First Recovery Rebate Credit Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Web The IRS has issued all first second and third Economic Impact Payments Most eligible people already received their Economic Impact Payments People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to

First Recovery Rebate Credit

First Recovery Rebate Credit

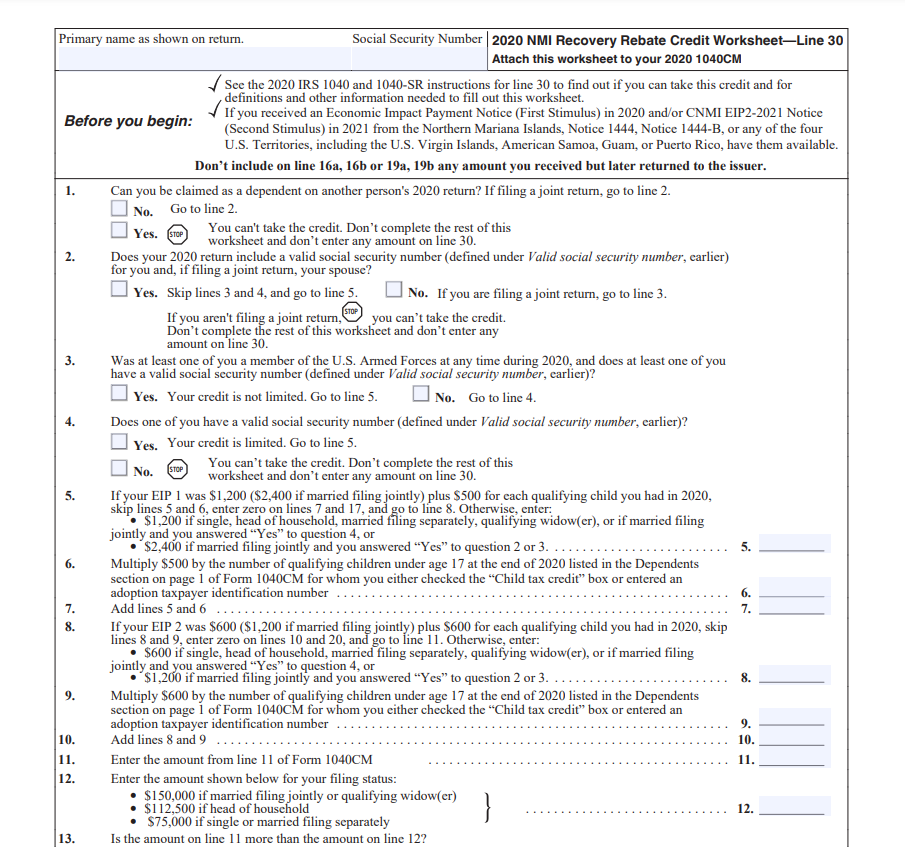

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Recovery Rebate Credit Form Printable Rebate Form

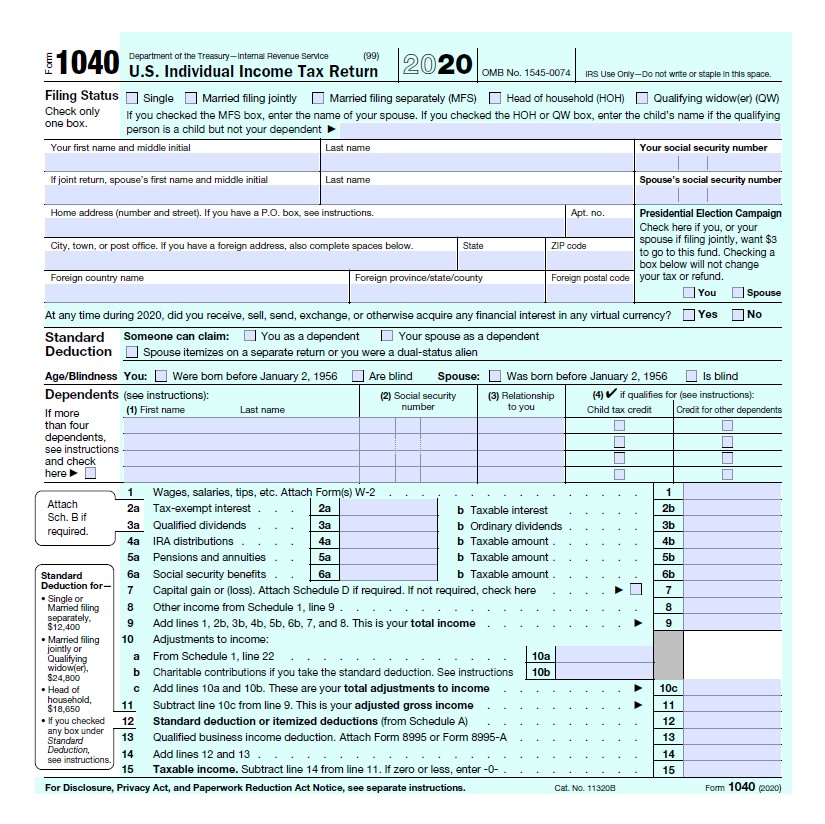

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full First and Second Payments Claim the 2020 Recovery Rebate Credit You may be eligible to claim the 2020 Recovery Rebate Credit by filing a 2020 tax return Claim 2020 Web 29 mars 2021 nbsp 0183 32 This tax season a recovery rebate credit has been added to returns in order for people to file for any unpaid stimulus check funds But you need to send in a 2020 federal tax return in order

Download First Recovery Rebate Credit

More picture related to First Recovery Rebate Credit

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-1.jpg?w=1280&ssl=1

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim the RRC on your 2020 Form 1040 U S Individual Income Tax Return or Form 1040 SR

Web A1 2020 Recovery Rebate Credit The first two rounds of Economic Impact Payments were advance payments of 2020 Recovery Rebate Credits claimed on a 2020 tax return The IRS issued the first and second rounds of Economic Impact Payments in 2020 and Web 30 mars 2022 nbsp 0183 32 quot Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money quot the IRS said in its fact sheet To see if you are eligible for a payment you

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-youtube.jpg

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-f...

Web 10 d 233 c 2021 nbsp 0183 32 You were issued the full amount of the 2020 Recovery Rebate Credit if the first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 and the second Economic Impact Payment was

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

How To Figure The Recovery Rebate Credit Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

Irs Recovery Rebate Credit For College Students IRSUKA Recovery Rebate

First Recovery Rebate Credit - Web 27 avr 2023 nbsp 0183 32 If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers