Federal Tax Credit 2024 IR 2024 273 Oct 22 2024 WASHINGTON The Internal Revenue Service announced today the annual inflation adjustments for tax year 2025 Revenue Procedure 2024 40 PDF provides

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an

Federal Tax Credit 2024

Federal Tax Credit 2024

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Commercial Solar Tax Credit Guide 2023

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Learn about different types of tax credits for individuals such as EITC Child Tax Credit and American Opportunity Tax Credit Find out how to claim them and check your All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

How to Claim the New Clean Vehicle Tax Credit Starting on Jan 1 2024 eligible consumers will have the option to transfer the value of the tax credit to dealers that meet certain requirements in exchange for an equivalent Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Download Federal Tax Credit 2024

More picture related to Federal Tax Credit 2024

New Federal Tax Brackets For 2023

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA16efiq.img

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

Several government entities and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate or a tax credit Rebates can be claimed at or after A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a federal tax credit of up to 7 500 provided it was manufactured in North America But the rules

The maximum earned income tax credit in 2024 for single and joint filers is 632 if the filer has no children Table 5 The maximum credit is 4 213 for one child 6 960 for two children and 7 830 for three or more children The list of EVs that qualify for the 7 500 federal tax credit got a lot shorter in 2024 but it s slowly climbing back up to 2023 numbers In 2023 17 full EVs qualified for the

