Filing A Recovery Rebate Credit Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Web 13 janv 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your

Filing A Recovery Rebate Credit

Filing A Recovery Rebate Credit

https://theeastcountygazette.com/wp-content/uploads/2022/02/2-20-2-1024x683.jpg

Recovery Rebate Credit Form Printable Rebate Form

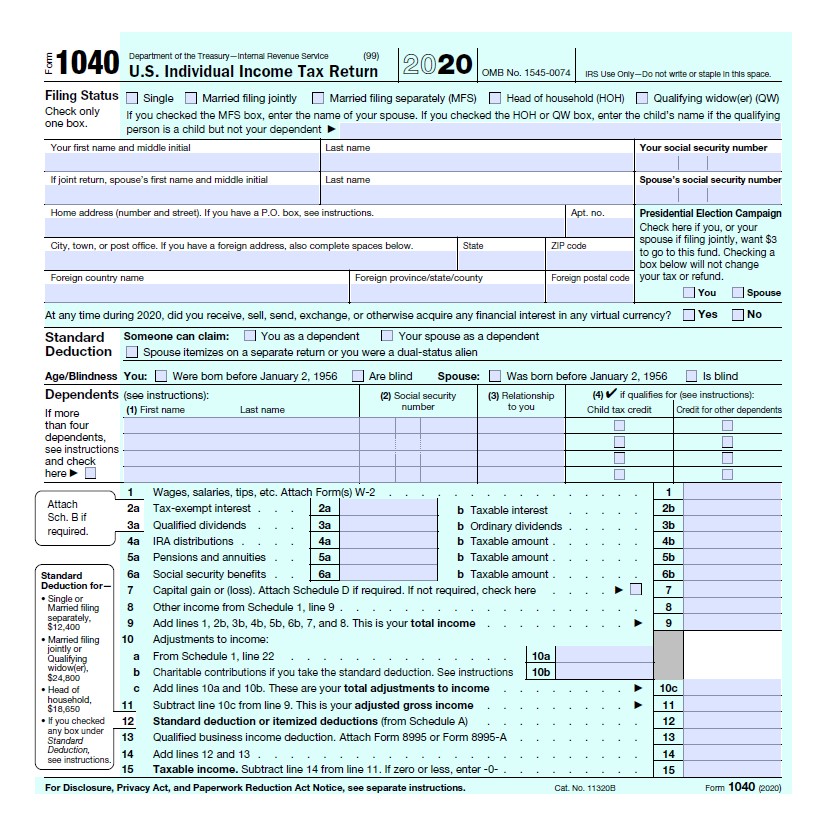

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

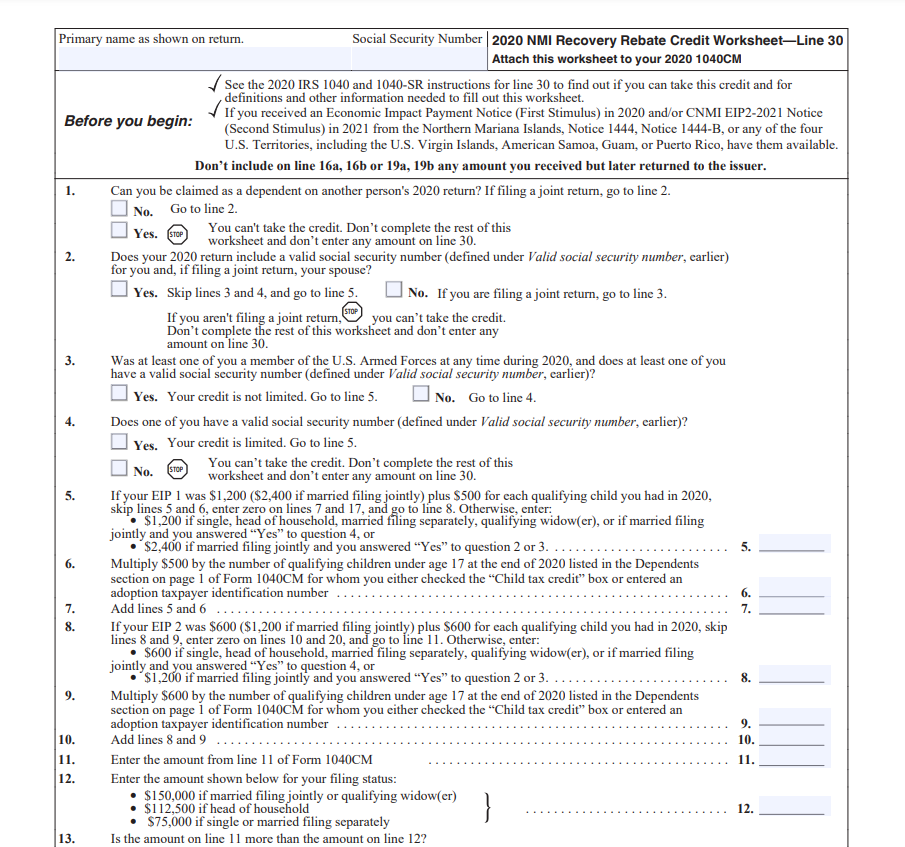

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

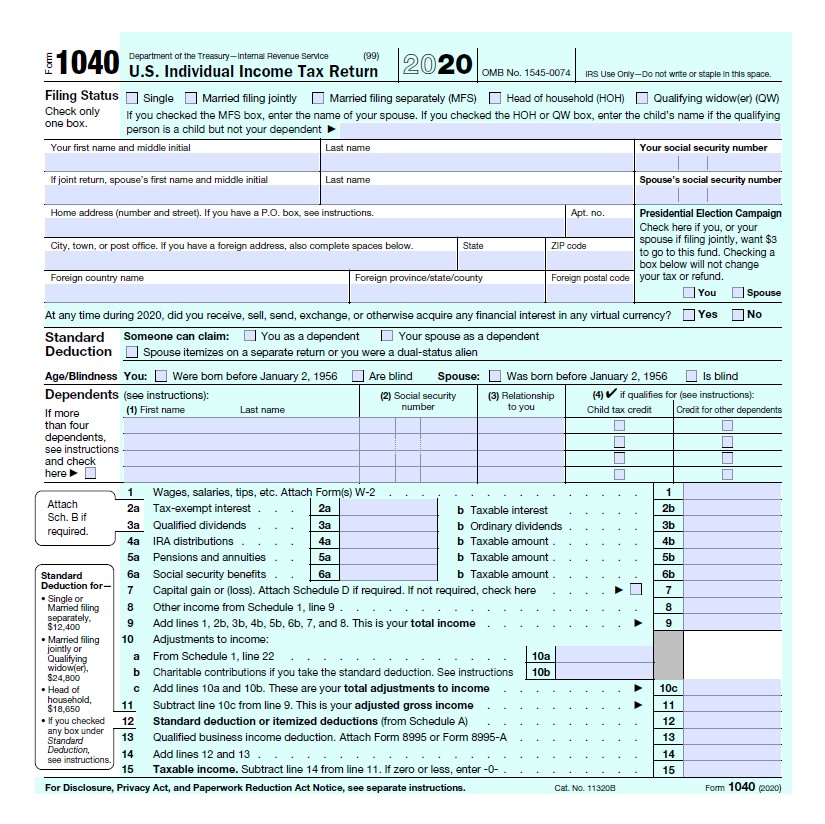

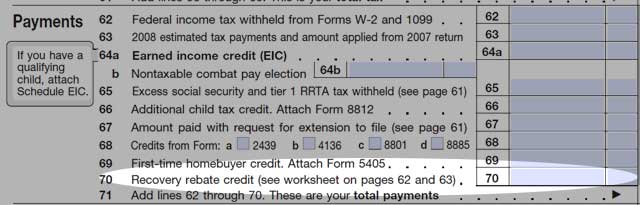

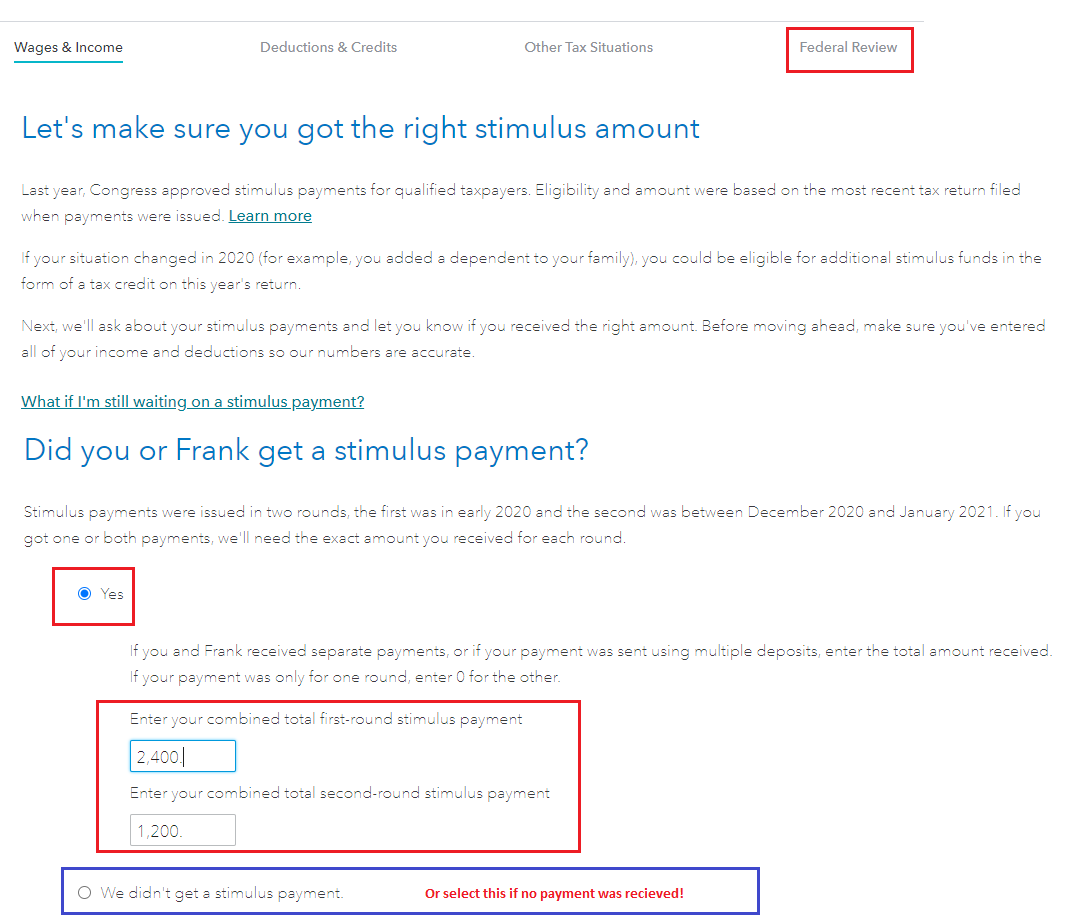

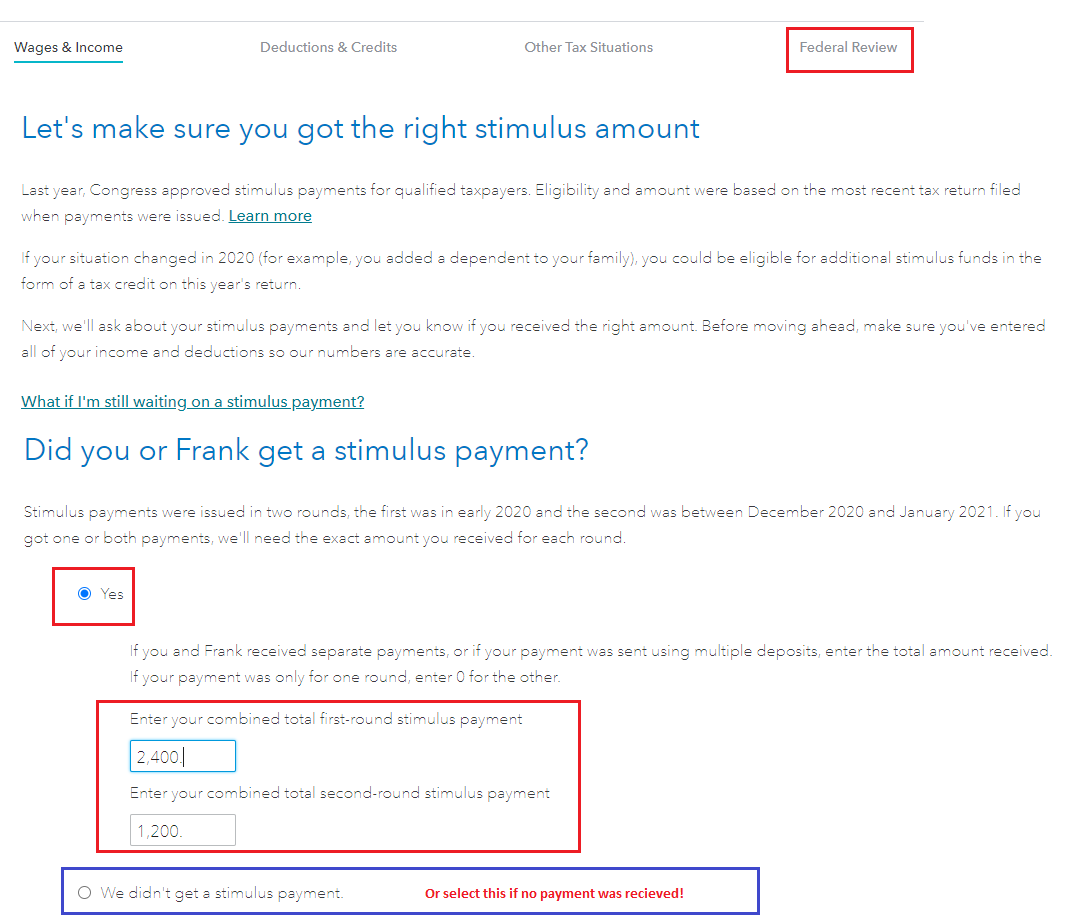

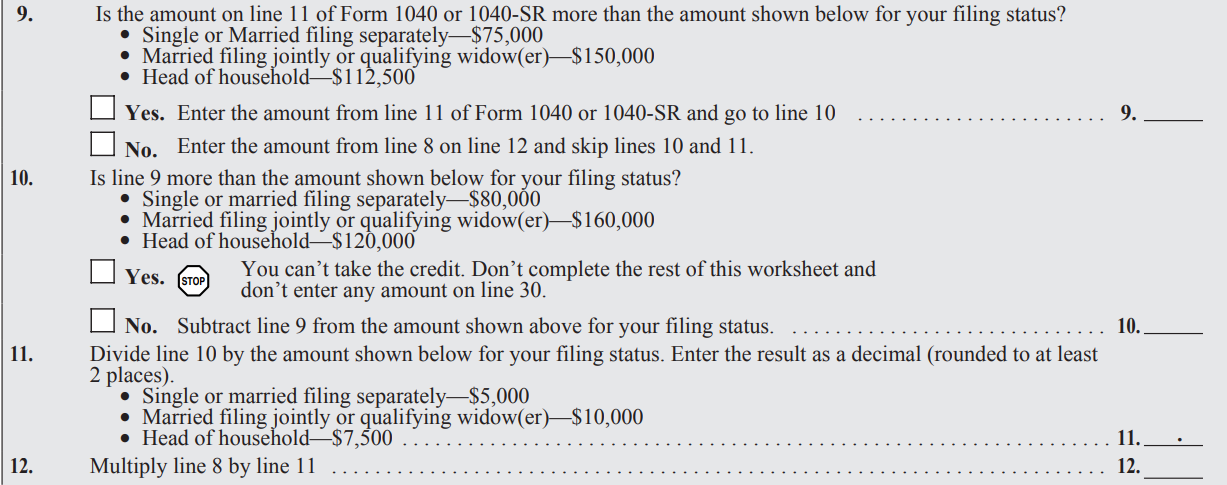

Web 10 d 233 c 2021 nbsp 0183 32 A1 If you re eligible you must file a 2020 tax return to claim the 2020 Recovery Rebate Credit even if you usually don t file a tax return You will need the amount of all first and second Economic Impact Payments to calculate the 2020 Web 10 d 233 c 2021 nbsp 0183 32 You should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the Recovery Rebate Credit on your 2020 tax return If you filed a 2020 tax return and didn t claim the credit on your return

Web 17 ao 251 t 2022 nbsp 0183 32 What Was the Recovery Rebate Credit The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return to claim it

Download Filing A Recovery Rebate Credit

More picture related to Filing A Recovery Rebate Credit

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

https://cdn.abcotvs.com/dip/images/9476384_recoery-rebate.jpg?w=1600

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Web 14 janv 2022 nbsp 0183 32 The recovery rebate credit for the 2021 tax year as for 2020 must be netted against any economic impact payment EIP a taxpayer and or spouse if filing jointly received during the year The 2021 EIP was the third such payment which the

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/strategies-to-maximize-the-2021-recovery-rebate-credit-18.png

Recovery Rebate Credit Calculator EireneIgnacy

https://lh6.googleusercontent.com/Qoc-LsvQE_Hrk4sCK81_YK2YswLbZbUmIoLEi4oo5uAaw4dZngGuuNO-IQNyEdOdl0H9yPVlnHHDqNB2djDUBQTkYTGx1DCFYtGrMm9WPqVxSZy8nFUW9fEITndcDxTP3yex1Ymy

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

The Recovery Rebate Credit Calculator MollieAilie

Filing A Recovery Rebate Credit - Web 10 d 233 c 2021 nbsp 0183 32 A1 If you re eligible you must file a 2020 tax return to claim the 2020 Recovery Rebate Credit even if you usually don t file a tax return You will need the amount of all first and second Economic Impact Payments to calculate the 2020