Federal Ev Tax Credit 2023 Lease Our experts show you how to qualify for a federal tax credit of up to 7 500 by leasing an electric vehicle or plug in hybrid

IRS states in their fact sheet topic G Q5 that businesses that lease vehicles are allowed to claim the commercial EV tax credit for each leased vehicle This means that as long as the Exceed the income eligibility limit of the 7 500 EV tax credit Interested in an EV that doesn t meet the North America assembly requirement of the tax credit Here are 15 cars that pass through the tax credit as an immediate 7 500 lease cash incentive through the manufacturer s affiliated lender

Federal Ev Tax Credit 2023 Lease

Federal Ev Tax Credit 2023 Lease

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

Tax Credits ElectricVehicleSolar

https://static.wixstatic.com/media/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit How to know if your car qualifies for the EV tax credit aka Clean Vehicle Tax Credit if it was delivered on or after April 18 2023

Dec 29 Reuters The U S Treasury Department said on Thursday that electric vehicles leased by consumers can qualify starting Jan 1 for up to 7 500 in commercial clean vehicle tax credits Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them

Download Federal Ev Tax Credit 2023 Lease

More picture related to Federal Ev Tax Credit 2023 Lease

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

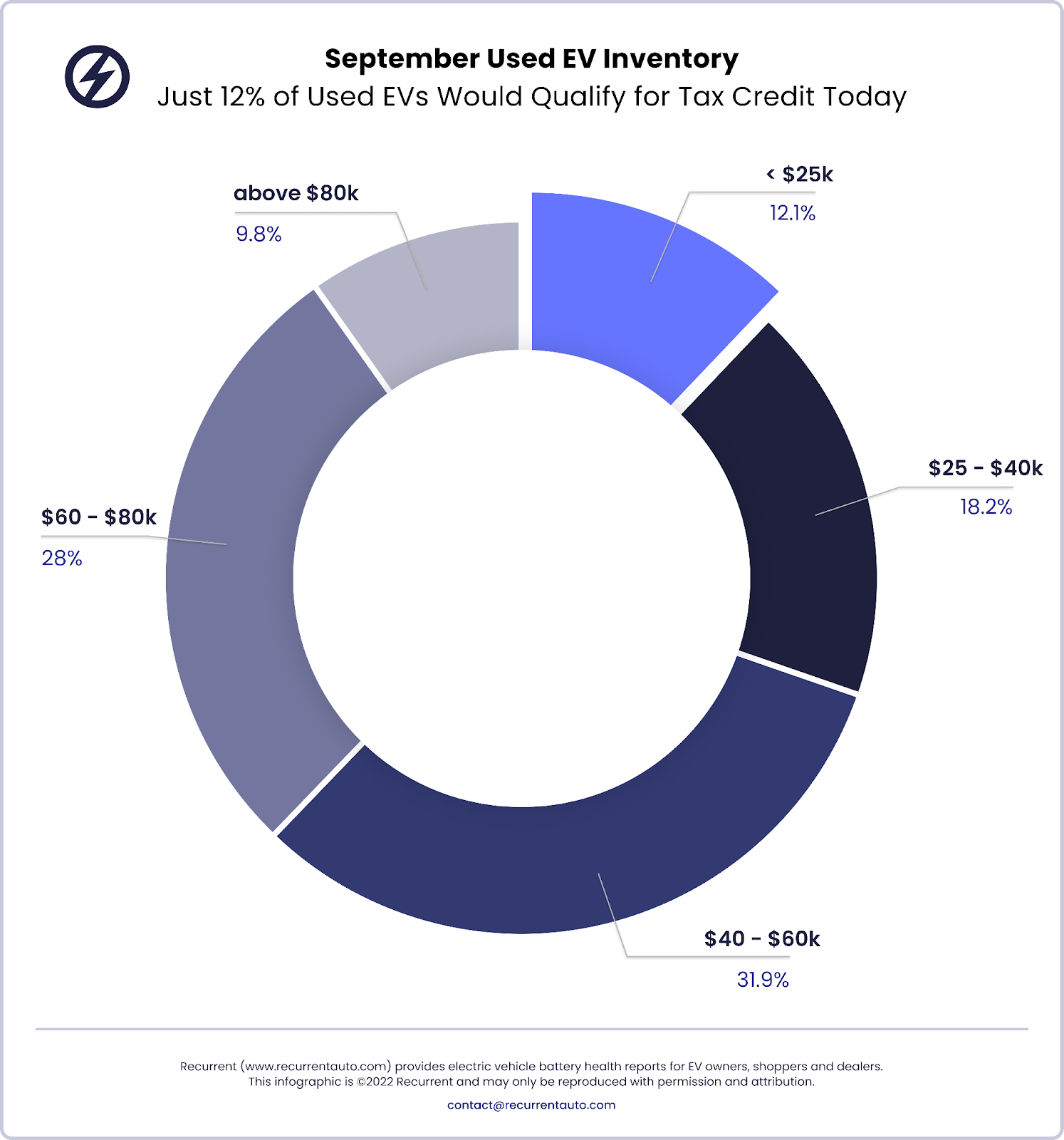

Inflation Reduction Act Used EV Funding Mostly Applies To PHEVs Motor

https://www.teslarati.com/wp-content/uploads/2022/10/Recurrent-EV-Inventory-by-Price.png

EV Tax Credit 2023 All You Need To Know Electric Vehicle Info

https://e-vehicleinfo.com/global/wp-content/uploads/2023/06/EV-Tax-Credit-2023-All-you-need-to-know-2-1024x536.png

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Purchases of used EVs and PHEVs after Jan 1 are now eligible for a tax credit of 30 of the sale price up to a maximum of 4 000 The credit also has restrictions though fewer than for new

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act Starting January 1 many Americans will qualify for a tax credit of up to 7 500 for buying an electric vehicle The credit part of changes enacted in the Inflation Reduction Act is designed

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

https://evadoption.com/wp-content/uploads/2021/08/Should-these-EVs-qualify-for-the-federal-EV-tax-credit.png

4 Ways How Does The Federal Ev Tax Credit Work Alproject

https://i1.wp.com/hips.hearstapps.com/hmg-prod.s3.amazonaws.com/images/2022-toyota-bz4x-127-1637027542.jpg

https://www.consumerreports.org/cars/what-to-know...

Our experts show you how to qualify for a federal tax credit of up to 7 500 by leasing an electric vehicle or plug in hybrid

https://electrek.co/2023/04/05/how-to-bypass-nearly...

IRS states in their fact sheet topic G Q5 that businesses that lease vehicles are allowed to claim the commercial EV tax credit for each leased vehicle This means that as long as the

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Solar Tax Credit What It Is How To Claim It For 2024

Ev Tax Credit 2022 Cap Clement Wesley

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

Has Federal EV Tax Credit Been Saved The Green Car Guy

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

U S Federal EV Tax Credit Update For January 2019

Federal Ev Tax Credit 2023 Lease - Dec 29 Reuters The U S Treasury Department said on Thursday that electric vehicles leased by consumers can qualify starting Jan 1 for up to 7 500 in commercial clean vehicle tax credits