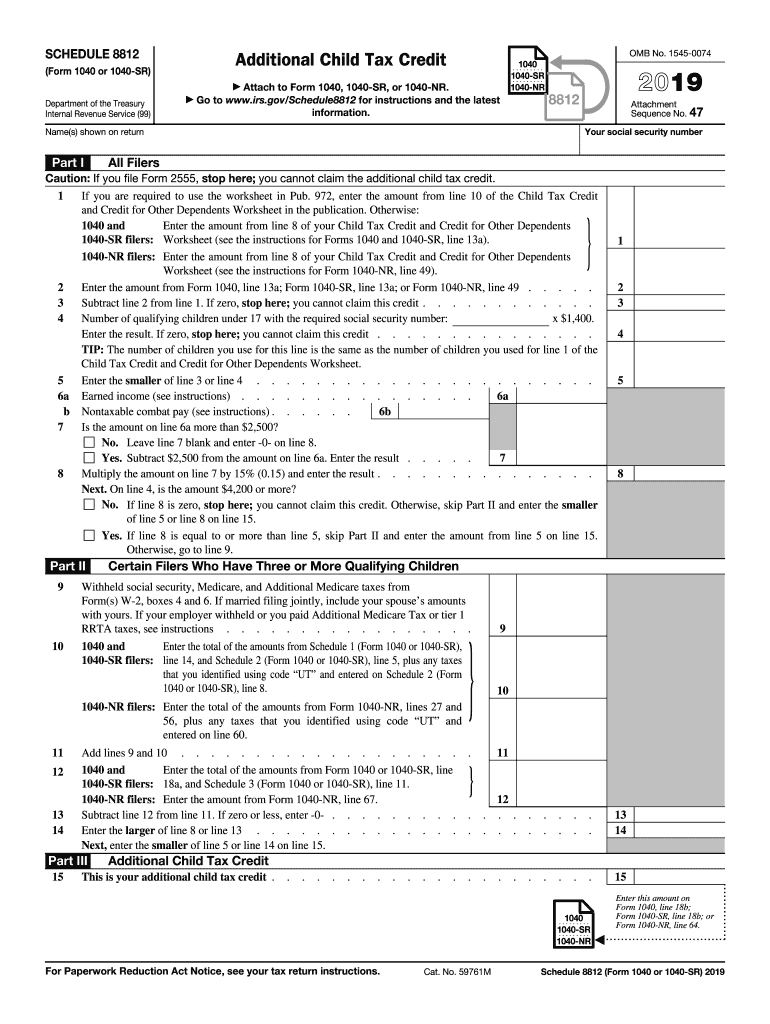

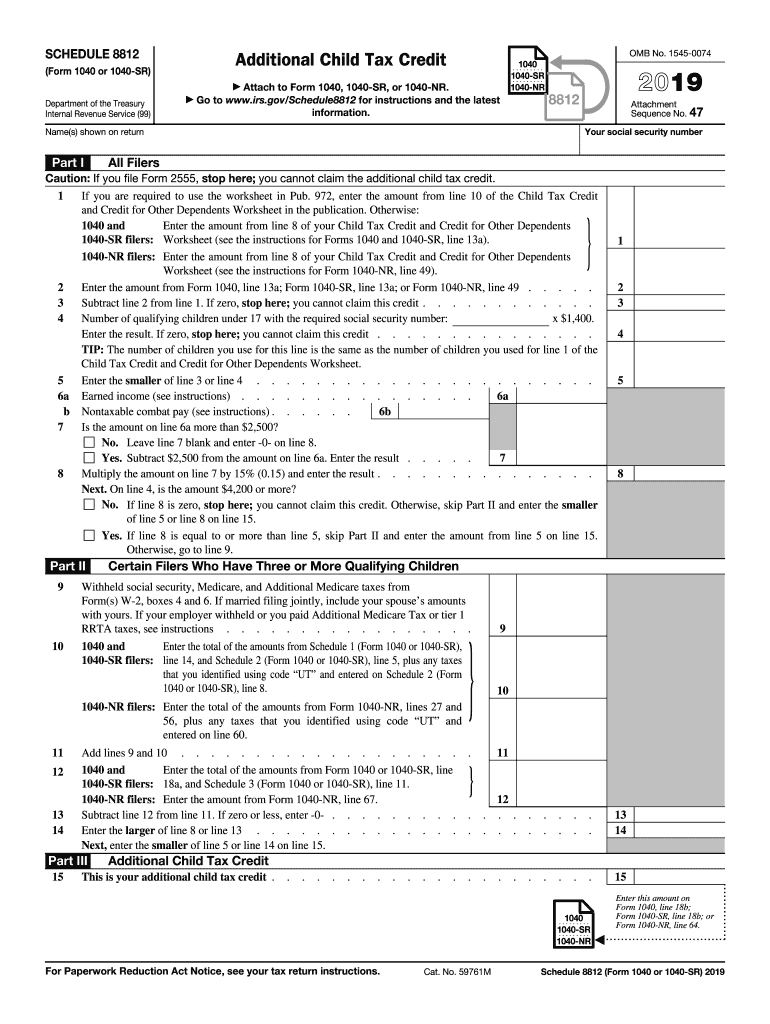

IRS 1040 Schedule 8812 2019 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/489/68/489068422/large.png

Resources

https://plsadaptive.s3.amazonaws.com/eco/images/builder/ZvodeQzx3gB9XGtqN5sLewr9fpLnN98LV17D1zfZ.png?0.8546703070713693

https://www.irs.gov › newsroom

IR 2024 273 Oct 22 2024 WASHINGTON The Internal Revenue Service announced today the annual inflation adjustments for tax year 2025 Revenue Procedure 2024 40 PDF provides

https://www.nerdwallet.com › article › t…

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how

IRS 1040 Schedule 8812 2019 Fill And Sign Printable Template Online

Earned Income Tax Credit For Households With One Child 2023 Center

Nys Withholding Tax Forms 2022 WithholdingForm

Tax Credit Universal Credit Impact Of Announced Changes House Of

Solar Tax Credit Extended 2 More Years SunWork

Solar Tax Credit Extended 2 More Years SunWork

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Easiest EITC Tax Credit Table 2022 2023 Internal Revenue Code

Federal Tax News For Businesses PKF Mueller

Federal Tax Credit 2024 - Starting Jan 1 2024 if you purchase a new or pre owned EV you may be able to effectively lower the vehicle s purchase price by transferring the clean vehicle tax credit to a registered