Federal Solar Rebate 2024 The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Federal Solar Rebate 2024

Federal Solar Rebate 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

The Federal Rebate For Solar Will Keep Your Installation Affordable New York Power Solutions

https://newyorkpowersolutions.com/wp-content/uploads/2022/12/Federal-Rebate-for-Solar.jpg

Understand Solar Rebate SINVESTA Group

https://www.sinvesta.com.au/wp-content/uploads/2020/04/array-1-2-1024x606.jpg

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

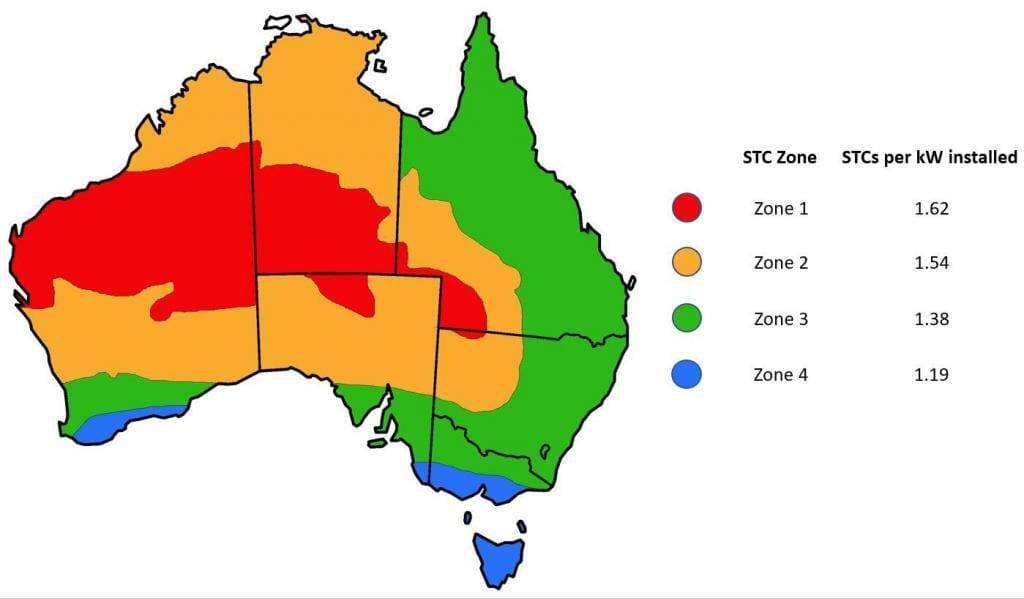

The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year 1 The production tax credit PTC is a per kilowatt hour kWh tax credit for electricity generated by solar and other qualifying technologies for the first 10 The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar

Download Federal Solar Rebate 2024

More picture related to Federal Solar Rebate 2024

New Federal Solar Rebate Available In Saskatchewan SkyFire Solar Blog

https://skyfireenergy.com/wp-content/uploads/Crescent-Point-Office-2-1024x658.jpg

Solar Panel Rebate How It Works And How To Get It

https://www.solarquotes.com.au/wp-content/uploads/2020/07/solar-rebate-1.jpg

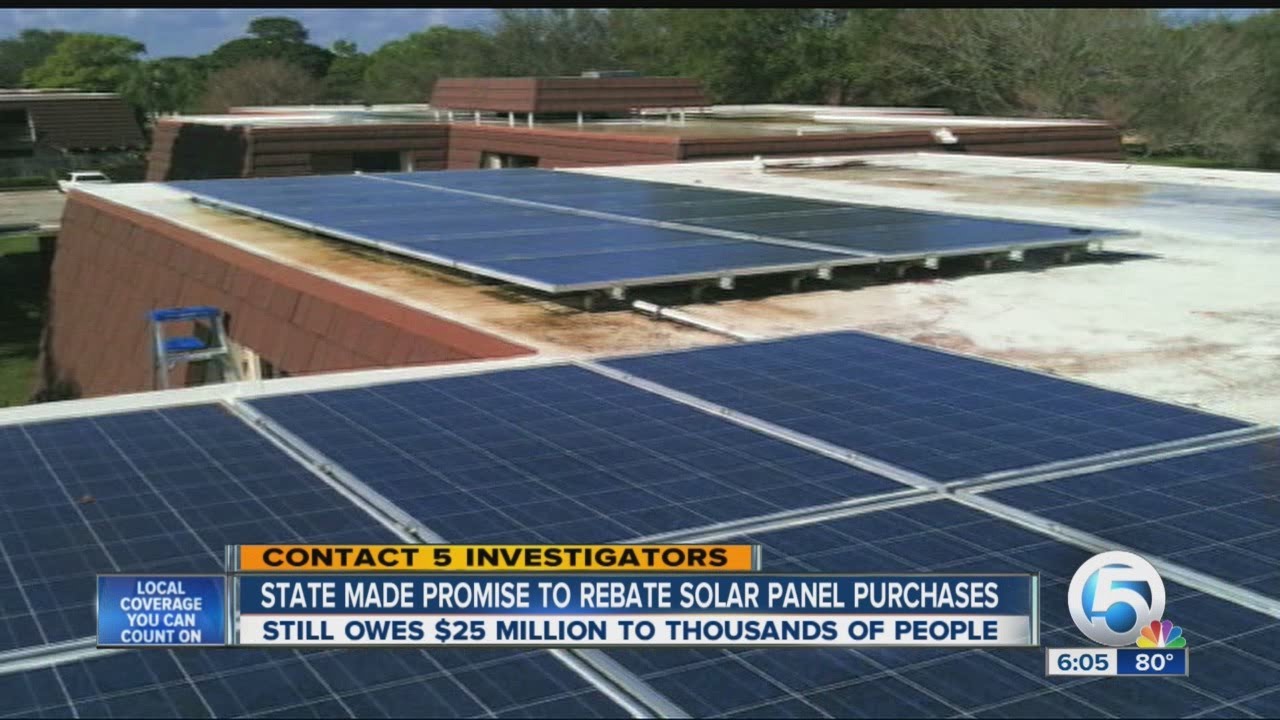

Federal Incentives Solar Rebates For Solar Power Solar Choice

https://www.solarchoice.net.au/wp-content/uploads/STC-Zones-in-Australia-as-of-1st-January-2019-1024x599.jpg

According to our 2023 survey of homeowners with solar respondents paid an average of 15 000 to 20 000 for their solar panel systems When you factor in the 30 federal solar tax credit the The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates Installing renewable energy equipment on your home can qualify you for Residential Clean Energy credit of up to 30 of your total qualifying cost depending on the year the equipment is installed and placed in service 30 for equipment placed in service in tax years 2017 through 2019 26 for equipment placed in service in tax years 2020

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

Be Wary Of Solar Rebate Eligibility Quizzes Solar Quotes Blog

https://www.solarquotes.com.au/blog/wp-content/uploads/2021/06/solar-rebate-eligibility.jpg

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Am I Eligible For A Solar Rebate Sunstainable

2021 Energy Federal Tax Credit And Rebate Programs Epic Energy

SolFarm Solar Co Solar News Blog Local National International

2021 Federal Solar Incentives And Tax Credits

2021 Federal Solar Incentives And Tax Credits

Solar Rebate Update YouTube

Residential Federal Solar Rebate Maximize Your Solar Savings Solar Power Nation

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Federal Solar Rebate 2024 - Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs