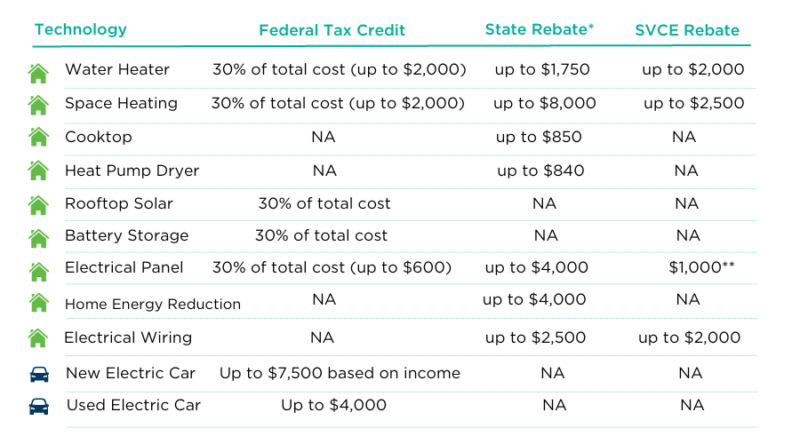

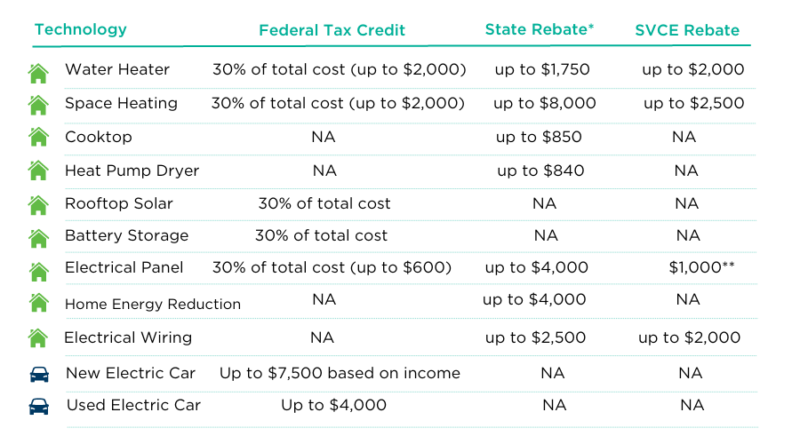

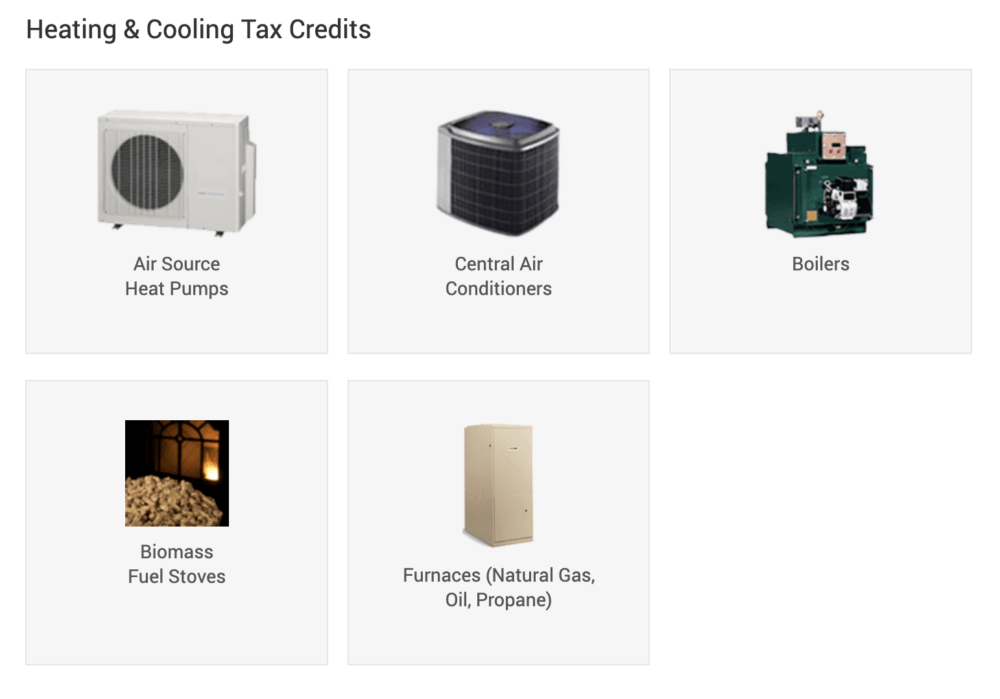

Federal Tax Credit Or Rebates For Home Improvements Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

Federal Tax Credit Or Rebates For Home Improvements

Federal Tax Credit Or Rebates For Home Improvements

https://svcleanenergy.org/wp-content/uploads/IRA-Webpage-Rebates-3-800x444.png

Federal Tax Rebate Program Benson s Heating Air

https://www.bensonshvac.com/wp-content/uploads/Federal-Tax-Credits-for-Air-Conditioners-and-Heat-Pumps.png

Get Sweet Rebates And Tax Credits On Clean Energy Systems

https://allamericanheating.com/wp-content/uploads/2023/01/Green-Energy-Tax-Credits-1.png

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Web Background Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home

Web 16 mars 2023 nbsp 0183 32 Which home improvements qualify for the Energy Efficient Home Improvement energy tax credit Beginning January 1 2023 the credit becomes equal Web 29 ao 251 t 2022 nbsp 0183 32 Jean Folger Published August 29 2022 Fact checked by Ryan Eichler If you ve been considering making green home improvements you might be in for some budgetary luck President

Download Federal Tax Credit Or Rebates For Home Improvements

More picture related to Federal Tax Credit Or Rebates For Home Improvements

Federal Tax Credits And Rebates Air Plus Heating Cooling S D

https://airplusmechanical.com/wp-content/uploads/2023/04/maxresdefault-768x432-1.jpg

2020 HVAC Rebates Federal Tax Credits DTC Air Conditioning Heating

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/2020-hvac-rebates-federal-tax-credits-dtc-air-conditioning-heating.jpg?fit=2400%2C1256&ssl=1

.jpg)

