Rebate 87a Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable Web 1 f 233 vr 2023 nbsp 0183 32 By Sunita Mishra February 1 2023 Budget 2023 24 extends exemption limit under Section 87A Those earning up to Rs 7 lakh annual income are exempted from

Rebate 87a

Rebate 87a

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

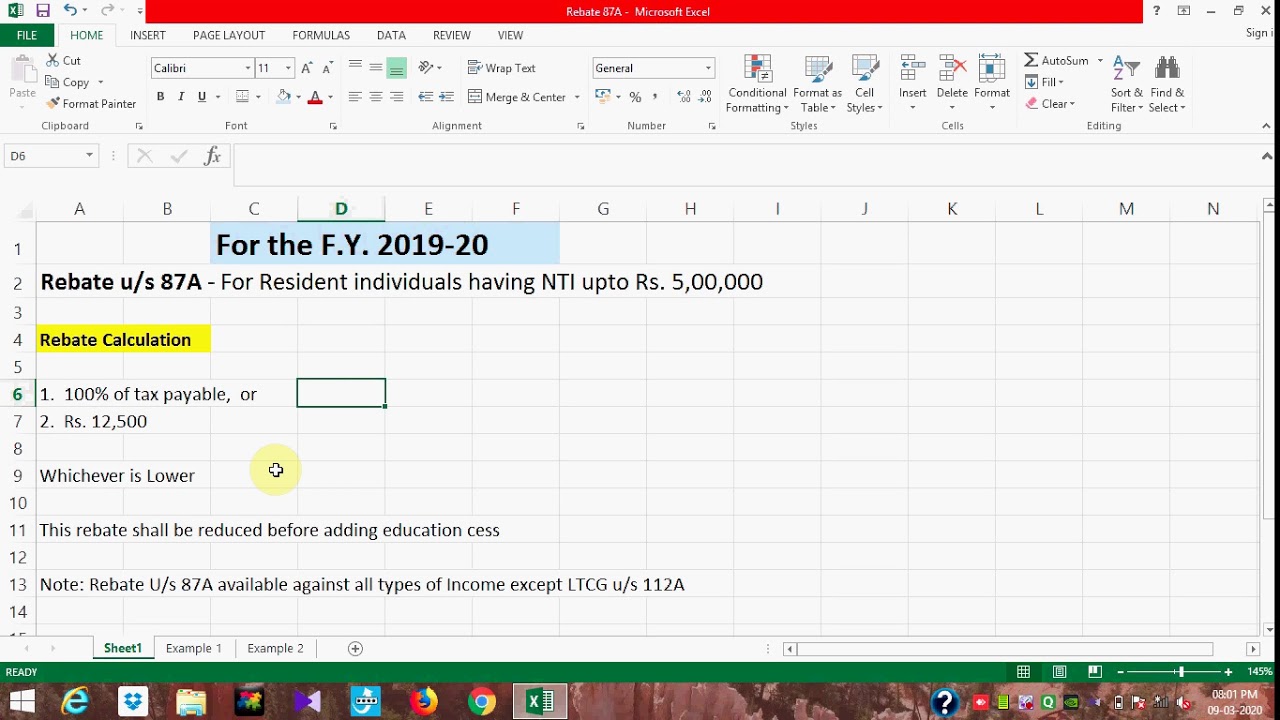

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://i.ytimg.com/vi/OS6nlwtzz-A/maxresdefault.jpg

Web Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual must be Web 26 juil 2023 nbsp 0183 32 Section 87A of the Income Tax Act 1961 allows an income tax rebate of Rs 12 500 for both old and new tax regime for FY 2022 23 AY 2023 24 This tax rebate

Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of Web Rebate of income tax in case of certain individuals 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees

Download Rebate 87a

More picture related to Rebate 87a

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

Rebate U s 87A

https://media.licdn.com/dms/image/C5112AQHGhIc7iVAbrg/article-cover_image-shrink_600_2000/0/1523954816383?e=2147483647&v=beta&t=BtH1y3BpTu4KevMTicf4-bfJurzHAXOcHYOEp8_GexA

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

https://i.ytimg.com/vi/Yo8nxqN-uJg/maxresdefault.jpg

Web 9 d 233 c 2022 nbsp 0183 32 As per the Income Tax Act 1961 if you have gross taxable income below 5 lakhs per year you can claim a tax rebate u s 87A We can also easily claim an income tax rebate of around 12 500 via tax Web 2 f 233 vr 2023 nbsp 0183 32 Tax rebate under Section 87A was introduced by the Government of India in 2013 2014 While presenting the Union Budget 2023 24 on February 1 2023 Finance

Web Rebate under section 87A can be claimed when your taxable income does not exceed the prespecified limit for the given financial year For example for FY 2021 22 AY 2022 23 Web 4 nov 2016 nbsp 0183 32 Under section 87A claimable rebate is up to Rs 12 500 The important thing here is that taxable income is calculated not just on tax slab Someone earning Rs 8 lakh

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://i.pinimg.com/736x/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Tax Rebate Under Section 87A All You Need To Know YouTube

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate U s 87A YouTube

Rebate Of Income Tax Under Section 87A YouTube

Rebate Of Income Tax Under Section 87A YouTube

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Rebate 87a - Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of