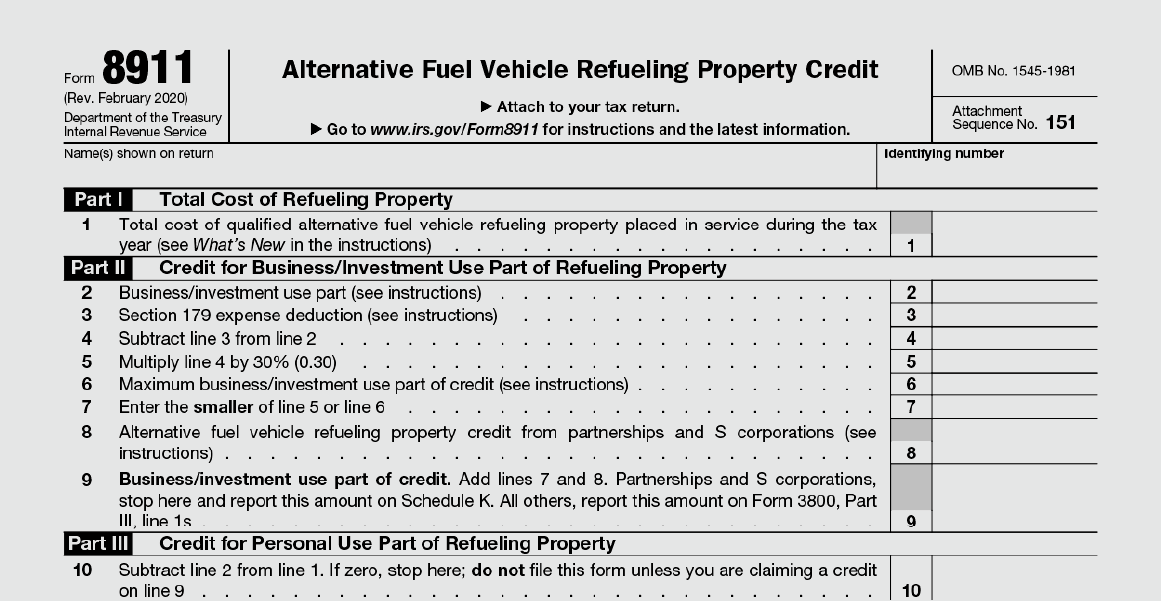

Federal Tax Credit For Installing Ev Charger For consumers who purchase and install qualified alternative fuel vehicle refueling property for their principal residence including electric vehicle charging equipment between December 31 2022 and January 1 2033 the tax credit equals 30 of the cost with a maximum amount of 1 000 per item

You May Get Federal Tax Credit for Your Home EV Charger During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business

Federal Tax Credit For Installing Ev Charger

Federal Tax Credit For Installing Ev Charger

https://jamarpower.com/wp-content/uploads/2022/10/EV-Charger-Tax-Credit-featured-image-1080-opt.jpeg

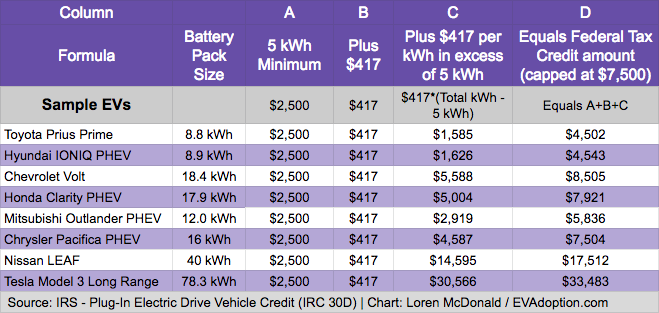

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

https://evadoption.com/wp-content/uploads/2019/03/Sample-EVs-Federal-EV-tax-credit-amount-calculation.png

Guide To Installing Ev Charger How To Install An Ev Charger At Home

https://expresselectricalservices.com/wp-content/uploads/2021/04/home-ev-charger.jpg

You could save up to 1 000 on your federal taxes with the recently renewed EV charger tax credit Here s how to claim it If you purchase EV charging equipment for your principal residence you may be eligible for a tax credit for the charging station This credit is generally 30 of the item s cost up to 1 000 Eligibility is based on the installation location being in an eligible census tract

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Download Federal Tax Credit For Installing Ev Charger

More picture related to Federal Tax Credit For Installing Ev Charger

Guide To Installing Ev Charger How To Install An Ev Charger At Home

https://www.theelectricconnection.com/wp-content/uploads/2018/05/ev-charger.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Federal EV Tax Credit Explained YouTube

https://i.ytimg.com/vi/CB6B0PfJdRc/maxresdefault.jpg

The Inflation Reduction Act IRA includes a tax credit for installing a home EV charger equal to 30 of the total cost including installation up to 1 000 The federal EV charger tax credit is only available to those who live in a The IRS has published new rules that will allow two thirds of Americans to qualify for a tax break when installing a home EV charger

If you ve bought an electric vehicle and intend to install an EV charger or other eligible refueling equipment in your home you can receive a credit of up to 30 of the cost of installation up to 1 000 How to claim the federal tax credit This incentive provides a credit for up to 30 of the cost of qualified alternative fuel vehicle refueling property placed in service by the taxpayer The credit may be claimed by individuals for home electric vehicle charging and other refueling equipment and by businesses

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax

https://images.cars.com/cldstatic/wp-content/uploads/ev-full-tax-credit.jpg

https://www.irs.gov/credits-deductions/alternative...

For consumers who purchase and install qualified alternative fuel vehicle refueling property for their principal residence including electric vehicle charging equipment between December 31 2022 and January 1 2033 the tax credit equals 30 of the cost with a maximum amount of 1 000 per item

https://www.forbes.com/.../ev-charger-tax-credit

You May Get Federal Tax Credit for Your Home EV Charger During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed

EV Charging Station Installation Everything You Need To Know

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News

How To Claim Your Federal Tax Credit For Home Charging ChargePoint

Steps To Follow When Installing EV Charging Stations WalTonk

4 Things To Consider When Installing Your EV Charger New

Our EV Charger Installation Process Green Electrical EV

Our EV Charger Installation Process Green Electrical EV

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

Installing Electric Vehicle Charging Station At Home VEHICLE UOI

Work To Start On Installing EV Chargers In Faringdon Vale Of White

Federal Tax Credit For Installing Ev Charger - Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit