First Time Homebuyer Tax Credit Passed The First Time Homebuyer Act was introduced by U S Reps Earl Blumenauer D Ore and Jimmy Panetta D Calif in April 2021 The bill is designed to provide a tax credit for first time buyers

The Biden First Time Homebuyer Act of 2021 is a bill that would provide a refundable tax credit of up to 15 000 for first time home buyers The proposed law seeks to revive and update a 2008 tax A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law Bills numbers restart every two years That means

First Time Homebuyer Tax Credit Passed

.png)

First Time Homebuyer Tax Credit Passed

https://www.nsktglobal.com/static/images/homebuyer tax credit (1).png

New Start Advice For First Time Home Buyers In Washington State

https://www.urbannw.com/blog/wp-content/uploads/2022/03/IMG_5673-1-edited.jpg

What Is The First Time Homebuyer Tax Credit SoFi

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SOHL1121063_1560x880_desktop.jpg

The first time homebuyer tax credit was an Obama era tax credit that no longer exists Here s what it did and which tax benefits homeowners can still use First time homebuyer credit a Allowance of credit In the case of an individual who is a first time homebuyer of a principal residence in the United States during a taxable

Passed into law expired 2021 First Time Homebuyer Act Not yet signed into law this act intends to pay first time buyers a tax refund of 10 of a home s purchase price up to 15 000 For the purposes of the The summary below was written by the Congressional Research Service which is a nonpartisan division of the Library of Congress and was published on Jul 6 2021 First Time Homebuyer

Download First Time Homebuyer Tax Credit Passed

More picture related to First Time Homebuyer Tax Credit Passed

First Time Homebuyer Tax Credit 2022 All That You Need To Know

https://apostolohomes.com/wp-content/uploads/2022/07/Cover-Photo.jpg

What Is The First Time Homebuyer Tax Credit Does It Still Exist

https://i.pinimg.com/736x/43/68/48/4368485612ee4c7e36e107dcc8a68d06.jpg

BUYING YOUR FIRST HOME You May Want To WAIT Biden s 15k First Time

https://i.ytimg.com/vi/MAkaW8BG-cc/maxresdefault.jpg

The first time homebuyer tax credit refers to a tax credit given in tax years 2008 2009 and 2010 worth up to 8 000 It s possible the term may also be used in the future as legislation for a new first time homebuyer tax The First Time Homebuyer Act Introduced in the House of Representatives in April by Rep Earl Blumenauer and Rep Jimmy Panetta the First Time Homebuyer Act would establish a refundable tax credit of 10 of

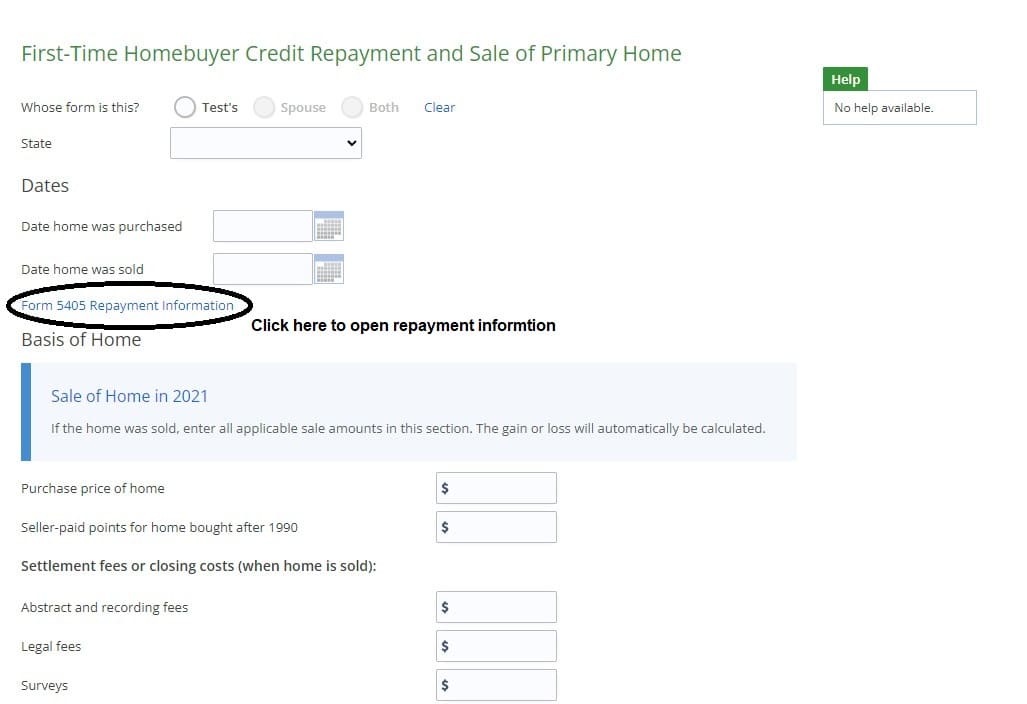

ZIP Code 3 Check your account Go to our First Time Homebuyer Credit account look up to receive Balance of your First Time Homebuyer Credit Amount you paid back to date Total Display Date March 22 2024 A tax credit for first time homebuyers could be an important step towards restructuring the way the US subsidizes home ownership But the version President

How The First time Homebuyer Tax Credit Worked HowStuffWorks

https://media.hswstatic.com/eyJidWNrZXQiOiJjb250ZW50Lmhzd3N0YXRpYy5jb20iLCJrZXkiOiJnaWZcL2hvbWVidXllci10YXgtY3JlZGl0LW9yaWcuanBnIiwiZWRpdHMiOnsicmVzaXplIjp7IndpZHRoIjoiMTIwMCJ9fX0=

Homebuyer Tax Credit

https://info.gonewhampshirehousing.com/hs-fs/hubfs/2018 AdWords/img_640x425@2x_tax_credit.jpg?width=1280&name=img_640x425@2x_tax_credit.jpg

.png?w=186)

https://www.cnn.com › cnn-underscore…

The First Time Homebuyer Act was introduced by U S Reps Earl Blumenauer D Ore and Jimmy Panetta D Calif in April 2021 The bill is designed to provide a tax credit for first time buyers

https://themortgagereports.com

The Biden First Time Homebuyer Act of 2021 is a bill that would provide a refundable tax credit of up to 15 000 for first time home buyers The proposed law seeks to revive and update a 2008 tax

First Time Homebuyer Tax Incentives All You Need To Know About

How The First time Homebuyer Tax Credit Worked HowStuffWorks

Fred Williams New Home Sales Inc A Military Salute

The Biden First Time Homebuyer Tax Credit How It Works Trelora Real

Bill Passed For First Time Home Buyers Guysinsweatpantz

What A 15k First time Homebuyer Tax Credit Could Mean For Borrowers

What A 15k First time Homebuyer Tax Credit Could Mean For Borrowers

First Time Homebuyer Tax Credit 2021 All Your Questions Answered About

Add IRS Form 5405 To Repay First Time Homebuyer Credit

Biden s First Time Homebuyer Tax Credit Is A Big Improvement Over The

First Time Homebuyer Tax Credit Passed - Passed into law expired 2021 First Time Homebuyer Act Not yet signed into law this act intends to pay first time buyers a tax refund of 10 of a home s purchase price up to 15 000 For the purposes of the