Federal Government Electric Car Rebates Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the requirements below

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 If you re shopping for or researching an electric vehicle in 2024 you ve probably heard that significant changes in the federal tax credit of up to 7 500 for EVs and plug in hybrids took

Federal Government Electric Car Rebates

Federal Government Electric Car Rebates

https://www.96fm.com.au/wp-content/uploads/sites/8/2022/05/electric-car.jpg?crop=0px,201px,2421px,1361px&resize=2400,1350&quality=75

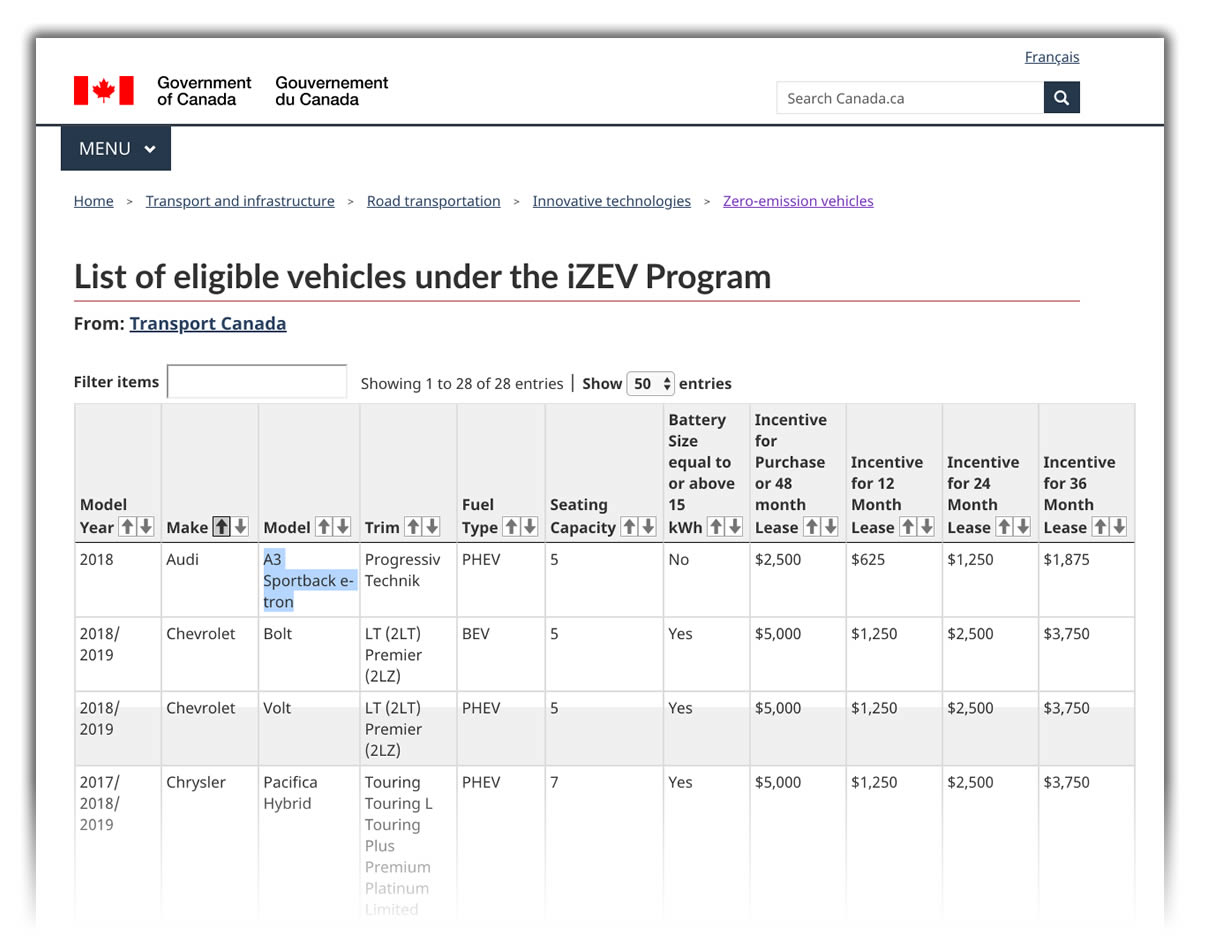

Hybrid Cars Canada Rebate 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/the-8-best-hybrid-cars-in-canada-2021-top-rated-models.jpg

Federal Tax Rebates Electric Vehicles ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives companies a few more Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable

Download Federal Government Electric Car Rebates

More picture related to Federal Government Electric Car Rebates

A Breakdown Of State And Federal Electric Car Rebates And Incentives

https://www.chivmen.com/wp-content/uploads/2022/03/EV-charging-768x432.jpg

California Cranks Up Electric Car Rebates For Lower Income Buyers

https://www.enbridge.com/-/media/Enb/Images/LearnAboutEnergy/Content-page-banners/EVrebates.jpg

A Breakdown Of State And Federal Electric Car Rebates And Incentives

https://www.chivmen.com/wp-content/uploads/2022/03/Tesla-charging-1-768x432.jpg

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit The government is offering free money for top notch EVs from a growing number of brands including Ford Rivian Tesla VW and Honda though fewer vehicles qualify in 2024 than in 2023

Electric Vehicle Tax Credits And Rebates Electric Car Incentives 2022

https://i0.wp.com/dkelectricalsolutions.com/wp-content/uploads/Electric-Vehicle-EV-Tax-Credits-and-Rebates.jpg

Government Of Canada Electric Vehicle Rebates ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/electric-vehicles-in-canada-available-rebates-leasecosts-canada.jpg

https://www.energy.gov/save/electric-vehicles

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the requirements below

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Hybrid Cars With Rebates 2022 Carrebate

Electric Vehicle Tax Credits And Rebates Electric Car Incentives 2022

Canada Rebates For Hybrid Cars 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

2019 Jaguar I Pace California Electric car Rebates And Latest Elio

Government Hybrid Car Rebates 2022 2023 Carrebate

Government Hybrid Car Rebates 2022 2023 Carrebate

Electric Car Rebates 2022 California 2023 Carrebate

Canadian Federal Government Electric Car Rebate 2022 2022 Carrebate

Electric Cars 2022 California Rebates 2023 Carrebate

Federal Government Electric Car Rebates - For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible