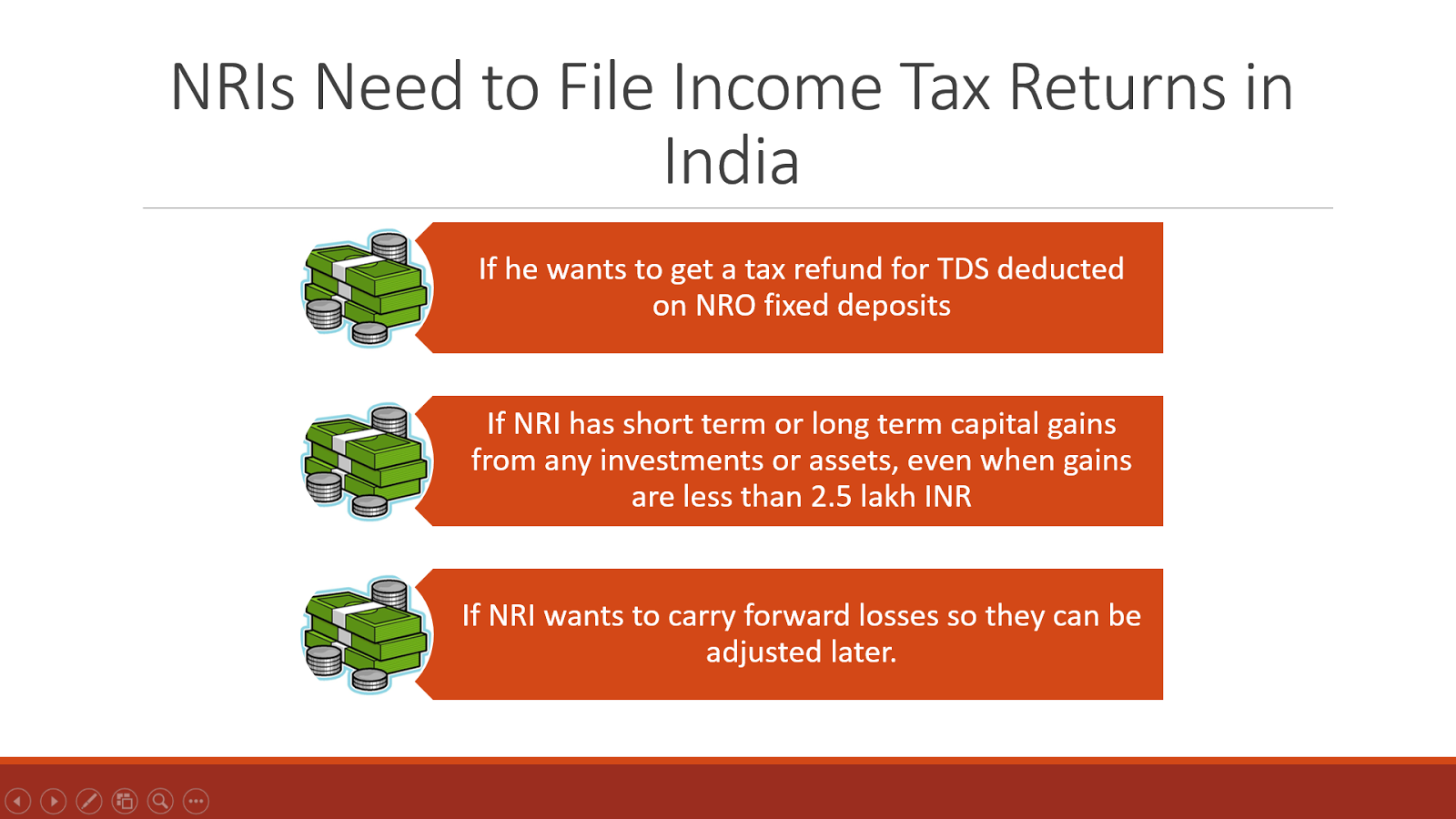

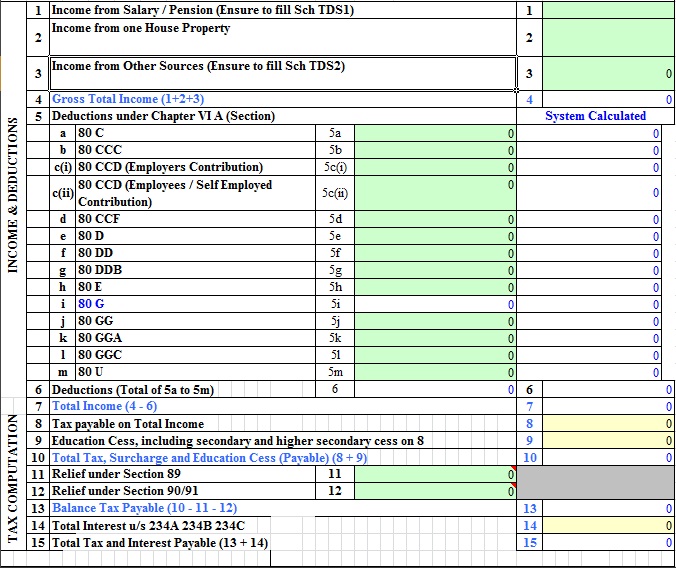

File Income Tax Return India Nri Verkko 28 maalisk 2023 nbsp 0183 32 July 31st is the last date to file income tax returns in India for NRIs unless the government extends it Do NRIs have to pay advance tax If NRIs tax liability exceeds Rs 10 000 in a financial year they must pay advance tax

Verkko Money received or deemed to be received in India is taxable In this article we will look at steps on how to file income tax return for NRI 1 Determine your residential status The first step is to be sure of your residential status Verkko Filing of Form 10 IC for AY 2021 22 has been enabled as per Circular no 19 of 2023 dated 23rd October 2023 1 According to the RBI Notification in the case of non individuals a Legal Entity Identifier LEI No is required

File Income Tax Return India Nri

File Income Tax Return India Nri

https://3.bp.blogspot.com/-belHOjns_24/WU4jBCMvAkI/AAAAAAAAI58/mAjeSm5dHC4fjmJLHJmeNwdr5o2j_0gIQCLcBGAs/s1600/Income%2Btax%2Bslab%2Brates%2B2017.png

A Complete Guide On NRI Income Tax Return Filing In India Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/08/nri-2048x1072.png

