Film Tax Incentives Malaysia Incentive 30 35 RebateLabor Resident ATL 30 Resident BTL 30 Non Resident ATL 30 Non Resident BTL 30 Qualified Spend Spend 30 Expenditure

The National Film Development Corporation Malaysia is the central government agency for the film industry in Malaysia The tax treatment of the film industry falls under the Incentives Before you start filming in malaysia make sure you are aware of all the tax breaks incentives as well as the best film locations using KFTV

Film Tax Incentives Malaysia

Film Tax Incentives Malaysia

https://www.kankakeecountyed.org/wp-content/uploads/shutterstock_667165351.jpg

Tax Incentives Under Malaysia s Budget 2023

https://www.aseanbriefing.com/news/wp-content/uploads/2023/03/Tax-Incentives-Under-Malaysias-Budget-2023.jpg

Tax Incentives In Malaysia The Star

https://apicms.thestar.com.my/uploads/images/2021/03/01/1060597.JPG

Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions Generally tax incentives are available for tax resident 75 tax rebate calculated on Total Fiji Expenditure The applicant for rebate must meet all the requirements for Film Tax Rebate set out under Regulation 6 of the Fiji Income Tax Film making and Audio Visual

Furthermore following input received from the Jelajah Belanjawan MADANI in Johor the government plans to introduce a special tax rate for film production Film in Malaysia Incentive Plus FIMI is a 30 cash rebates on all Qualifying Malaysian Production Expenditure QMPE film production activity in Malaysia for clients of

Download Film Tax Incentives Malaysia

More picture related to Film Tax Incentives Malaysia

TAX INCENTIVES SA EMPLOYERS NA TATANGGAP NG K 12 GRADUATES The POST

https://the-post-assets.sgp1.digitaloceanspaces.com/2020/10/TAX-INCENTIVES-K-12.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

TAX INCENTIVES FOR GREEN TECHNOLOGY FOR A MORE SUSTAINABLE FUTURE I2

https://i2energy.my/wp-content/uploads/2021/04/news-taxincentives-by-mida.jpg

The Malaysia Government introduced the Film In Malaysia Incentive FIMI a 30 cash rebate on all qualifying Malaysian Production Expenditure QMPE to provide an The Malaysia Government introduced the Film In Malaysia Incentive FIMI a 30 cash rebate on all qualifying Malaysian Production Expenditure QMPE to provide an

It is proposed that a special Income Tax rate ranging from 0 to 10 will be granted to film production companies foreign actors and film crews who carry out filming KUALA LUMPUR July 2 The Film in Malaysia Incentive Fimi is aiming to make Malaysia a hub for international film production in the near future This follows the

Tax Incentives Tax Reliefs In Malaysia Paul Hype Page

https://www.paulhypepage.my/wp-content/uploads/2020/05/Tax-Incentives-Tax-Reliefs-in-Malaysia.svg

Car Tax Reduction Malaysia

https://assets.autobuzz.my/wp-content/uploads/2021/10/29183115/2021-Budget-2022-ST-Exempt-Extended-4.jpg

https://www.ep.com/production-incentives/asia/malaysia

Incentive 30 35 RebateLabor Resident ATL 30 Resident BTL 30 Non Resident ATL 30 Non Resident BTL 30 Qualified Spend Spend 30 Expenditure

https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2023/...

The National Film Development Corporation Malaysia is the central government agency for the film industry in Malaysia The tax treatment of the film industry falls under the

Malaysia Expands Tax Incentives For Companies To Set Centers There

Tax Incentives Tax Reliefs In Malaysia Paul Hype Page

Incentives In Rescheduling Payments In Accordance With Emergency

Study Says Film Tax Credits Have No Economic Benefits Daily Trojan

2020 Charitable Giving Tax Incentives

PDF Tax Incentives In Indonesia During The COVID 19 Pandemic

PDF Tax Incentives In Indonesia During The COVID 19 Pandemic

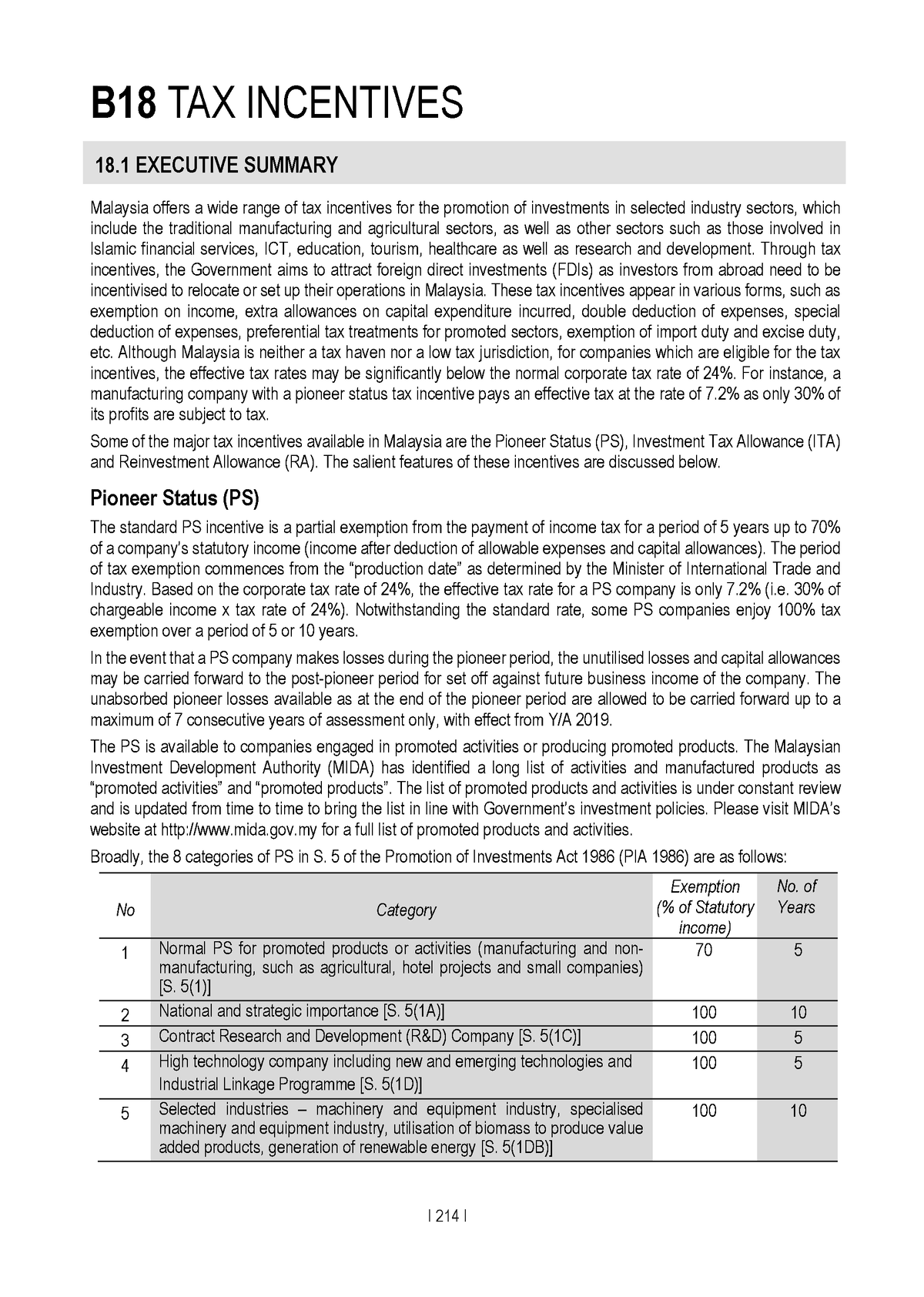

Tax Incentives MIA B18 TAX INCENTIVES Malaysia Offers A Wide Range Of

Do Tax Incentives For Big Business Really Spur The Economy The Lars

SEVEN ISLANDS FILM Tax Incentives

Film Tax Incentives Malaysia - Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions Generally tax incentives are available for tax resident