Federal Ev Charger Tax Credit Form Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit

Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year The part of the credit attributable to business investment use is treated as a general business credit The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business

Federal Ev Charger Tax Credit Form

Federal Ev Charger Tax Credit Form

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

EV Charging Equipment Tax Credit Extended Solar Electric Contractor

https://artisanelectricinc.com/wp-content/uploads/2021/02/EV-Charger-Tax-Credit.png

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

https://evadoption.com/wp-content/uploads/2021/08/Should-these-EVs-qualify-for-the-federal-EV-tax-credit-1024x557.png

IRS Form 8911 may give you an idea of how much you qualify to receive as a tax credit Just make sure you save your receipts for when you file your taxes More Types of EV Chargers Can To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

Complete your full tax return then fill in form 8911 You ll need to know your tax liability to calculate the credit We re EV charging pros not CPAs so we recommend getting advice from a tax professional To claim the credit EV drivers must file Form 8911 with the IRS You don t get the credit automatically when you purchase an EV charger you must submit income and state information when

Download Federal Ev Charger Tax Credit Form

More picture related to Federal Ev Charger Tax Credit Form

Ev Charger Tax Credit Form

https://i.pinimg.com/originals/a9/b0/00/a9b000c597949528990db733d150da3d.jpg

New EV Tax Credits The Details Virginia Automobile Dealers Association

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

Ev Charger Tax Credit California Expose Log Book Picture Show

https://evcharging.enelx.com/images/PR/Articles/blog/how-the-rise-of-ev-charging-will-impact-multifamily-communities.jpg

If you purchase and install a ChargePoint electric vehicle EV charging solution between Jan 1 2023 and Dec 31 2032 your business may be eligible to receive a 30 tax credit up to 100 000 per station under the 30C Alternative Fuel Infrastructure Tax Credit If you purchase and install a ChargePoint electric vehicle EV charging solution between Jan 1 2023 and Dec 31 2032 your business may be eligible to receive a 30 tax credit up to 100 000 per station under the

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the requirements below Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year The part of the credit attributable to business investment use is treated as a general business credit

EV Charger Federal Tax Credit

https://uploads-ssl.webflow.com/635a8ce404fcf6b3f3ba8748/637324a75603d236fb0d2cce_federal-tax-credit-p-2600.jpg

EV Charger Tax Credit 2023 WattLogic

https://wattlogic.com/wp-content/uploads/2021/10/Wattlogic-Can-You-Receive-a-Tax-Credit-for-Installing-an-Electric-Vehicle-Charging-Station_-1024x538.jpg

https://www.irs.gov › forms-pubs

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit

https://www.irs.gov › instructions

Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year The part of the credit attributable to business investment use is treated as a general business credit

Electric Vehicle Charging Station Installation In Washington

EV Charger Federal Tax Credit

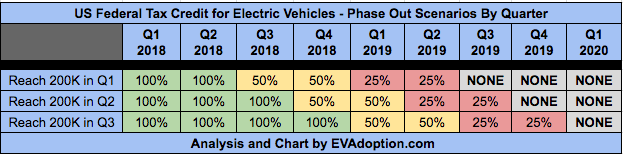

Updated Federal EV Tax Credit Phase Out Scenarios Nov 24 2017

Ev Charger Tax Credit Form

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

How To Get The Federal EV Charger Tax Credit Forbes Advisor

How To Get The Federal EV Charger Tax Credit Forbes Advisor

The Federal EV Charger Tax Credit Is Back What To Know Kiplinger

Federal EV Tax Credit News And Reviews InsideEVs

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Ev Charger Tax Credit Form - Complete your full tax return then fill in form 8911 You ll need to know your tax liability to calculate the credit We re EV charging pros not CPAs so we recommend getting advice from a tax professional