Federal Ev Charger Tax Credit 2023 To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business

Federal Ev Charger Tax Credit 2023

Federal Ev Charger Tax Credit 2023

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

EV Charger Tax Credit 2023 WattLogic

https://wattlogic.com/wp-content/uploads/2021/10/Wattlogic-Can-You-Receive-a-Tax-Credit-for-Installing-an-Electric-Vehicle-Charging-Station_-1024x538.jpg

New EV Tax Credits The Details Virginia Automobile Dealers Association

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed at their homes in 2022 It s a one time nonrefundable Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in service and whether the vehicle meets certain requirements for a full or partial credit

This incentive provides a credit for up to 30 of the cost of qualified alternative fuel vehicle refueling property placed in service by the taxpayer The credit may be claimed by individuals for home electric vehicle charging and other refueling equipment and by businesses All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Download Federal Ev Charger Tax Credit 2023

More picture related to Federal Ev Charger Tax Credit 2023

EV Charger Tax Credit 2023 What You Need To Know Garage Charge

https://www.garage-charge.com/cdn/shop/articles/EV_Charger_Tax_Credit_2023-_What_You_Need_to_Know_-_Kiplinger_2023-05-23_10-12-42.png?v=1684851239&width=1100

Ev Tax Credit 2022 Cap Clement Wesley

https://electrek.co/wp-content/uploads/sites/3/2021/07/EV-Federal-Tax-Credit-Hero-2.jpg?quality=82&strip=all

Redeem Your Federal EV Charging Tax Credit

https://hypercharge.com/wp-content/uploads/hc-all.png

If you install an EV charger at home credits may be available The new law revives a federal tax credit that had expired in 2021 it provides 30 of the cost of hardware and Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023

The new law revives a federal tax credit that had expired in 2021 it provides 30 of the cost of hardware and installation up to 1 000 It adds a requirement that the charger must be in a As with the EV though you can get a tax break on the charger You may qualify for a federal tax credit that covers 30 percent of the charger s installation cost up to 1 000

EV Charging Equipment Tax Credit Extended

https://artisanelectricinc.com/wp-content/uploads/2021/02/EV-Charger-Tax-Credit.png

How Do I Claim Ev Charger Tax Credit By Laney Rollball Sep 2023

https://miro.medium.com/v2/resize:fit:958/1*R7hjkdQbdkESxMIWS6r0Rw.png

https://www.kiplinger.com/taxes/605201/federal-tax...

To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

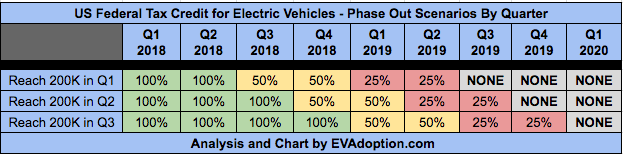

Updated Federal EV Tax Credit Phase Out Scenarios Nov 24 2017

EV Charging Equipment Tax Credit Extended

2023 Federal Tax Credit Only Six BEV Manufacturers Qualify

Federal Solar Tax Credits For Businesses Department Of Energy

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

IRS Form 8911 Walkthrough Alternative Fuel Vehicle Refueling Property

IRS Form 8911 Walkthrough Alternative Fuel Vehicle Refueling Property

Your Guide To EV Charger Tax Credits What You Need To Know By Austin

Federal EV Charger Rebates 2023 Save Money Today

EV Or Bust Why Everyone s Going Electric

Federal Ev Charger Tax Credit 2023 - The IRS released new guidance on the EV tax credit today and the changes mean that starting next year low and middle income buyers will be able to get the full 7 500 credit even if they don