Federal Tax Credit 2023 Heat Pump The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through

30 of project cost 2 000 maximum amount credited This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 Qualifying Credit Amounts and Expenses 2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate

Federal Tax Credit 2023 Heat Pump

Federal Tax Credit 2023 Heat Pump

https://goenergylink.com/wp-content/uploads/2021/07/AdobeStock_98024254-1536x1022.jpeg

Heat Pump Tax Credits And Rebates Continue In 2024 Moneywise

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

https://akheatsmart.org/wp-content/uploads/2022/04/heat-pump-indoor_300.jpg

2023 through 2032 30 of your project costs up to 2 000 with an additional 600 tax credit for electric panel upgrades if needed to support heat pump installation Heat For the tax credit program the new incentives will apply to equipment installed on January 1 2023 or later A smaller tax credit of up to 300 for a heat

Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity Fuel Cells 30 of cost Wind Turbine Battery Storage N A 30 of cost There s no better way to save energy and money around the house than taking advantage of these 2023 home energy tax credits for solar panels heat pumps

Download Federal Tax Credit 2023 Heat Pump

More picture related to Federal Tax Credit 2023 Heat Pump

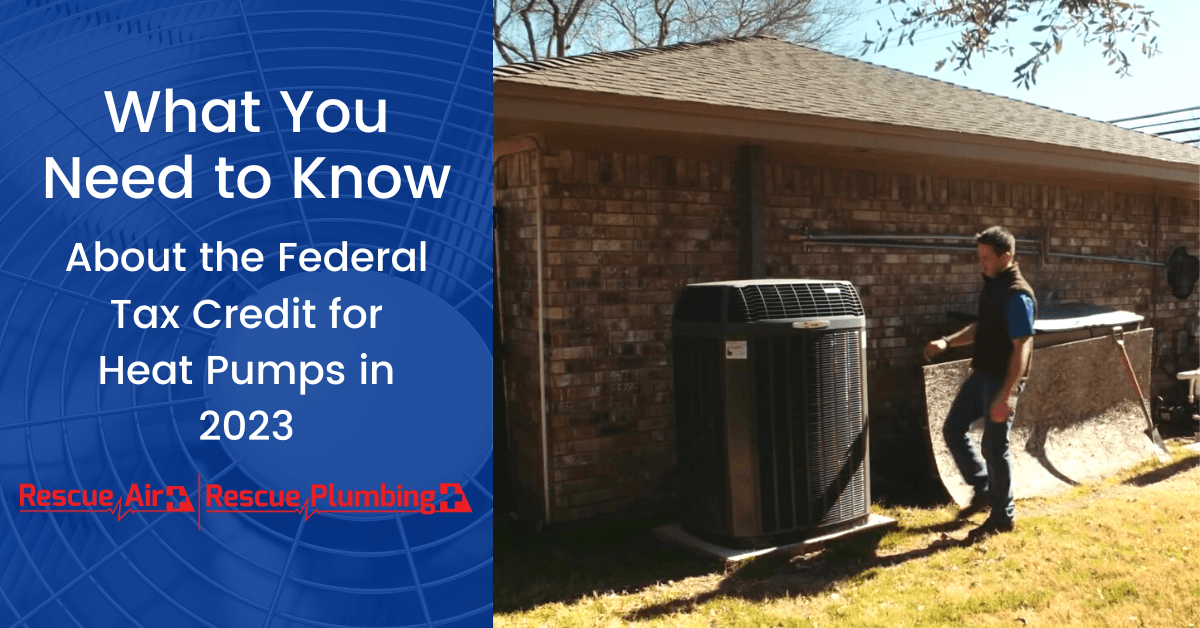

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

https://www.rescueairtx.com/images/blog/Jan-9.png

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

The Inflation Reduction Act pumps Up Heat Pumps Hvac

https://www.hvac.com/wp-content/uploads/2022/09/heat-pump-rebates-2023.png

The tax credit covers 30 percent of the cost of heat pumps for air and water capped at 2 000 each year but resets annually so it can be used for other projects Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for

Heat pump federal tax credit 2024 Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit 2023 Heat Pump Tax Credit 2022 Inflation Reduction Act Heat pump rebate Other benefits of tax relief policy 2022 Inflation Reduction Act The 2022 Inflation Reduction Act was

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

2 000 Tax Credit For Heat Pumps Air Conditioners Installed 2023

https://airconditioningarizona.com/wp-content/uploads/2023/02/[email protected]

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through

https://www.energystar.gov/about/federal_tax...

30 of project cost 2 000 maximum amount credited This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032

Inflation Reduction Act Expands 45L Tax Credit For Energy Efficient

Federal Solar Tax Credit What It Is How To Claim It For 2024

New Federal Tax Brackets For 2023

Heat Pumps Wattsmart Savings

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

30 Federal Tax Credits For Heat Pump Water Heaters 2023

30 Federal Tax Credits For Heat Pump Water Heaters 2023

Federal Tax Credits Carrier Residential

2023 Home Energy Federal Tax Credits Rebates Explained

3 Energy Trends To Watch In 2023

Federal Tax Credit 2023 Heat Pump - For the tax credit program the new incentives will apply to equipment installed on January 1 2023 or later A smaller tax credit of up to 300 for a heat