Federal Rebate For Solar 2024 The Residential Clean Energy Credit is a dollar for dollar income tax credit equal to 30 of solar installation costs An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 2024 Solar tax credit But these solar incentives should be available in some form to homeowners who place Key Takeaways The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such

Federal Rebate For Solar 2024

Federal Rebate For Solar 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

How To Claim Solar Rebate Residential Solar Panels Solar System

https://regenpower.com/wp-content/uploads/2021/09/solar-rebate.jpg

Electric Vehicle With Most Federal Rebate ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/2019-federal-budget-includes-rebate-for-electric-vehicles-wheels-ca.jpg

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit The installation of the system must be complete during the tax year Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible

President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system The credit lowers your federal taxes So if you spend 24 000 on a system you can subtract 30 percent of that or 7 200 from the federal taxes you owe You must take the credit for the year

Download Federal Rebate For Solar 2024

More picture related to Federal Rebate For Solar 2024

Solar Panel Rebate How It Works And How To Get It

https://www.solarquotes.com.au/wp-content/uploads/2020/07/solar-rebate-1.jpg

2021 Energy Federal Tax Credit And Rebate Programs Epic Energy

https://www.thinkepic.com/wp-content/uploads/2021/06/AdobeStock_165208034-scaled.jpeg

Is There A Federal Rebate For Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-6.jpg

The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which According to our 2023 survey of homeowners with solar respondents paid an average of 15 000 to 20 000 for their solar panel systems When you factor in the 30 federal solar tax credit the

Resolution 2 Save the Planet Clean energy improvements reduce your carbon footprint Far too often a community s resilience is tested by severe weather and extreme natural disasters exacerbated due to the climate crisis Communities across the U S experience severe droughts wildfires and floods displacing folks from their homes Previously the Investment Tax Credit ITC offered a 26 tax credit for systems installed from 2020 through 2022 However starting from the tax year 2022 and extending through 2032 the ITC will provide a more generous 30 tax credit for newly installed systems Therefore potential solar panel owners should consider this 26 to 30 discount

Am I Eligible For A Solar Rebate Sunstainable

https://sunstainable.com.au/wp-content/uploads/2022/08/solar-rebate-Melbourne.jpg

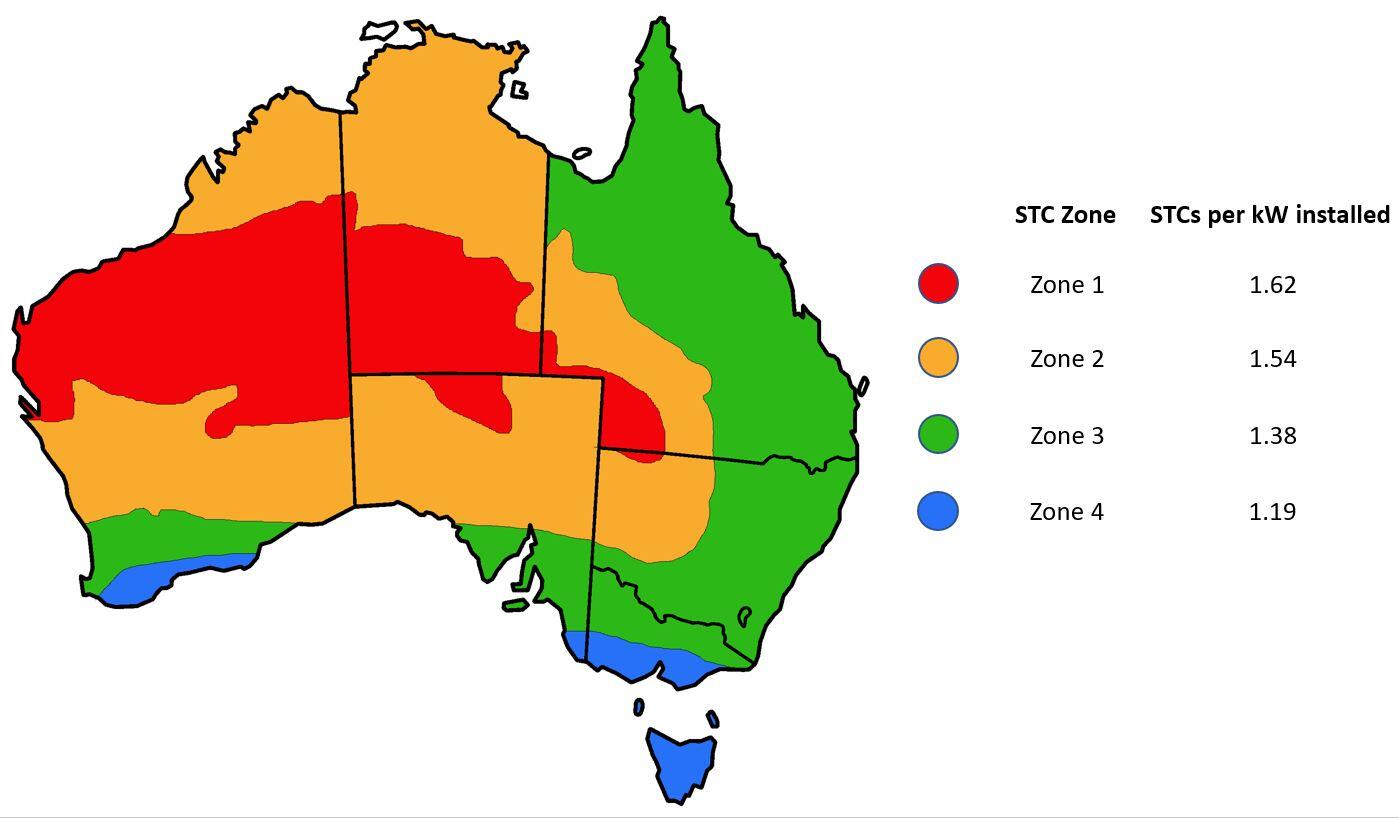

Federal Government Solar Rebate Solar Rebate Australia

https://www.pioneersolar.com.au/wp-content/uploads/2020/09/Untitled-design-2-e1600757607431.png

https://www.solarreviews.com/blog/federal-solar-tax-credit

The Residential Clean Energy Credit is a dollar for dollar income tax credit equal to 30 of solar installation costs An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 2024 Solar tax credit But these solar incentives should be available in some form to homeowners who place

Solar Tax Credits Rebates Missouri Arkansas

Am I Eligible For A Solar Rebate Sunstainable

Government Rebate Solar Panels Compare Solar Quotes

Government Solar Rebate Solar Power Incentives Solar Choice

Mass Save PrintableRebateForm

You Cannot Afford To Overlook Solar Rebate Victoria For Solar Panel Installation

You Cannot Afford To Overlook Solar Rebate Victoria For Solar Panel Installation

How To Claim Solar Rebate In WA Energy Theory

How To Apply For A Rebate On Your Solar Panels REenergizeCO

SolFarm Solar Co Solar News Blog Local National International

Federal Rebate For Solar 2024 - The solar tax credit provides dollar for dollar amounts that you can subtract from your federal tax liability Depending on the installation year you can claim a federal tax credit on your expenses at up to a 30 rate You can use state and local incentives in tandem with the solar tax credit but doing so can affect your total savings