Federal Income Tax Filing Requirements 2021 Top Learn the basic steps to file your federal taxes and how to contact the IRS for help Find out what documents you will need and how to pay if you owe money

The maximum Earned Income Tax Credit EITC in 2021 for single and joint filers is 1502 if the filer has no qualifying children Table 5 The maximum credit is Gross income requirements for each filing status are Single filing status 12 950 if under age 65 14 700 if age 65 or older Married filing jointly 25 900 if both

Federal Income Tax Filing Requirements 2021

Federal Income Tax Filing Requirements 2021

https://www.taxestalk.net/wp-content/uploads/a-reader-asks-im-dying-to-vote-in-the-u-s-prez-election-but-will.jpeg

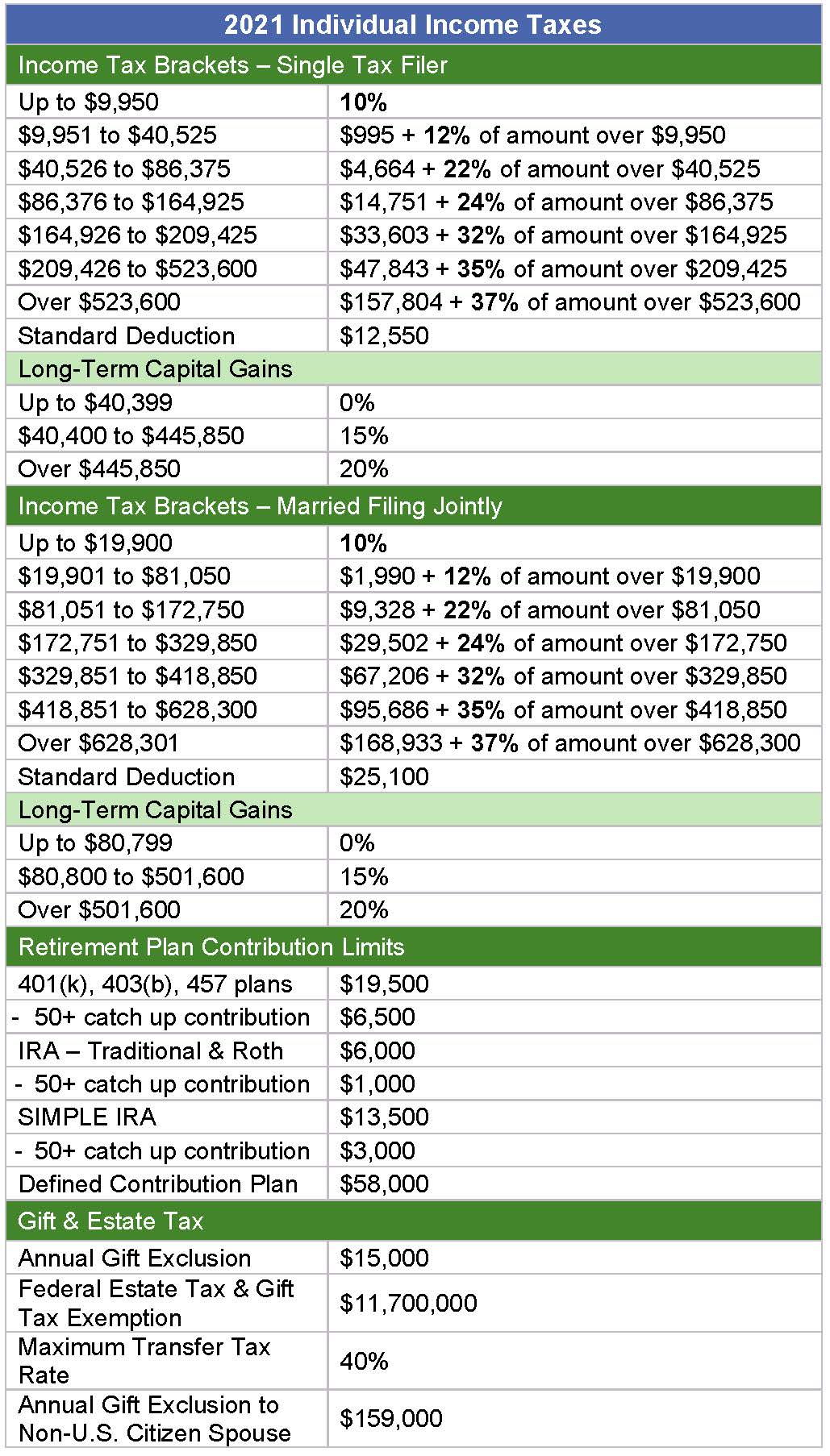

IRS Tax Charts 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-tax-chart-cmh-3.jpg

