Federal Tax Credit Used Phev Verkko 1 tammik 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000

Verkko Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit also referred to as a previously owned clean vehicle credit The credit equals 30 of the sale price up to a maximum credit of 4 000 Verkko 25 lokak 2023 nbsp 0183 32 The five PHEVs that receive a 3750 credit are the BMW X5 xDrive 50e the Ford Escape PHEV the Jeep Grand Cherokee 4xe and Wrangler 4xe and the Lincoln Corsair Grand Touring

Federal Tax Credit Used Phev

Federal Tax Credit Used Phev

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/41cce697d02567f472ac5922c1f0db93.jpg

The New Federal Tax Credit For EVs

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

CHP Federal Tax Credit To Expire In 2024 EnergyLink

https://goenergylink.com/wp-content/uploads/2021/07/AdobeStock_98024254-1536x1022.jpeg

Verkko 21 huhtik 2023 nbsp 0183 32 Tax Credits Are Now in Play for Both New and Used EVs Starting today if you buy an eligible MY22 23 24 EV PHEV or FCV you won t have to worry about whether say Ford sells 200k of them Verkko Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Verkko Preowned Plug In Electric and Fuel Cell Vehicles Eligible for Federal Tax Credits for 2023 and after Model Year Certifying Manufacturer Make Model Type 2016 Audi of America LLC Audi A8L PHEV Plug in Hybrid 2019 Audi of America LLC Audi e tron EV 2021 Audi of America LLC Audi e tron EV Verkko Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Download Federal Tax Credit Used Phev

More picture related to Federal Tax Credit Used Phev

How To See If The EV Or PHEV You Want Qualifies For A Tax Credit Autoblog

https://o.aolcdn.com/images/dims3/GLOB/legacy_thumbnail/1062x597/format/jpg/quality/100/https://s.yimg.com/os/creatr-uploaded-images/2022-08/15c1cc80-1e51-11ed-8d67-8a747c37277f

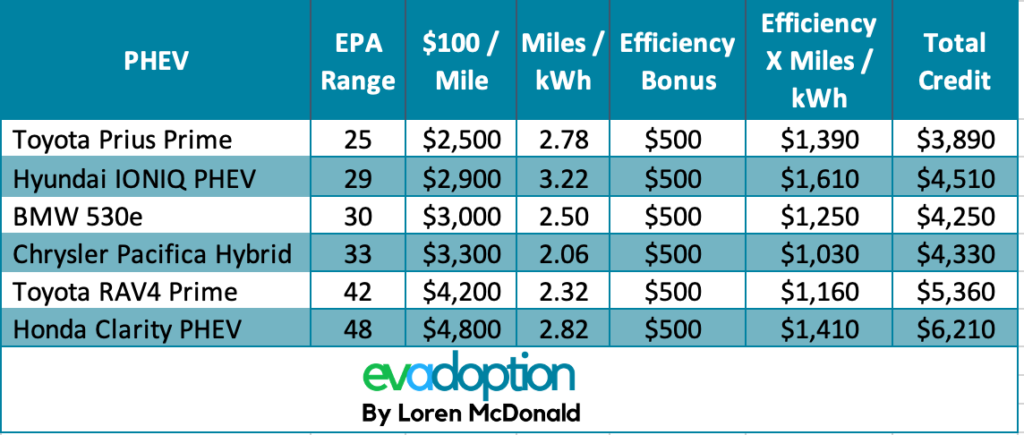

PHEV Federal EV tax credit formula EVAdoption

https://evadoption.com/wp-content/uploads/2021/03/PHEV-Federal-EV-tax-credit-formula-1024x435.png

Federal Tax Credit For Redevelopment Introduced REHAB Act Greater

http://static1.squarespace.com/static/59396fee59cc6877bacf5ab5/5947ec9a2985262ece0ebb1e/5e7a6fe1b8ae72565ee2e35a/1631114839305/?format=1500w

Verkko 1 tammik 2023 nbsp 0183 32 This report came as the federal government prepared to adopt a 4 000 tax credit for used plug in hybrids under the Inflation Reduction Act IRA a credit that as of January 1 consumers Verkko 17 elok 2022 nbsp 0183 32 In the meantime here are the electric cars and plug in hybrids for 2022 that remain eligible for the 7 500 federal tax credit through the end of the year subject to the aforementioned

Verkko 1 jouluk 2023 nbsp 0183 32 Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 in 2023 and 2024 Verkko 3 marrask 2023 nbsp 0183 32 The tax credit for a used EV or PHEV is either 4 000 or 30 percent of the sale price of the vehicle whichever is lower That means if you re spending less than 13 333 you re not going to

20 EVs Still Eligible For US Federal Tax Credit YouTube

https://i.ytimg.com/vi/4mlKaItwYYc/maxresdefault.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://www.fueleconomy.gov/feg/taxused.shtml

Verkko 1 tammik 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000

https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

Verkko Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit also referred to as a previously owned clean vehicle credit The credit equals 30 of the sale price up to a maximum credit of 4 000

EVs That Are Eligible For A Federal Tax Credit In 2024

20 EVs Still Eligible For US Federal Tax Credit YouTube

EV Tax Credit Gets Tougher US Treasury Issues New Guidelines For Clean

U S Treasury Delays EV Tax Credit Guidance Until March 2023 Rivian

PHEV Models That Qualify For The Federal EV Tax Credit LeafScore

Change To Federal Tax Credit A Big Boost To Alberta Lithium Extraction

Change To Federal Tax Credit A Big Boost To Alberta Lithium Extraction

Phev federal Tax Credit

Federal Tax Credit Where To Look Tesla Motors Club

Federal Tax Credit Calculation

Federal Tax Credit Used Phev - Verkko 21 huhtik 2023 nbsp 0183 32 Tax Credits Are Now in Play for Both New and Used EVs Starting today if you buy an eligible MY22 23 24 EV PHEV or FCV you won t have to worry about whether say Ford sells 200k of them