Federal Tax Credit Electric Vehicle Charger For consumers who purchase and install qualified alternative fuel vehicle refueling property for their principal residence including electric vehicle charging equipment between December 31 2022 and January 1 2033 the tax credit equals 30 of the cost with a maximum amount of 1 000 per item

The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

Federal Tax Credit Electric Vehicle Charger

Federal Tax Credit Electric Vehicle Charger

https://zevsociety.com/wp-content/uploads/2022/09/B2.png

Tax Credit For Electric Vehicles Khou

https://media.khou.com/assets/KHOU/images/fda45742-0ba4-4512-b143-375cf49d3da4/fda45742-0ba4-4512-b143-375cf49d3da4_1920x1080.jpg

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

If you purchase and install a ChargePoint electric vehicle EV charging solution between Jan 1 2023 and Dec 31 2032 your business may be eligible to receive a 30 tax credit up to 100 000 per station under the 30C Alternative Fuel Infrastructure Tax Credit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit Learn how consumers fleets businesses and tax exempt entities can receive alternative fuel infrastructure tax credits for installing EV charging equipment including bidirectional charging equipment This tax credit is also available for fueling equipment for hydrogen and nine other clean burning fuels installed after December 31 2022

Download Federal Tax Credit Electric Vehicle Charger

More picture related to Federal Tax Credit Electric Vehicle Charger

IP65 Commercial Electric Vehicle Charging Stations OCPP1 6 22kW Fast

https://www.smartev-charger.com/photo/ps133755012-ip65_commercial_electric_vehicle_charging_stations_ocpp1_6_22kw_fast_charger.jpg

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What

https://cmg-cmg-tv-10050-prod.cdn.arcpublishing.com/resizer/fxWDPB5OeMjSyTd96KEnjXgh9yY=/1440x0/filters:format(png):quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png

EVs That Are Eligible For A Federal Tax Credit In 2024

https://www.moneydigest.com/img/gallery/evs-that-are-eligible-for-a-federal-tax-credit-in-2024/l-intro-1706717045.jpg

If you purchase and install a ChargePoint electric vehicle EV charging solution between Jan 1 2023 and Dec 31 2032 your business may be eligible to receive a 30 tax credit up to 100 000 per station under the 30C You could save up to 1 000 on your federal taxes with the recently renewed EV charger tax credit Here s how to claim it

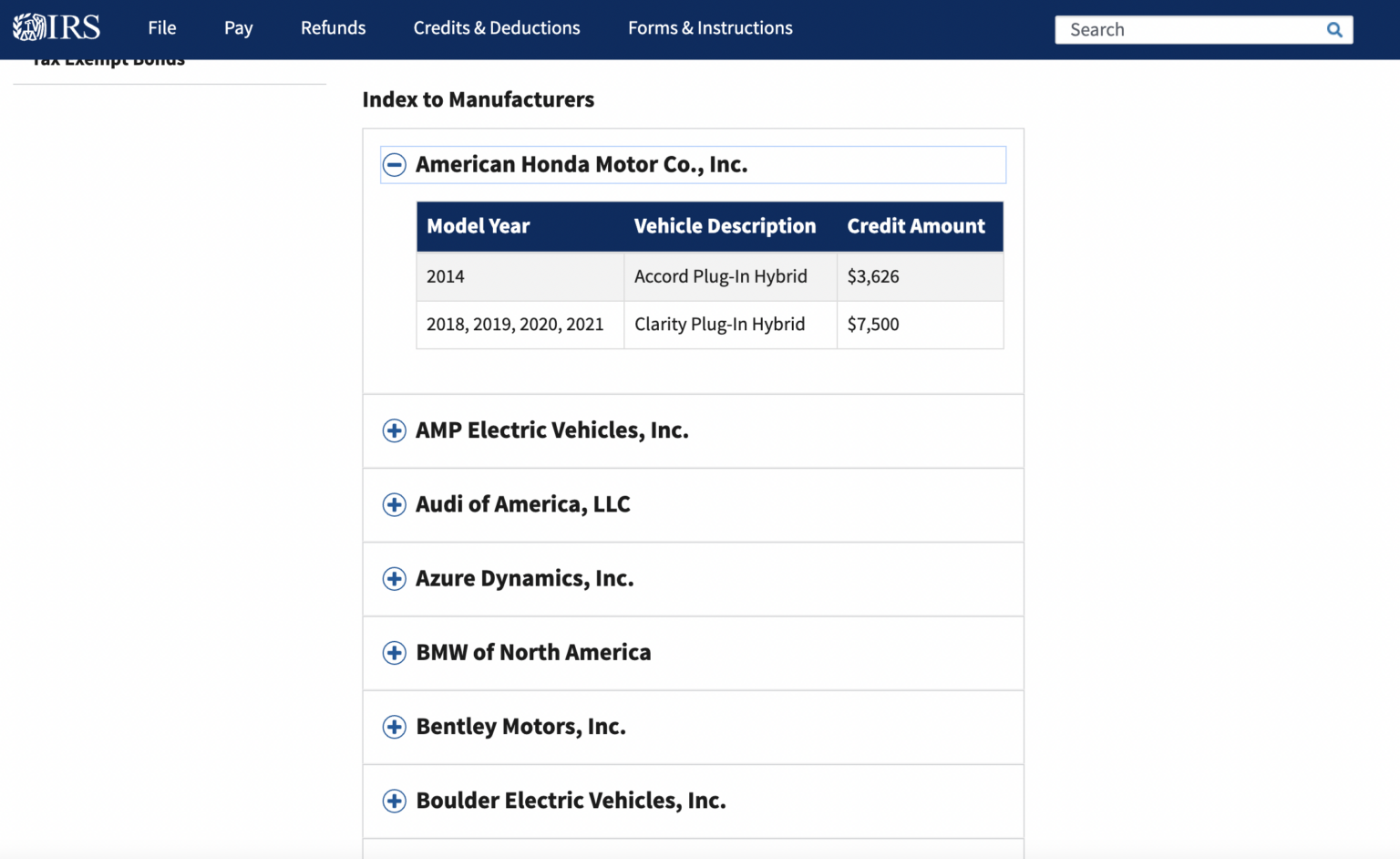

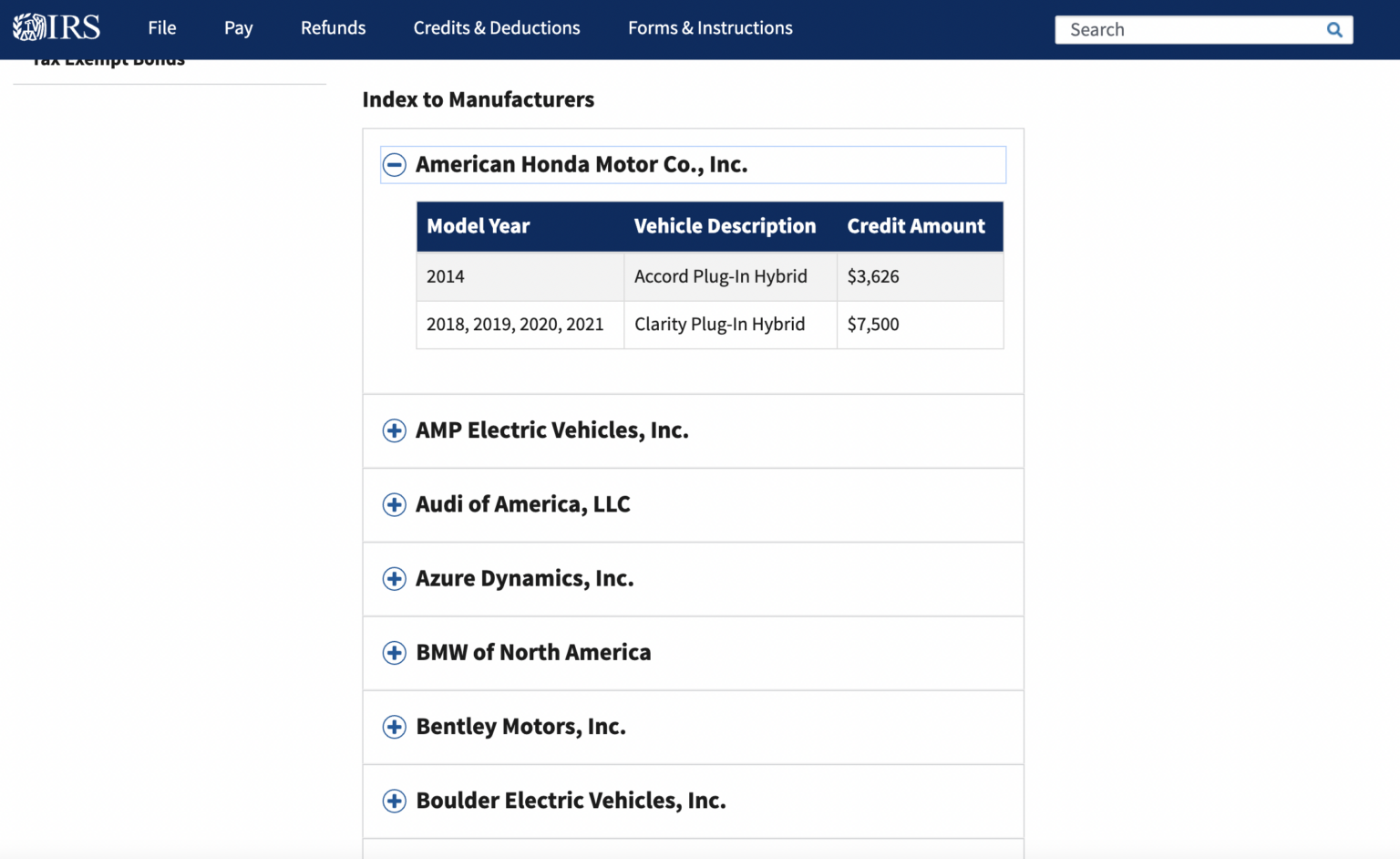

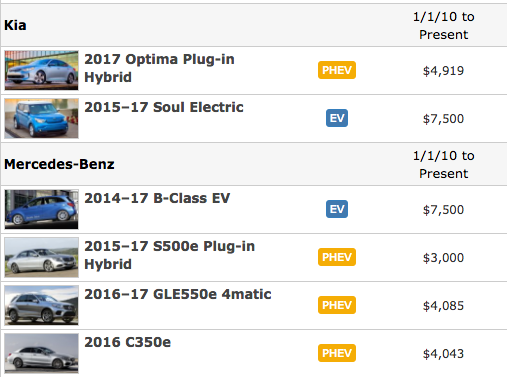

The federal tax credit for electric vehicles Clean Vehicle tax credit in 2023 is 7 500 for a new EV and 4 000 for a pre owned EV if the EV qualifies Forty one states plus the District of The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

The Federal Tax Credit For Electric Cars How To Save 7 500

https://evroom.com/wp-content/uploads/2022/11/Screen-Shot-2022-10-22-at-8.37.36-PM-1536x942.png

Federal Income Tax Credit Electric Vehicle Todrivein

https://todrivein.com/wp-content/uploads/2023/06/federal-income-tax-credit-electric-vehicle_featured_photo.jpeg

https://www.irs.gov/credits-deductions/alternative...

For consumers who purchase and install qualified alternative fuel vehicle refueling property for their principal residence including electric vehicle charging equipment between December 31 2022 and January 1 2033 the tax credit equals 30 of the cost with a maximum amount of 1 000 per item

https://electrek.co/2024/03/11/the-us-treasury...

The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business

Change To Federal Tax Credit A Big Boost To Alberta Lithium Extraction

The Federal Tax Credit For Electric Cars How To Save 7 500

EV Charger Federal Tax Credit

Federal Tax Credit Where To Look Tesla Motors Club

EV Charger Tax Credit 2023 WattLogic

What s Happening With Electric Car Incentives Green Energy Times

What s Happening With Electric Car Incentives Green Energy Times

Electric Vehicle Tax Credit What You Need To Know

What Is The Electric Vehicle Tax Credit Electric Vehicle List

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

Federal Tax Credit Electric Vehicle Charger - Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the requirements below