Federal Government Rebate For Electric Cars Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

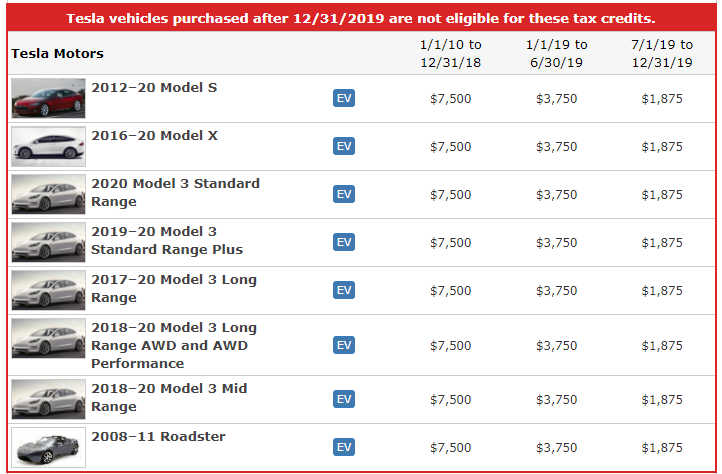

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Web 7 janv 2023 nbsp 0183 32 For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some

Federal Government Rebate For Electric Cars

Federal Government Rebate For Electric Cars

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/2022-tax-brackets-jeanxyzander-5.jpg

Cars That Meet Federal Rebate On Electric Cars 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-2.jpg

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in Web 6 juin 2023 nbsp 0183 32 First you must buy a new EV that qualifies Then you ll need to fill out IRS Form 8936 to claim your credit of up to 7 500 against your tax bill when you file your

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Download Federal Government Rebate For Electric Cars

More picture related to Federal Government Rebate For Electric Cars

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

Texas Rebate For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/mitchell-schnurman-is-texas-going-green-with-rebates-for-electric-cars-1.png

Federal Electric Car Rebate Rules ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-make-buying-an-electric-vehicle-more-affordable-2.png

Web 17 avr 2023 nbsp 0183 32 CNN The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than Web 31 ao 251 t 2023 nbsp 0183 32 3 01 The Biden administration is making up to 12 billion available for automakers to retrofit their facilities to make electric vehicles and hybrids The funding

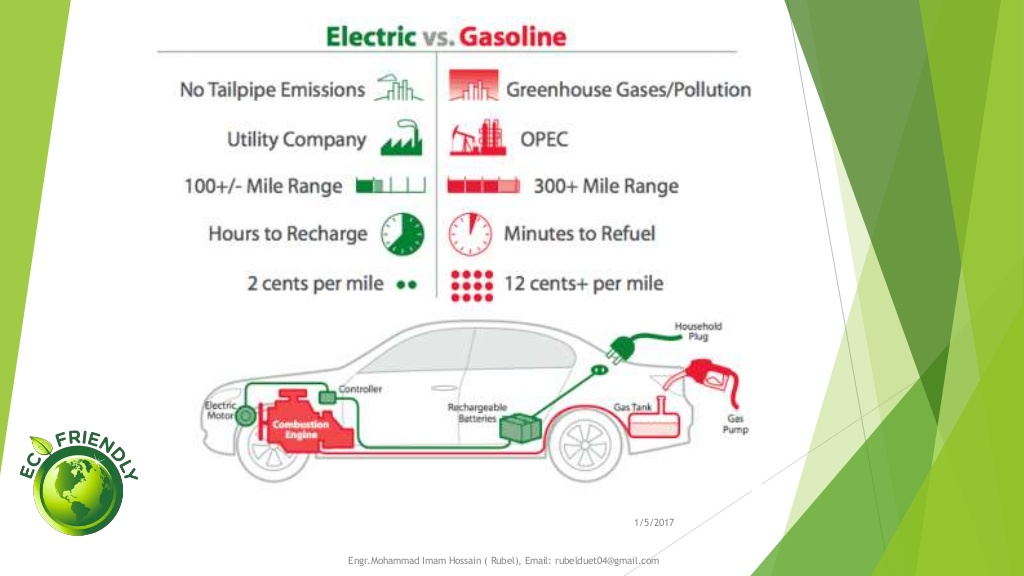

Web 10 ao 251 t 2022 nbsp 0183 32 Regarding the original tax credit according to the IRS For vehicles acquired after December 31 2009 the credit is equal to 2 500 plus for a vehicle which draws Web Battery electric hydrogen fuel cell and longer range plug in hybrid vehicles are eligible for up to 5 000 longer range plug in vehicles have an electric range equal to or greater

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Federal Rebate Set To Make Electric Cars More Affordable See 100M Go

https://cloudinary.jpbgdigital.com/dmlwdg4vj/image/fetch/w_1200,h_675/https://s3.amazonaws.com/socast-superdesk/media/20210525150520/60ad15a1023d16089dbb441fjpeg.jpg

https://www.bloomberg.com/news/articles/2022-05-07/what-to-know-about...

Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Government Rebate For Electric Cars 2022 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

Rebate On Electric Cars Canada 2022 Carrebate

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Electric Water Heater Rebates Michigan WaterRebate

Federal Rebate On Electric Cars ElectricCarTalk

Federal Rebate On Electric Cars ElectricCarTalk

California Electric Car Rebate

Electric Car Rebates By State ElectricRebate

Canada Rebates For Electric Cars 2023 Carrebate

Federal Government Rebate For Electric Cars - Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section