Federal Solar Tax Credit Irs Form Department of the Treasury Internal Revenue Service Residential Energy Credits Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form5695 for instructions and

How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form Form 5695 is the official IRS tax form you must use to claim the federal solar tax credit when you file your taxes You can download a copy of Form 5695 PDF on

Federal Solar Tax Credit Irs Form

Federal Solar Tax Credit Irs Form

https://www.leafscore.com/wp-content/uploads/2022/08/federal-solar-tax-credit-inflation-reduction-act-scaled.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

How To Claim The Solar Tax Credit IRS Form 5695

https://optiononesolar.com/wp-content/uploads/2021/10/ClaimingSolarITC.jpg

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe Step by step instructions on how to fill out IRS Form 5695 to claim the Solar Investment Tax Credit on your federal taxes and get the savings you deserve

Download Federal Solar Tax Credit Irs Form

More picture related to Federal Solar Tax Credit Irs Form

Solar Tax Credit Explained For 2022

https://news.measuresolar.com/wp-content/uploads/2022/03/Large-Rectangle-2-1-1536x864.png

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgZShlMA8=&rs=AOn4CLD0u4VMgupTPJWuWOaZRVksaroCPw

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

Step by step instructions for using IRS Form 5695 to claim the 30 federal solar tax credit You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your To claim your tax credit for solar panels you must file Form 5695 Residential Energy Credits along with Form 1040 for the year the panels were installed You ll need

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

https://www.irs.gov/pub/irs-pdf/f5695.pdf

Department of the Treasury Internal Revenue Service Residential Energy Credits Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form5695 for instructions and

https://www.energy.gov/eere/solar/hom…

How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

Federal Solar Tax Credits For Businesses Department Of Energy

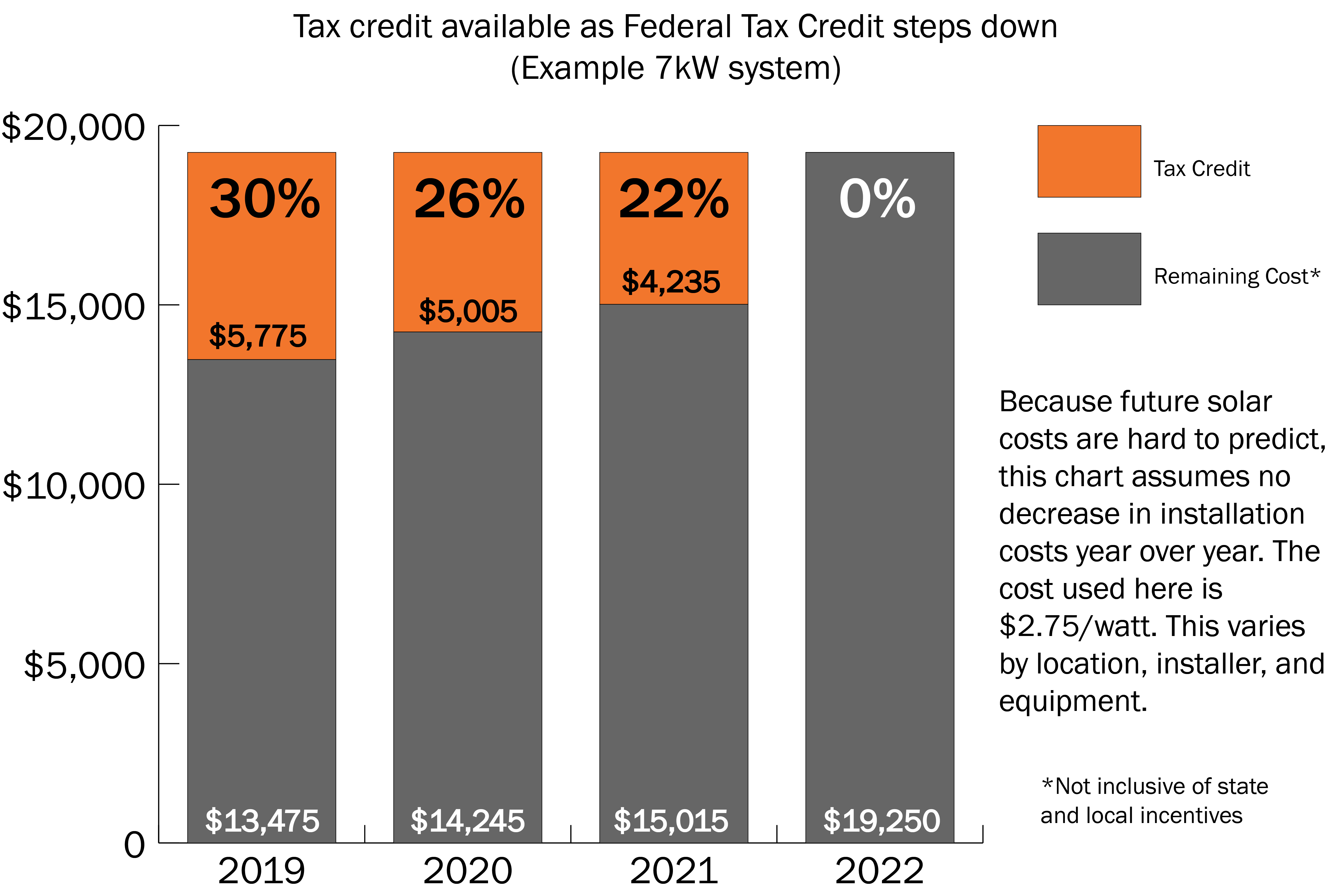

Solar Tax Credit Graph without Header Solar United Neighbors

How Does The Federal Solar Tax Credit Work PB Roofing Co

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

The Federal Solar Tax Credit Extension Can We Win If We Lose

Congress Gets Renewable Tax Credit Extension Right Institute For

Federal Solar Tax Credit Irs Form - How does the federal solar tax credit work What costs are covered by the solar tax credit Qualified homes How do I qualify for the solar tax credit What are