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

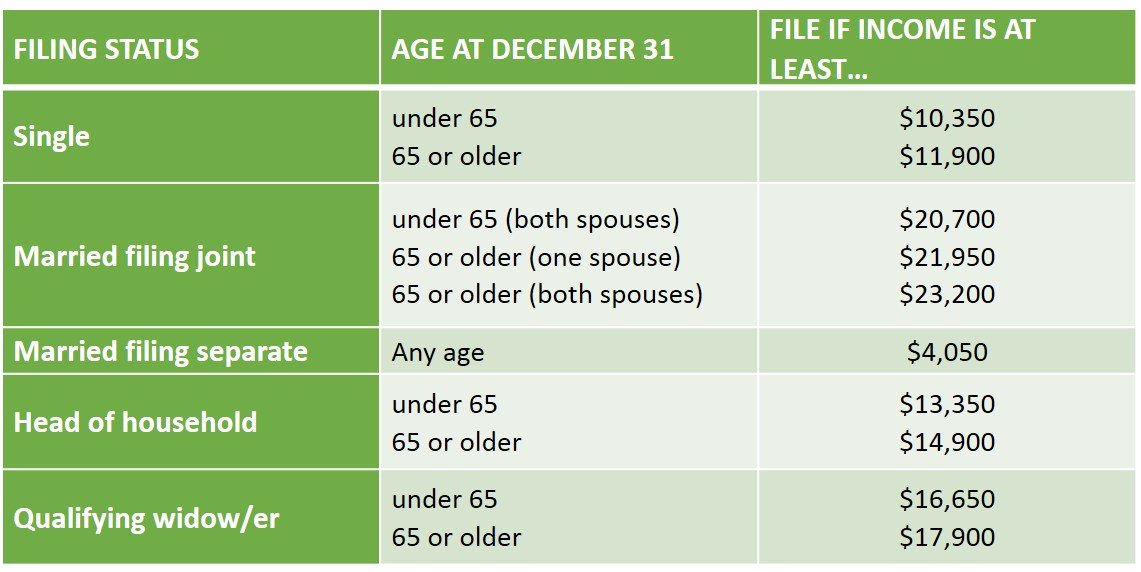

Taxes File Your Own Taxes Minimum Income Requirements for 2022 Tax Returns Your income determines whether you must file a tax return By Beverly Bird OVERVIEW Not everyone is required to file an income tax return each year Generally if your total income for the year doesn t exceed certain thresholds then you

Single Dependents 65 or older AND blind 17 550 earned or 4 950 unearned Married Dependents Under 65 and not blind 13 850 earned or 1 250 unearned OR Your gross income was at least 5 and your The determination of whether you are required to file a federal individual income tax return is based on your federal tax filing status your gross income whether you are

Download Federal Income Tax Filing Requirements 2021

More picture related to Federal Income Tax Filing Requirements 2021

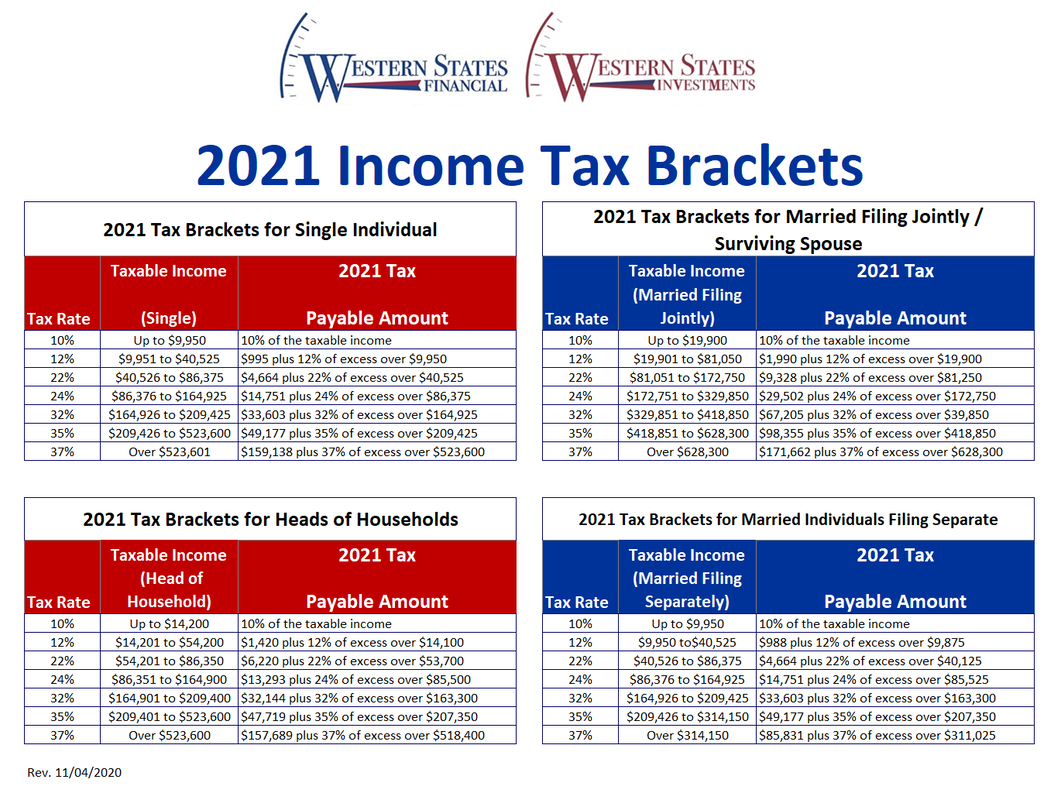

2021 Federal Tax Brackets Tax Rates Retirement Plans Western

https://www.westernstatesfinancial.com/uploads/1/8/7/0/18703714/2021-fed-tax-brackets-pic_orig.png

2022 Tax Tables Married Filing Jointly Printable Form Templates And

https://images.axios.com/Ker5wAavgxDK0S7kOs1MY-vJkQM=/0x0:1280x720/1920x1080/2022/10/19/1666195709283.png

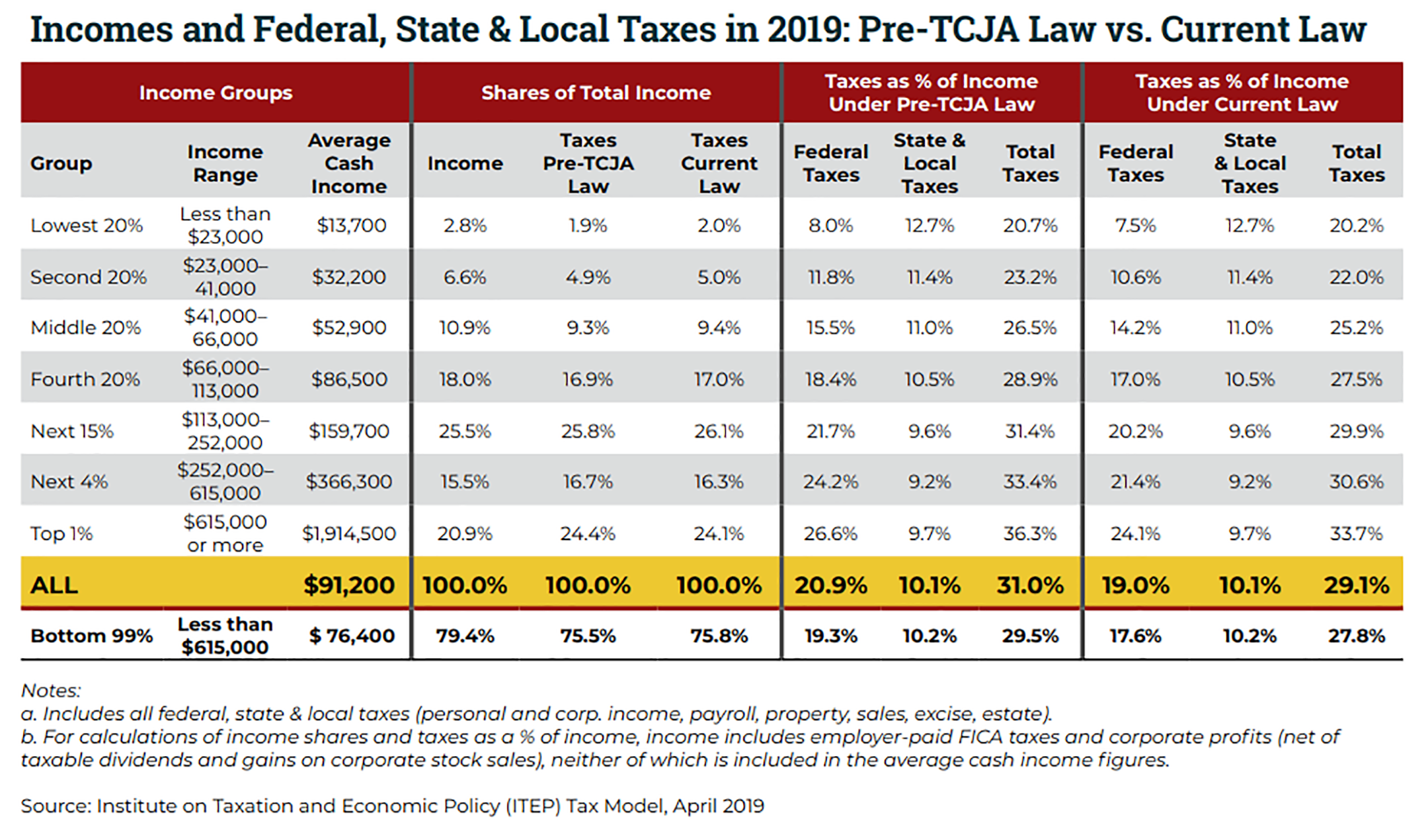

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

https://westernnews.media.clients.ellingtoncms.com/img/photos/2020/02/29/2019_Tax_Table_courtesy_Institute_on_Taxation_and_Economic_Policy_ITEP.png

A minor who may be claimed as a dependent has to file a return once their income exceeds their standard deduction For tax year 2023 this is the greater of 1 250 Finally these proposed regulations would amend 301 6033 4 d 2 to include Form 990 EZ Short Form Return of Organization Exempt From Income Tax

The filing requirements outlined above apply to federal income tax returns but if you live in a state with its own income tax you may also need to file According to IRS Publication 501 here s how much you have to have made in 2023 to be required to file taxes in 2024 and the general rules for whether you have

New 2021 IRS Income Tax Brackets And Phaseouts The Estate Legacy And

https://specials-images.forbesimg.com/imageserve/5f9efb6cca80f05baa42a4a2/960x0.jpg?fit=scale

Irs Tax Table 2022 Married Filing Jointly Latest News Update

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

https://www.usa.gov/file-taxes

Top Learn the basic steps to file your federal taxes and how to contact the IRS for help Find out what documents you will need and how to pay if you owe money

https://taxfoundation.org/data/all/federal/2021-tax-brackets

The maximum Earned Income Tax Credit EITC in 2021 for single and joint filers is 1502 if the filer has no qualifying children Table 5 The maximum credit is

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Printable Tax Declaration Form Printable Form Templates And Letter

New 2021 IRS Income Tax Brackets And Phaseouts The Estate Legacy And

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

Income Tax Return Filing Requirements Explained How To Know When To

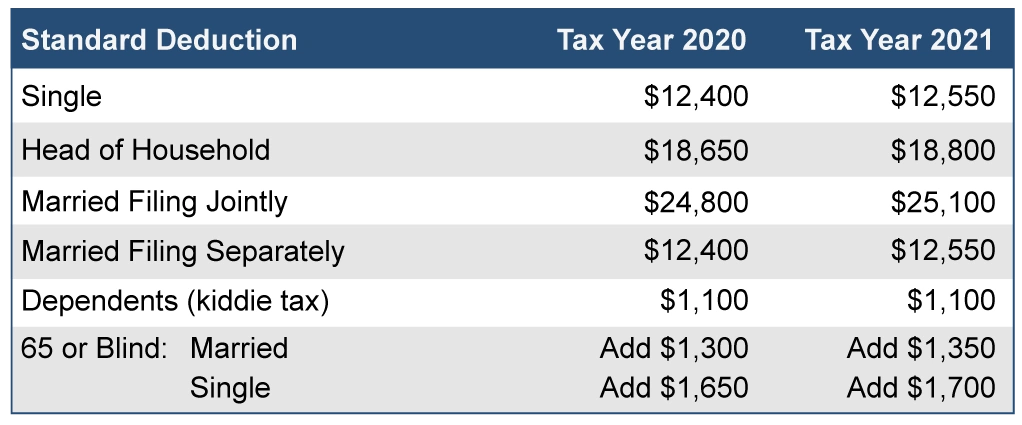

What Is The Standard Deduction For 2021

California Federal Income Tax Rate 2021 Yabtio

California Federal Income Tax Rate 2021 Yabtio

Federal Tax Filing Us Federal Tax Filing Status

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

/https://blogs-images.forbes.com/mikepatton/files/2015/03/Table-of-Federal-Tax-Filing-Requirement-Thresholds.jpg)

Five Years Later Obamacare Penalties Begin

Federal Income Tax Filing Requirements 2021 - The determination of whether you are required to file a federal individual income tax return is based on your federal tax filing status your gross income whether you are