Rebates Residential Central Liberty

https://central.libertyutilities.com/uploads/brand/Mom_EV(Crop).jpg

Web 22 d 233 c 2022 nbsp 0183 32 Q1 Will a taxpayer qualify for the credits if the property installed has been used by another individual added December 22 2022 A1 No Used property is not Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web 30 d 233 c 2022 nbsp 0183 32 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection

The New Federal Tax Credits And Rebates For Home Energy Efficiency

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/the-new-federal-tax-credits-and-rebates-for-home-energy-efficiency.jpg?resize=768%2C510&ssl=1

How To Take Advantage Of New Federal Heat Pump Rebates Adeedo Drain

https://www.adeedo.com/wp-content/uploads/2023/04/business-finance-save-money-for-investment-concep-2021-08-31-01-53-11-utc-1024x683.jpg

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

https://www.cbsnews.com/news/inflation-reduction-act-joe-biden-climate...

Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat

Recovery Rebate Credit Form Printable Rebate Form

The New Federal Tax Credits And Rebates For Home Energy Efficiency

How To Get A Tax Rebate On Energy Efficient Appliances Learn How To

Baker Heating Cooling 2023 Home Energy Federal Tax Credits Rebates

Tax Credits And Rebates For Energy Efficiency

Ultimate 2020 Inland Empire Solar And Battery Guide

Ultimate 2020 Inland Empire Solar And Battery Guide

Rebates And Energy Star Tax Credits Michigan C C Heat Air

Hunter Douglas Rebates Federal Tax Credit Washington DC Area

How To Find Your Federal Tax Credits HVAC Rebates

Federal Tax Credit Or Rebates For Home Improvements - Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide