Federal Tax Deductions 2023 Advertiser disclosure 20 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly

For single taxpayers and married individuals filing separately the standard deduction rises to 13 850 for 2023 up 900 and for heads of households the standard deduction will be 20 800 for tax year 2023 up 1 400 from the amount for tax year 2022 FS 2023 10 April 2023 A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay FS 2023 01 Jan 2023 The federal income tax is a pay as you go tax Taxpayers pay the tax as they earn or receive income during the year Taxpayers can

Federal Tax Deductions 2023

Federal Tax Deductions 2023

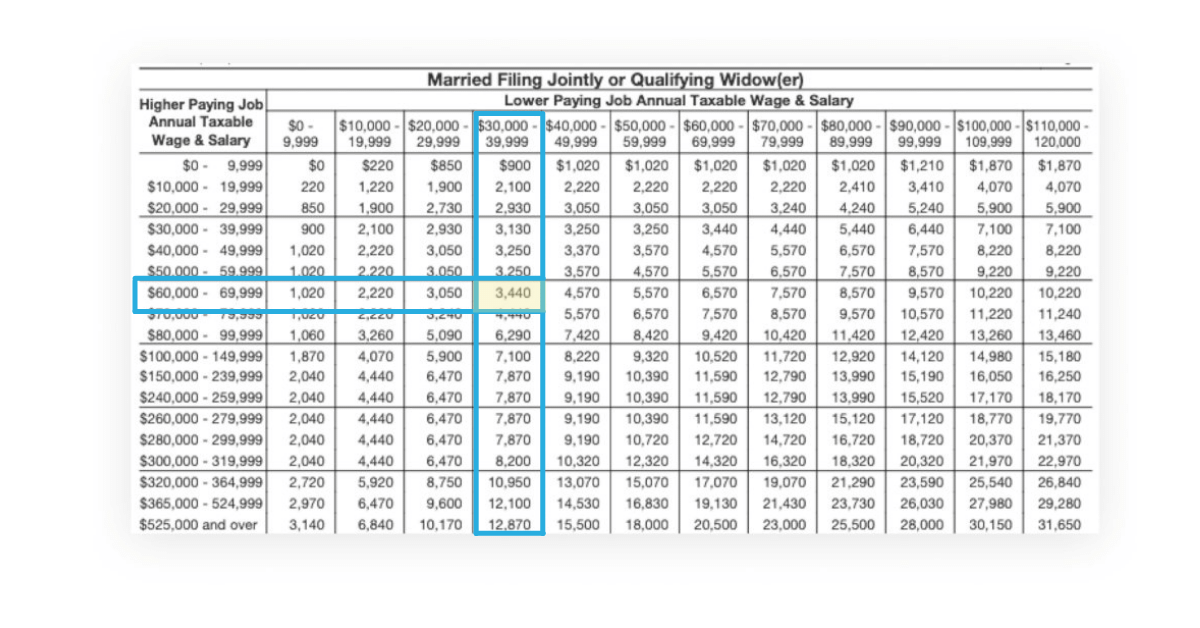

https://apspayroll.com/wp-content/uploads/2021/07/Form-W-4-Married-Filing-Jointly-Table.png

The Master List Of All Types Of Tax Deductions infographic Free

https://help.taxreliefcenter.org/wp-content/uploads/2018/06/Tax-Relief-Center-Types-of-Tax-Deductions.jpg

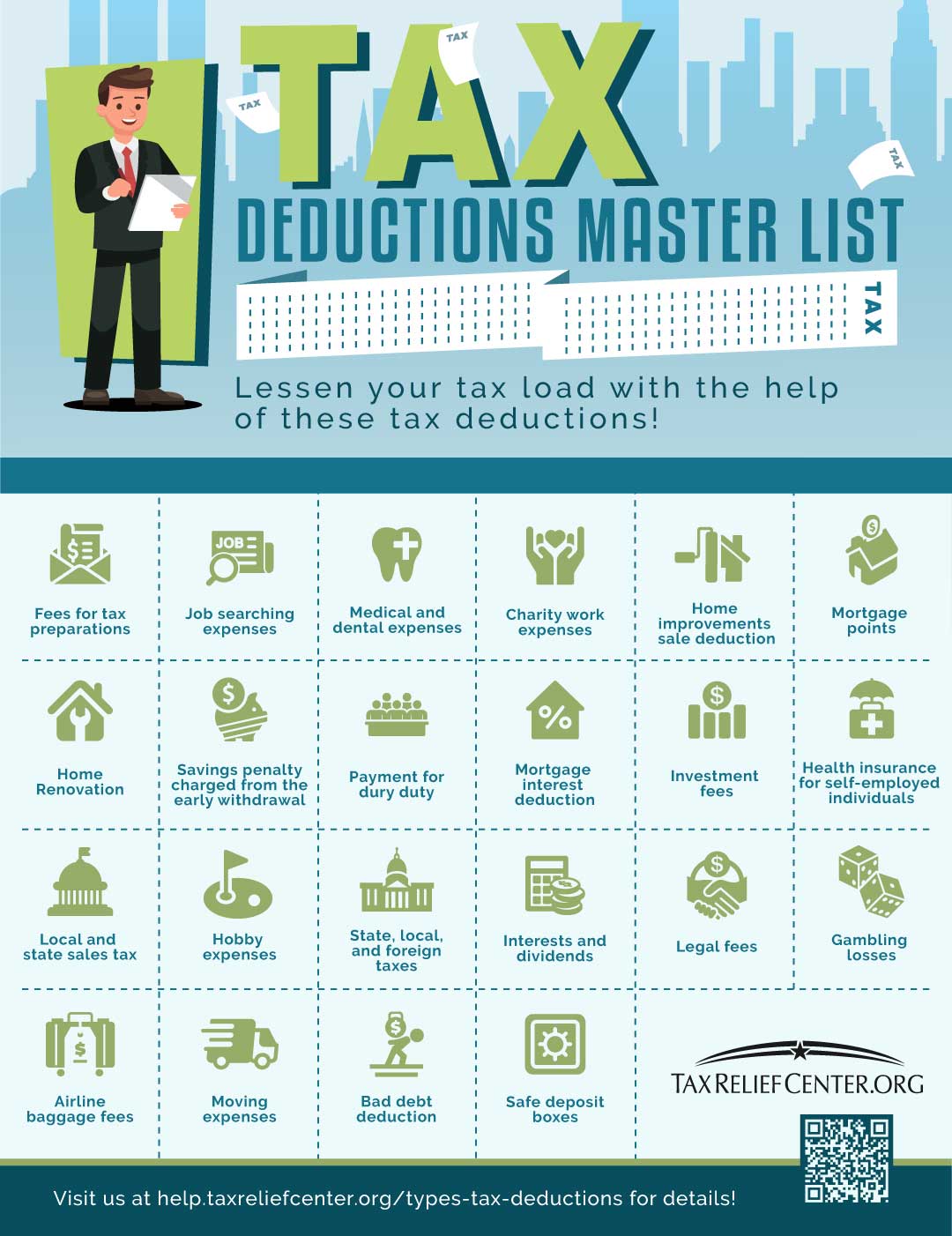

2022 Tax Brackets Pearson Co PC

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The 2023 standard deduction for tax returns filed in 2024 is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of household People 65 or older may be eligible for a

The additional standard deduction for someone who is 65 or older will rise to 1 500 per person from 1 400 in 2022 if that senior is unmarried the additional deduction will be The Internal Revenue Service recently announced its inflation adjustments to the standard deduction and federal income tax brackets for 2023 Knowing these numbers can allow you to make some

Download Federal Tax Deductions 2023

More picture related to Federal Tax Deductions 2023

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

What s the 2023 Standard Deduction Most people claim the standard deduction on their federal tax return instead of itemizing deductions How much can you claim for 2023 and 2024 IRS announces tax year 2023 changes to the standard deduction EITC and more Read the Article Written by Intuit Accountants Team Modified Nov 3 2022 5 min read With inflation rates being the highest in several decades the IRS announced inflation adjustments for tax year 2023

Here s what you can take on your 2023 federal income tax return The Standard Deduction and Personal Exemptions The standard deduction for 2023 is 13 850 for individuals and 27 700 for married people filing jointly up from 12 950 and 25 900 respectively in 2022 Federal Income Tax Calculator Tax Return and Refund Estimator 2023 2024 Estimate your 2023 2024 federal taxes with our free income tax calculator and refund estimator Input your

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

https://www.nerdwallet.com/article/taxes/tax-deductions-tax-breaks

Advertiser disclosure 20 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly

https://www.irs.gov/newsroom/irs-provides-tax...

For single taxpayers and married individuals filing separately the standard deduction rises to 13 850 for 2023 up 900 and for heads of households the standard deduction will be 20 800 for tax year 2023 up 1 400 from the amount for tax year 2022

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Federal Tax Brackets And Standard Deduction Printable Form

Tax Rates Absolute Accounting Services

10 Business Tax Deductions Worksheet Worksheeto

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

What Is The Standard Deduction For 2021

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Tables 2018 Computerfasr

Federal Tax Deductions 2023 - February 23 2023 The IRS Announces New Tax Numbers for 2023 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts