Rebate 87a Fy 2022 23 Learn how to claim the income tax rebate under Section 87A for individuals with total taxable income of up to Rs 7 lakh under the new tax regime Find out the eligibility

People with taxable incomes under Rs 5 lakhs are eligible for a tax rebate under Section 87A of the Income Tax Act of 1961 in the financial year 2022 23 Both the previous and the new tax regimes would offer a maximum Learn how to claim a tax rebate under Section 87A for FY 2023 24 and FY 2022 23 if your total income does not exceed Rs 5 lakh or Rs 7 lakh See the steps conditions and limits for the new and old tax regimes

Rebate 87a Fy 2022 23

Rebate 87a Fy 2022 23

https://png.pngtree.com/png-clipart/20211024/original/pngtree-2022-gold-3d-rendering-png-image_6869618.png

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

FAQs On Rebate U s 87A FinancePost

https://financepost.in/wp-content/uploads/2019/04/rebate.png

Learn who is eligible for tax rebate under Section 87A of the Income tax Act 1961 which allows an individual to claim tax rebate if their taxable income does not exceed Rs 7 Learn how to claim a tax rebate of Rs 12 500 or Rs 25 000 under Section 87A for FY 2021 22 2022 23 and 2023 24 Find out the eligibility limitations and tax liabilities covered by this rebate for resident individuals

An individual is eligible for a tax rebate under section 87A of the Income Tax Act 1961 if their taxable income is below Rs 5 lakh in FY 2022 23 AY 2023 24 Rs 12 500 is the maximum amount of income tax rebate that is The maximum 87A rebate is up to 12 500 old and new regime till FY 2022 23 and 25 000 for the new regime from FY 2023 24 The rebate is not applicable if the tax liability exceeds

Download Rebate 87a Fy 2022 23

More picture related to Rebate 87a Fy 2022 23

Income Tax Calculation FY 2022 23 Salary 9 Lakh

https://i.ytimg.com/vi/2_IEVDmfpX8/maxresdefault.jpg

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

Mar Apr 2022

https://naesp.ygsclicbook.com/pubs/principal/2022/marapr-2022/G133675_0322_NAESP_cover.jpg

Learn how to claim tax rebate under Section 87A of Income tax Act for FY 2023 24 Find out the eligibility amount and steps for both the new and old tax regimes Learn how to claim a tax rebate u s 87A for FY 2023 24 under the new and old tax regimes Find out the eligibility criteria rebate amounts and steps to calculate your tax liability

Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of up to 12 500 or the total tax payable in an assessment Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified A resident individual with taxable income up to Rs 7 00 000

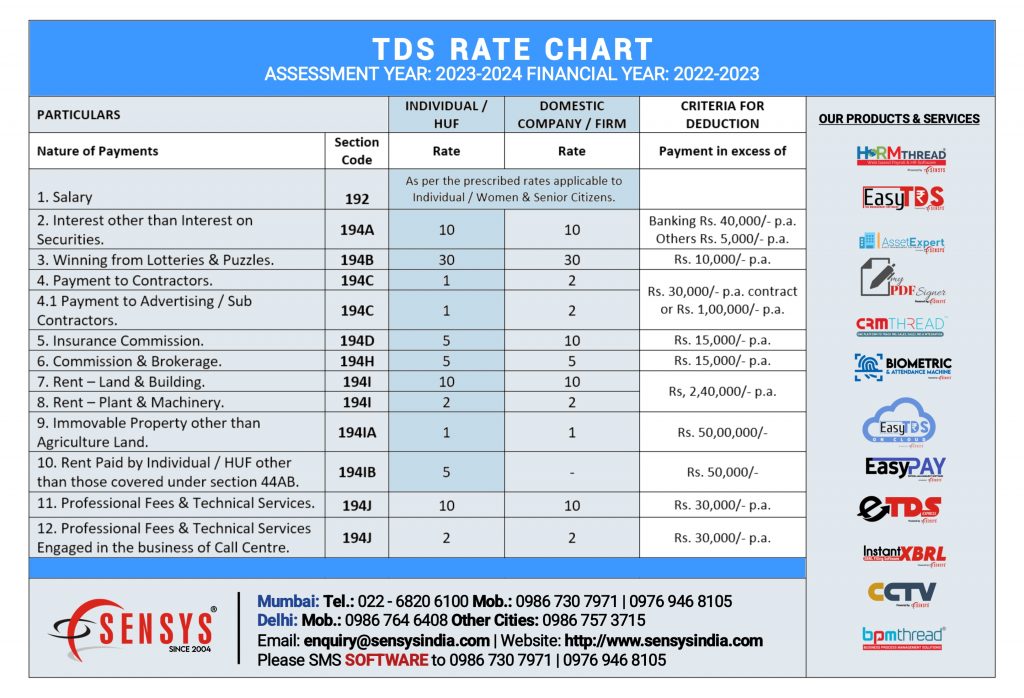

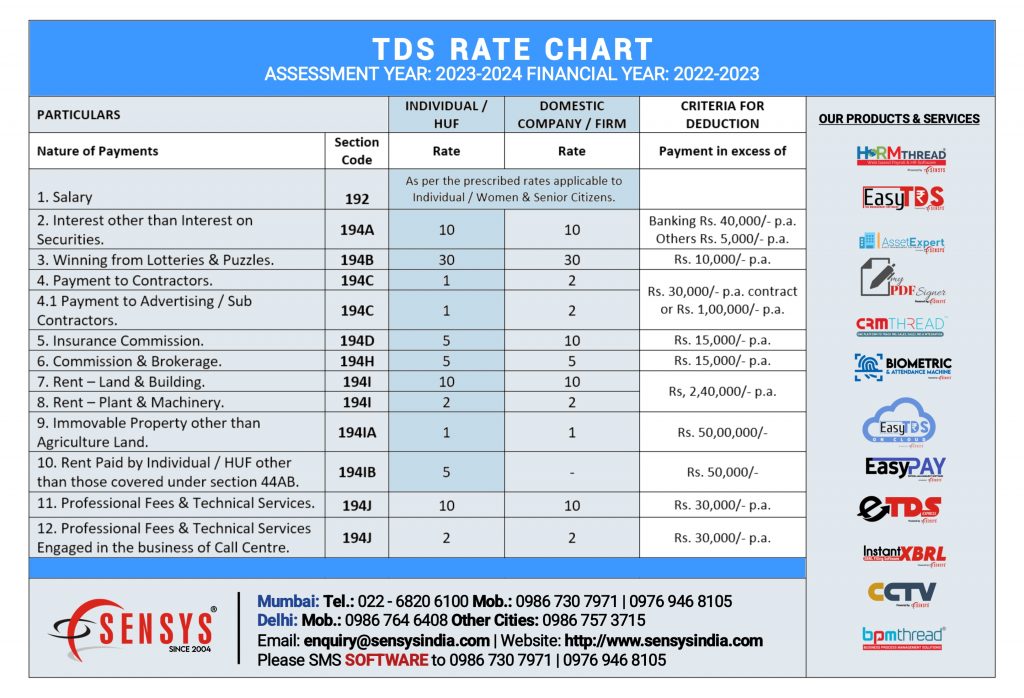

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210-1024x698.jpg

1 5 News 2022

https://lysa.book.fr/files/1/65011/g_30_zkBH1Pyfby.jpg

https://tax2win.in/guide/section-87a

Learn how to claim the income tax rebate under Section 87A for individuals with total taxable income of up to Rs 7 lakh under the new tax regime Find out the eligibility

https://www.bankbazaar.com/tax/section-8…

People with taxable incomes under Rs 5 lakhs are eligible for a tax rebate under Section 87A of the Income Tax Act of 1961 in the financial year 2022 23 Both the previous and the new tax regimes would offer a maximum

Income Tax Slab Rates For FY 2021 22 AY 2022 23 Bachat Mantra

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

Tax Rebate U S 87a For FY 2022 23 And FY 2023 2024

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

Greek Rebate Free Stock Photo Public Domain Pictures

Gazetka Promocyjna Aldi Pe ny Katalog Wa na 17 01 Do 22 01 2022 23

Gazetka Promocyjna Aldi Pe ny Katalog Wa na 17 01 Do 22 01 2022 23

Income Tax Rebate Under Section 87A

Traderider Rebate Program Verify Trade ID

Real Betis Vs Athletic Club I Liga F 2022 23 MD12

Rebate 87a Fy 2022 23 - Learn how to claim the tax rebate under Section 87A for FY 2023 24 AY 2024 25 if your income is below Rs 5 lakh Find out the eligibility criteria ineligible incomes and how to