Federal Rebate For Hvac Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web The law includes 391 billion to support clean energy and address climate change including 8 8 billion in rebates for home energy efficiency and electrification projects These

Federal Rebate For Hvac

Federal Rebate For Hvac

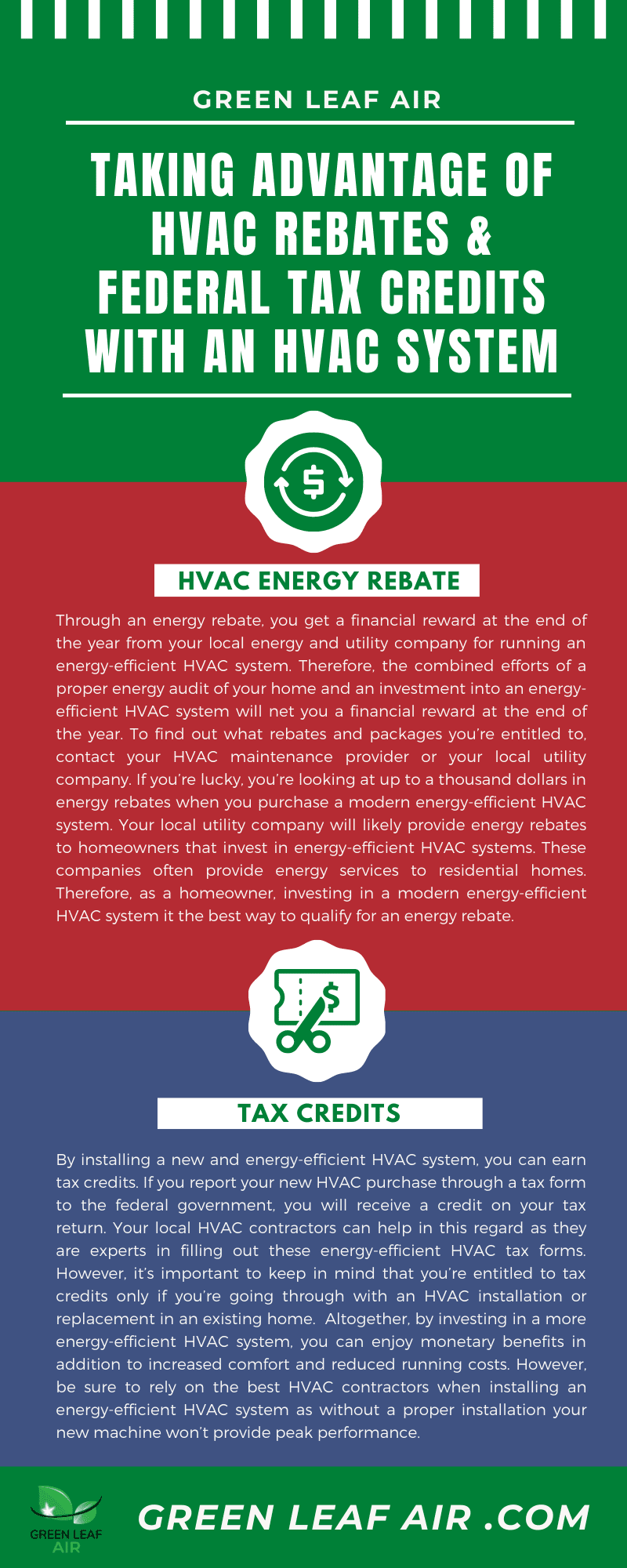

https://149354076.v2.pressablecdn.com/wp-content/uploads/2020/10/Taking-Advantage-of-HVAC-Rebates-and-Federal-Tax-Credits-with-An-HVAC-System.png

How To Find Federal Tax Credits Rebates For HVAC Upgrades

https://www.blueheatingandcooling.com/wp-content/uploads/2016/10/BHC-taxcredits.jpg

Federal Tax Rebate Program Benson s Heating Air

https://www.bensonshvac.com/wp-content/uploads/Federal-Tax-Credits-for-Air-Conditioners-and-Heat-Pumps.png

Web 30 d 233 c 2022 nbsp 0183 32 30 of project cost 600 maximum amount credited What products are eligible For split systems ENERGY STAR certified equipment with SEER2 gt 16 is Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of

Web 11 mars 2021 nbsp 0183 32 The US government has extended the energy efficiency tax credit through 2021 Now by purchasing a qualifying HVAC system you can save on your monthly energy bills and qualify for up to 300 tax Web 27 avr 2021 nbsp 0183 32 The applicable percentages are In the case of property placed in service after December 31 2016 and before January 1 2020 30 In the case of property

Download Federal Rebate For Hvac

More picture related to Federal Rebate For Hvac

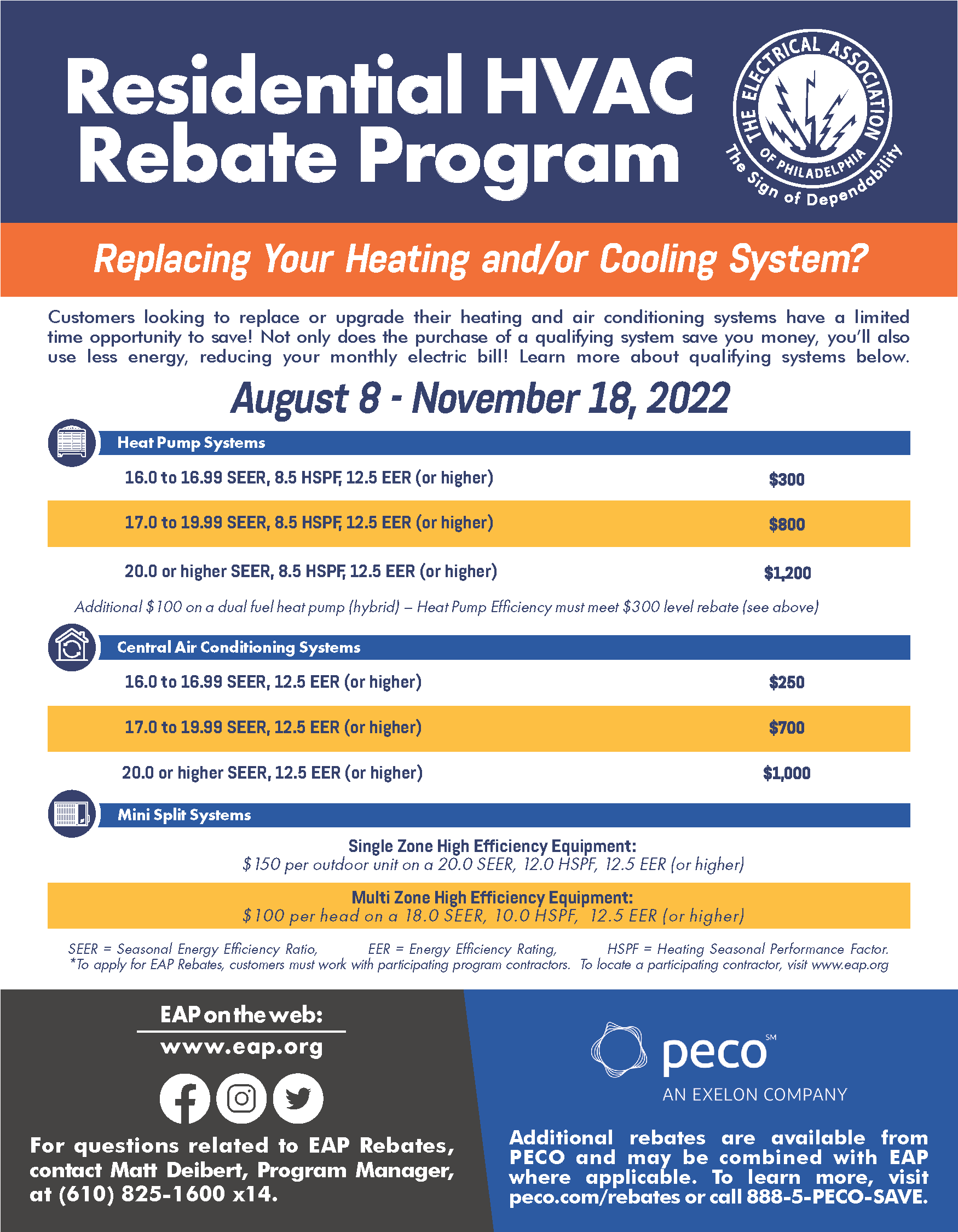

HVAC Rebates

https://eap.org/images/Consumers/Fall 2022 Rebate Flyer back for web.png

HVAC Maintenance Rebate Application

https://www.westlandhvac.com/assets/images/Screen Shot 2019-03-28 13_28_02-FEOH_HVACMaintenanceRebate_2018_web-FINAL.pdf.png

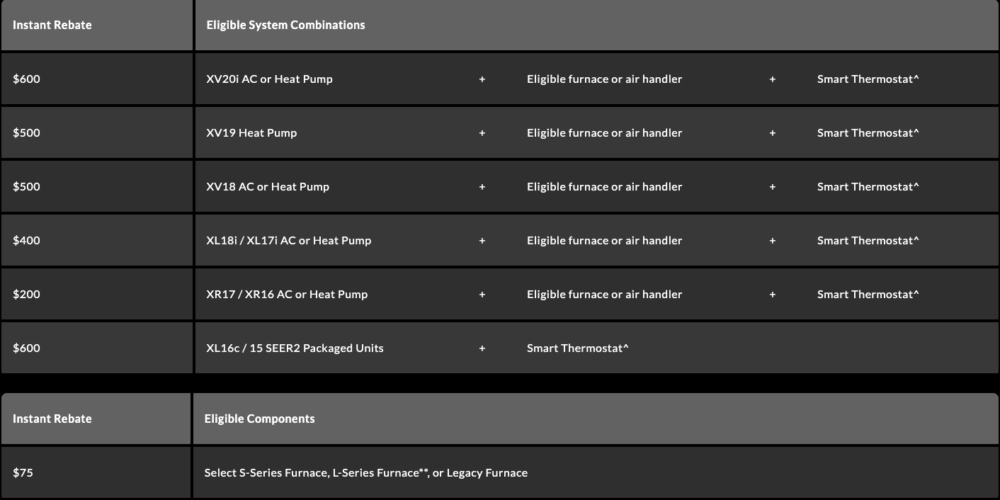

Why Carrier Cool Cash Is The Best 2023 HVAC Rebate Apollo

https://apolloheatingandair.com/wp-content/uploads/2023/02/Carrier-–-Turn-to-the-Experts-of-HVAC-Systems-.jpg

Web 26 juil 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

Web 19 f 233 vr 2020 nbsp 0183 32 And you ll either get 10 percent of the cost up to 500 or the set prices above Now most of the HVAC equipment caps out at 300 for the credits In all you can apply for up to 500 in your lifetime Finally Web 16 janv 2023 nbsp 0183 32 The Federal Energy Tax Credit is a specified amount that the homeowner can subtract from the taxes owed to the IRS to help offset the cost of HVAC

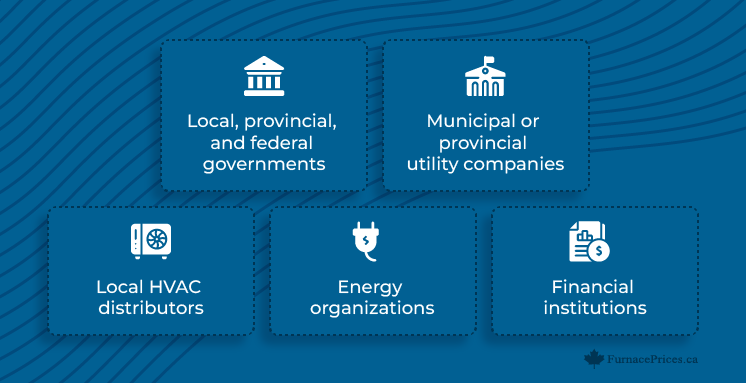

2023 Government Rebates For HVAC FurnacePrices ca

https://www.furnaceprices.ca/wp-content/uploads/2022/09/FP_16-1.png

HVAC Specials And Rebate Offers Pacific Heat And Air Inc

https://pacificheatandair.com/wp-content/uploads/2023/04/TraneSpring2023promo-1000x500.png

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

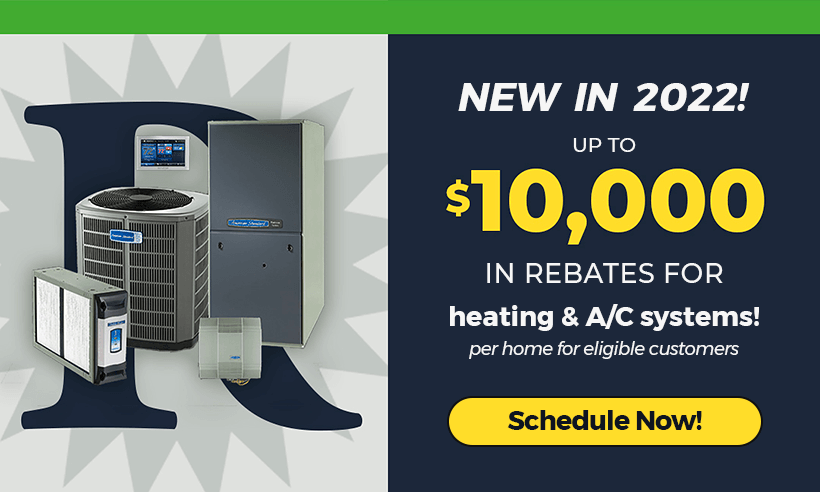

2022 HVAC Rebates Rodenhiser Plumbing Heating AC And Electric

2023 Government Rebates For HVAC FurnacePrices ca

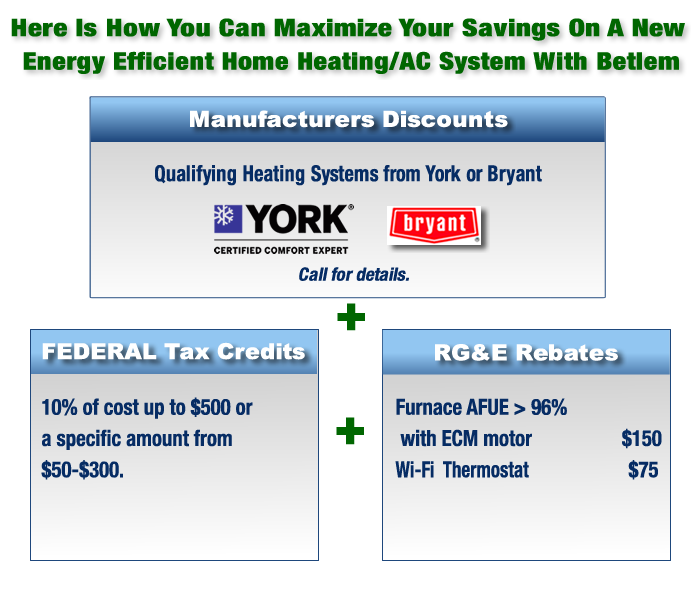

Rebates Tax Credits On Energy Efficient HVAC Equipment BETLEM

Federal Rebate For Heat Pump 2023 PumpRebate

.jpg)

Residential HVAC Rebates

Aps Rebate For New Air Conditioner Hvac Rebates Financing Options

Aps Rebate For New Air Conditioner Hvac Rebates Financing Options

FL HVAC Efficiency Card Form Fill And Sign Printable Template Online

Top Mass Save Rebate Form Templates Free To Download In PDF Format

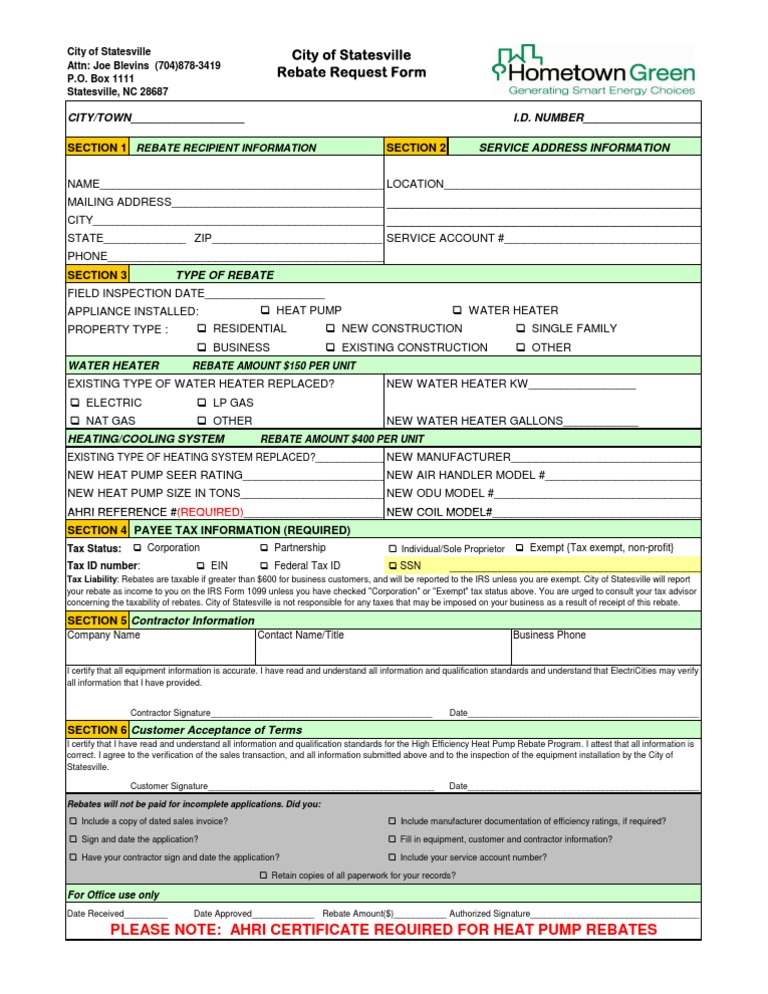

Rebate Form CityofStatesville Revised 8 28 09 Rebate Marketing

Federal Rebate For Hvac - Web 30 d 233 c 2022 nbsp 0183 32 30 of project cost 600 maximum amount credited What products are eligible For split systems ENERGY STAR certified equipment with SEER2 gt 16 is