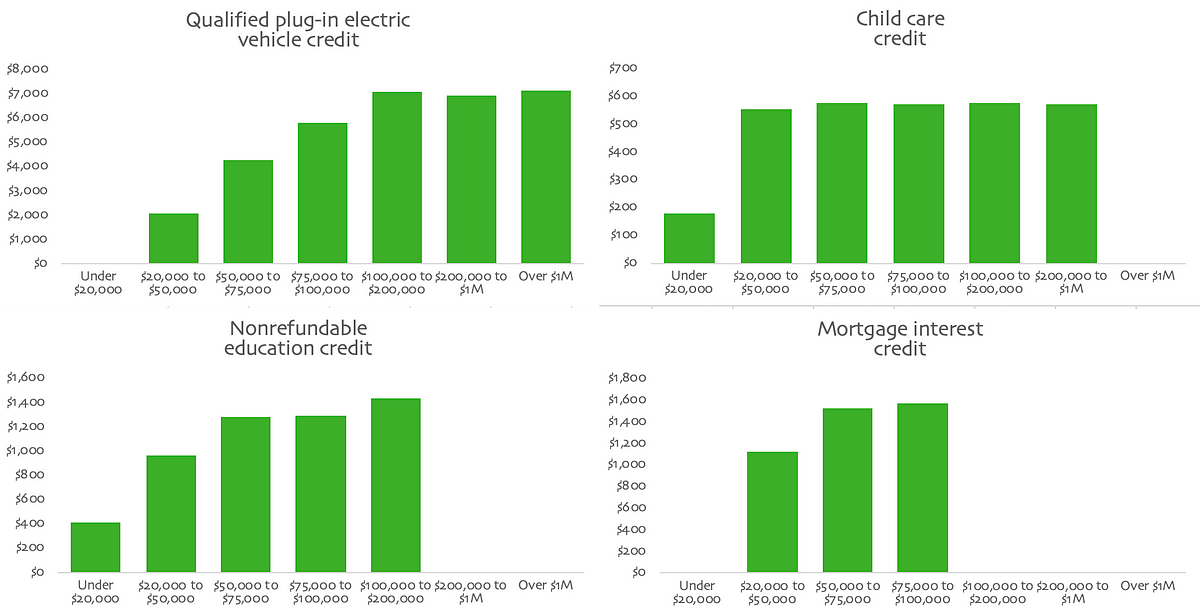

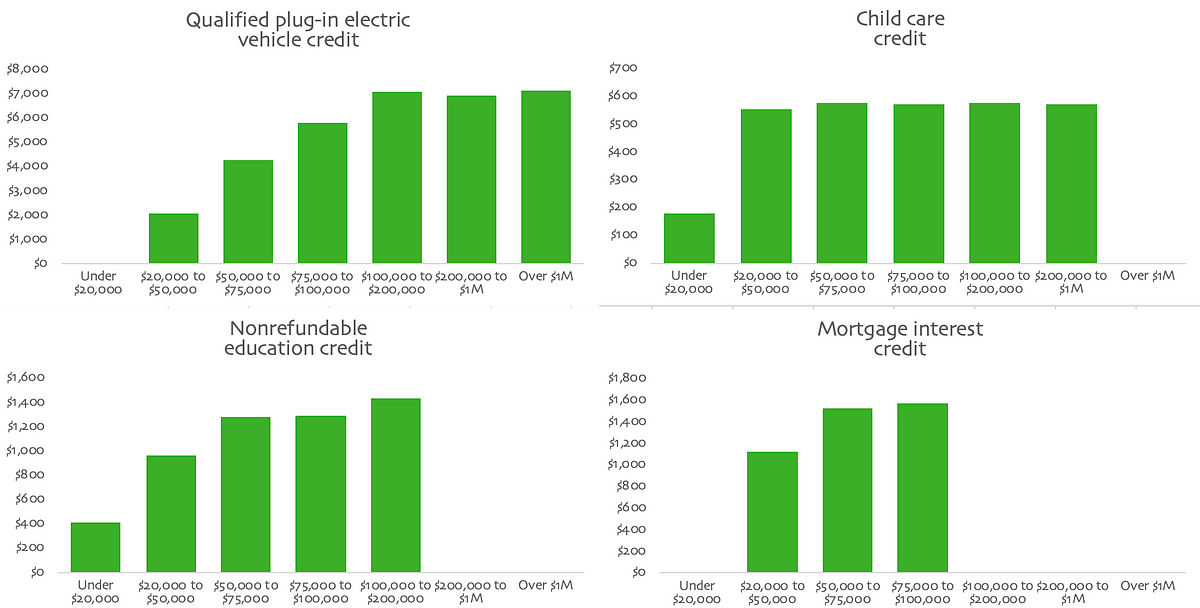

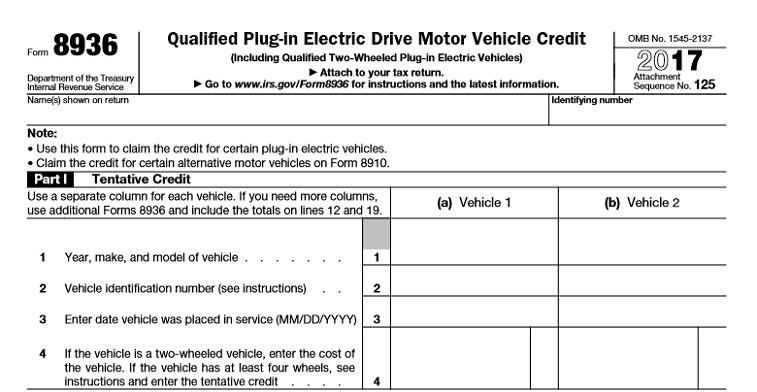

Federal Tax Rebates For Electric Vehicles Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only Web 7 janv 2023 nbsp 0183 32 For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some

Federal Tax Rebates For Electric Vehicles

Federal Tax Rebates For Electric Vehicles

https://miro.medium.com/max/1200/1*cP2UYTDcx9sKAmw8O3hEtw.png

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/2022-tax-brackets-jeanxyzander-5.jpg

Federal Electric Car Rebate Rules ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-make-buying-an-electric-vehicle-more-affordable-2.png

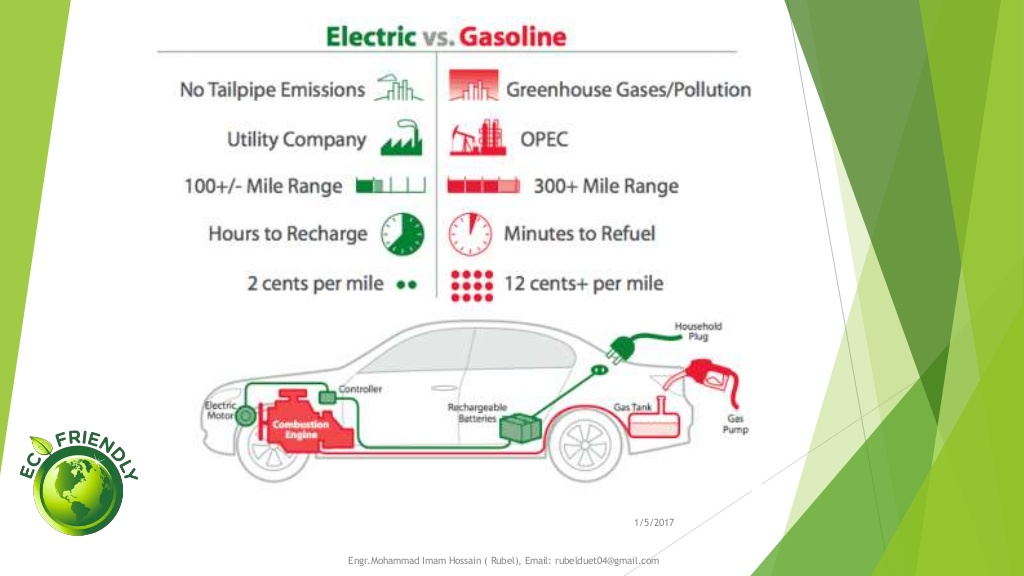

Web 7 sept 2023 nbsp 0183 32 The Treasury Department has released updated rules for electric car buyers this time related to where EV battery components and minerals come Web 22 ao 251 t 2022 nbsp 0183 32 The Biden administration s climate and health care bill revamps the available tax credits for buyers of electric cars Here s what to know about how they work

Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s Web 5 sept 2023 nbsp 0183 32 The EV tax credit income limit for married couples filing jointly is 300 000 And if you file as head of household and make more than 225 000 you also won t be

Download Federal Tax Rebates For Electric Vehicles

More picture related to Federal Tax Rebates For Electric Vehicles

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

2022 Tax Rebate For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-4.jpg

Electric Vehicle EV Incentives Rebates

https://wbmlp.org/docs/rebates/EVs/EV-Tax-Credits-23.png

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used Web 17 ao 251 t 2022 nbsp 0183 32 Plug in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 Save up to 7 500

Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a Web 15 avr 2023 nbsp 0183 32 The 7 500 tax credit is actually two separate credits worth 3 750 each Before April 18 every qualifying vehicle got both credits but now vehicles can qualify for

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

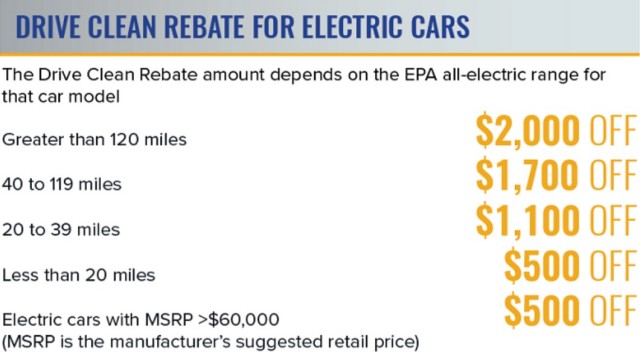

NY 2 000 Electric car Rebate Falls To 500 If It s Over 60K Sorry Tesla

https://images.hgmsites.net/med/new-york-state-drive-clean-electric-car-rebate-program-amounts-march-2017_100596542_m.jpg

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.bloomberg.com/news/articles/2022-05-07/what-to-know-about...

