Rebate Under Section 87a Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

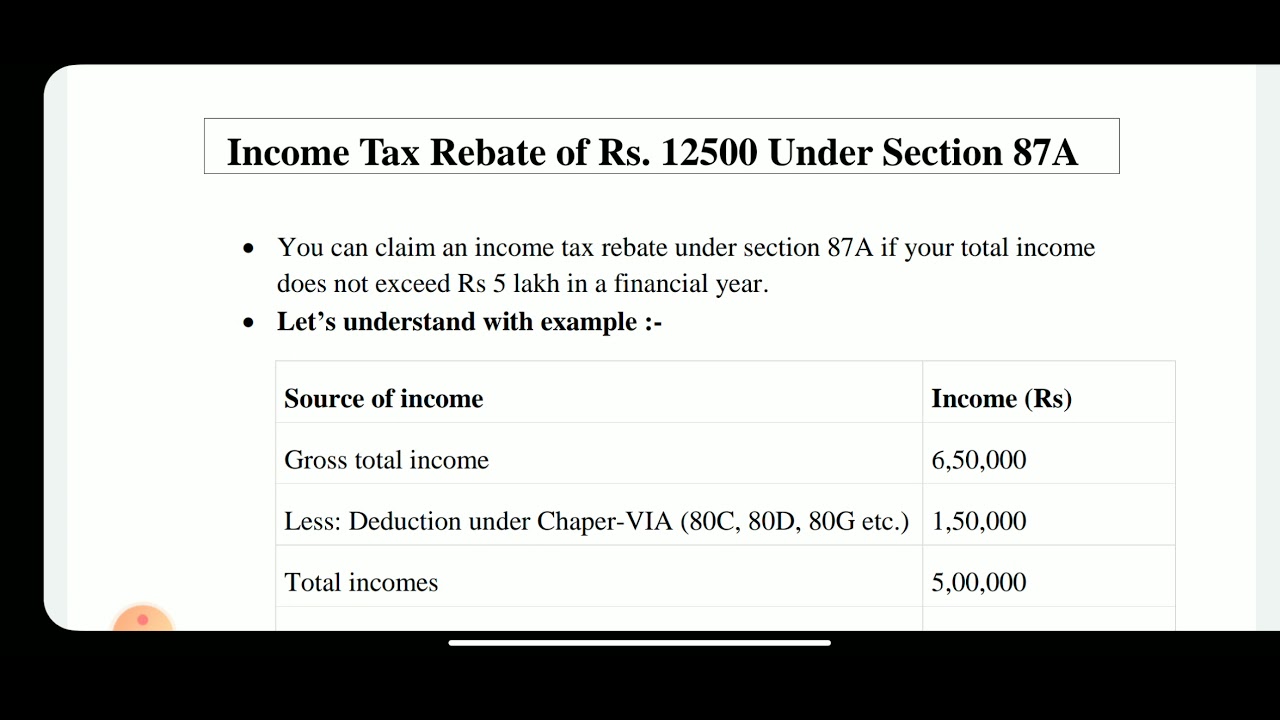

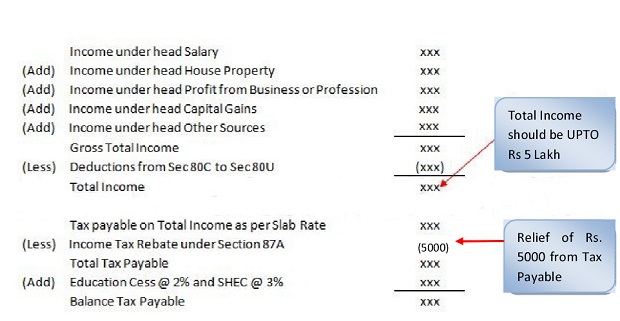

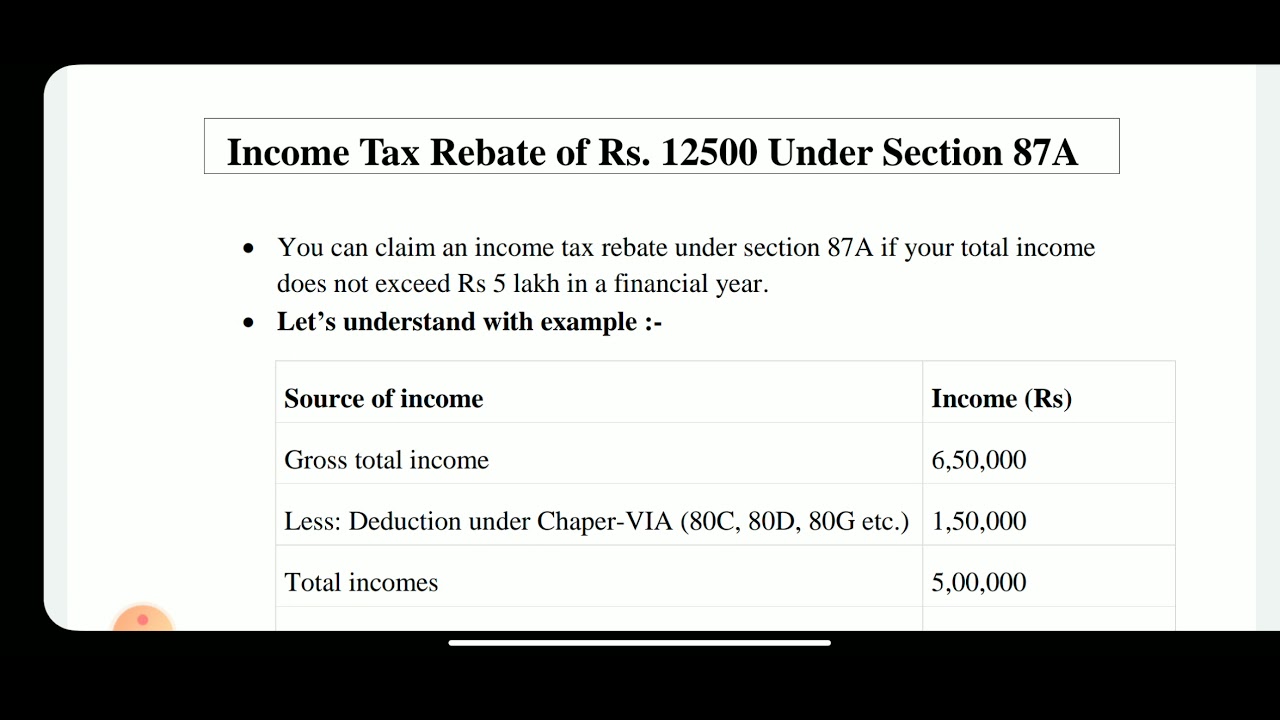

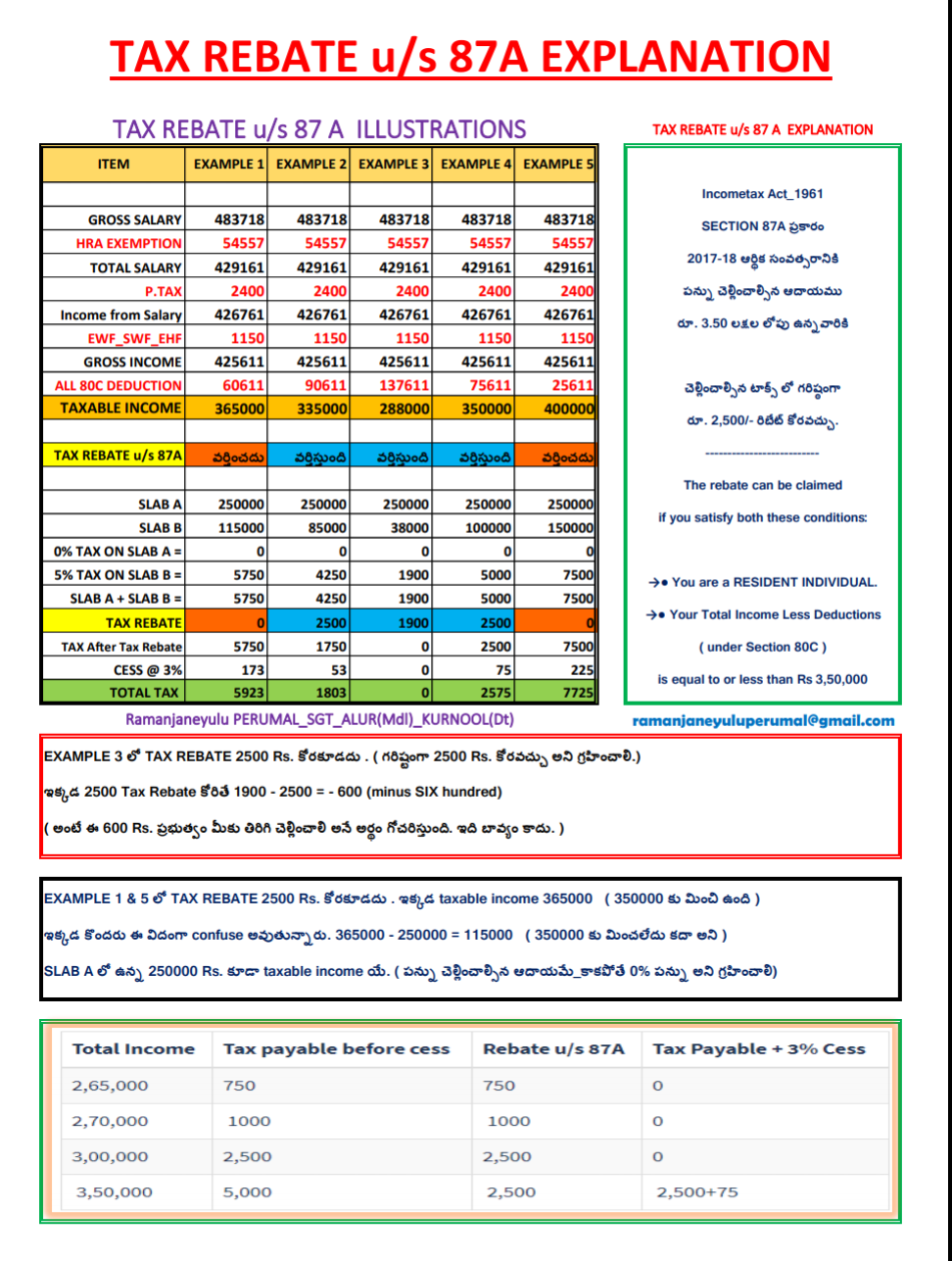

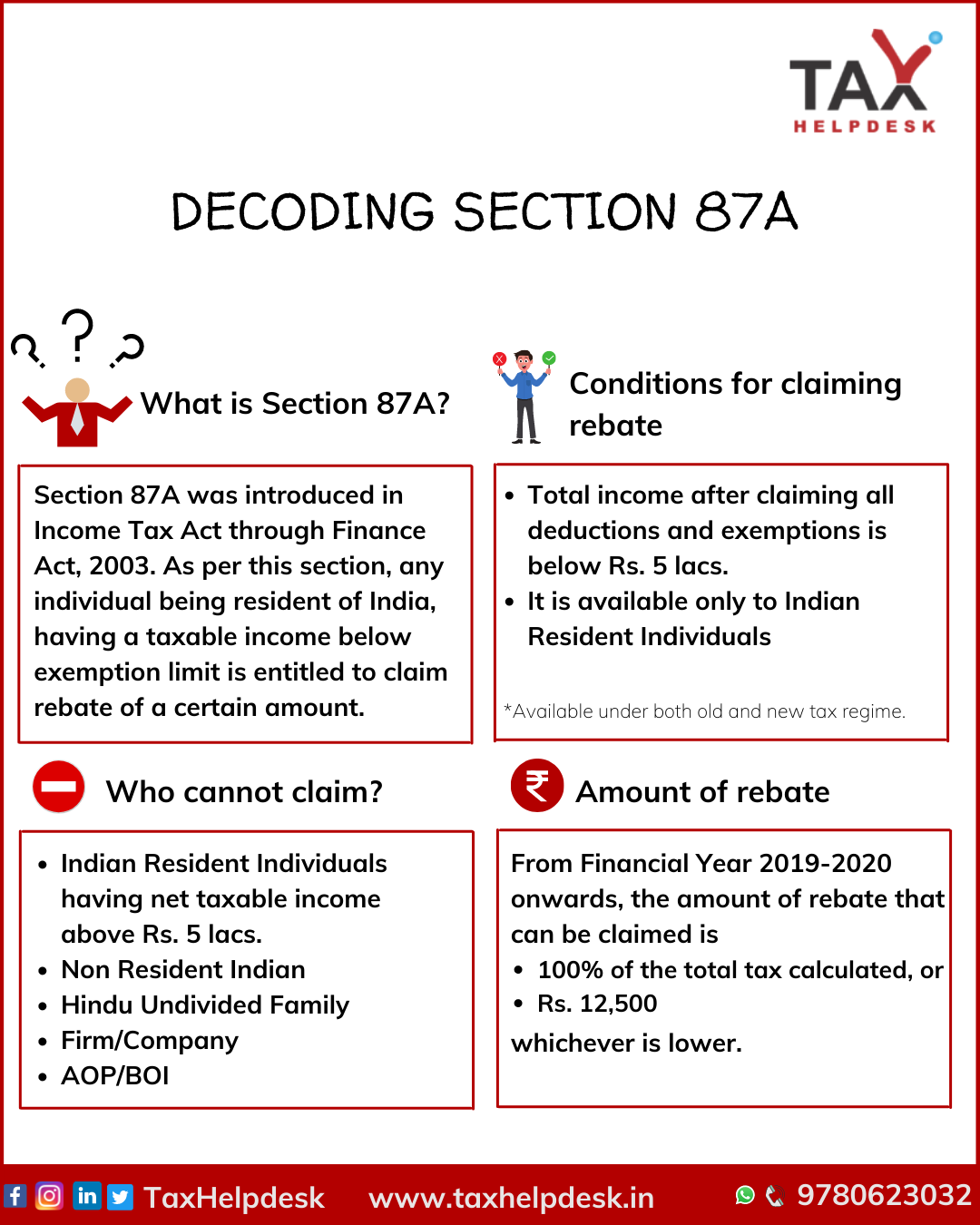

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable Web Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual

Rebate Under Section 87a

Rebate Under Section 87a

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

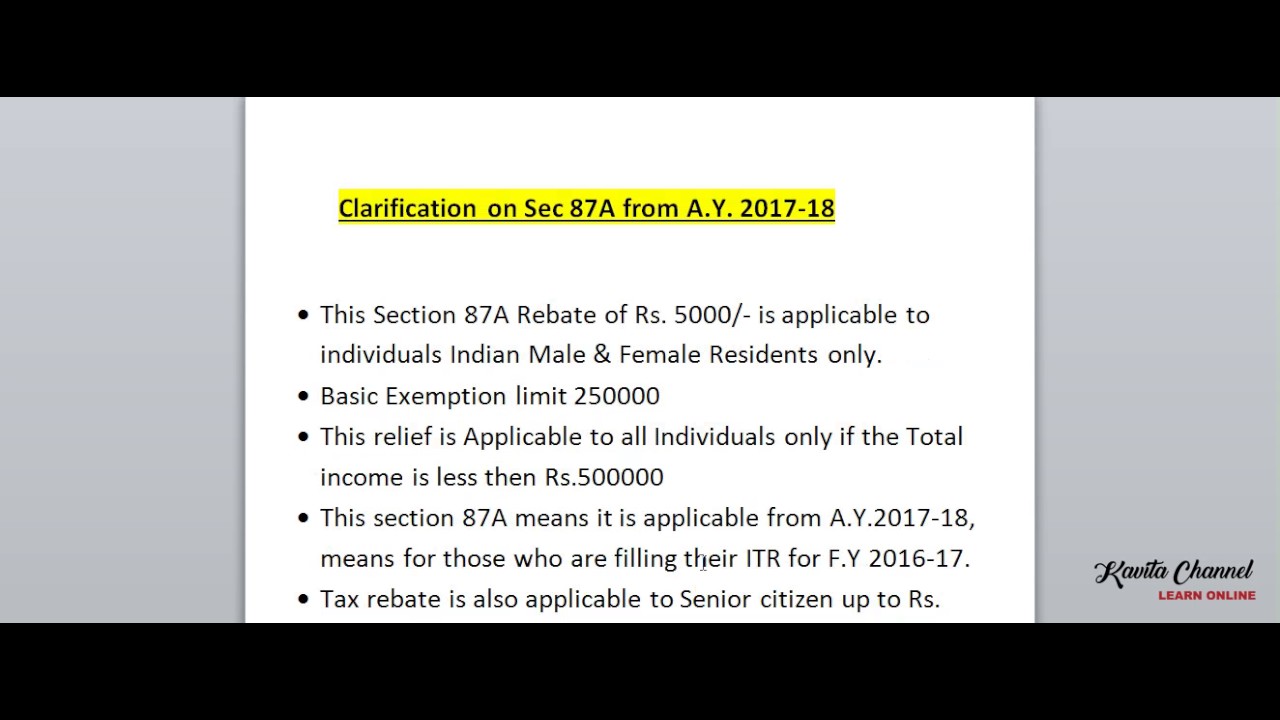

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Section 87A Tax Rebate FY 2019 20 Tax Wealth Tax Tax Deductions

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

Web 10 avr 2023 nbsp 0183 32 Who can claim a rebate under section 87A Individual taxpayers are eligible for a rebate under Section 87A provided their total taxable income does not exceed Rs Web 9 d 233 c 2022 nbsp 0183 32 The income tax rebate u s 87A is the same for both FY 2020 21 AY 2021 22 and FY 2021 22 AY 2022 23 The maximum rebate that can be claimed u s 87A of the income tax act for FY

Web The maximum rebate under Section 87A will be 100 up to Rs 12 500 in a financial year So if your tax liability is Rs 2 500 the rebate amount will be Rs 2 500 only While if Web 1 f 233 vr 2023 nbsp 0183 32 Rebate under Section 87A on income explained Section 87A of the Income Tax I T Act helps you lower your taxes Taxpayers can claim rebate us 87A if their

Download Rebate Under Section 87a

More picture related to Rebate Under Section 87a

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/TvlWdoFkYts/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

Web 2 f 233 vr 2023 nbsp 0183 32 Individuals can claim rebate u s 87A of income tax act if they satisfy these conditions Only resident individuals can claim a rebate under this section The total Web To calculate rebate under section 87A calculate your gross income and subtract the available deductions under Sections 80C to 80U Now if your net taxable income is

Web 17 juil 2023 nbsp 0183 32 87A Tax Rebate under the New Regime FY 2023 24 amp AY 2024 25 The basic exemption limit under the new income tax regime is 7 00 000 You will have to pay tax if your income exceeds this limit The Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Rebate Under Section 87A Of Rs 12 500 Under Income Tax Important

https://i.ytimg.com/vi/ByPTqQHFkp4/maxresdefault.jpg

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://i.pinimg.com/736x/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Rebate Under Section 87A Of Rs 12 500 Under Income Tax Important

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Tax Rebate 2017 18 Clarification Under Section 87 A Teachers9 Com

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Income Tax Rebate Under Section 87A

Tax Rebate Under Section 87A All You Need To Know YouTube

Rebate Under Section 87a - Web 4 nov 2016 nbsp 0183 32 Individuals whose income does not exceed Rs 3 50 000 are eligible to claim the rebate under section 87A This rebate is limited to Rs 2 500 and is applied before