Federal Rebate For Hybrid Cars Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount Web Credits for New Electric Vehicles Purchased in 2022 or Before If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean

Federal Rebate For Hybrid Cars

Federal Rebate For Hybrid Cars

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-7.jpg?resize=840%2C473&ssl=1

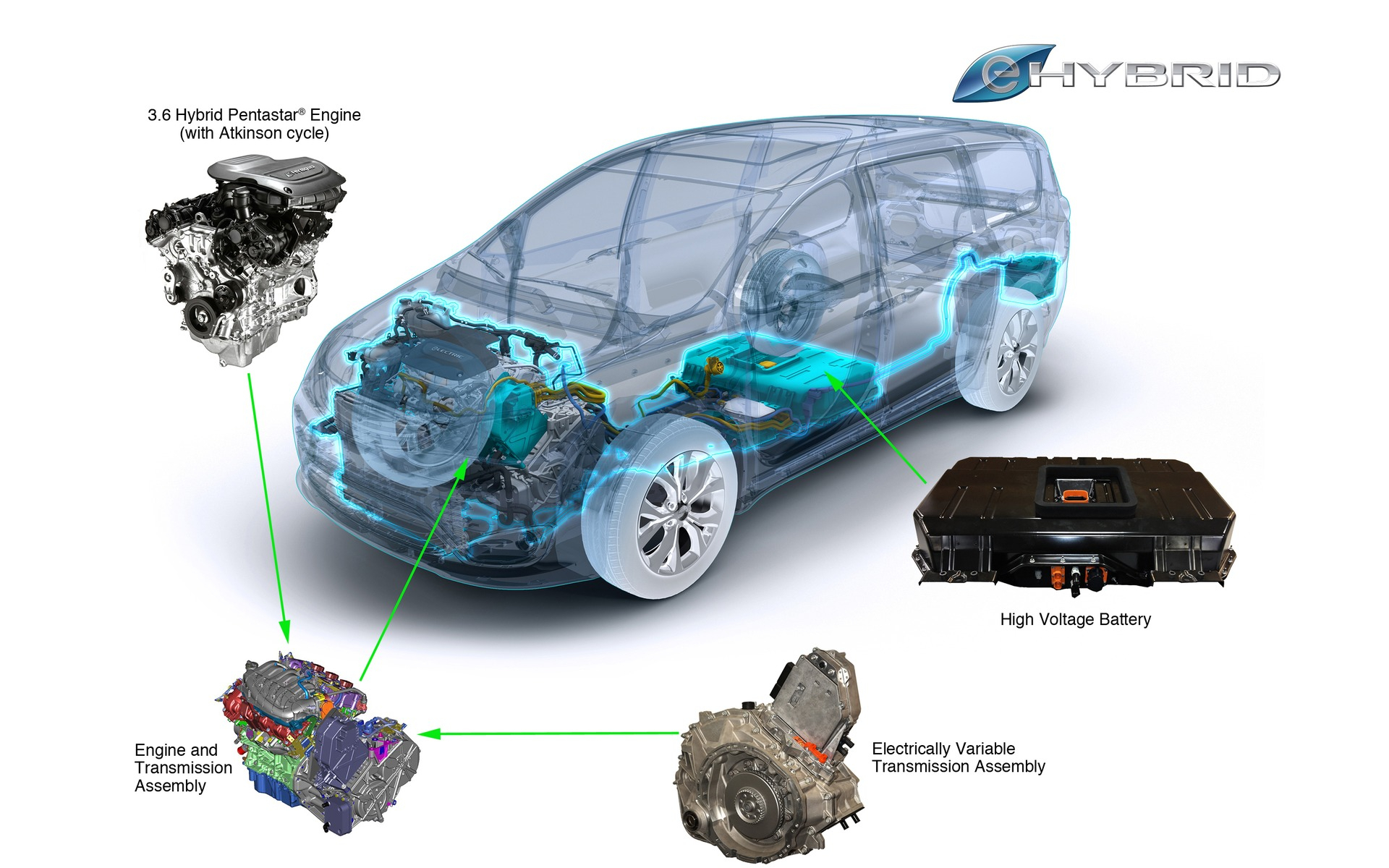

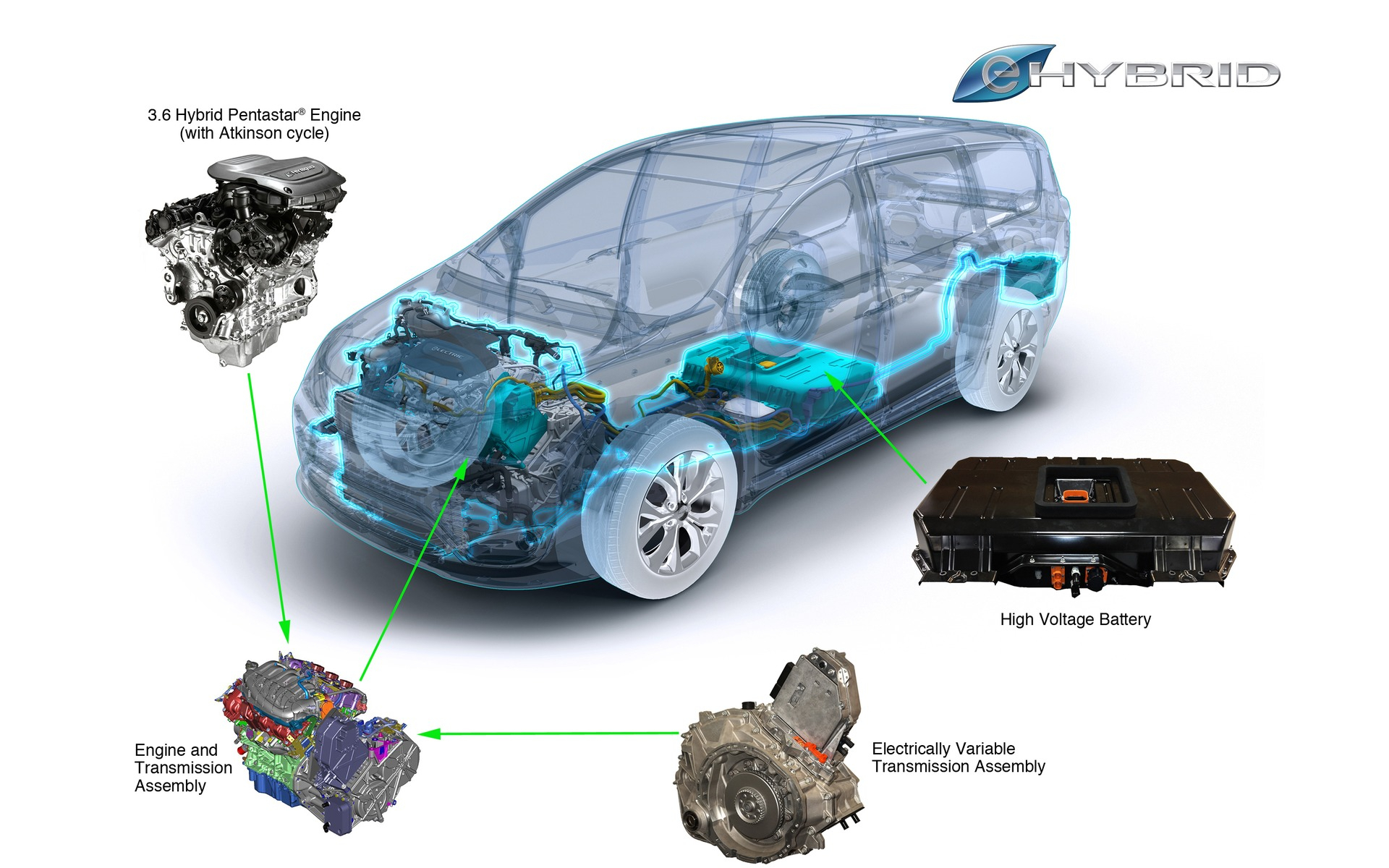

Cars That Meet Federal Rebate On Electric Cars 2022 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-2.jpg

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

https://www.californiarebates.net/wp-content/uploads/2023/04/federal-plug-in-hybrid-rebate-used-cars-2022-carrebate-6.jpg

Web 18 ao 251 t 2022 nbsp 0183 32 Only EVs and plug in hybrids built at plants in the U S Mexico or Canada now qualify for the federal tax credit incentive Domestics Still Eligible in 2022 General Motors and Tesla both lost Web 25 janv 2022 nbsp 0183 32 A one time federal tax credit was established in 2010 to help get plug in vehicles onto showroom floors and into consumers garages Buyers of new EVs get to

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a

Download Federal Rebate For Hybrid Cars

More picture related to Federal Rebate For Hybrid Cars

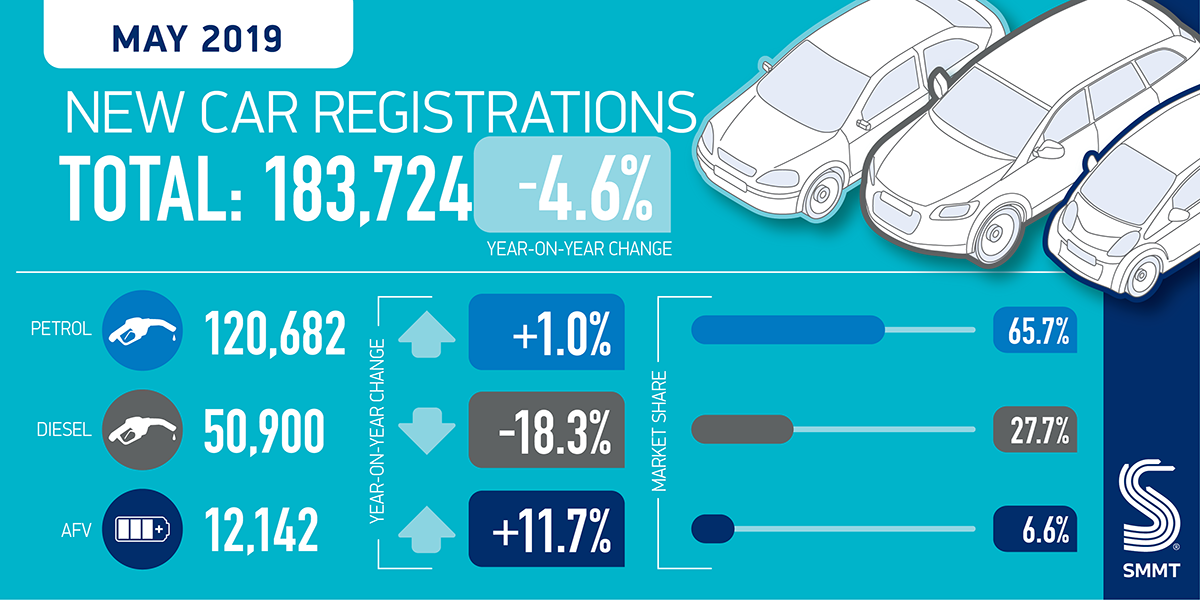

Government Rebate For Buying A Hybrid Car 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/hybrid-and-diesel-car-sales-fall-in-may-amid-government-policy.png

Federal Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/where-federal-rebates-for-toyota-and-lexus-hybrids-stand-as-of-oct-1.jpg

Virginia Rebates Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/nj-electric-car-rebate-reddit-virginia-made-progress-on-clean-3.jpg

Web All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Web 17 oct 2022 nbsp 0183 32 Some Hybrids Are Eligible for the Revised 7 500 EV Tax Credit The 7 500 tax credit is an attractive incentive but is your hybrid vehicle you re eyeing even

Web A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive a tax credit Web 16 ao 251 t 2022 nbsp 0183 32 Prius Prime Plug In Hybrid 2017 2022 4 502 2 251 Prius Plug in Electric Drive Vehicle 2012 2015 2 500 1 250 RAV4 EV 2012 2014 7 500 3 750

Federal Rebates For Hybrid Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebates-for-electric-cars-kick-in-but-tesla-model-3-doesn-t.jpg

Federal Tax Rebate For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-rebate-on-hybrid-cars-2023-carrebate.png

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used

https://fueleconomy.gov/feg/tax2022.shtml

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Federal Rebate Set To Make Electric Cars More Affordable See 100M Go

Federal Rebates For Hybrid Cars 2023 Carrebate

Rebate On Electric Cars Canada 2022 Carrebate

Rebate For Hybrid Car 2023 Carrebate

Is There A Federal Rebate For Buying An Electric Car 2023 Carrebate

What Car Rebates Are Available For Hybrids 2023 Carrebate

What Car Rebates Are Available For Hybrids 2023 Carrebate

Colorado Rebate For Hybrid Cars 2023 Carrebate

Rebates For Hybrid Cars In California 2023 Carrebate

California Rebates For Hybrid Cars 2023 Carrebate

Federal Rebate For Hybrid Cars - Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a