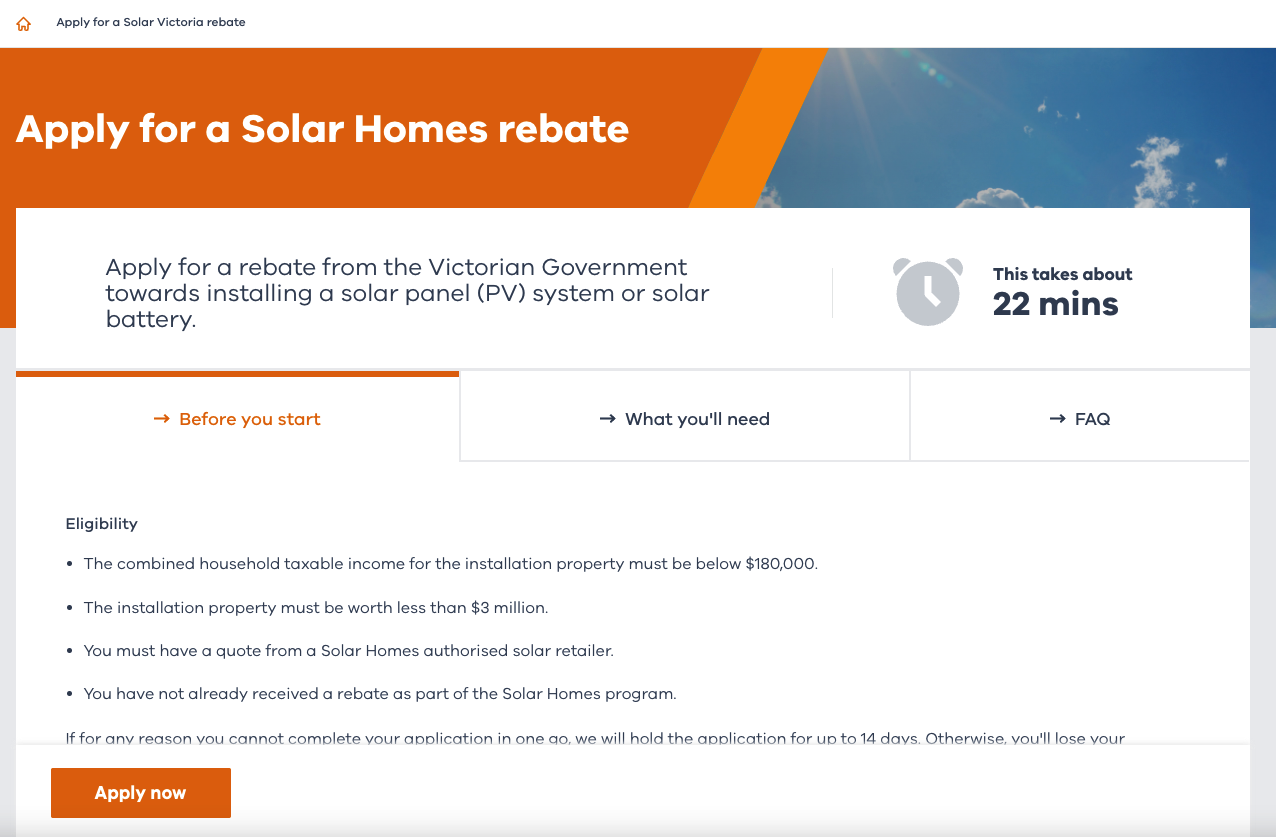

Solar Rebate Victoria 2022 Printable Rebate Form

Tax Rebates For Solar Power Ineffective For Low income Americans But

Guide To Solar Panel Cost And Savings In Las Vegas Nevada In 2020

Fed Tax Solar Rebate - Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation