Federal Incentives For Ev Cars Federal tax credit for EVs will remain at 7 500 The timeline to qualify is extended a decade from January 2023 to December 2032 Tax credit cap for automakers after they hit 200 000 EVs sold is

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit By Jack Fitzgerald Updated Mar 6 2024 Marc Urbano Car and For a broader view of what vehicles may now be eligible for this credit the Department of Energy published a list of Model Year 2022 and early Model Year 2023 electric vehicles that likely meet the final assembly requirement The eligibility for a specific vehicle should be confirmed using its VIN number

Federal Incentives For Ev Cars

Federal Incentives For Ev Cars

https://blog.fossnational.com/hubfs/Blog Images/2021/Canada Federal EV Incentives 3 Key Benefits for Fleets - Update/federal-ev-incentives-1.jpg

What Are The Federal Incentives For Solar Batteries And EVs

https://www.greenmtnsolar.com/hs-fs/hubfs/Final Array- Coyman.jpg?width=1088&name=Final Array- Coyman.jpg

Auto Industry Takes A Dive Amid Semiconductor Shortages

https://etimg.etb2bimg.com/photo/82625800.cms

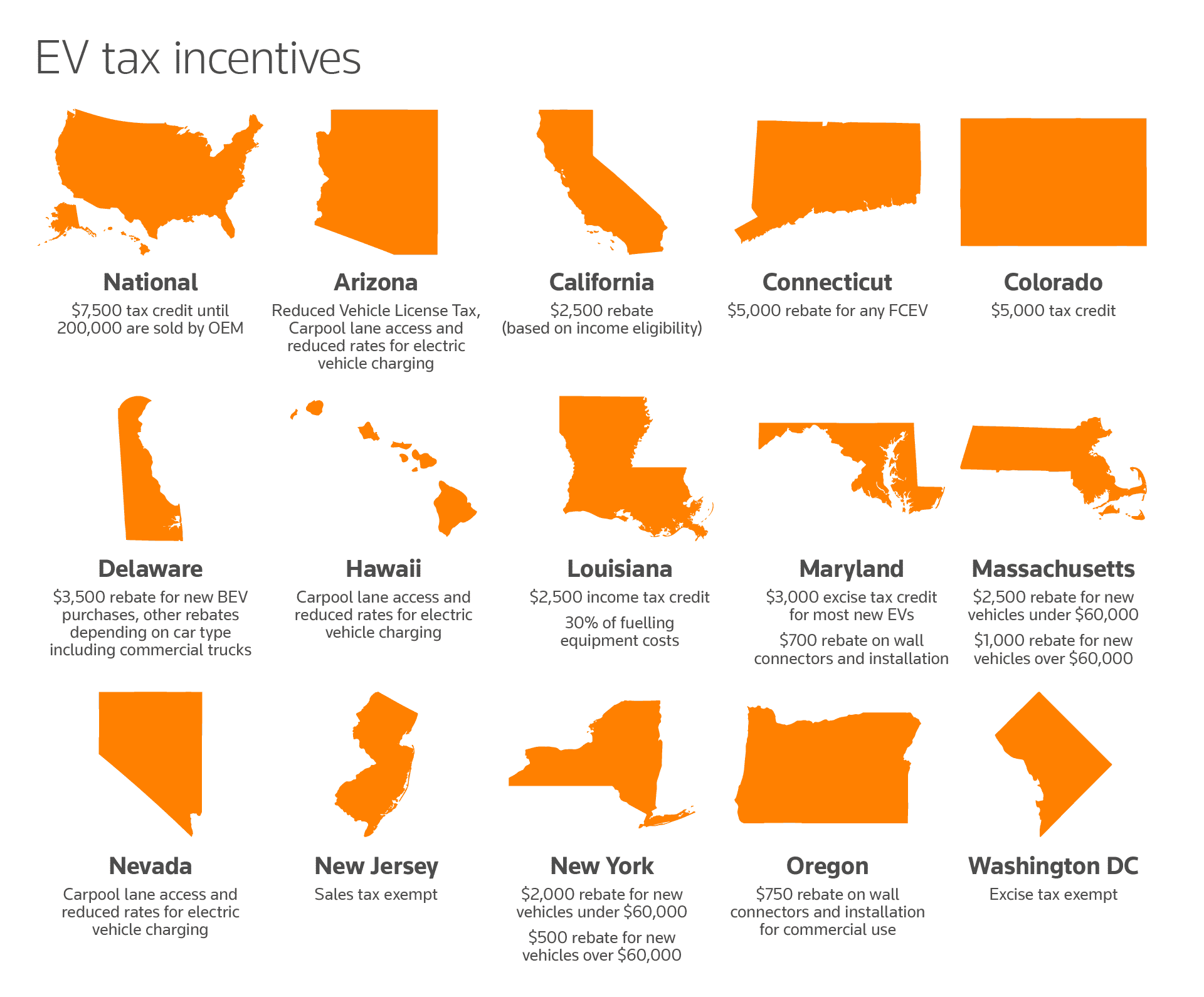

Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical Qualifying clean energy vehicle buyers are eligible for a tax credit of up to 7 500 Internal Revenue Service Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but

Download Federal Incentives For Ev Cars

More picture related to Federal Incentives For Ev Cars

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

MITI Is Proposing More EV Incentives For Budget 2023 Paultan

https://carsradars.com/wp-content/uploads/2022/09/MITI-is-proposing-more-EV-incentives-for-Budget-2023-paultan.org_.jpg

New Federal Incentives For Zero emission Commercial Vehicles Will Put A

https://cleanenergycanada.org/wp-content/uploads/2022/07/39242029375_509fb01213_c.jpg

Electric Vehicles Department of Energy Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the requirements below How to claim a tax credit for electric vehicles All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Justin The 2022 Inflation Reduction Act IRA drastically changed the incentives available for electric vehicles While there are many great new opportunities for electric vehicle EV incentives the details can be challenging to follow In this article we ll explain what you need to know about which EVs qualify for incentives now and in the coming

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

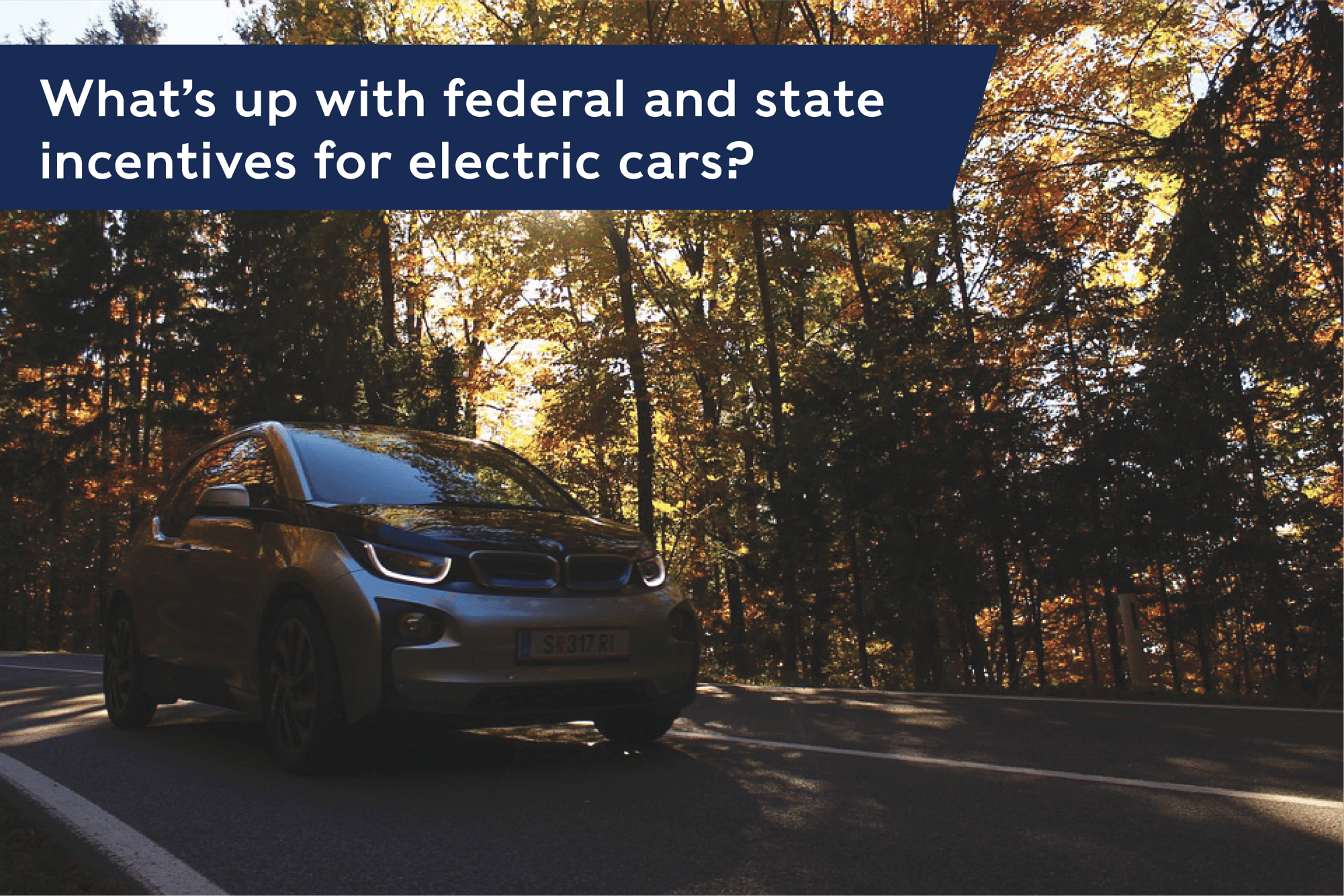

What s Up With Federal And State Incentives For Electric Cars

https://blog.greenenergyconsumers.org/hs-fs/hubfs/Blog header_ev-16.png?width=2001&name=Blog header_ev-16.png

https://electrek.co/2024/01/03/which-electric...

Federal tax credit for EVs will remain at 7 500 The timeline to qualify is extended a decade from January 2023 to December 2032 Tax credit cap for automakers after they hit 200 000 EVs sold is

https://www.caranddriver.com/news/g43675128/cars...

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit By Jack Fitzgerald Updated Mar 6 2024 Marc Urbano Car and

Incentives For Ev Cars Todrivein

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

EV Tax Credit 2022 Updates Shared Economy Tax

Electric Vehicle EV Incentives In Australia 2023

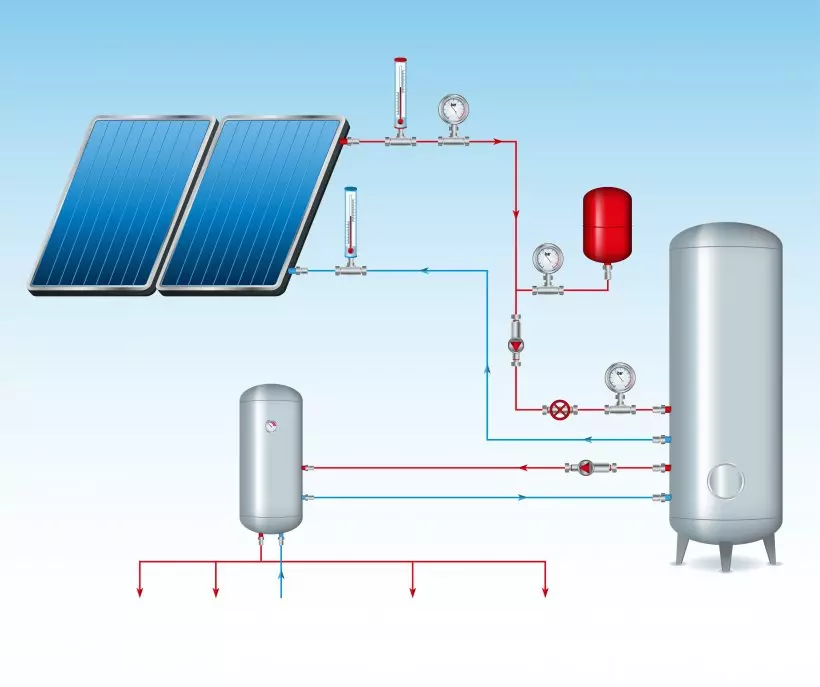

Federal Solar Tax Credit What It Is How To Claim It For 2023

Federal Solar Tax Credit What It Is How To Claim It For 2023

Benefits Of Switching To A Solar Water Heater Verde Energy

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Solar Tax Credits Rebates Missouri Arkansas

Federal Incentives For Ev Cars - The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit