First Year Self Employed Tax Rebate Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay

Web 100 first year allowances you can claim the full amount for certain plant and machinery in the year that it was bought the super deduction or 50 special rate first year Web 13 juil 2023 nbsp 0183 32 Published 13 July 2023 Get emails about this page Contents Before you start Claim online Information you ll need to claim Print this page You may be able to claim

First Year Self Employed Tax Rebate

First Year Self Employed Tax Rebate

https://goselfemployed.co/wp-content/uploads/2023/05/Uniform-tax-rebate.png

Pin On Informational

https://i.pinimg.com/736x/6a/82/a9/6a82a9263061207cba22fd8899508833.jpg

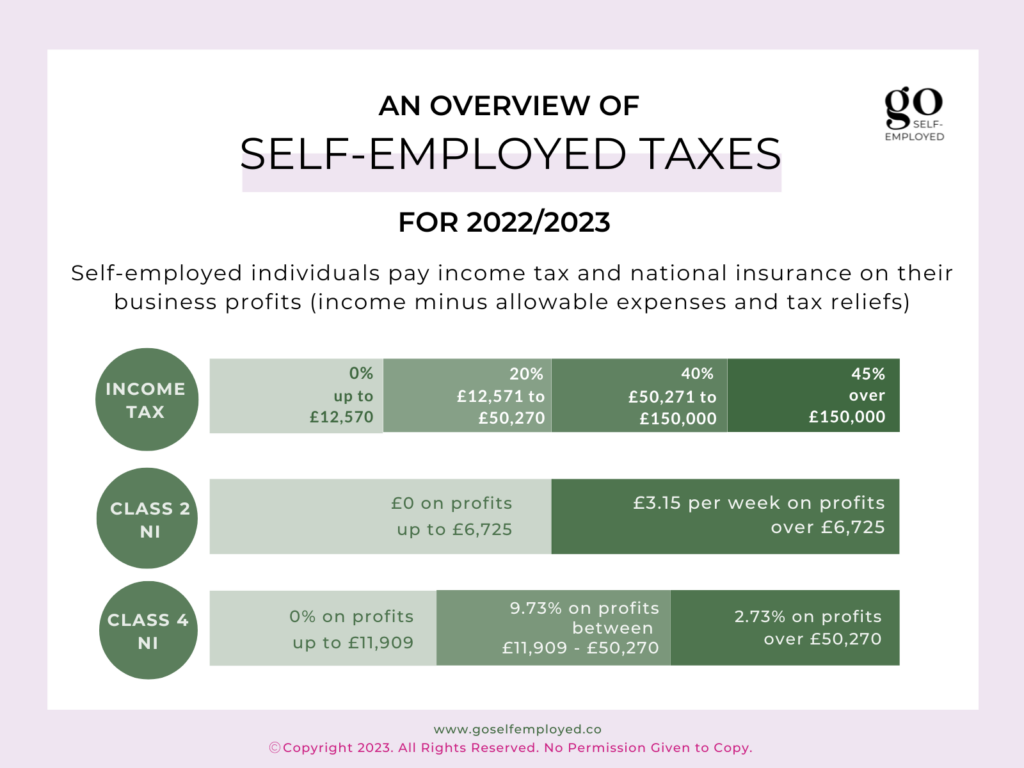

How Self Employment Tax Works Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2020/08/Self-Employed-Tax-Rates-1024x768.png

Web You won t get any working tax credits straight away but if your income changes and you become eligible later in the year your claim can be backdated to when you first applied Web 2 juin 2023 nbsp 0183 32 You can claim a tax credit for the lesser of 200 per day or 67 of your average daily self employment income for the year per day How do I calculate and claim these tax credits quot Average daily self

Web 25 ao 251 t 2023 nbsp 0183 32 If you re self employed you ll pay income tax in a different way to employed workers as it s charged on your profits rather than your gross income via a Web 6 avr 2023 nbsp 0183 32 You can get a refund on any taxable income you ve paid taxes on including pay from your current or previous job pension payments income from a life or pension

Download First Year Self Employed Tax Rebate

More picture related to First Year Self Employed Tax Rebate

NPS Tax Benefit Sec 80C And Additional Tax Rebate Tax Benefit To

https://i.ytimg.com/vi/TqSSuNglkSg/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgALQBYoCDAgAEAEYZSBgKFUwDw==&rs=AOn4CLCBf5LDqx4ao2xyM9hyvx_JdhVGVQ

Claim Now Claim Tax Back

https://www.selfemployedtaxback.com/wp-content/uploads/2015/02/claiming-ppi-yourself.jpg

Self Employment Tax Nonfarm Optional Method EMPLOYMENT HJQ

https://i.pinimg.com/originals/8b/a8/56/8ba856167d15cb21369df584dede8ada.png

Web Use our self employed tax calculator to check the tax and other deductions from self employment profits updated for the 2023 2024 tax year Web 75 lignes nbsp 0183 32 The self employment tax very much follows the camel theory starting at a maximum of 81 in 1951 and growing to a 2023 maximum of 24 511 38 plus 2 9

Web Self Employed Rebate Calculator When this happens HMRC are then able to recalculate your Tax position for the year and credit you the Tax rebate At the current time of writing HMRC allow Tax claims to be Web 5 avr 2020 nbsp 0183 32 There s a limit on the total amount of Income Tax reliefs that you may claim for deduction from total income for a tax year Loss relief is one of the reliefs affected The

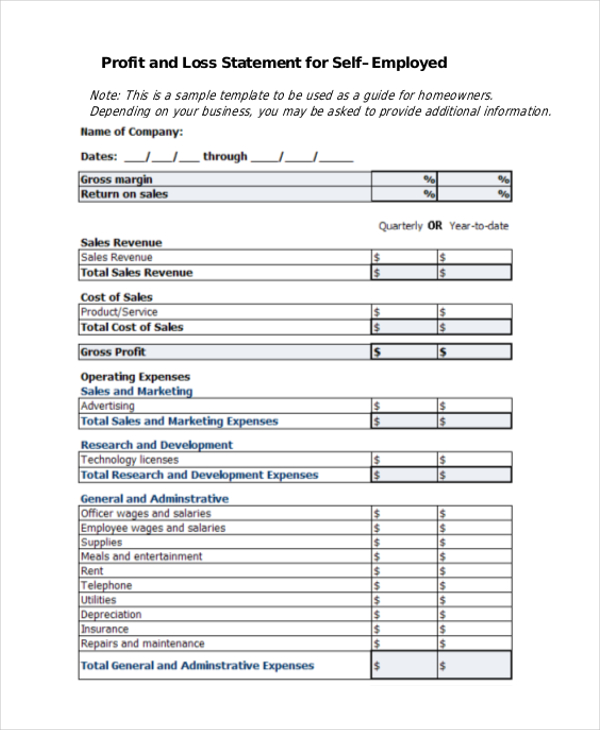

Self Employment Printable Small Business Tax Deductions Worksheet

https://i.pinimg.com/originals/1f/d9/cc/1fd9ccb549ddaa388f0869e56e104393.png

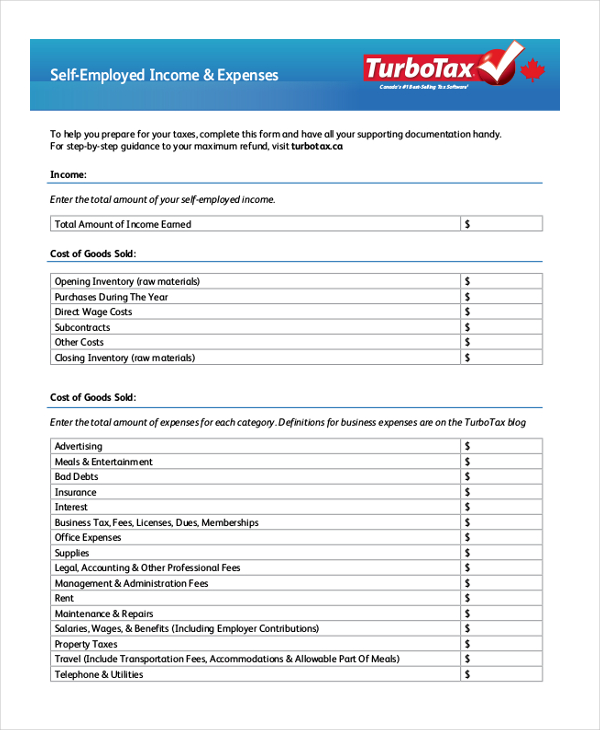

Self Employed Expense Worksheet

https://db-excel.com/wp-content/uploads/2019/01/self-employed-tax-spreadsheet-for-self-employed-expense-sheet-printables-self-employment-tax-and.jpg

https://www.gov.uk/claim-tax-refund

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay

https://www.gov.uk/capital-allowances

Web 100 first year allowances you can claim the full amount for certain plant and machinery in the year that it was bought the super deduction or 50 special rate first year

My First Year Self Employed What I ve Learnt Plans For Year 2 Medium

Self Employment Printable Small Business Tax Deductions Worksheet

Self Employed Printable Profit And Loss Template Printable Templates

FREE 11 Sample Self Employment Forms In PDF MS Word

How To Become Self Employed Goselfemployed co

Hmrc Tax Return Self Assessment Form Printable Rebate Form

Hmrc Tax Return Self Assessment Form Printable Rebate Form

First Year Self Employed In Hotel And Gastro Visit From Germany

Zru nos Do Toho Ob ianstvo Tax Return Calculator Ontario 2019

What Is A Self Assessment Tax Return Form Go Self Employed

First Year Self Employed Tax Rebate - Web 2 juin 2023 nbsp 0183 32 You can claim a tax credit for the lesser of 200 per day or 67 of your average daily self employment income for the year per day How do I calculate and claim these tax credits quot Average daily self