Federal Ev Rebate Income Limit Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Web 5 sept 2023 nbsp 0183 32 You won t qualify for the EV tax credit if you are single and your modified adjusted gross income exceeds 150 000 The EV tax credit income limit for married

Federal Ev Rebate Income Limit

Federal Ev Rebate Income Limit

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/06/cropped-USRebate-Logo-1.png?fit=500%2C216&ssl=1

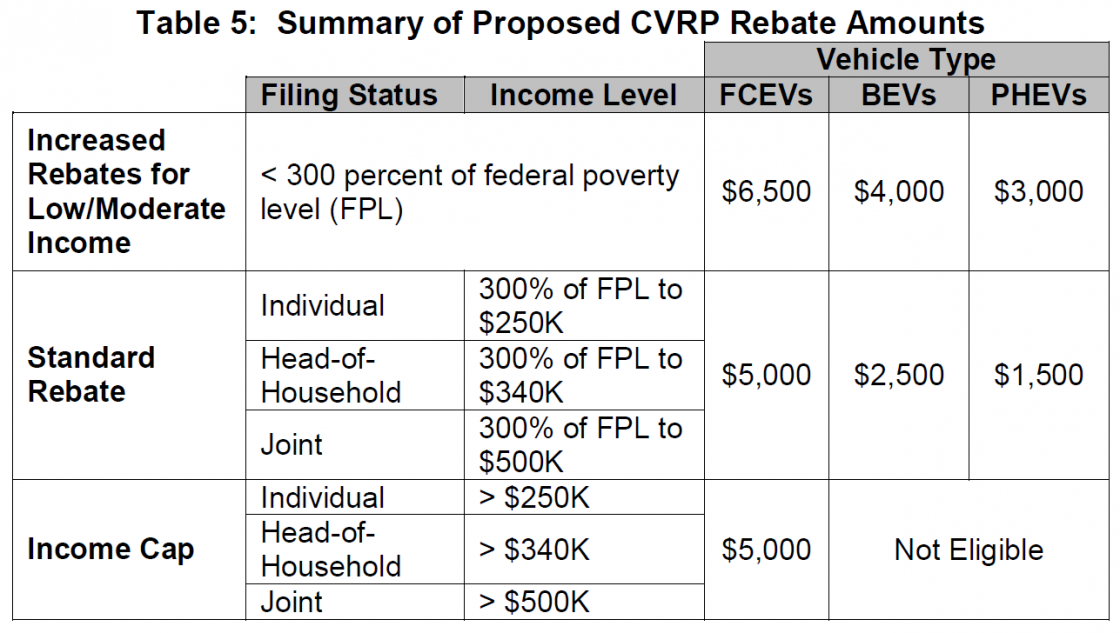

California EV Rebate Income Limit How To Claim The EV Rebate

https://www.glowingsplint.net/wp-content/uploads/2023/01/xhgjkj.png

California EV Rebate Income Limit How To Claim The EV Rebate

https://www.glowingsplint.net/wp-content/uploads/2023/01/sghok.png

Web The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find Web 5 sept 2023 nbsp 0183 32 The White House has estimated that credit could save taxpayers up to 950 per year Here s what you need to know about the federal tax incentives for electric

Web 11 ao 251 t 2021 nbsp 0183 32 As part of the new federal budget the US Senate approved an amendment introduced by Senator Deb Fischer R NE to introduce a limit on the price of electric cars eligible to the 7 500 Web 2 sept 2022 nbsp 0183 32 Single tax filers are eligible if their income is below 150 000 For heads of households that income cap rises to 225 000 Joint filers are eligible for the EV tax

Download Federal Ev Rebate Income Limit

More picture related to Federal Ev Rebate Income Limit

California EV Rebate Income Limit How To Claim The EV Rebate

https://www.glowingsplint.net/wp-content/uploads/2023/01/gxhjh.png

2021 Electric Car Tax Credit Irs Galore Blogging Picture Show

https://evadoption.com/wp-content/uploads/2019/03/Sample-EVs-Federal-EV-tax-credit-amount-calculation.png

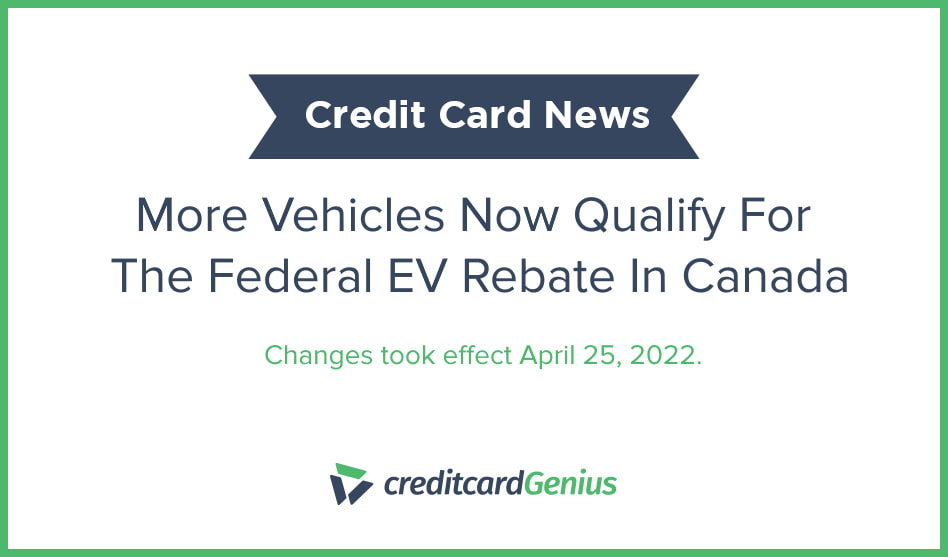

More Vehicles Now Qualify For The Federal EV Rebate In Canada

https://cms.creditcardgenius.ca/wp-content/uploads/2022/04/federal-ev-rebate-canada.jpg

Web 30 nov 2021 nbsp 0183 32 For individuals the maximum income would be 250 000 and for single income households the income limit would be 375 000 The version proposed earlier Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Web 25 janv 2023 nbsp 0183 32 The law which extended the tax break through 2031 changed some requirements to get the full 7 500 value of the clean vehicle credit Web 24 avr 2023 nbsp 0183 32 Starting in 2024 you ll receive the cash when you buy your electric car not when you file your taxes In this guide we ll help you determine whether you and the car

Ev Tax Credit 2022 Retroactive Shemika Wheatley

https://images.hgmsites.net/med/ev-tax-credit-support--climate-nexus-may-2019_100702679_m.jpg

Ca Electric Car Rebate Income Limit ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/key-states-rethink-electric-car-subsidies-bestride-1.png

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

Rebate On Electric Cars Canada 2022 Carrebate

Ev Tax Credit 2022 Retroactive Shemika Wheatley

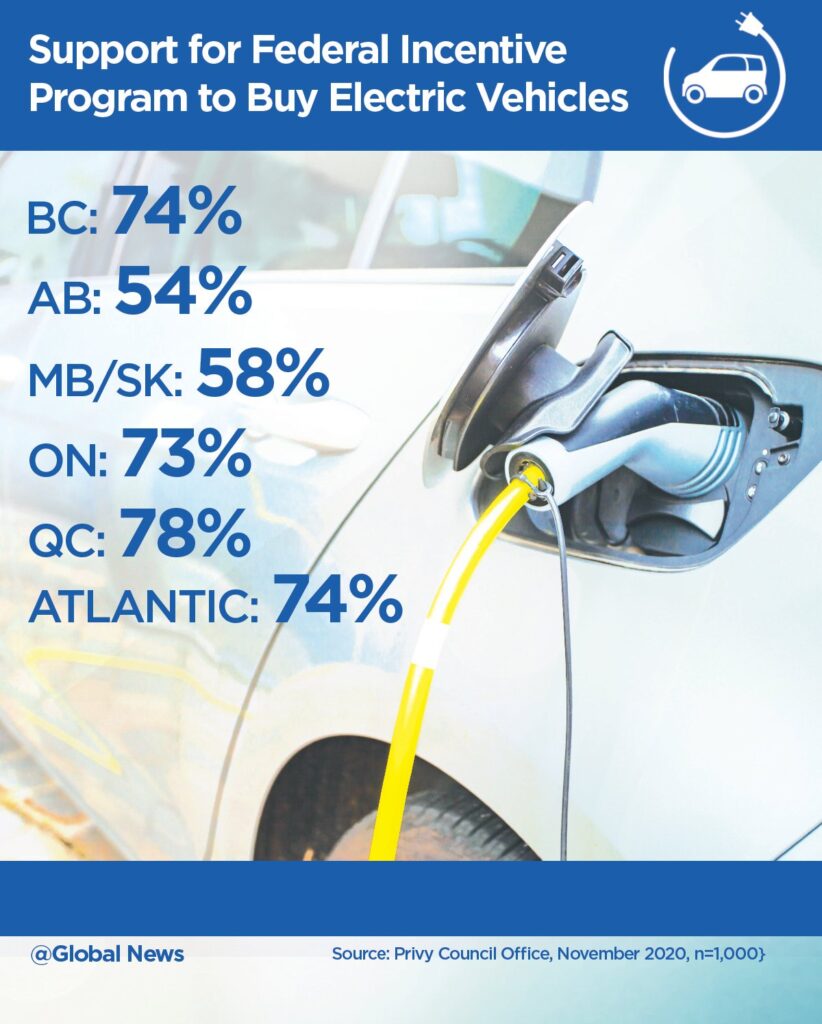

Canadians Support Federal EV Rebates Shows Internal Govt Poll

2023 Federal Budget Includes One time grocery Rebate For Canadians

/cloudfront-us-east-1.images.arcpublishing.com/tgam/2NL45IATXZGRXI23LJA7M46D4I.jpg)

Which Provinces Have The Best EV Rebates The Globe And Mail

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

3 EV Incentives GoEV CITY

Proposed Federal EV Tax Credit Reform Will It Move The Sales Needle

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

Federal Ev Rebate Income Limit - Web 1 ao 251 t 2023 nbsp 0183 32 Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30 000 That limit applies to projects that were completed