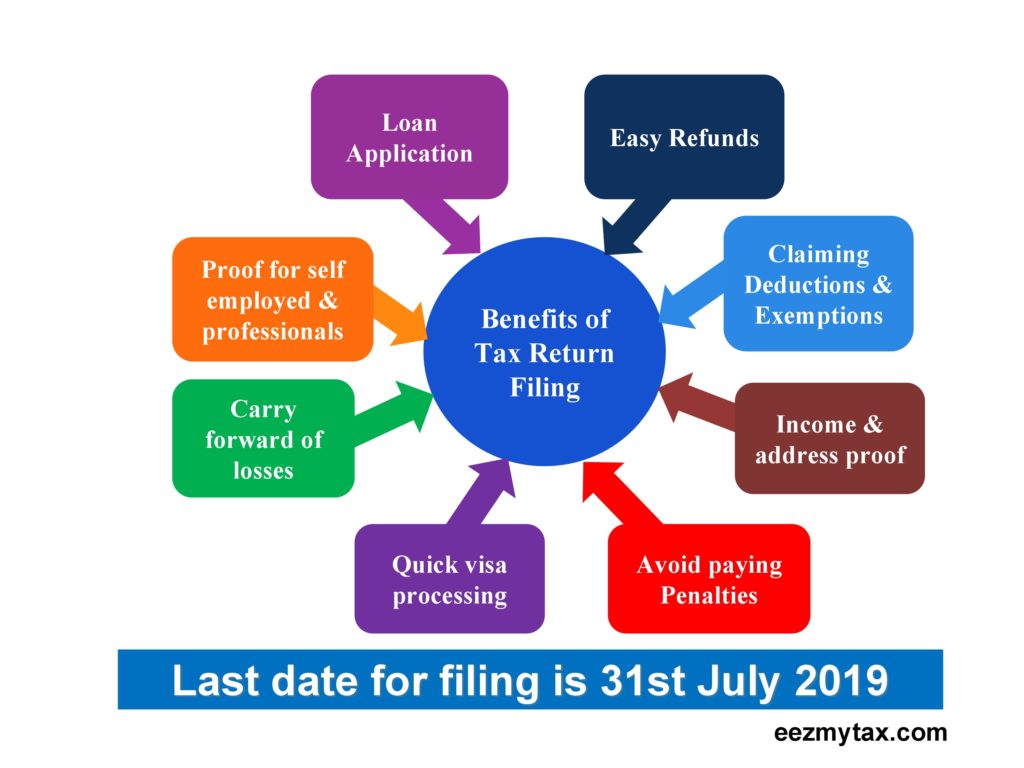

8 Reasons To File Income Tax Return In India Eezmytax NRI Tax Services

https://eezmytax.com/wp-content/uploads/2019/06/benefits-of-ITR-1024x768.jpg

Verkko How to File Income Tax Returns for NRI 27 September 2023 7 min read Picture this You have just moved abroad from India and now working at a renowned MNC while holding an NRI status You are now earning a decent income with a bunch of amazing perks and having the best time of your life But wait what about your taxes Verkko You can file income tax return online from anywhere in the world You can now e verify your ITR from anywhere You can send signed copy of ITR V to the CPC Income Tax Department Bengaluru or e verify the same within 30

Verkko 16 maalisk 2020 nbsp 0183 32 Procedure for Filing Return NRIs can easily file their income tax return online In addition to e filing they can also file through the following methods Furnishing the return electronically using a digital signature DSC Transmitting the income tax data in the return electronically under electronic verification code Verkko 28 jouluk 2023 nbsp 0183 32 Yes an NRI has to file an income tax return in India on income earned in India NRIs have to pay tax on income that accrues or arises in India NRIs also need to pay tax on income which is deemed to accrue or arise in India

Download File Income Tax Return India Nri

More picture related to File Income Tax Return India Nri

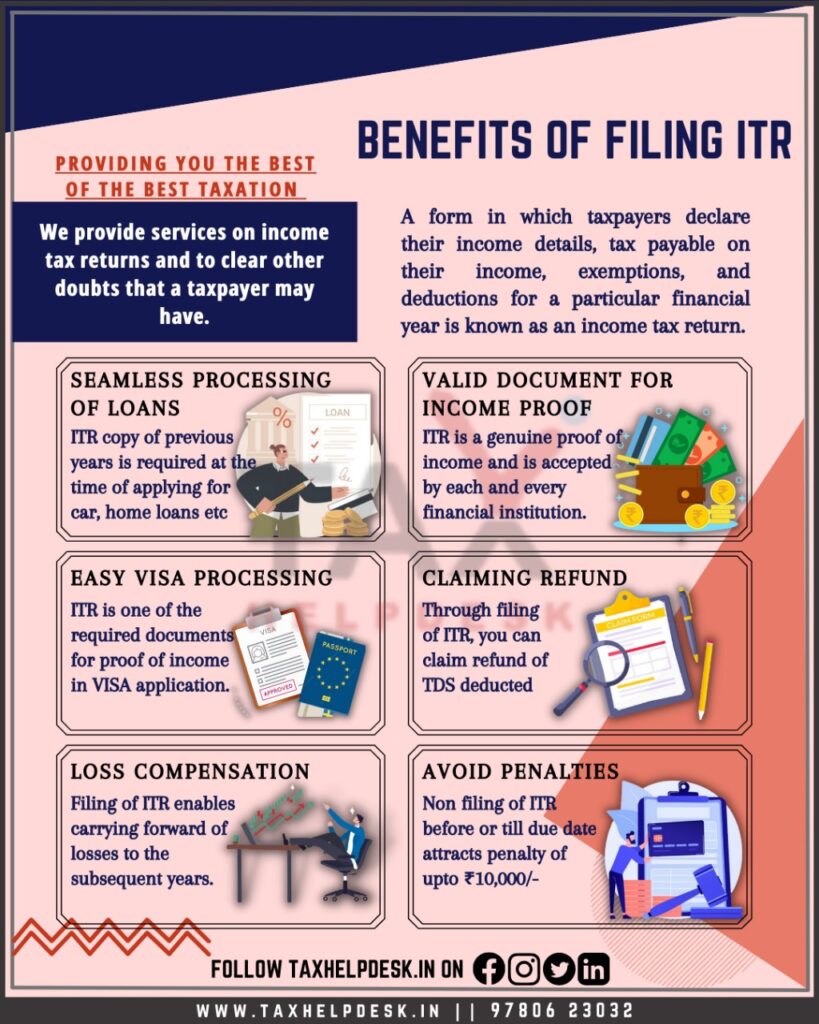

7 Reasons Why You File Your Income Tax Return In India TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/12/benefits-of-filing-income-tax-return-2-819x1024.jpeg

How To File Income Tax Returns In India Easyaccountax

https://www.easy-gst.in/wp-content/uploads/2019/06/Income-Tax-Return-India.jpg

When Do NRIs Need To Pay Income Tax In India NRI Banking And Saving Tips

https://3.bp.blogspot.com/-nx1BPqm81z0/Vu0M8SZbRGI/AAAAAAAAFKY/KzabNt_JpGw8w_t9Q9Vaztcz0It_eHl4A/s1600/When%2Bdoes%2BNRI%2Bneeds%2Bto%2Bfile%2Bincome%2Btax%2Bin%2BIndia.png

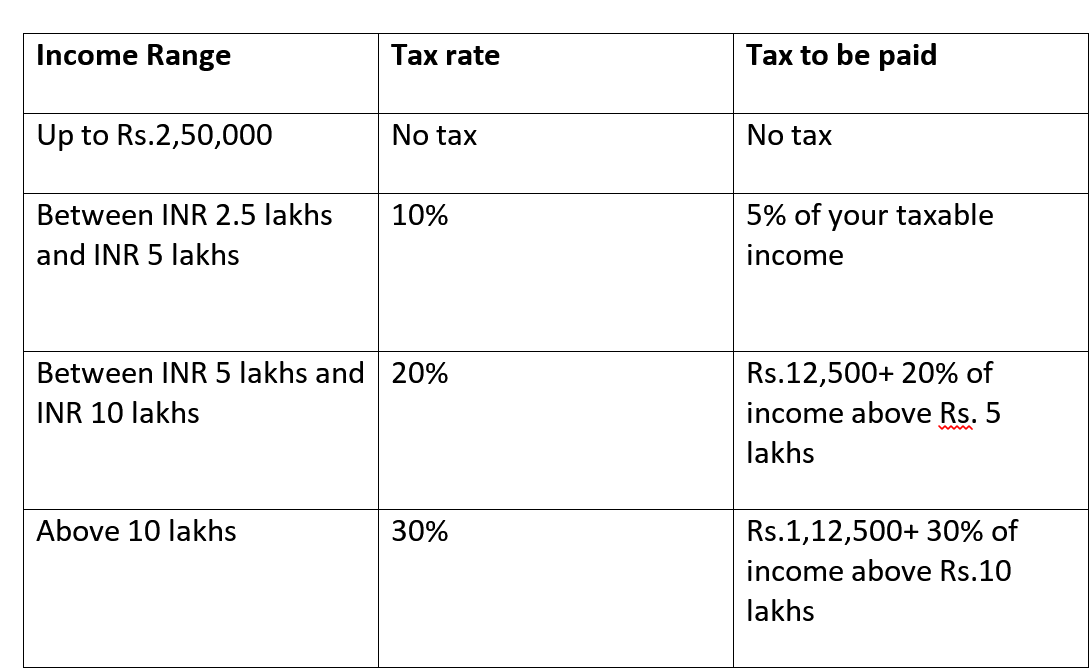

Verkko 16 maalisk 2023 nbsp 0183 32 To file tax offline NRIs must follow the below process Collect and fill the ITR form with required information Submit the filled form with an acknowledgement from to an Income Tax officer The last day for filing income tax returns for NRIs is 31st July for any financial year What are the Documents Required for Tax Filing by an Verkko Tue Jun 27 2023 Filing income tax returns is an important responsibility for all citizens including Non Resident Indians NRIs NRIs are liable to pay income tax in India if their income from sources in India exceeds the basic exemption limit of Rs 2 5 lakh

Verkko 12 syysk 2021 nbsp 0183 32 Almost half of the NRIs 48 per cent who had not filed the ITR mistakenly believed that tax TDS or Tax Deducted at Source which is tax deducted at source of income before paying the Verkko 28 syysk 2023 nbsp 0183 32 Criteria for NRIs to File Income tax Return Incomes Included in the Threshold Limit of Rs 2 5 Lakh Treatment of Exempt Income for Slab Calculation Treatment of Tax Deductions in Slab Calculation Threshold Level of Income for NRI Senior Citizens Benefits of Filing Tax Returns Even if NRIs Annual Income is less

Essential Tips For NRIs While Filing Income Tax Returns In India

https://blog.saginfotech.com/wp-content/uploads/2019/08/tips-nri-while-filing-income-tax-returns.jpg

PPT How Can NRI S File Income Tax Return Online In India 91

https://image4.slideserve.com/7849125/file-income-tax-return-online-in-india-n.jpg

https://cleartax.in/s/income-tax-for-nri

Verkko 28 maalisk 2023 nbsp 0183 32 July 31st is the last date to file income tax returns in India for NRIs unless the government extends it Do NRIs have to pay advance tax If NRIs tax liability exceeds Rs 10 000 in a financial year they must pay advance tax

https://www.hdfcbank.com/.../save/how-to-file-income-tax-for-nri

Verkko Money received or deemed to be received in India is taxable In this article we will look at steps on how to file income tax return for NRI 1 Determine your residential status The first step is to be sure of your residential status

5 Things NRIs Need To Know When Filing Income Tax Returns In India Is

Essential Tips For NRIs While Filing Income Tax Returns In India

Income Tax Planning For An NRI Planning To Return To India AOTAX COM

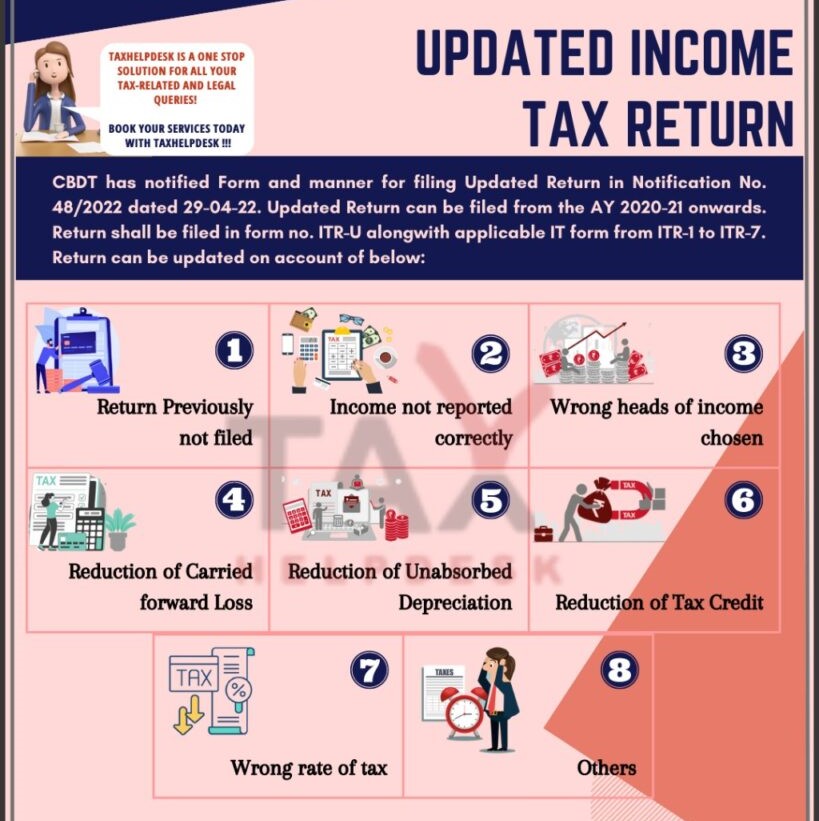

Updated Income Tax Return India Financial Consultancy

Is It Mandatory For NRI To File Income Tax Return In India NRI

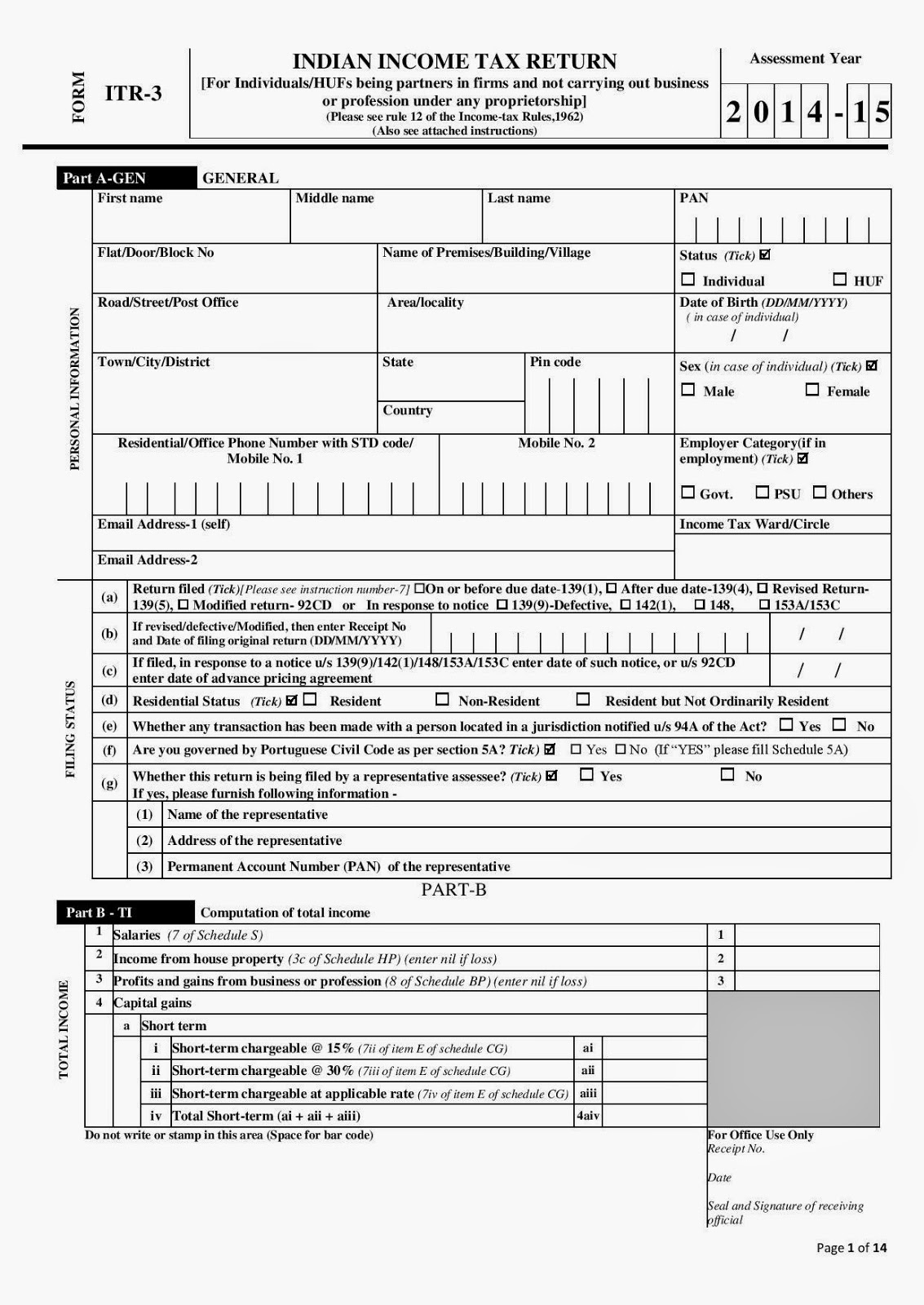

Income Tax For Individual In India File Income Tax Return Online

Income Tax For Individual In India File Income Tax Return Online

Is It Mandatory For NRI To File Income Tax Return In India NRI

Government Announces New Tax Provision For NRIs The Indian Wire

Nri Tax Income Tax News Judgments Act Analysis Tax Planning

File Income Tax Return India Nri - Verkko 16 maalisk 2020 nbsp 0183 32 Procedure for Filing Return NRIs can easily file their income tax return online In addition to e filing they can also file through the following methods Furnishing the return electronically using a digital signature DSC Transmitting the income tax data in the return electronically under electronic verification code