Flex Spending Account Tax Deductible The contributions you make to a flexible spending account FSA are not tax deductible because the accounts are funded through salary deferrals However contributing to an FSA does reduce

Flexible Spending Arrangements FSAs are tax free use it or lose it savings accounts for medical and certain non medical expenses FSAs are set up by an employer in a cafeteria plan where your employer provides certain benefits on a pretax basis The amount you decide to contribute to the account for the year is deducted from your salary before income taxes This deduction reduces your taxable income saving you money on taxes

Flex Spending Account Tax Deductible

Flex Spending Account Tax Deductible

https://www.the-ifw.com/wp-content/uploads/2022/03/shutterstock_1505244791.jpg

Tax Deduction Tracker Printable Business Tax Log Expenses Tracker

https://i.etsystatic.com/23545555/r/il/f49ff7/3754474129/il_1080xN.3754474129_gsw3.jpg

6 Surprising Flex Spending Account Items Flex Spending Account Flex

https://i.pinimg.com/originals/97/2f/52/972f527147da3b6fc760f8d81619e344.jpg

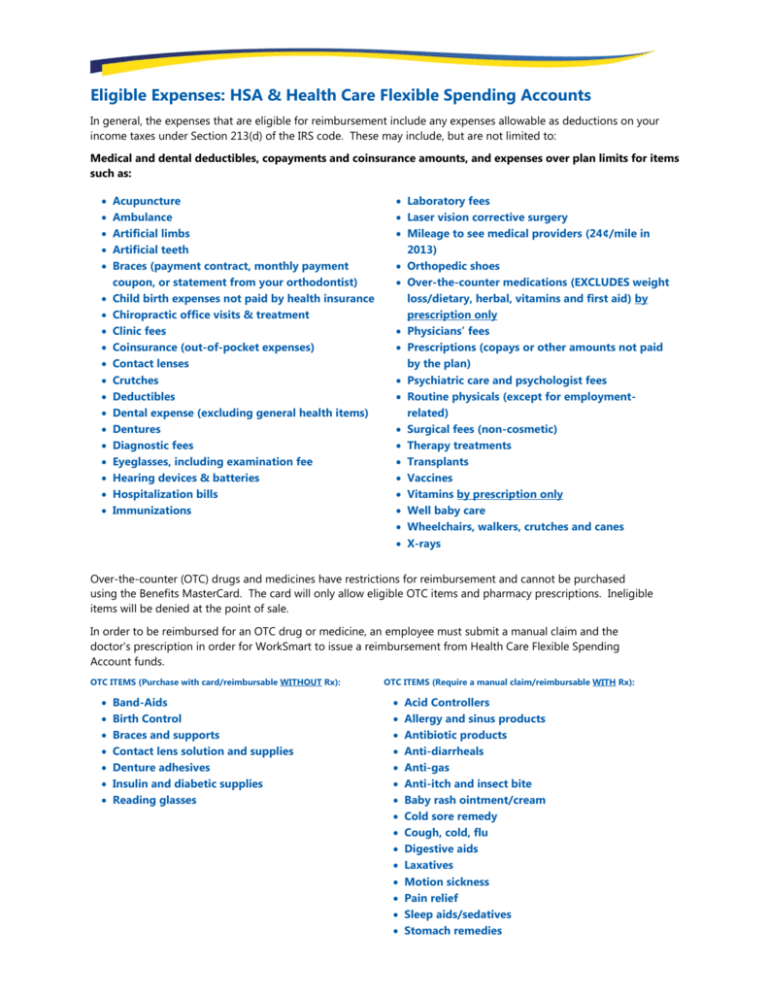

A flexible spending account FSA is a tax advantaged way to save for future healthcare costs You can use an FSA to pay copayments deductibles prescription drugs and health costs The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

For 2024 there is a 150 increase to the contribution limit for these accounts An employee who chooses to participate in an FSA can contribute up to 3 200 through payroll deductions during the 2024 plan year Amounts contributed are not subject to federal income tax Social Security tax or Medicare tax Health FSA contribution and carryover for 2022 Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health

Download Flex Spending Account Tax Deductible

More picture related to Flex Spending Account Tax Deductible

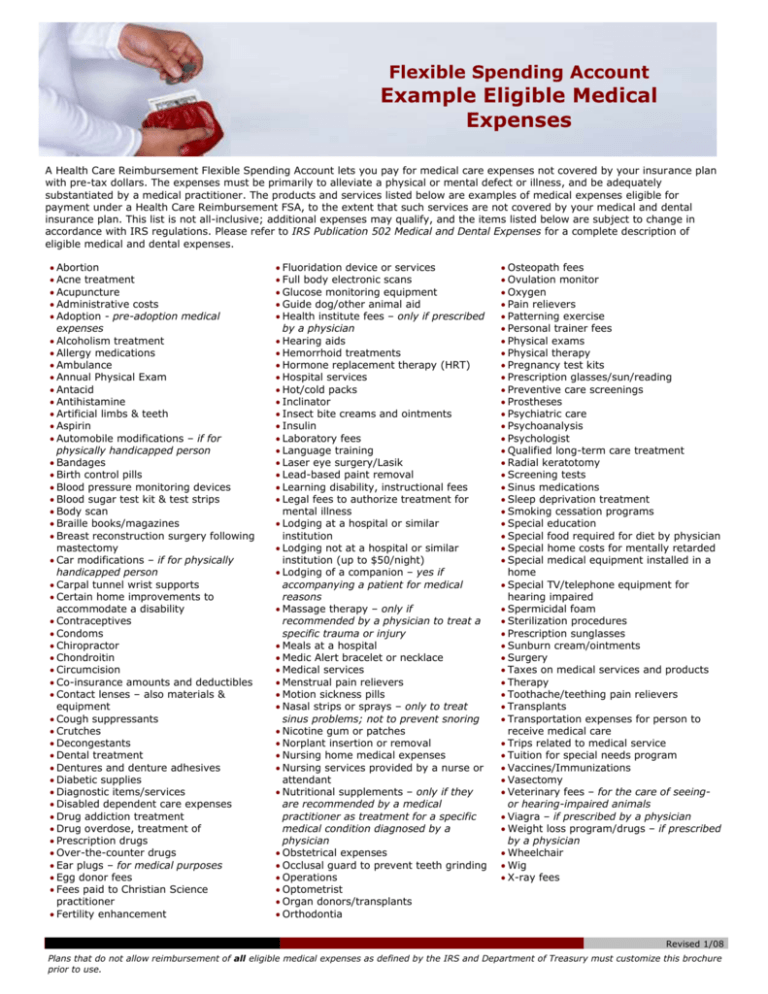

Flexible Spending Account Example Eligible Medical Expenses

https://s3.studylib.net/store/data/007783568_2-ce6693b5ed4cb9d25441e26bfd42732d-768x994.png

FSA Flexible Spending Account

https://dlnxw8d9lzu3i.cloudfront.net/files/54025f8cf8c1562754b6b6c07ab2542e-FULL.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

Health Savings Accounts HSAs and Flexible Spending Accounts FSAs are effective ways to help ease the burden of certain expenses Because these accounts are often offered during benefits enrollment it can be easy to mix up what each is One of the key benefits of a flexible spending account is that the funds contributed to the account are deducted from your earnings before taxes lowering your taxable income

Flexible spending accounts FSAs also known as flexible spending arrangements help offset the high price of healthcare by allowing you to pay for some medical expenses with pretax By using untaxed dollars in a Health Savings Account HSA to pay for deductibles copayments coinsurance and some other expenses you may be able to lower your overall health care costs HSA funds generally may not be used to pay premiums Refer to glossary for more details

Flexible Spending Account FSA Workest

https://www.zenefits.com/workest/wp-content/uploads/2022/11/iStock-1415930168-e1669675694501.jpg

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What s The Difference

https://www.investopedia.com/thmb/PE1dbX0Tuo1ohlHmjw_RcTUcvNw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg

https://www.investopedia.com/ask/answers/112315/...

The contributions you make to a flexible spending account FSA are not tax deductible because the accounts are funded through salary deferrals However contributing to an FSA does reduce

https://www.1040.com/tax-guide/health-and-life...

Flexible Spending Arrangements FSAs are tax free use it or lose it savings accounts for medical and certain non medical expenses FSAs are set up by an employer in a cafeteria plan where your employer provides certain benefits on a pretax basis

/images/2021/01/28/fsa-account.jpeg)

How FSAs Work And What They Cover 2021 FinanceBuzz

Flexible Spending Account FSA Workest

Investment Expenses What s Tax Deductible Charles Schwab

Using Flexible Spending Accounts To Keep Dental Care Affordable First

:max_bytes(150000):strip_icc()/20-ways-use-your-flexible-spending-account_final_rev-d861e123d8b64ced89a51a3b178f7fc4.png)

20 Ways To Use Up Your Flexible Spending Account

What Is A Flex Spending Account And How Does It Work Login Pages Info

What Is A Flex Spending Account And How Does It Work Login Pages Info

Calculate Self Employment Tax Deduction ShannonTroy

Flexible Spending Accounts The Tennessee Tribune

Flex Spending Accounts Summary

Flex Spending Account Tax Deductible - Health FSA contribution and carryover for 2022 Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health