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Federal Rebate For Electric Cars FederalProTalk

Electric Car Available Rebates 2023 Carrebate

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Federal Tax Rebates Electric Vehicles ElectricRebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Illinois Electric Vehicle Rebate PaymentGrant Refund Cheque Funny

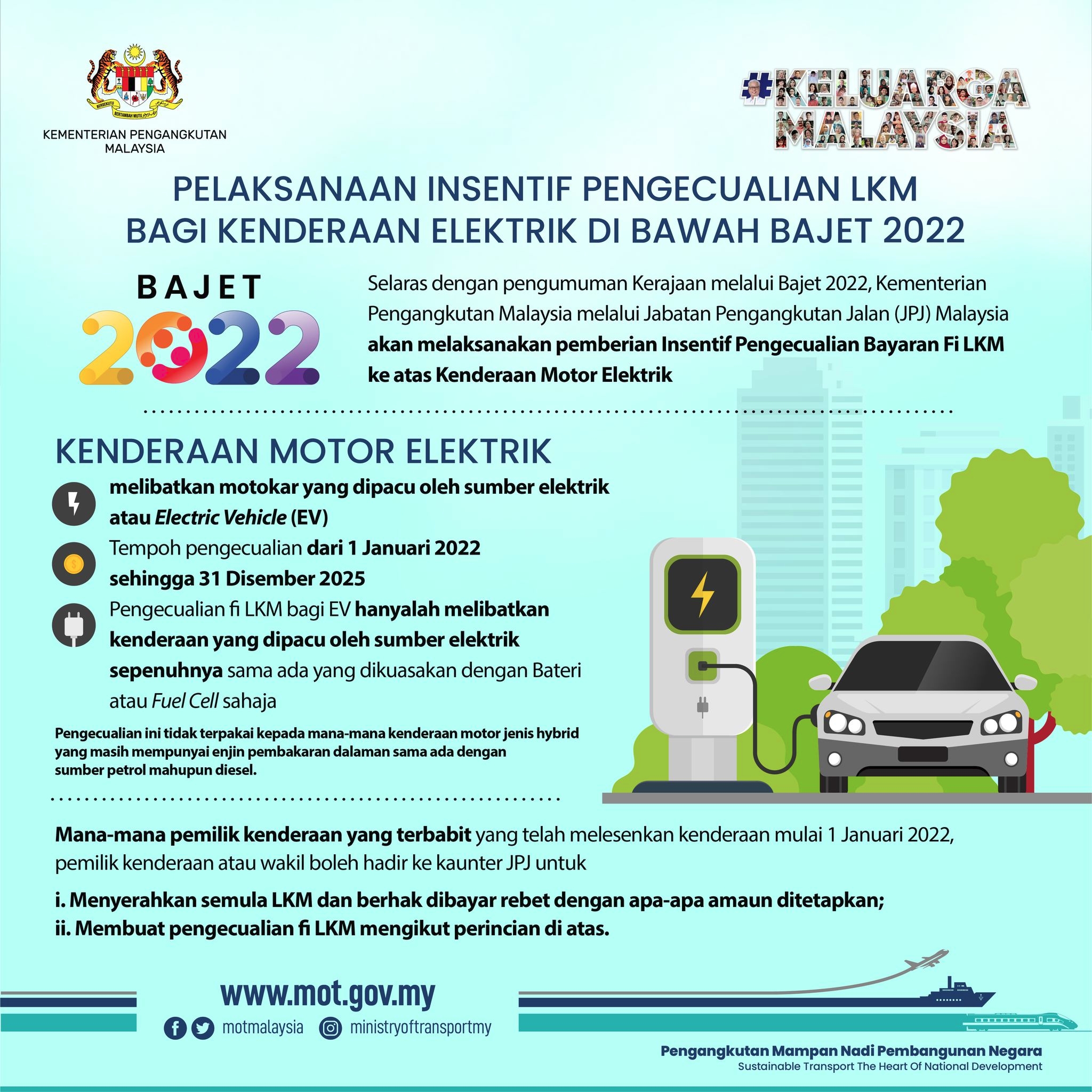

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

Federal Tax Rebates For Electric Vehicles - Web 7 sept 2023 nbsp 0183 32 The Treasury Department has released updated rules for electric car buyers this time related to where EV battery components and minerals come