Federal Income Tax Credit For First Time Home Buyers The Biden First Time Homebuyer Act of 2021 is a bill that would provide a refundable tax credit of up to 15 000 for first time home buyers The proposed law seeks to revive and update a 2008

The bill is designed to provide a tax credit for first time buyers worth up to 15 000 or 10 of a home s purchase price whichever is less The bill also known as the Biden first time Key takeaways A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to

Federal Income Tax Credit For First Time Home Buyers

Federal Income Tax Credit For First Time Home Buyers

https://i.pinimg.com/736x/ca/41/b2/ca41b295636905f68d116936facbe37c.jpg

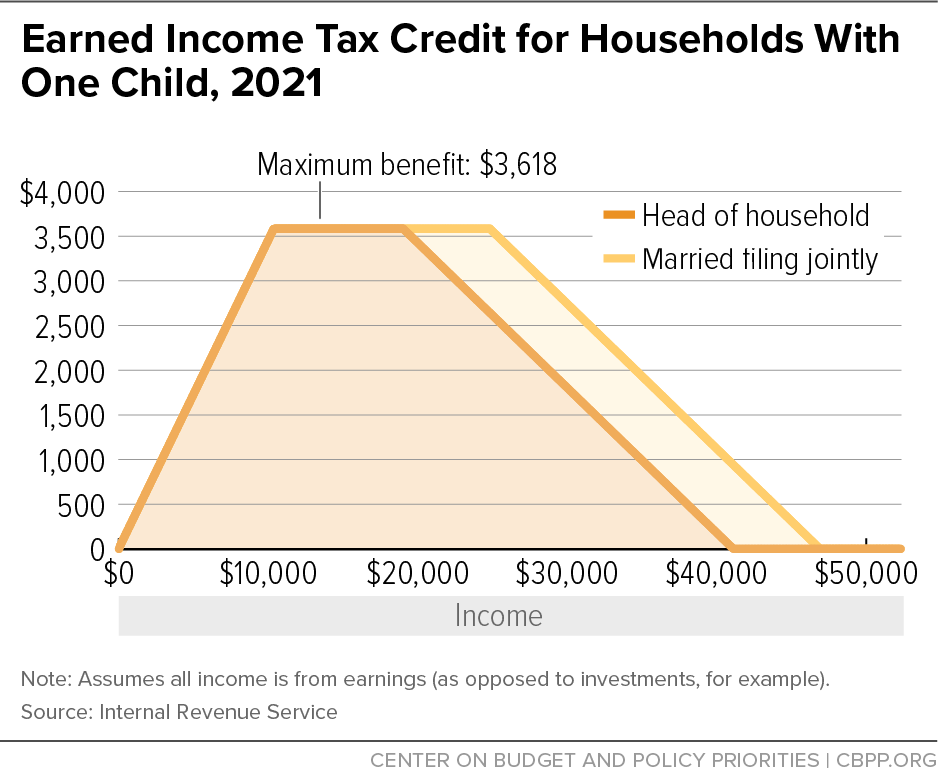

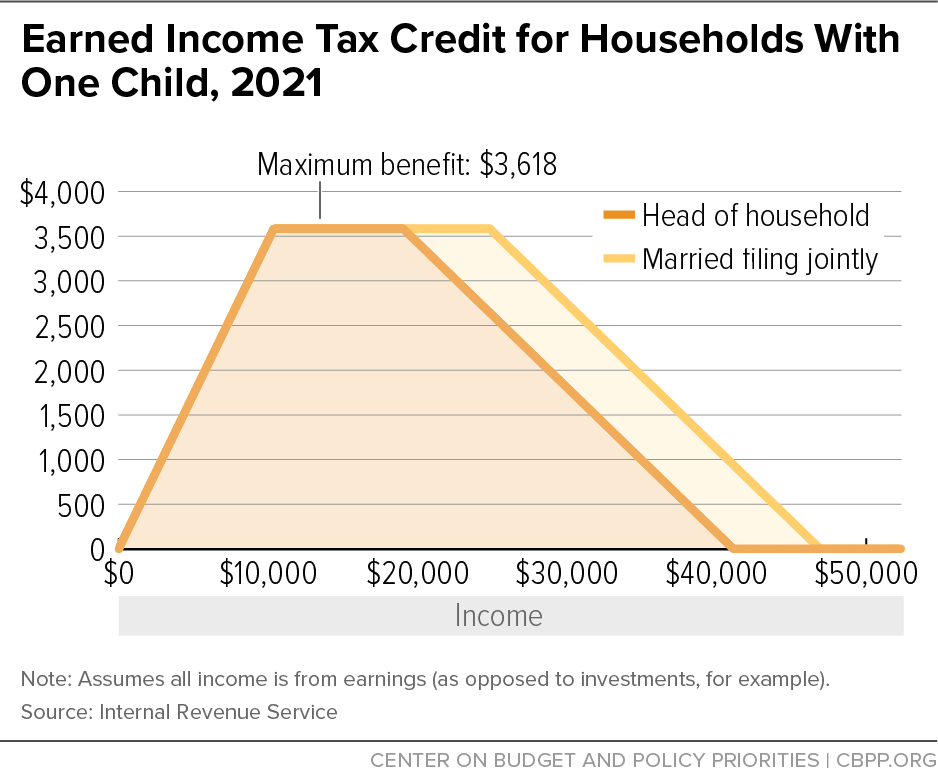

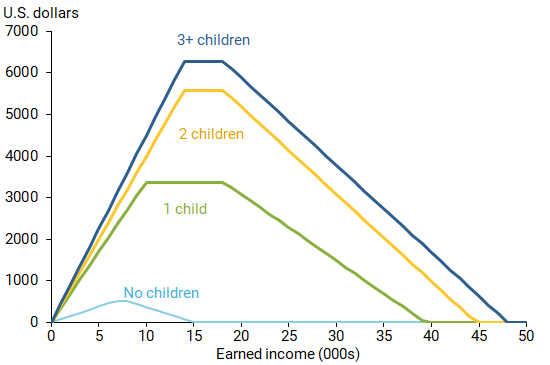

Earned Income Tax Credit For Households With One Child 2021 Center

https://www.cbpp.org/sites/default/files/2022-02/Jan 2022 EITC paper updates_f5.png

Tax Credit For First Time Home Buyers YouTube

https://i.ytimg.com/vi/iODCeR0Qy0M/maxresdefault.jpg

To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your deductions on Schedule A Form 1040 The MCC program allows buyers to claim a dollar for dollar tax credit for a portion of the mortgage interest paid per year up to 2 000 Eligible individuals must be first time

Despite recent attempts there is currently no first time home buyer tax credit available at the federal level However that doesn t mean there aren t options available in your state States also can issue mortgage credit The first time homebuyer tax credit was an Obama era tax credit that no longer exists Here s what it did and which tax benefits homeowners can still use

Download Federal Income Tax Credit For First Time Home Buyers

More picture related to Federal Income Tax Credit For First Time Home Buyers

IRS Changes For Tax Year 2022 Returns Next Step Enterprises

https://nextstepenterprises.com/wp-content/uploads/2023/01/taxes-wordmap-sp.jpg

Home Buyers Tax Credit Get 750 Refunded Mortgage Rates Ontario

https://altrua.ca/wp-content/uploads/2020/07/home-buyer-tax-credit-1.jpg

Home Buyers Amount On Your Canada Tax Return

https://torontoaccountant.ca/wp-content/uploads/2015/02/Its-Tax-Time-1596x798.png

Information to help you look up a first time homebuyer credit account Before accessing the tool please read through these questions and answers to determine the requirements for repaying the credit The primary tax credit available to first time homebuyers is the mortgage credit certificate MCC This federal tax credit allows you to deduct a portion of your mortgage interest each tax year MCCs are limited to low and moderate

The federal government under President Barack Obama encouraged consumers to buy their first homes by offering tax credits of 7 500 in 2008 and 8 000 in both 2009 and 2010 via the Housing and The First Time Homebuyer Tax Credit is a proposed federal tax credit for qualifying first time homebuyers It would provide a refundable tax credit of up to 15 000 or 10 of a property s

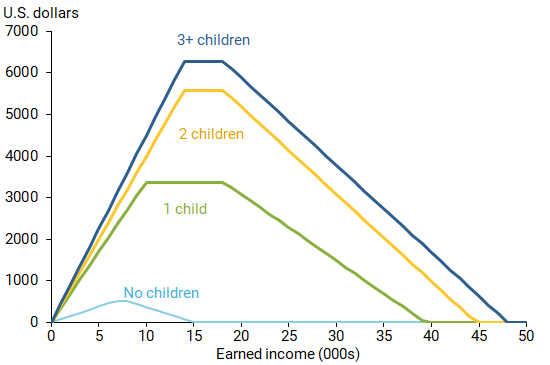

Long Run Effects Of The Earned Income Tax Credit San Francisco Fed

https://www.frbsf.org/wp-content/uploads/sites/4/el2020-01-1.png

Irs Tax Brackets 2023 Chart Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1.png

https://themortgagereports.com/106765

The Biden First Time Homebuyer Act of 2021 is a bill that would provide a refundable tax credit of up to 15 000 for first time home buyers The proposed law seeks to revive and update a 2008

https://www.cnn.com/cnn-underscored/…

The bill is designed to provide a tax credit for first time buyers worth up to 15 000 or 10 of a home s purchase price whichever is less The bill also known as the Biden first time

What Is Maryland Earned Income Credit Margurite Munn

Long Run Effects Of The Earned Income Tax Credit San Francisco Fed

2022 Tax Brackets

7 Essential Insurance Tips For First Time Home Buyers Eagle Insurance

A Home Is under Contract When A Seller Has Accepted An Offer From A

No Down Payment Bad Credit Declined By The Bank Call Today 818 462

No Down Payment Bad Credit Declined By The Bank Call Today 818 462

Are They Sending Out Child Tax Credit Checks In 2023 Leia Aqui Will

Taxpayers Mad About High Property Appraisals But Officials Argue Tax

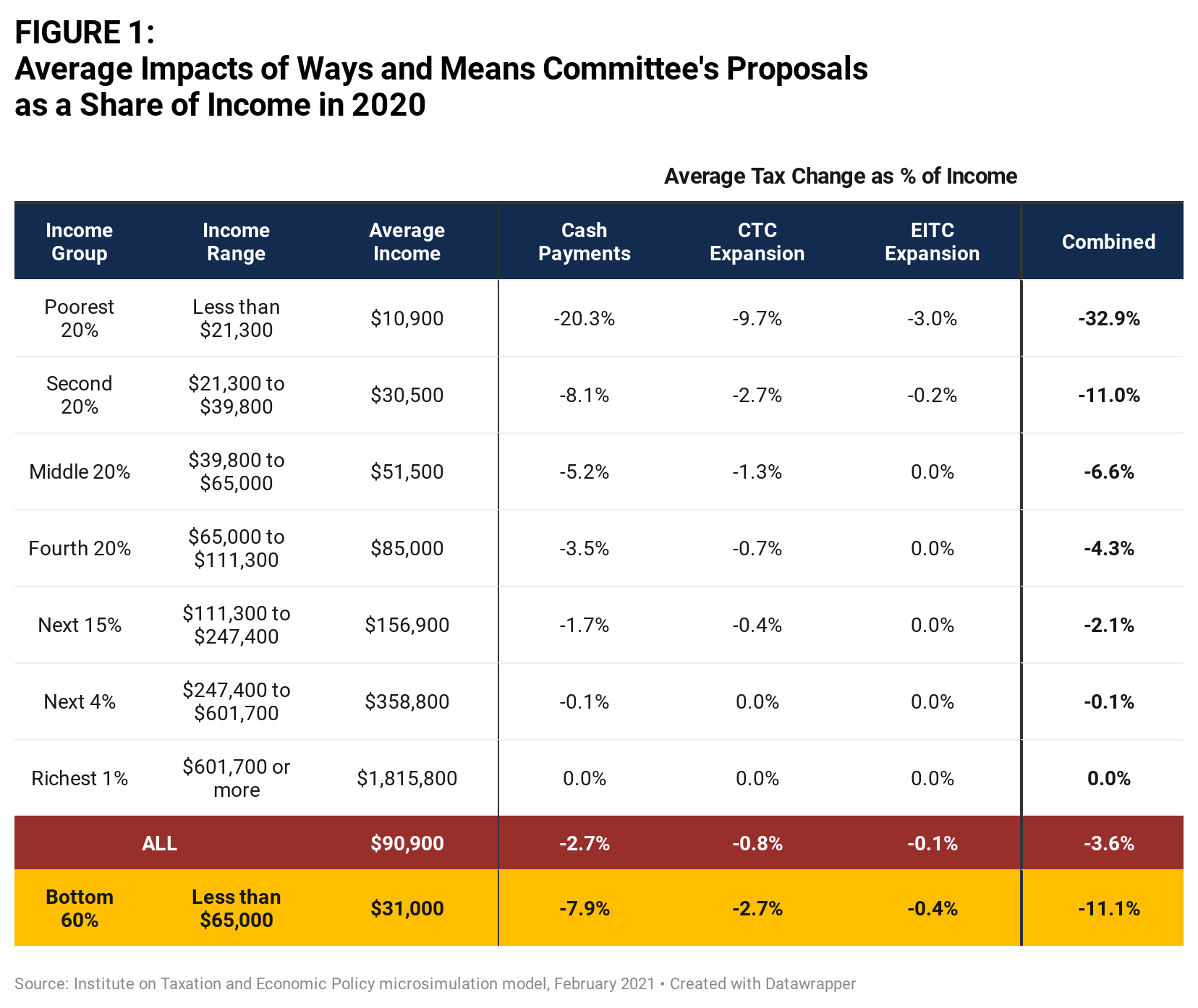

EITC The Earned Income Tax Credit And Also Called EIC Is A Tax Credit

Federal Income Tax Credit For First Time Home Buyers - To encourage Americans to buy their first homes the government offers credits and tax breaks Here s the lowdown on who can qualify for each benefit